BTC Usdt Crypto Short p.Dragon BTC: Strengthening, but Outflows Slow Down

Funding remains neutral, institutional activity is moderate

📉 Exchange Reserves: 2.4297M BTC (–0.11%)

💵 USD Reserves: $203.3B (–1.42%)

📥 Inflow: +27.09K BTC (+0.9%)

📤 Outflow: +29.68K BTC (+0.81%)

⚖️ Netflow: –2.58K BTC ➜ Still outflow, but weakening

🔎 Market Outlook:

BTC is in an accumulation phase but lacks strong impulsive demand

ETH is losing activity but supported by stable volume

XRP / TRX / SOL are overheated — potential for pullback / profit-taking

BNB showing surging activity and volume — watch for breakout towards $600+

Bitcoin (Cryptocurrency)

BITCOIN Bull Run Activated – Here’s Why $105K Is NEXT!COINBASE:BTCUSD is displaying strong bullish potential after forming a clear double bottom around the significant support zone near $74,000. The decisive rejection of this critical area and the inability to form a lower low highlights the exhaustion of sellers at this key level. The formation of this double bottom, coupled with a solid bullish reaction, suggests institutions are actively accumulating Bitcoin, driving prices upward.

The current market structure implies a bullish continuation toward the significant resistance zone around $105,000. With the ascending channel clearly intact and buyers stepping aggressively at support, a sustained bullish impulse toward the channel's upper boundary is very likely.

From a fundamental perspective, Bitcoin is gaining strength due to several key macroeconomic factors unfolding globally. The recent decision by the Trump administration to significantly escalate trade tariffs has heightened economic uncertainty, disrupting traditional markets and spurring investors toward alternative assets. Historically, Bitcoin has thrived during periods of economic instability and policy uncertainty, as investors seek to hedge against volatility in equities, bonds, and fiat currencies.

Furthermore, the tightening monetary policies across major global economies are exacerbating recessionary fears. Central banks face increasingly difficult decisions between managing inflation and sustaining economic growth. This dilemma continues to reinforce Bitcoin's narrative as "digital gold," a decentralized hedge immune to direct manipulation by central authorities. As institutions and investors recalibrate their portfolios amid these conditions, capital allocation toward Bitcoin is expected to rise significantly.

Institutional adoption continues its upward momentum, evidenced by increased activity on spot markets and significant inflows into crypto-based investment vehicles. Regulatory clarity in major jurisdictions and infrastructure improvements have reduced previous barriers, enabling broader and deeper institutional participation in the crypto ecosystem. This growing institutional endorsement solidifies Bitcoin's bullish case, providing strong foundational support for a sustained move towards the targeted $105,000 resistance zone.

The convergence of technical patterns and powerful fundamental catalysts strongly supports Bitcoin's imminent upside potential.

Traders should closely watch for confirmation signals, such as increasing bullish volume, strong candle closures above intermediate resistance levels, and higher low formations, to validate this bullish scenario.

Feel free to share your thoughts or add further insights into this analysis!

Bitcoin - This Is Just Wonderful!Bitcoin ( CRYPTO:BTCUSD ) creates textbook market stucture:

Click chart above to see the detailed analysis👆🏻

The entire stock market is selling off significantly but Bitcoin and most cryptocurrencies are still holding their strong levels. This is clearly a sign of bullish strength and even if we see a retest of the previous all time high, the overall uptrend remains perfectly valid over the next months.

Levels to watch: $70.000

Keep your long term vision,

Philip (BasicTrading)

Bitcoin - 2025After a long consolidation around $100,000, and a correction of ~32% from the top, it seems we are preparing for a new move.

In the previous idea, I mentioned that there could be either consolidation or a healthy correction, but both happened.

I will describe several scenarios that I see.

I will describe only positive, super-positive and ultra-positive ones.

Since the negative sounds like this - we have already reached the peak, there will be a small over-high, and we will go bearish.

Positive scenario - parabolic growth, with a new peak in the region of $150,000-$200,000

Super-positive scenario - parabolic growth, with a new peak in the region of $200,000-$300,000

Ultra-positive scenario - parabolic growth, with a new peak in the region of $300,000-$400,000

Now you must ask - can we really reach $400,000, how is this possible, with the current price of $84,000, and April outside the window?

