Market analysis from City Index

The Dow Jones tends to share the strongest correlation with the ASX 200, out of the three Wall Street indices. It is therefore worth noting that Dow futures formed a bearish pinbar at trend resistance on Thursday, following an intraday false break of the March low. The daily RSI (2) was also overbought by the day’s close. The March 31 low also hovers nearby for...

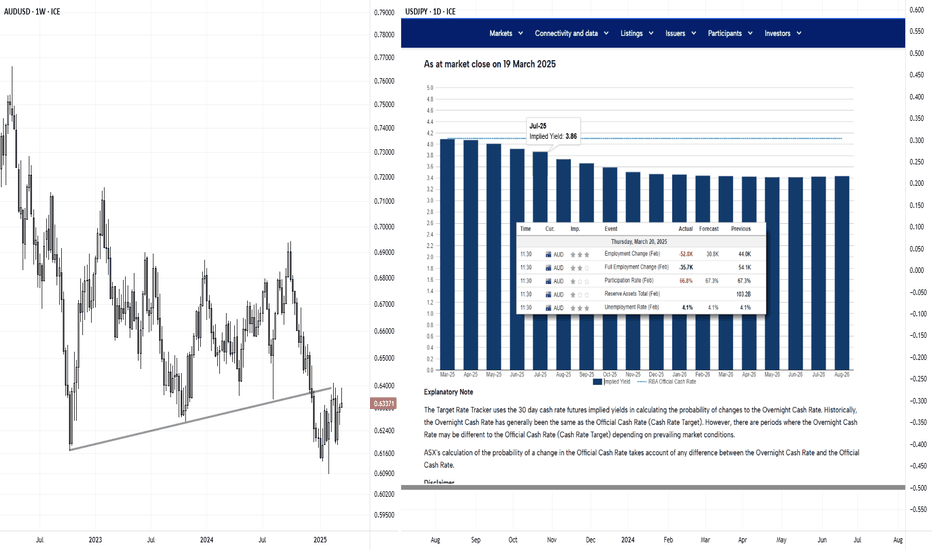

Matt Simpson breaks down the latest Australian inflation data and what it could mean for the Reserve Bank of Australia’s next move. Plus, we dive into the AUD/USD, AUD/CAD, GBP/AUD and EUR/AUD charts for key technical setups traders need to watch right now.

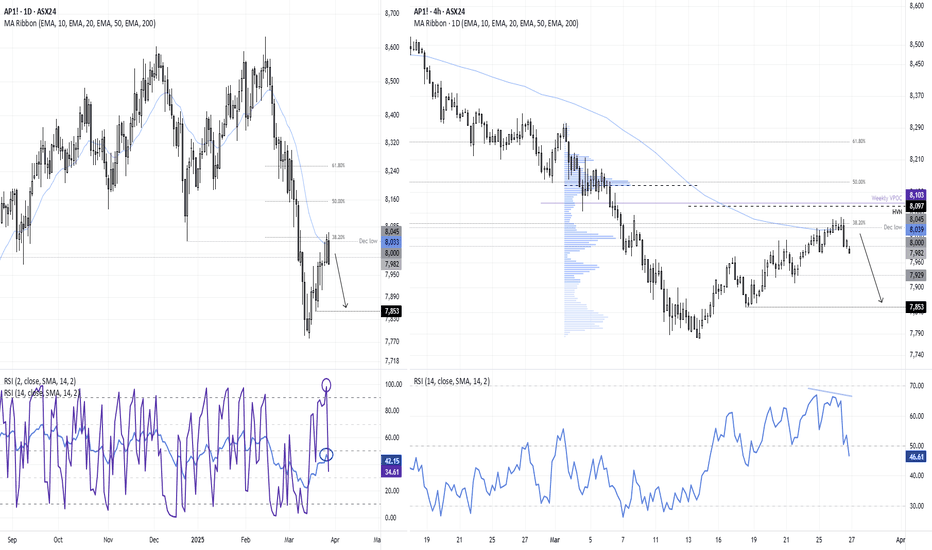

Here is my 2-minute take on the ASX 200 futures daily chart, where I discuss my hunch that a pullback could be due and how that could set us up for a better long setup further out. Matt Simpson, Market Analyst and Forex.com and City Index

It can be useful to monitor several renditions of the same market, in order to identify higher probability support and resistance levels. And I would personally argue this becomes the more important if one trades CFDs exclusively. Today I am comparing the ASX 200 cash market (XJO) and ASX 200 futures market (SPI 200, or AP1!) alongside the forem.com AUS200 CFD....

