Market analysis from Fusion Markets

Last weeks bearish engulfing candle could signal the start of a correction back to the trendline. Look for a break of the low and a sell setup that meets your trading rules. This is an idea of what MAY happen. Always trade with a profitable strategy and good risk management.

The overall market direction is bearish with sellers in control. However, with a triple rejection of circa 0.58500, we have seen a bottom formed and buyers now in play. There is a potential for price to continue bullish towards the trendline. This is an idea of what MAY happen. Always trade with a profitable strategy and good risk management.

Price has been in a correction pattern recently after the start of a bearish impulse from 1.5959 Now price has broken out and began the next impulse lower. Look for a sell setup to target the -27% Fib and then potentially the -61.8% Fib. This is an idea of what may happen. Always trade with a profitable strategy and good risk management.

XAU/USD was finding support last week at the $3270 mark for a second time on the four hour time frame. The last four hour resistance was also seen last week at circa $3365. Look for price to head back towards resistance. This is an idea of what may happen. Always trade with a profitable strategy and good risk management.

Over March and April 2025, price has been trying to break the 101.50 to 102.00 zone which was support in August 2024. The last 2 day candle in this area printed as a bullish Hammer candle which was followed by 2 more bullish candles. We may possibly see price break out above the trendline and buyers taking control of the market. This is an idea of what may...

Price is back at a territory not seen since early 2022. In January/February 2022, we saw buying stall at circa 1.1460 for 4 weeks before the turn around and sellers taking control. Could we see something similar now?

Price is moving in a daily uptrend. The moving averages are in a bullish order and price has pulled back amongst them. If price breaks out above the counter trend line, then this may be another impulse of buying in line with the daily trend. This is an idea of what may happen next. Always trade with a robust and profitable strategy.

After multiple rejections of 0.5950, we saw a huge stimulus of buying which has now taken price up to the 0.6400 zone. We have recently seen rejections in this area, and what is noticeable is that the most recent price action appears to be slowing down, with the higher highs and lows not significantly advancing. Is this a sign to exit any buy positions and...

Price is in a strong bullish trend. After 6 bullish candles, we may now see a correction back towards the moving averages as profit taking occurs. This is just an idea of what may happen. Always trade with a profitable strategy and good risk management.

Friday saw price attempt to break the 1.5800 zone for a second since March. However with a failure to break and close above, a break below the days low of 1.5640 could see price continue lower towards the most recent support at 1.5400. This is just an idea of what may happen. You should always trade with a well tested and profitable trading strategy using good...

Strong buying came into play at the $29 supply/support zone which we last saw tested and rejected twice back in December 2024. After a brief pause at $31 on Thursday, buyers took price to a high of the week at $32.27 It's possible that we might see a pullback and correction, testing $31 which was support in February this year. This is just an idea of what may...

Price is testing support for the 3rd time (last tested and rejected in late 2024 and February 2025) This MAY now lead to opportunities to buy if we see a bullish setup or bullish impulse and correction. A break and close below support would invalidate this idea. This is just an idea of what could happen. You should always trade with a well tested and profitable...

We can see a huge weekly candle (circa 500 pips) as sellers took price all the way down to sub 0.8600 last week. Looking back over the years, 0.8600 has been a huge demand zone for this pair. This may now lead to opportunities to buy on the smaller time frames. This is just an idea of what may happen. You should always trade with a well tested and profitable...

President Trumps recent tariff announcements have shook the market with some huge moves and a USD sell off. The weekly USD/CHF chart shows the huge bearish sentiment of the Dollar market last week. We may see some pullback/correction now in the market, with a potential for price to then continue down to 0.8400 which has proved to be a strong demand zone. This...

Price is moving within an ascending channel with price now testing support. Look for potential buy setups after a change of sentiment on the smaller time frames if this meets your strategy rules. This is an idea of what may happen. You should always trade with a well tested and profitable trading strategy using good risk management.

Price has closed below the CTL (counter trendline) on the final day of trading last week. The current bearish trend started in February and has most recently been in a potential corrective pattern where it retested and rejected 0.6200 We may now see a push from the sellers back towards major support at 0.6060 unless the current break below the CTL is a false...

The daily chart shows price is making higher highs and higher lows since price bottomed out at circa 187.00 in February this year. The moving averages are bullish with angle and separation showing a strong trend. With price back at the 8 EMA (black line), we may see a change of sentiment on the smaller time frames if it acts as support. Failing that, we could...

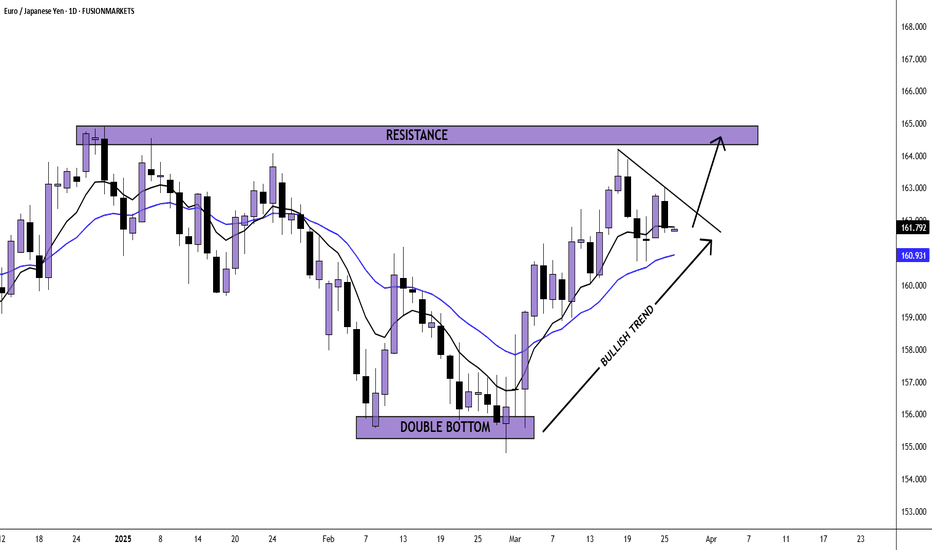

After printing a double bottom circa 155.50 in February, price has seen a steady move to the upside. Price appears to be currently correcting. Look for a break to the upside and a potential long trade (if it meets your strategy rules) into 164.50 which was resistance in December 2024.