I will tell you that there is nothing complicated or incredible here, that is why it is ultra-positive.

But you should focus only on positive and negative scenarios, and not float in the clouds hoping for a miracle.

As for altcoins, in this scenario, I don't think Bitcoin dominance will last long, so high, in any case, soon there will either be an overflow and altcoins will start shooting, or we will all die from the paws of bears

HOLD YOUR BEARS, IT'S NOT OVER

BTC/USDT Analysis – Shorts in FocusHello everyone! This is CryptoRobotics’ trader-analyst with your daily analysis.

Yesterday and today, Bitcoin continued to trade sideways and even attempted to break the local high, but was met with market selling pressure.

At the moment, we still prioritize the short scenario. Around the ~$84,700 level, we observed a battle between buyers and sellers. If the price consolidates below this level, it will confirm the bearish scenario and we’ll look for a move down to the next buy zone.

If buyers strongly defend this level, we may retest the local high.

Sell zones:

$85,600–$88,000 (absorption of aggressive buying),

$95,000–$96,700 (accumulated volume),

$97,500–$98,400 (pushing volumes),

$107,000–$109,000 (volume anomalies).

Buy zones:

$82,700–$81,400 (volume zone),

Level at $74,800,

$69,000–$60,600 (accumulated volume).

What do you think will happen first?

A full breakout through the sell zone and continuation of the uptrend, or a correction?

Share your thoughts in the comments — would be interesting to compare views!

This post is not financial advice

Bitcoin Bullish Bat Harmonic Forming – Breakout Imminent!?Bitcoin ( BINANCE:BTCUSDT ) then reached $85,500 , as I expected in my previous post .

Today, I want to share with you a short-term analysis of Bitcoin , and Bitcoin can break the Important Resistance line !

Bitcoin is trading near the Support zone($83,880-$82,380) and Support lines .

Bitcoin is likely to start rising again with the help of the Bullish Bat Harmonic Pattern .

I expect Bitcoin to start rising again either with the help of the Bullish Bat Harmonic Pattern or near the Support lines and Cumulative Long Liquidation Leverage($82,426-$81,439) . The first target could be the important resistance line , and if it breaks, it looks like Bitcoin could break the resistance zone ($87,520-$85,840 ) as well.

Cumulative Short Liquidation Leverage: $86,624-$85,486

Note: To break the Important Resistance line , we need a candle with high volume at least on the 4-hour time frame , like the Bullish Marubozu candle ; otherwise, it is probably we will see fake break . Since this line is of great importance, it is better to look for a confirming candle on the 4-hour time frame as well ( even a Doji candle with a small green body ).

Note: If Bitcoin falls below $81,000, we can expect further declines.

Do you think Bitcoin can break the Important Resistance line!?

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Bullish??? That was all very sudden, is it over now?The market correction really seamed to be an over reaction. I am hopeful that the worst is behind us, at least for the meantime.

maybe this will be closer to 2018 correction and we just keep grinding higher for the rest of the year. I suppose anything is possible.

-Everyone got way to bearish to quick - Spidey senses going off!

-we never copy and paste last cycle to the next, but people have such a recency bias, sometimes its all they can see ( I may know from experience)

- hopefully bullish

Bitcoin can exit from wedge and then drop to support levelHello traders, I want share with you my opinion about Bitcoin. Earlier, the price was moving inside a broad horizontal range, with clear rejections from both support and resistance. The lower boundary of this range was located near the support level at 81200 points, and the market found solid footing there. After a series of bounces, BTC gradually started to grow, breaking out of the lower range and forming a new short-term trend. The growth accelerated after the price exited the buyer zone, leading to the development of an upward wedge. Within this pattern, BTC continued climbing and eventually broke through interim resistance levels, reaching new local highs. The current movement shows clean reactions to the support and resistance lines of the wedge, with the price respecting the structure closely. Now, BTC is approaching the resistance level at 88500, which aligns with the upper boundary of the previous range and borders the seller zone. The combination of this resistance and the narrowing wedge formation increases the probability of a bearish reversal. Given this setup, I expect BTC to reverse soon and continue moving down toward the 81200 support level, which remains my current TP1. Please share this idea with your friends and click Boost 🚀

Long Coinbase as a proxy bet on Crypto until end of yearUntil proven otherwise I must be under the assumption that the worst is behind us for the time being. That being said, more debasement is infinitely more likely than less, so long risk assets.

