#APT/USDT Buyers Need To Establish Support Zone#APT

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to break strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 4.10.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 4.05, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the Moving Average 100.

Entry price: 4.25.

First target: 4.35.

Second target: 4.46.

Third target: 4.05.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Aptos

#APT/USDT#APT

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.1560.

We have a bearish trend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.1555, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.1600

First target: 0.1640

Second target: 0.1677

Third target: 0.1719

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

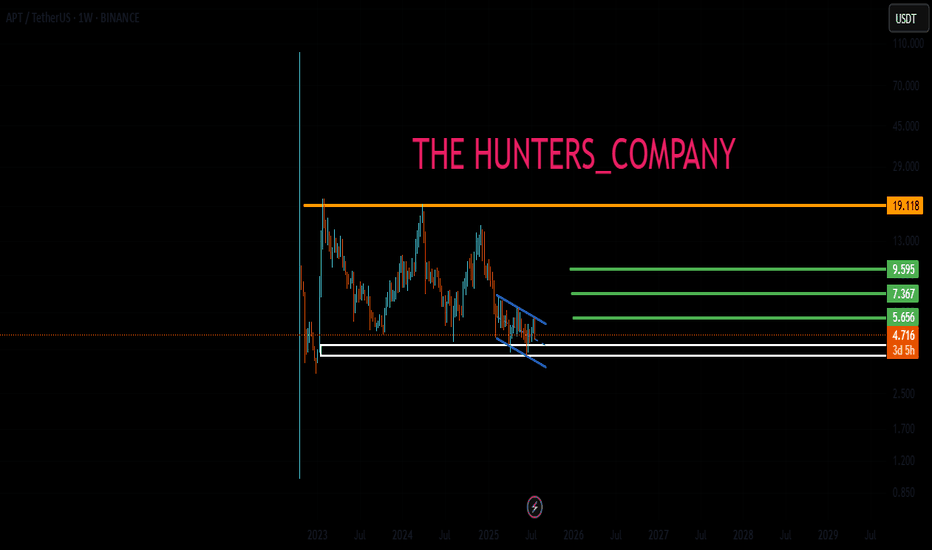

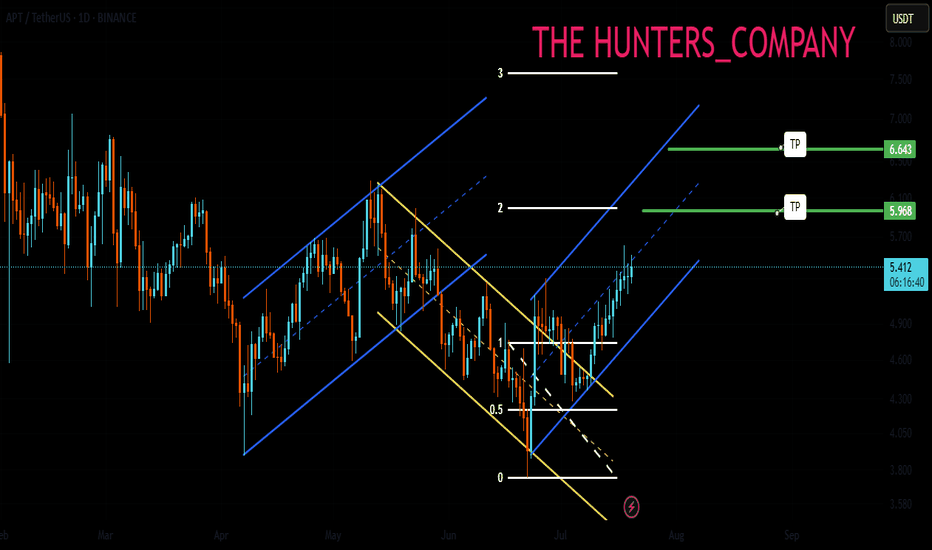

APT : Long term purchaseHello friends🙌

👀You see that the price is in a range and now we are at the bottom of the range. The scenario is simple. The bottom of the range is a good buying opportunity that can be used because 80% of the failures in the range are fake.

