Market analysis from ActivTrades

By Ion Jauregui - ActivTrades Analyst The IBEX 35 starts today's trading day in an environment in which two major scenarios converge that will set the course of European markets. On the one hand, expectations regarding the statements of the President of the European Central Bank, Christine Lagarde, and the continuity of the corporate results season in the US,...

By Ion Jauregui - Analyst ActivTrades The global financial market experienced one of its most intense days in years following the unexpected announcement by President Donald Trump, who decreed a 90-day pause in the “mega-tariffs” applied to his main trading partners. The decision, which contradicts official statements issued only 48 hours earlier, has been...

By Ion Jauregui – Markets Analyst, ActivTrades Amid the renewed escalation of trade tensions, Fluidra faces the potential impact of new tariffs driven by the Trump administration. The tariff dispute not only complicates international operations but also directly affects the company’s cost structure. With 50% of its sales in North America coming from products...

By Ion Jauregui – ActivTrades Analyst Gold, historically relegated to the background of investment strategies, is now emerging as a first-rate asset. This change is due to factors such as rising inflation, the implementation of aggressive tariff measures, and the geopolitical tensions that have intensified in recent years. The war in Ukraine and the consolidation...

The announcement of new tariffs by the Trump Administration has unleashed a wave of uncertainty in global markets. With a 10% across-the-board tariff in the US, 20% for the European Union and up to 34% for China, these measures have ignited fears of stagflation in the US, which has repercussions internationally and directly affects investor confidence. Initial...

By Ion Jauregui - Analyst ActivTrades The announcement of new reciprocal tariffs by President Donald Trump has triggered an immediate reaction in the markets, causing dizzying drops in various companies since the beginning of the week. The measure has generated an environment of high volatility, with investors seeking refuge in the face of growing instability. ...

By Ion Jauregui - ActivTrades Analyst Former President Donald Trump's recent decision to impose across-the-board tariffs has had a strong impact on global markets. European and Asian stock markets reacted with significant declines, while the oil market experienced notable volatility. Impact on the oil market The announcement of tariffs has affected global...

By Ion Jauregui - Analyst at ActivTrades The recent announcement of tariffs by Donald Trump's administration has generated a wave of uncertainty in financial markets. This measure could trigger a forceful response from the European Union, marking a paradigm shift in global trade and in the European bloc's economic strategy. Reactions in Europe and the ECB ...

By Ion Jauregui - ActivTrades Analyst The EUR/USD trades cautiously on Tuesday, in a context marked by the release of key data that could define its direction in the coming days. The pair is trading slightly lower by 0.09%, reflecting investors' uncertainty ahead of the Eurozone Consumer Price Index (CPI) and manufacturing PMIs in Europe and the United States. ...

Chinese giant Tencent(HKG:0700) (Ticker AT: TMC.US) has gone further in its expansion in the digital gaming industry by extending its interest in the Ubisoft (EPA:UBI)(Ticker AT:UBI.FR) Spin-Off with a whopping €1.2 billion, in a company currently valued at €4 billion. With this deal, Tencent acquires a 25% stake, while Ubisoft retains control, trying to sustain...

By Ion Jauregui - Analyst ActivTrades The price of gold has hit record highs, hovering around $3,100 per ounce, driven by renewed investor appetite for safe-haven assets in the face of growing uncertainty in international markets. Drivers of the rally The decision to impose 25% tariffs on the automotive sector, announced by US President Donald Trump, has...

By Ion Jauregui –ActivTrades Analyst The EUR/USD is at a time of high expectation, with key European Central Bank (ECB) appearances and the release of quarterly U.S. Gross Domestic Product (GDP) promising to generate significant moves in the financial markets. Today, all eyes are on Christine Lagarde and Luis de Guindos, president and vice-president of the ECB,...

By Ion Jauregui - ActivTrades Analyst In a surprising turn of events for the stock market, so far in 2025 we see how retail investors have taken center stage, betting heavily on “ buy the dip” as large investors reduce their positions. According to data from VandaTrack, these small investors have injected nearly $70 billion into U.S. stocks and ETFs. This...

By Ion Jauregui - ActivTrades Analyst The copper market is going through a decisive phase, influenced by political and economic factors that could alter its behavior in the coming months. The return of Donald Trump to the U.S. presidency and his reactivation of tariff policies has generated expectations of a new record in the price of the red metal since the...

By Ion Jauregui - ActivTrades Analyst Santander, the second largest listed company on the IBEX 35, is on the verge of reaching a new milestone: regaining €100 billion in market capitalization. This figure, not seen since 2015, marks a turning point in the trajectory of the bank, which consolidates its position as the largest in the euro zone, surpassing BNP...

By Ion Jauregui - ActivTrades Analyst The IBEX 35 is at an interesting juncture. Despite the fact that the average of its stocks is trading at just 40% of its historical highs, the national index is 17% away from its 2007 high, having reached a resistance at 13,466 points (19.69% since 2007) on Tuesday, March 3. This data shows a significant gap between the...

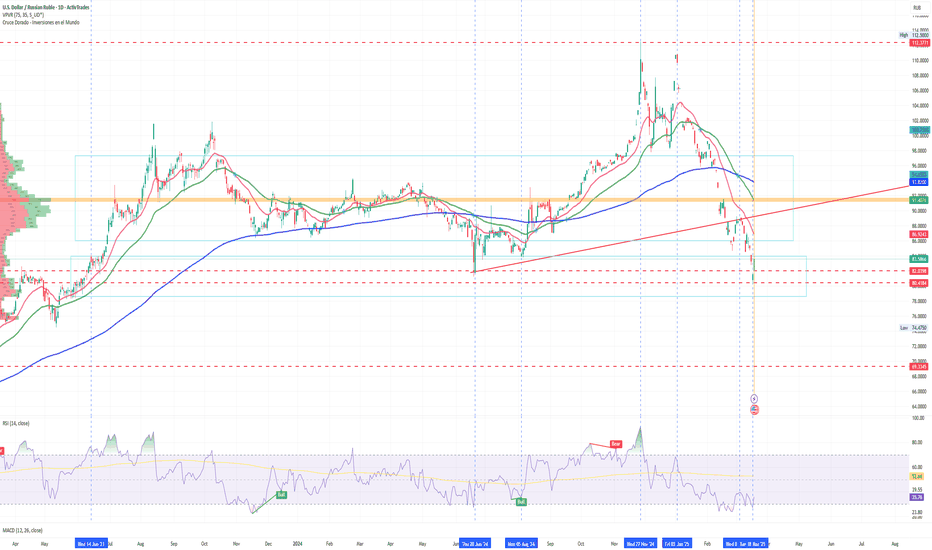

The outlook for the currency market has been radically transformed. After a period in which the ruble hit record lows, today marks the start of a bullish rebound. The dollar's loss of value has allowed the ruble to strengthen significantly, while attention is focused on the appearance of Christine Lagarde, president of the European Central Bank (ECB). Lagarde's...

By Ion Jauregui, ActivTrades Analyst The Russell 2000 small cap index has experienced a marked deterioration in positioning, with a significant increase in short positions over the past week. Investor confidence in small caps has weakened markedly, in contrast to the S&P 500, whose positioning has returned to neutral after the sharp pullback from January's bullish...