-looking for a lovely retest of the broken downtrend, coinciding with a nice support level within the next 30 days. This has to be a buy for me (in the green box).

-looking to close position late this year (likely December)

HelenP. I Bitcoin will rebound from trend line and drop to $80KHi folks today I'm prepared for you Bitcoin analytics. After multiple attempts to break through the resistance zone between 88500 and 89800 points, Bitcoin continues to respect the upper boundary of the descending wedge. The price remains confined within this structure, with each test of the trend line resulting in a rejection. The most recent rally brought Bitcoin back into the resistance area and right up to the trend line once again, but the breakout didn’t happen. Earlier, Bitcoin bounced strongly from the support zone between 80000 and 78800 points, forming a local bottom before initiating its move upward. However, even after this strong bounce, the price still failed to break above the trend line, confirming that bearish pressure remains active. The resistance zone has rejected the price four times, reinforcing its significance. Currently, BTCUSDT is trading just below the trend line and inside the wedge. Given the repeated failures to break higher, the strong supply zone, and the continuation of the downward pattern, I expect Bitcoin to reverse again and fall back toward the 80000 level. That's why this level is my current goal. If you like my analytics you may support me with your like/comment ❤️

Bitcoin Interesting Fractal And Timing! GOING STRAIGHT UP!I noticed that the timing and pattern of how this is playing out in 2025 in Bitcoin is very similar to that of 2017. This fractal is not identical but its damn close. In 2017 there were approximately 15 million people in crypto, very few leverage exchanges, and trading was no where near what it is today. Now we have exchanges everywhere, hundreds of them most with leverage which we didn't really have before. Also not to mention that now we have big players getting in and they aren't buying and selling on the daily, they are buying it all and holding it, hence why we aren't seeing the typical "Alt season". The sloshing effect we had in the early days when traders would rotate out of Bitcoin into alts is not happening as it used to.

In 2017 Trump took office and in the end of March the bull run started in full swing. Something very similar is also happening now that we are in March and these fractals are lining up. Let see how this plays out. I think we are on the cusp of a giant mega bull run like you've seen before.

Crypto traders last year made mega profits cashing out multiple billions in capital gains. Once the selling stops around the end of March and beginning of April from people selling to pay taxes I think its on. This is not financial advice this is just my opinion. Lets see how this chart ages. Thank you for reading.

The Bitcoin Trust Flow Cycles- by FXPROFESSOR🏆 The Bitcoin Trust Flow Cycles™ by FXPROFESSOR

Video:

Friends, today I’m sharing what may be the most important Bitcoin framework of 2025.

Forget the broken halving expectations. Forget the chaos of macro headlines.

What if the real signal has been here all along?

What if Bitcoin’s true rhythm follows the capital rotation between itself and the U.S. Treasury market?

📊 Introducing: The Bitcoin Trust Flow Cycles™

This is not a model of where Bitcoin could go (like Stock-to-Flow)…

This is a model of when and why it moves — based on the trust rotation between U.S. Treasury Bonds (TLT) and Bitcoin.

What I’ve found is a repeating structure — not based on supply or halvings, but on macro trust dynamics.

🔁 The Two Core Phases:

• Correlated Periods 🟦 (Blue zones): BTC and TLT move together — both rising or falling

• Inverted Periods 🟩 (Green zones): BTC and TLT move in opposite directions

These aren't random — they're structural rotations that occur at key technical levels in the bond market.