⚠So we can buy with risk and capital management and move with it to the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

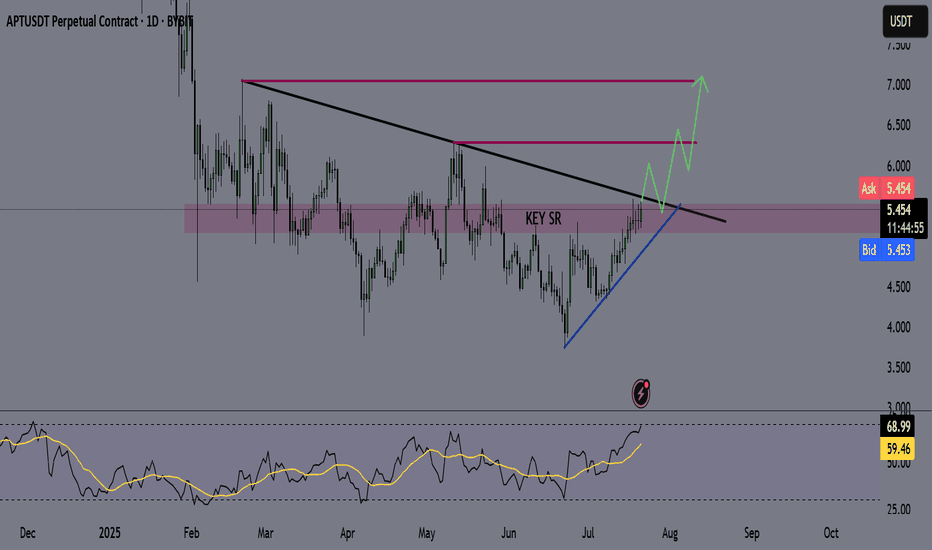

APT - APTOS Coin - Swing Long Idea📌 Fundamental Sentiment:

The entire crypto market is rallying, alongside other risk assets. This momentum is largely driven by U.S. policy expectations — specifically, Trump’s increasing pressure on Powell to resign and aggressively push for rate cuts from the Federal Reserve.

📌 Technical Analysis:

Price is currently testing the HTF supply zone with strong momentum. Additionally, it’s approaching a long-term bearish trendline that has dictated the downtrend since February 2025.

📌 Gameplan:

I want to see:

A clean breakout above the HTF supply zone with daily candle closure.

A confirmed break and close above the HTF bearish trendline on the daily timeframe.

If both confirmations align, I’ll start preparing for swing long setups, potentially riding into the early stages of a 2025 altseason.

—

🔔 Like & Follow for more daily updates. Feel free to drop your thoughts in the comments!

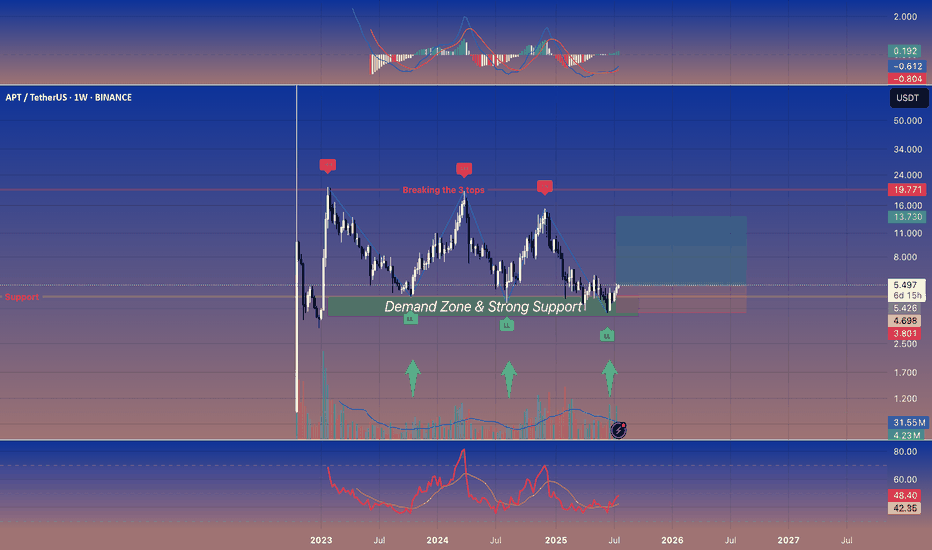

Aptos: The Sleeping Giant🚀 Aptos: The Sleeping Giant 😴🌋

APT keeps bouncing off a rock‑solid \~\$5 demand zone. If it finally pops above \~\$7.5‑8, the giant could wake up in a hurry. 📈