Cride oil may have recovered back above $60, but it is making hard work of it. And with resistance looming and large specs increasing short bets, perhaps a pullback due. But does that mean a break below $60 is imminent? Matt Simpson, Market Analyst at Forex.com and City Index

The US dollar index has handed back all of its Q4 gains with traders betting that Trump's trade war will do more damage than good to the US economy. I update my levels on the US dollar index and EUR/USD charts then wrap up market exposure to USD index futures.

Rising yields can usually be associated with a period of risk on. But seeing the 30-year treasury yield rise over 20bp in Asia while Wall Street futures cling on to their cycle lows is anything but usual. In fact, it's a bad omen of things to come. Matt Simpson, Market Analyst at City Index and Forex.com

We finally saw the shakeout on gold I was expecting around $3000. This clearly changes things for gold traders over the near-term, even though the fundamentals remain in place for bulls. I highlight key levels for gold and take a look at the devastation left across key assets on Thursday. Matt Simpson, Market Analyst at City Index and Forex.com

The rally of the past two week on the ASX took a turn for the worse on Wednesday, on the warning (and official announcement) of Trump's 25% tariff on non-US cars. This has seen the ASX get caught in the negative sentiment on Wall Street. The daily chart shows that momentum has turned lower around a resistance cluster, including the December low, 38.2%...

Volatility has receded with less than 20-hours to go until Trump's tariffs are officially implemented, with traders now clearly in watch-and-wait mode. So while headline risks around tariffs remain in place, moves could remain limited unless traders are treated to any last-minute negotiations. Typically, risk has benefitted when it has been expected that tariffs...

The RBA held their cash rate at 4.1%, and keep a May cut up in the air without any appetite to commit to one. I highlight my observations on the RBA's statement, before updating my analysis for AUD/USD, AUD/CAD and GBP/AUD. Matt Simpson, Market Analyst at City Index and Forex.com

USD/CAD closed higher for a fourth day on Monday, on the even of Trump's liberation day. It also accelerated away from its 50-day EMA after establishing support around its 100-day EMA last week. This has also seen USD/CAD break trend resistance, and a falling wedge pattern now appears to be in play. This suggests an upside target near the 1.4550 cycle...

I discuss whether the RBA will cut next week and the reasons why, before taking a look at AUD/USD, AUD/CAD, EUR/AUD and GBP/AUD charts. Matt Simpson, Market Analyst at City Index and Forex.com

Trump's tariffs are clearly not going away. In fact, he's upped the ante with a 25% tariff on all non-US cars, vowed to target pharmaceuticals and promised more are to come on April 2nd. Given the dire weakness in consumer sentiment data, I suspect Wall Street indices may have seen a swing high. Matt Simpson, Market Analyst at City Index and Forex.com

Futures traders are net-long GBP/USD futures and net-short AUD/USD futures. So it is quite fitting to see GBP/AUD in a strong uptrend, with traders now eyeing the 2020 high. However, the weekly chart suggests the current upswing may be nearing a cycle peak. A small bearish divergence has also formed on this timeframe. I am therefor seeking evidence of a swing...

The retracement higher for the US dollar is finally underway, which also shows further upside potential. And this is why I am wary of being long EUR/USD over the foreseeable future, even if I suspect it is poised to break to new highs in the coming weeks. Matt Simpson, Market Analyst at City Index and Forex.com

Australia's employment report for February delivered a surprising set of weak figures. Understandably, markets reacted by pricing in another RBA cut to arrive sooner than later. But if we dig a little deeper, an April or May cut may still not be a given. Matt Simpson, Market Analyst at City Index and Forex.com

I take a closer look at the Japanese yen futures market to highlight why I think the Japanese yen has reached an important inflection point. And that could further support the bounce of yen pairs such as AUD/JPY, CAD/JPY and NZD/JPY - alongside USD/JPY should the Fed not be as dovish as many hope. Matt Simpson, Market Analyst at City index and Forex.com