🧠 The Cycle Timeline:

Jan 2019 – Feb 2020 → Correlated (pre-COVID calm)

Feb 2020 – Sep 2021 → Inverted (Fed QE, Bitcoin moon)

Sep 2021 – Nov 2022 → Correlated (everything dumps)

Nov 2022 – Oct 2023 → Inverted (TLT collapse, BTC recovers)

Nov 2023 – Aug 2024 → Correlated (sideways digestion)

Aug 2024 – Now (Apr 2025) → Inverted again — and compressing fast

We're now in Period 6 — an Inverted Period — but all signs point to an upcoming Reversion.

📉 What Happens at Each Flip?

These transitions tend to occur when:

• TLT hits major channel support or resistance

• Macro fear or liquidity shocks drive trust shifts

• Smart money starts reallocating across asset classes

Right now, TLT is at channel support — a zone that has previously triggered reversions into correlated periods.

📌 What Comes Next:

According to the Bitcoin Trust Flow Cycles™:

→ We are statistically due for a reversion** back into correlation

→ If TLT bounces from 76–71 zone… BTC may follow — not fight

→ The target remains: BTC breaking above 115 resistance

This flip — from inverse to correlated — has historically marked breakout windows for Bitcoin.

🔮 This Is Bigger Than a Halving

Plan B’s Stock-to-Flow gave us valuable insight into long-term valuation.

But it doesn’t explain timing.

This model isn’t about supply mechanics.

It’s about macro trust mechanics.

When institutional confidence leaves Treasuries…

And enters Bitcoin…

That’s the rotation we track.

That’s what moves the chart now.

🎯 Watchlist: • TLT support: 76 → 71 zone = reversal signal

• BTC breakout trigger: 115 resistance

• Cycle shift: Reversion = Bitcoin joining TLT upside

If this plays out, it could mark the most important trust cycle breakout we’ve seen since the COVID inversion.

Bitcoin doesn’t need permission anymore.

It just needs a macro trigger. And this model helps us spot it.

One Love,

The FXPROFESSOR 💙

📌 Missed the full credit market breakdown? Check my recent posts on BKLN, HYG, LQD, and TLT to understand the full Trust Flow rotation.

Forget halving hype. This new model tracks when Bitcoin moves with (🔄) or against (🔁) U.S. Treasuries — based on macro trust flows.

And right now? We're at the edge of an EPIC reversion.📈📈📈

👇

#Bitcoin #Macro #TrustFlow #TLT CRYPTOCAP:BTC

Early Bullish Signals for Bitcoin Emerge: What’s Next?Bitcoin has now broken above its downtrend channel, likely signaling the first bullish shift in trend. So far, tariffs haven’t fully impacted economic data aside from inflation expectations, consumer sentiment, and PMIs. The more tangible effects are likely to start appearing in June. With the bulk of tariffs (excluding those on China) postponed for three months, the next 1.5 months may offer a window for crypto to stage a positive reaction.

Still, it’s too early to celebrate the start of a full bull market. The ongoing tariff situation continues to keep markets on edge, and sentiment could shift quickly even with a single post from Trump.

Technically, breaking out of the trend channel and holding above it is a strong bullish signal. A move above 86K could further boost bullish momentum. Additionally, support from the 20-EMA and 200-SMA is holding, increasing the chances of a sustained breakout.

For now, unless there's a surprise reversal, any dips or a clean break of 86K could present buying opportunities. If BTC follows through on this move, bullish traders should monitor the 91K area closely, as it may act as key resistance ahead of next stage.

Please also check the daily chart too:

TradeCityPro | Bitcoin Daily Analysis #62👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. As usual, in this analysis I want to review the futures session triggers for New York.

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, the price has a bullish structure that is still ongoing, and currently, one of the resistance levels at 85482 has been broken, and the probability of a bullish price move is high.

✔️ If you already have a position from the break of 85482, you have likely hit neither the target nor the stop-loss yet. The target for this position could be the 88502 zone.

✨ But if you don’t have an open position and are looking for a trigger, a price pullback to the 85482 zone with confirmation, or even a break of one of the short-term resistances in lower time frames, can be a suitable trigger for a short position.

📉 For a short position, if the price fakes the breakout of the 85482 resistance and moves downward, with confirmation in lower time frames and a break of the Fake Breakout trigger, we can enter a short position. The main short trigger is the break of the 83233 zone.