---

👀 Quick‑Glance Weekly Checklist

| 🔍 Focus | What’s Happening |

| ------------------------ | ------------------------------------------------------------------------------------------- |

| **Demand Zone** 🟢 | Repeated wick rejections + volume spurts every dip into **\$5‑5.2** = buyers camping there. |

| **Structure Squeeze** 🔄 | Series of **LH ➡️ LL ➡️ reclaim** – bears push down, bulls yoink it back. |

| **Momentum Curling** 📈 | MACD & RSI‑style oscillators turning up from oversold = reversal vibes. |

| **R/R Sweet Spot** 🍬 | Long near green box, cut below latest LL, reward toward prior LHs. |

---

🎯 Levels on My Radar

1. $5.00‑5.20 – “Do‑not‑break” support ⚔️

2. $6.00‑6.50 – First speed‑bump zone 🛑

3. $7.50‑8.00 – “Break the 3 tops” 🚪➡️ *Door to trend shift*

---

🛠️ Trade Idea (NFA, DYOR)

Scale‑in: nibble inside the green demand band 🍣

Stop‑out: just under the last LL – keep it tight ✂️

Take‑profit: peel some at **\$6s**, leave a moon‑bag for \$7.5‑8 🌖

---

⚡ Why I Care

APT’s been the kid in the back row while other alts moon. If that stacked high cluster cracks, short fuel + fresh eyeballs could send it sprinting. 🏃♂️💨

---

💬 Want intraday alerts or lower‑TF setups? Drop a comment! Let’s see if this giant wakes up or keeps snoozing. 🛌🔔

APT : Did the buyers arrive?Hello friends🙌

📈An ascending channel and then a descending channel and then an ascending channel.📉

✔The point is that when the price entered an ascending channel, your price entered and with a failure it entered a descending channel and you exited with a loss and again when the price is at the peak of despair you see that the main buyers enter and push the price up and cause a new ascending channel.

🔊Considering these tips we have told you, always have a trading plan and follow capital management so that you do not fall into the trap.

🔥Follow us for more signals🔥

*Trade safely with us*

Aptos Bullish Bias Intensifies · Moving Above 2 EMAs WeeklyLast week APTUSDT (Aptos) closed above EMA8 and this week it is trading, and set to close, above EMA13. The bullish bias is becoming stronger; notice the bullish reversal pattern in black. Each time this type of pattern showed up Aptos turned bullish. This is the fourth time and it won't be different. It will be different only in the sense that the long-term consolidation descending channel will break. Instead of resistance being found and confirmed at the upper-boundary of the channel, APTUSDT will produce a new high, a higher high and a new all-time high. You are witnessing the start of the 2025 bull market cycle. Growth potential goes beyond 800%. Total growth from bottom to top can reach 1,000% or more.

Thank you for reading.

Namaste.

Aptos $45 Target Mapped, Ready To Boom! (PP: 867%)A market bottom leads to a bullish wave. Back in late 2022 Aptos (APTUSDT) produced a small market bottom and this led to a small bullish wave. This bottom lasted only one month in the making.

"Small" but this wave was more than 560% strong. Some 20 years holding a conventional index fund all happened here within 28 days. Cryptocurrency, it is certainly different compared to dinasourian investment products.

Present day the market bottom is a big one, it has been going for five months. This in exchange will lead to a very strong bullish wave, 3-5 times bigger than the previous one because the bottom is 3-5 times wider.

We have mainly two targets on the chart. These are easy targets and the market can definitely move higher in late 2025.

The first target is $22.5 for a nice 376%. The second target stands at $34 for a massive 620%. You can aim higher of course and if you do, you aren't likely to miss because the all-time high is $100 set on day one.

After these two targets we have $45 and this one is also mapped on the chart. 867% profits potential. You can scroll up to find it.

