AUDUSD BEARISH FLAGAUDUSD Is approaching the floor of the Ascending Channel after completing 5 impulse bullish waves

after the 5 waves price tends to have a mayor decline in price in conjunction with a bear flag the odds for a potential breakdown to the downside is imminent,

will execute the trade after a clean breakdown of the floor of the ascending channel following with a downtrend confirmation

targets will be place at 0.69988/067616

stops in the top mid range of the channel

Bearish Flag

Kahoot!: Bearish Flag FormationKahoot! - Short Term - We look to Sell at 48.75 (stop at 54.80)

Prices are extending lower from the bearish flag/pennant formation. Continued downward momentum from 54.45 resulted in the pair posting net daily losses yesterday. The medium term bias remains bearish. The continuation lower in prices through support has been impressive with strong momentum and shows no signs of slowing. Further downside is expected although we prefer to sell into rallies close to the 48.75 level.

Our profit targets will be 36.30 and 33.00

Resistance: 48.75 / 54.45 / 55.50

Support: 47.80 / 45.50 / 42.15

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing toa trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

$HD ST Long Trade IdeaHome Depot broke down out of a bear flag formation Friday, and now the path of least resistance is DOWN. However, I am speculating on a short term bounce here as HD approaches a good support zone.

Plan is to play weekly calls then look for another short opportunity at $383 zone.

Ethereum closed $ 50 million in one hour. Watch out for this !Hello everyone!

With a sharp drop, price stopped at strong support ($ 3600).

Scenario 1 on bullish rises:

Make a quick comeback with a bear flag top test or create a short term double bottom on strong support ($ 3600)

The surest entry is with test the bearish flag from top. Close to the price ($ 3900)

Scenario 2 for bearish rides:

Testing a bear flag from below and it will drop (Book play)

The best place to entry in this situation is the second low at $ 3,600 tested from the bottom.

In this scenario, I aim to test the highs from 09/23 and 09/27, which have not been tested and are very close to 0.5 FIB

I myself will deal with a new one with my strategy if it happens.

Comment and like.

Greetings!

Ethereum closed $ 50 million in one hour. Watch out for this !Hello everyone!

With a sharp drop, price stopped at strong support ($ 3600).

Scenario 1 on bullish rises:

Make a quick comeback with a bear flag top test or create a short term double bottom on strong support ($ 3600)

The surest entry is with test the bearish flag from top. Close to the price ($ 3900)

Scenario 2 for bearish rides:

Testing a bear flag from below and it will drop (Book play)

The best place to entry in this situation is the second low at $ 3,600 tested from the bottom.

In this scenario, I aim to test the highs from 09/23 and 09/27, which have not been tested and are very close to 0.5 FIB

I myself will deal with a new one with my strategy if it happens.

Comment and like.

Greetings!

EURUSD WedgeThere is a wedge formation on the 4h and 1h on EURUSD. I will not predict which way it will breakout, as I am a reactionary trader and neither I nor anyone can predict the future. However if it breaks under or above support/resistance AND closes, then I will execute a trade in that direction until it reaches the next support/resistance.

DO YOUR OWN ANALYSIS, DO NOT EXECUTE A TRADE JUST BECAUSE A STRANGER ON THE INTERNET HAS A COMPELLING ANALYSIS>

HAPPY TRADING AND BE CAREFUL :)

Thanks,

Richard Blake

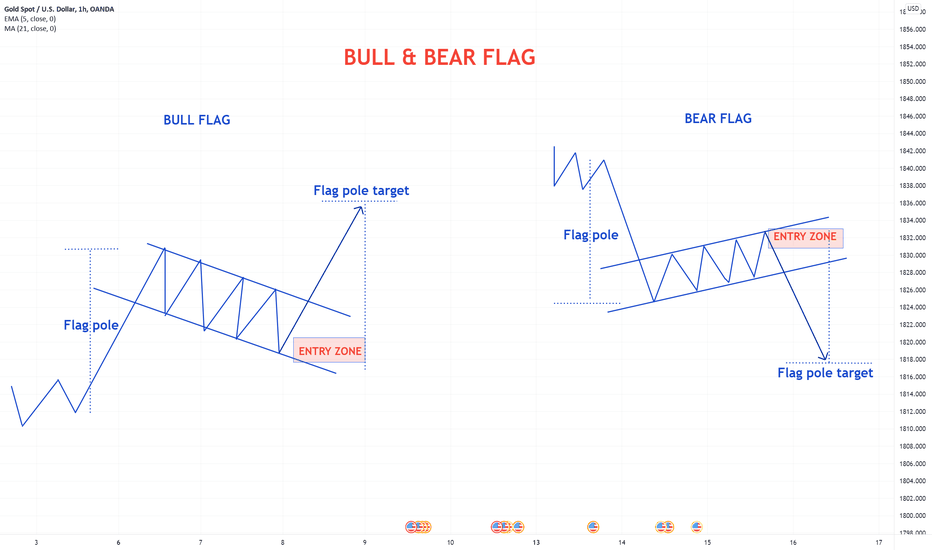

BULL & BEAR FLAG PATTERNSBULL FLAG

This pattern occurs in an uptrend to confirm further movement up. The continuation of the movement up can be measured by the size of the of pole.

BEAR FLAG

This pattern occurs in a downtrend to confirm further movement down. The continuation of the movement down can be measured by the size of the pole.

Please don't forget to like, comment and follow to support us,

GoldViewFx

XAUUSD TOP AUTHOR

Bitcoin's current price action (December 2021) bear flag?Hello all,

The uptrend from July got destroyed with a $16,000 crash before stopping at $42,000. The uptrend which triggered the bull market that started March 2020 hasn't been tapped since the 2nd validation touch in October of 2020. It's been over a year now....be ready for anything.

If we see a rejection from the retest of the broken uptrend it's likely we go much lower which would result in painting a bear flag leading to deviation of Septembers low for liquidity purposes.

(not financial advice, this is my journal)

BTC/USD ABC Correction in PlayLikely BTC/USD ABC correction in play.

Notice the confluence of extensions and key levels. If compared to the 4 hour downtrend line (in white), a bounce to 56k would still make a daily downtrend valid.

Meanwhile the recent bounce off of $47.1K could be a potential support but the more likely scenario is a bear flag and an ABC dead cat bounce.

Zooming out to the weekly we see fractal patterns resembling a bear flag with further downside in play. Volume candles on the recent capitulation dump prove notable but not convincing. The recent break below the orange trend line shows a potential bull trap fake out last week followed by a Friday night massacre on the markets.

Useful is a comparison the the ETH/USD and ETH/BTC charts when compared with ETH.D dominance which recently peaked at 22%.

🔥 SHIBA Bear Flag: Volatility ExpectedSince yesterday's massive sell-off, SHIBA has been following a clear triangular pattern, also known as a flag. Since the pattern appears during a bearish trend, it's a bear flag.

Consolidation patterns, like this flag pattern, often result in a volatile move once the pattern is complete. Since this is a bearish continuation pattern, statistically a bearish break out would be more likely.

However, the current dip is being bought up very quickly, so I wouldn't be surprised if SHIBA made a bullish move withing the next couple of hours.

In case of a bullish break out, wait for the price to close above the yellow dotted line before entering. Same goes for bearish, but on the other side of the pattern.

Targets placed at recent local tops and bottoms.

Happy trading!