👑 BTC.D Analysis

Let’s take a look at Bitcoin dominance. As you can see, dominance has started another bullish leg and after breaking 63.61, it reached 63.80, and now with the break of 63.80, it's ready to carry out its main bullish move.

🔼 For now, we see the trend in dominance as bullish, so long positions on Bitcoin and short positions on altcoins are suitable.

📅 Total2 Analysis

Let’s take a look at the Total2 analysis. As I mentioned, since dominance is bullish, Bitcoin is moving more than altcoins. Right now, we can also see this in Total2, where momentum is less than Bitcoin and it has moved slightly away from its top, while Bitcoin has broken its high.

🔍 For a long position, the break of the 980 zone is still valid, and if it breaks, the price could move up to the 1.2 zone. For a short position, we have two triggers.

📉 The first trigger is the 956 zone, which is a good entry point but risky, and the chance of hitting stop-loss is high. The second trigger is the 947 zone, which is a more reliable trigger, but if it breaks, opening a position will be harder and we might not get a solid confirmation candle.

📅 USDT.D Analysis

Let’s move on to Tether dominance. You could say the entire market is waiting for Tether dominance to move, and even Bitcoin, despite breaking its resistance, hasn't moved yet because the 5.39 zone in dominance hasn't broken.

🎲 This zone is a very important one, and if it breaks, we could see a bearish leg down to the 5.24 zone, which would push the market upward. The bullish trigger for dominance for now is the break of 5.53.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

New era: 'The Bitcoin Trust Flow Cycles'🏆 The Bitcoin Trust Flow Cycles™ by FXPROFESSOR

Friends, today I’m sharing what may be the most important Bitcoin framework of 2025.

Forget the broken halving expectations. Forget the chaos of macro headlines.

What if the real signal has been here all along?

What if Bitcoin’s true rhythm follows the capital rotation between itself and the U.S. Treasury market?

📊 Introducing: The Bitcoin Trust Flow Cycles™

This is not a model of where Bitcoin could go (like Stock-to-Flow)…

This is a model of when and why it moves — based on the trust rotation between U.S. Treasury Bonds (TLT) and Bitcoin.

What I’ve found is a repeating structure — not based on supply or halvings, but on macro trust dynamics .

🔁 The Two Core Phases:

• Correlated Periods 🟦 (Blue zones): BTC and TLT move together — both rising or falling

• Inverted Periods 🟩 (Green zones): BTC and TLT move in opposite directions

These aren't random — they're structural rotations that occur at key technical levels in the bond market.

🧠 The Cycle Timeline:

Jan 2019 – Feb 2020 → Correlated (pre-COVID calm)

Feb 2020 – Sep 2021 → Inverted (Fed QE, Bitcoin moon)

Sep 2021 – Nov 2022 → Correlated (everything dumps)

Nov 2022 – Oct 2023 → Inverted (TLT collapse, BTC recovers)

Nov 2023 – Aug 2024 → Correlated (sideways digestion)

Aug 2024 – Now (Apr 2025) → Inverted again — and compressing fast

We're now in Period 6 — an Inverted Period — but all signs point to an upcoming Reversion.

📉 What Happens at Each Flip?

These transitions tend to occur when:

• TLT hits major channel support or resistance

• Macro fear or liquidity shocks drive trust shifts

• Smart money starts reallocating across asset classes

Right now, TLT is at channel support — a zone that has previously triggered reversions into correlated periods.

📌 What Comes Next:

According to the Bitcoin Trust Flow Cycles™ :

→ We are statistically due for a reversion** back into correlation

→ If TLT bounces from 76–71 zone… BTC may follow — not fight

→ The target remains: BTC breaking above 115 resistance

This flip — from inverse to correlated — has historically marked breakout windows for Bitcoin.

🔮 This Is Bigger Than a Halving

Plan B’s Stock-to-Flow gave us valuable insight into long-term valuation.

But it doesn’t explain timing.

This model isn’t about supply mechanics.

It’s about macro trust mechanics .