Remember to do your own planning. We tend to sell portions at each target on the way up. If in doubt, you don't have to be 100% right. You can sell 5%, 10% and then continue to hold. If prices rise too much and you feel uncertain, "should I hold or should I sell?" You don't have to be 100% right, again. You can sell tiny bits and you continue this process through the entire bullish wave. There are other ways to approach the market, buy and hold long-term. When prices are really high, close the position and move on.

Make sure to be you, do you and do great.

Thanks a lot for your continued support.

Namaste.

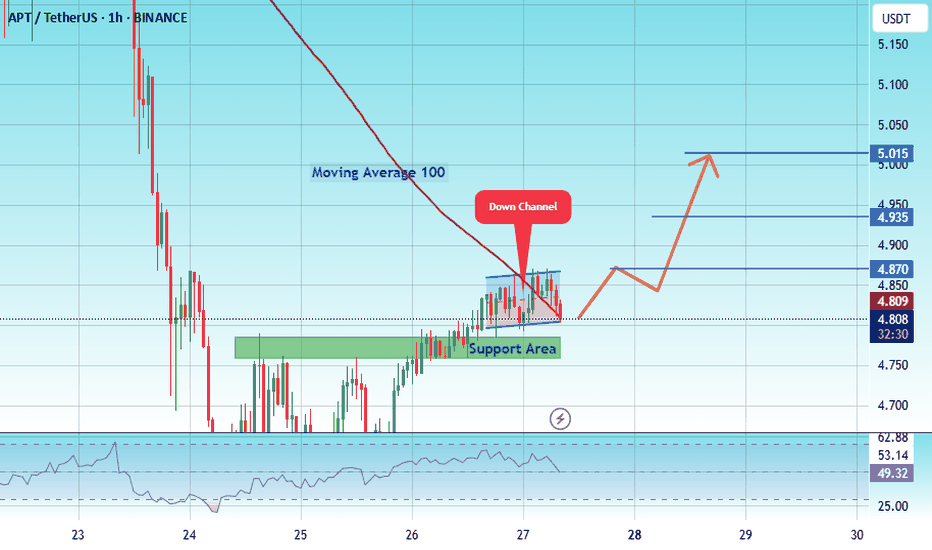

#APT/USDT#APT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 4.43.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 4.35, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 4.47

First target: 4.50

Second target: 4.54

Third target: 4.60

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Live tradehello friends👋

✅️Considering the drop we had, now the price has reached an important and good support and the price is supported by the buyers, and the downward trend line has broken and the ceiling has been raised. Considering this, we entered into the transaction with capital and risk management.

🔥Join us for more signals🔥

*Trade safely with us*

APT/USDT – Final Defense at Weekly Demand Zone! Prepare for MoveAPT is currently standing at a make-or-break level. Price has retraced back to the critical weekly demand zone between $4.00 and $4.40 — a region that previously served as the launchpad for a major rally in early 2023.

This isn't just any support — it’s a historical accumulation zone, where strong buying interest was previously observed. The big question is: Will history repeat itself, or is a major breakdown looming?

🔍 Pattern Structure and Technical Outlook:

APT has been consolidating inside a large horizontal range (accumulation box) between $4.00 and $18.27 for nearly two years.

Price is now retesting the lower boundary of this range, right at the $4.00–$4.40 zone.

Current price action shows heavy selling pressure, but buyers may step in at this demand level.

A potential double bottom or false breakdown could form if this week closes with a long lower wick and bullish body.

🟢 Bullish Scenario: Reversal from the Legendary Support

If the $4.00–$4.40 zone holds once again, we could witness a technical rebound with meaningful upside targets:

Key Bullish Targets:

1. $5.14 – Immediate minor resistance, easy to break if short-covering begins.

2. $5.86 – A key level previously rejected, acting as the first confirmation of trend reversal.

3. $7.63 – $9.00 – Former consolidation zone, potential mid-term target.

4. $10.18 to $14.51 – If momentum builds, this becomes the next major expansion zone.

> 📈 Positive catalysts such as improving crypto sentiment, strong volume inflow, or bullish fundamentals could accelerate this scenario.

