Current picture and structure

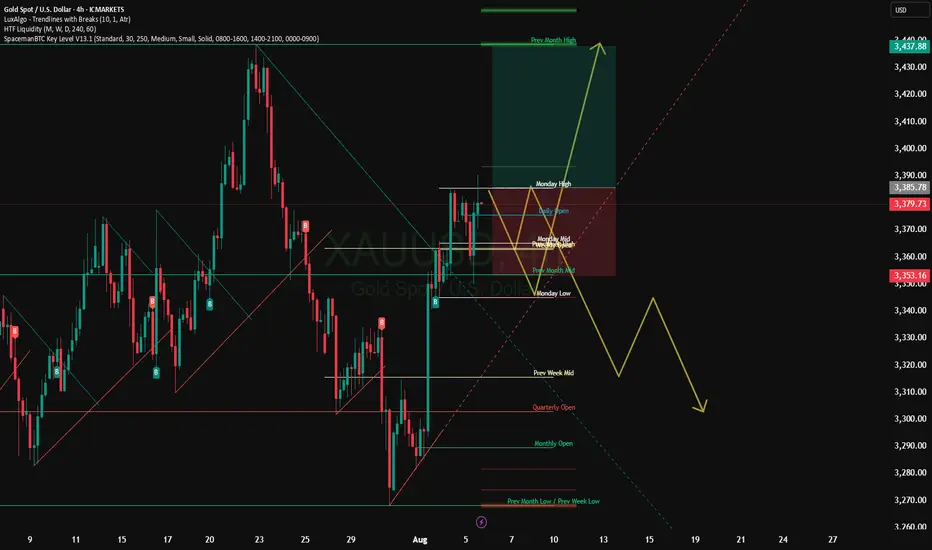

The instrument is trading in a narrow range of $3,360-3,375, demonstrating low volatility - ADX is at the low of 2025, which confirms consolidation

The price is held inside a long-term ascending channel, with an increase of about 27% since the beginning of 2024

Indicators and signals

RSI (14): around 58-59, indicates moderate overbought, but remains in the bullish momentum zone

Stochastic (%K ~61%) and MACD (value ~3.8): Buy signals - short-term upward momentum is confirmed

ADX (14): around 23-24 - range, weak trend without a clear direction

Moving averages on different timeframes give a common signal indicator "Strong Buy" in daily and weekly frames

Support and resistance levels

Key support:

$3,360 — current lower stop range

$3,330–3,293 — swing low zone, critical for short-term sales

Main resistance:

$3,400–3,415 — profit acceptance zone and possible reversal pressure

$3,450 — psychological and technical barrier upon breakout of current zone

The instrument is trading in a narrow range of $3,360-3,375, demonstrating low volatility - ADX is at the low of 2025, which confirms consolidation

The price is held inside a long-term ascending channel, with an increase of about 27% since the beginning of 2024

Indicators and signals

RSI (14): around 58-59, indicates moderate overbought, but remains in the bullish momentum zone

Stochastic (%K ~61%) and MACD (value ~3.8): Buy signals - short-term upward momentum is confirmed

ADX (14): around 23-24 - range, weak trend without a clear direction

Moving averages on different timeframes give a common signal indicator "Strong Buy" in daily and weekly frames

Support and resistance levels

Key support:

$3,360 — current lower stop range

$3,330–3,293 — swing low zone, critical for short-term sales

Main resistance:

$3,400–3,415 — profit acceptance zone and possible reversal pressure

$3,450 — psychological and technical barrier upon breakout of current zone

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.