When institutional confidence leaves Treasuries…

And enters Bitcoin…

That’s the rotation we track.

That’s what moves the chart now.

🎯 Watchlist: • TLT support: 76 → 71 zone = reversal signal

• BTC breakout trigger: 115 resistance

• Cycle shift: Reversion = Bitcoin joining TLT upside

If this plays out, it could mark the most important trust cycle breakout we’ve seen since the COVID inversion.

Bitcoin doesn’t need permission anymore.

It just needs a macro trigger. And this model helps us spot it.

One Love,

The FXPROFESSOR 💙

📌 Missed the full credit market breakdown? Check my recent posts on BKLN, HYG, LQD, and TLT to understand the full Trust Flow rotation.

BTC made a bottom at 200MA on 2D. What's next?So far, everything is in line with the fractal I shared earlier, and this was the bottom.

The first stop was around the 50MA on 2D, and the next target, before a major correction, was the 0.618 level. If that's the case, we could test 88-90k by the end of April and then move towards 96k.

If the price fails to break through the 50MA relatively easily, as it did earlier, then we will be talking about a different scenario.

P.S. Timing could be off, but that doesn't really matter to me.

Bitcoin breaks resistance trend lineIn another sign of recovery, Bitcoin is trying to break away from a key short-term resistance trend line that has been in place since the cryptocurrency topped out in January this year at above $109K.

BTC/USD has already reclaimed a few short-term levels such as FWB:83K and moved above the 21-day exponential moving average to provide the first objective bullish signal.

More work is still needed before we get the all-clear, with the 200-day average and more importantly a key resistance range around $90K (specifically in the $88.8K to $91.2K range) to contend with.

Still, we have a few tentative signs of a possible reversal, which is evidenced across risk assets including major stock indices.

By Fawad Razaqzada, market analyst with FOREX.com

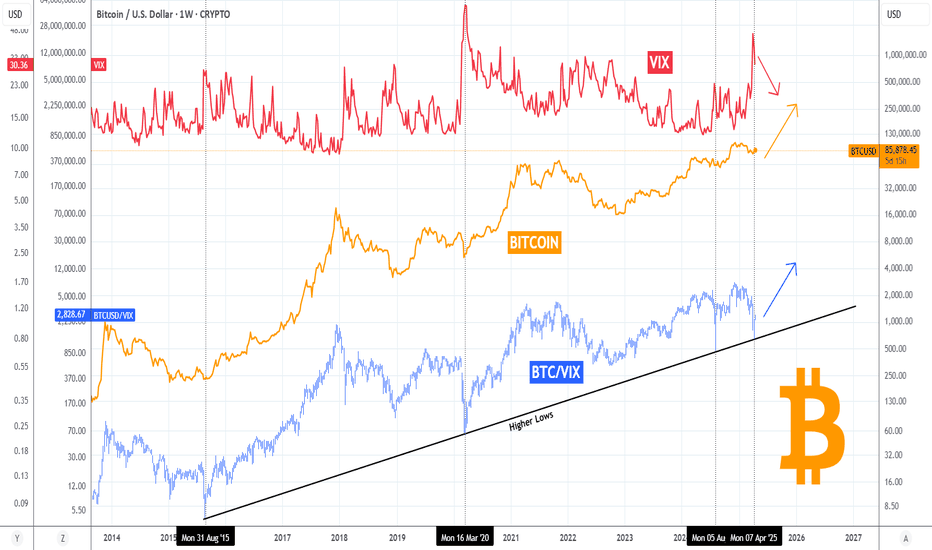

BITCOIN's ultimate VIX bottom signal-Last time gave +100% profitBitcoin (BTCUSD) is attempting to make yet another green day, yesterday not only did it close above its 1D MA50 again but was also the 4th green day in the last 6. This attempt is showing that the trend is gradually shifting again towards long-term bullish but today we'll present to you another one, this time in relation to the Volatility Index (VIX).

BTC's (orange trend-line) recent rise is naturally on a negative correlation with VIX (red trend-line) which is currently pulling back after it's most aggressive spike since the COVID flash-crash (March 2020).