🔴 Bearish Scenario: Critical Breakdown from Demand Structure

If sellers remain dominant and price closes below $4.00, this would:

Confirm a breakdown from the long-standing accumulation range

Open the door for a deeper retracement toward:

$3.50

$2.80

Possibly as low as the psychological level of $2.00

> ⚠️ Such a breakdown could indicate a major distribution phase and a loss of confidence from larger market players.

🧠 Suggested Trading Strategies:

Buy on Confirmation: Look for strong bullish reversal candles (hammer, pin bar, bullish engulfing) at the demand zone.

Breakout Strategy: Wait for a breakout and retest above $5.86–$7.63 for a safer entry.

Bearish Bias: Consider short entries on a confirmed breakdown and failed retest above $4.00.

📌 Conclusion:

APT is testing its final line of defense. The $4.00 zone remains the last stand for bulls before opening the door to deeper downside levels. Will buyers show strength once again, or are we headed for a major sell-off?

> This week’s close is crucial and could define APT’s trajectory for the upcoming quarter. Watch volume, candle structure, and buyer reaction very closely.

#APTUSDT #APTAnalysis #CryptoReversal #DemandZone #SupportAndResistance #PriceActionTrading #AltcoinSetup #TechnicalAnalysis #CryptoBreakout

Aptos Long Term ViewAptos taken out almost all liquidation from below side, it can fall more towards 3.5$ to take out all new buyers and then push towards 15$, remember 15-16$ is an unmitigated zone, sooner or later this imbalance zone will be filled. So if your an investor and want easy 3x gain then buy apt from 5$ 2nd entry 4$ and last buying from 3.5$, ignore lower timeframe volatility and BTC movement, these entries are easily achievable if market crashes by any chance so you can close your position at breakeven. While 7.19-7.50$ area is crucial to break, once this zone is broken there is nothing upside that can stop Aptos from hitting 15$. Any daily candle closing above the marked zone will confirm trend shift, before this trade setup is like high risk n reward. While I'm very confident on Aptos that it will hit 15% mark.

APT at 4.78 $ Historic Support – Massive Reversal Incoming?#APT

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 4.78, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 4.60.

Entry price: 4.88

First target: 5.047

Second target: 5.19

Third target: 5.35

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

#APT/USDT#APT

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 3.81, acting as strong support from which the price can rebound.

Entry price: 4.03

First target: 4.16

Second target: 4.30

Third target: 4.59

Aptos APT price analysis💰 We will soon find out whether the price of #APT has finally begun to recover, or whether this is just a rebound before a further decline.

📈 For growth to continue, it is important that buyers manage to keep the price of OKX:APTUSDT above $4

◆ Next, the price will exit the falling channel and move towards the strong mirror level of $8

◆ And only after the #APTOS price consolidates above this level will it be possible to talk about an ambitious uptrend.

🐻 Well, the negative scenario is a lackluster fall from $4 to $3, or maybe even lower...

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

APT around a historical support DO or DIEAPT / USDT

Price dropped hard to retest the massive historical support again

This multi years support ( 3$-4$) zone always shows great buying pressures thats why it catch our attention!

This support also can play as DO or DIE borderline between bulls and bears

The buyers must defend this area otherwise it will die and make new lows

Keep an eye on it

Aptos Bullish, Altcoins BullishThe best is yet to come. Do not despair my dear friend, patience is key.

Aptos is breaking bullish right now after a final low with the highest volume since February. This confirms the latest double-bottom as the market bottom.

The high bullish momentum developing on today's candle, full green, coupled with the fact that a major flush is present on the chart reveals really good news. Today, things might seen down and quiet; everything can change in a day.

The bullish wave is on, it is starting now and it will be strong. Bottom prices will be gone within hours but we will experience long-term growth. Keep in mind that 100%-200% can happen within a matter of days. This is because the market is set to grow in excess of 1,000-2,000%, so the first jump is very strong but only signals the start. Getting bottom prices can be life changing.

This is a friendly reminder; the best is yet to come.

Aptos bullish means the altcoins are bullish.

The altcoins going bullish means that Bitcoin will soon resume with new all-time highs and additional growth.

Trust crypto, trust the market, trust your plan. You will be rewarded long-term.

The time to buy is now. Profits are on their way. To you!

Namaste.

Aptos, Good & Bad (Leveraged Trading vs Spot)This is both good and bad at the same time.

The bad part, or rather sad part, is the fact that there hasn't been any decent bullish action recently. This pair did not grow by any significant amount after its 7-April low.

Ok, what about the good part?

The good part is that prices are low. This pair is "yet to move."

Low prices means a great buy opportunity for what we know comes next.

I know, I know... You might not believe me or your morale might be done but we already had a preview with many pairs growing between 100 and 300%. In less than two months. That's the preview. But the market is big and not the entire market can advance in a single wave. That's why I keep on harping "choose wisely," because sometimes we can end up with the pairs that are not moving in the current wave. They will move, trust, but some will move now and others later down the road.

Ok, good and bad.

The bad part is not that bad but it can be said that it is bad that prices are low. But this is actually good. If prices were high, there would be no buying opportunity, we would have to ignore, dismiss this pair. Since prices are trading low-near support, we can accumulate; buy and hold focused on the long-term.

I mentioned tons of times leveraged trading but all these chart setup can be traded spot. In fact, any setup that is good for leverage is even better for spot because the risk is none.

With spot trading we simply hold. What's the problem? You expected 1,000% growth in 2 months? If that's the case, it simply takes longer and we wait. See? No loss, the worst case scenario is a long-term wait. That's spot trading, buy and hold and you will win in the end.

Leveraged trading is more complex but you know, risk vs reward. You put on lots of risk, huge risk but wow, the rewards potential is awesome. We only approach this tool when we learn the market, when we know what we are doing and we have no need for money; only when money is already plentiful and available.

If you have a need to earn now, "make money fast," and so on; avoid leveraged trading at all costs because it is very likely that you will lose everything rather than achieve success. But, on the other hand, if you are living the good life, you communicate with your wife and you have heart, you are grateful for the food you eat, for the simple stuff, for your house, your friends, your bed; then you can use leveraged trading. Because you will be able to know when to close a position and say "thank you!" rather than double-down on a losing trade.

In short, we need a stable life and mind to use this tool with any success. If our lives and minds are not stable, it is better to start slow. If you cannot make money slow, you will not be able to make money fast. If you cannot appreciate $100, you won't be able to accept $1,000 for a single trade.

So, thanks a lot for your continued support.

I hope you are enjoying the content. It is always my pleasure to write for you, day after day after day.

Remember, it is not about getting it right or getting it wrong, it is all about a mental, emotional and spiritual connection. I am sharing what I learn just so that you can avoid the pain of a major loss, something that I know just too well because I've been there before. I've lost everything countless times and yet, I continue to fight, prosper and grow.

Namaste.

#APT/USDT#APT

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 4.87.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 4.92

First target: 4.95

Second target: 5.02

Third target: 5.10

TradeCityPro | APT: Triangle Squeeze Near Crucial Support Zone👋 Welcome to TradeCity Pro!

In this analysis, I’ll be reviewing the APT coin. The Aptos project is one of Ethereum’s Layer 2 solutions.

✔️ This project’s token currently holds a market cap of $3.1 billion and ranks 32nd on CoinMarketCap.

📅 Daily Timeframe

On the daily chart, you can see a very strong support level at 4.718, which has been tested multiple times. The price has once again reached this zone.

💥 A descending trendline can also be drawn, showing clear reactions from the price. The area between this trendline and the 4.718 support forms a triangle pattern.

⭐ If the 4.718 support breaks, a short position could be considered. A breakdown below 37.78 on the RSI would serve as strong confirmation of bearish momentum.

📉 The initial target for the short would be 4.338. However, if a new bearish leg forms and the market heads toward lower lows, a drop toward the 3.12 support level is also possible.

📊 Confirmation of a bullish reversal would come from a breakout above the descending trendline. If this trendline is broken and the 6.152 trigger activates, it would justify opening a long position or even buying in the spot market.

🛒 When it comes to spot purchases, the most important factor is a trend reversal in Bitcoin dominance. Personally, I do not buy any altcoins on spot until Bitcoin dominance shifts downward on the daily chart — I only trade them in futures.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️