Their ratio BTCUSD/VIX (blue trend-line) made a very interesting contact with the Higher Lows trend-line that has been holding since the August 24 2015 Low, which was the bottom of the 2014 Bear Cycle. Since then it made Higher Lows on March 16 2020, August 05 2024 and the most recent, April 07 2025. Every time it was a bottom indication and a massive rally followed. The 'weakest' of all was the previous one, which 'only' gave a +105% rise approximately. Based on that, there is no reason not to expect BTC to hit at least $150k by the end of this Bull Cycle.

Do you think that's a plausible target? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Market Update - This Stock Market Analysis Aligns With Bitcoin..What if I told you that the stock market’s pattern could actually reveal what’s coming next for Bitcoin—would you stick around and watch the entire video? That’s exactly what I’m diving into here. I didn’t force this analysis to fit; somehow, over the past week, it just lined up this way.

In this video, I break down exactly why the next market move could be more severe than anything we’ve seen in our lifetime—yet it’s not the end of the world. In fact, if approached correctly, this could be the opportunity of a lifetime. The rebound that follows could be massive.

I’ve always had a gut feeling about this, but now the patterns are speaking loud and clear. This is the reason I created AriasWave—and this is exactly where we are right now.

This also aligns with my latest Euro analysis linked below in related ideas.

Gold – Potential Bearish Continuation After Lower High FormationMarket Context:

Gold has shown strong bullish momentum in recent sessions, but the current price structure hints at potential exhaustion. After forming a possible lower high near the $3,220 zone, price action has started to roll over, and the market may now be transitioning into a distribution phase.

Technical Breakdown:

- The chart shows a clear uptrend leading into the $3,220 region, followed by a rejection and initial breakdown.

- A lower low has already been printed, signaling a potential change in character (CHOCH) from bullish to bearish.

- A Fair Value Gap (FVG) has been left behind on the move down, sitting between approximately $3,160–$3,180. This area could act as a supply zone if price attempts a retracement.

Bearish Scenario Development:

Price is expected to retrace back into the FVG (imbalance), where selling pressure may reappear. This area also aligns roughly with a 0.28 Fibonacci level from the recent impulse down — a common retracement point for corrective moves in a shifting market.

Should this retracement hold and show rejection (e.g., wick rejections, bearish engulfing, displacement), the market could resume downward movement, continuing the developing bearish trend. The next potential liquidity target sits around the $3,060–$3,040 zone, aligning with the 0.618–0.65 Fibonacci retracement of the prior bullish move.

Key Technical Levels:

- Supply/FVG zone: ~$3,160–$3,180

- Current resistance region: ~$3,220 (prior swing high)

- Potential demand zone: ~$3,060–$3,040 (0.618–0.65 retracement)

- Deeper retracement zone: ~$3,000 (0.786 level and prior structure confluence)

What to Look For:

- If price retraces into the FVG and shows weakness, this could confirm the lower high and continuation of the bearish leg.

- A clean break of the $3,060 level would further validate the bearish bias, likely drawing price toward deeper retracement zones.

- If, however, price reclaims and holds above the FVG zone, the bias may shift back to bullish, and a reevaluation would be necessary.

Conclusion:

Gold is currently setting up a possible bearish continuation following a lower low and signs of exhaustion. The upcoming reaction to the FVG zone will be crucial. If the market respects this supply region, it could offer a clean move toward the $3,060 area and possibly lower. As always, let price confirm before acting—structure and reaction at key zones remain vital in this unfolding setup.

Bitcoin Dominance Ascending Channel and Altseason (1W Log)CRYPTOCAP:BTC.D has been in a clean uptrend inside an ascending channel for over 2 years.

• The midline has consistently acted as a magnet, but BTC.D has recently detached from it and might be headed for another retest of the upper boundary.

• Unless major macro catalysts intervene, I expect no notable changes until the 72-73% key area, the same zone that triggered 2021's altseason.

Regarding altseason, this cycle isn't like previous ones. With millions of tokens today, dilution is real, and a full-blown altseason where everything pumps seems unlikely.

Instead, I expect selective rotation into quality projects, and that might actually make it easier to find real outperformance.