Bitcoin's market share rises despite decline in active usersThe data shows that Bitcoin's dominance has been rising steadily since 2022. It also highlights that Bitcoin's market share of active users has fallen over time. The data shows that on-chain activity in Ethereum and other layer 1 (L1) networks has increased.

OnChain data shows that Bitcoin's dominance has increased since 2022, and the upward trend is the longest in history. The data also shows that Bitcoin's active user market share has fallen as on-chain activity on the Ethereum network has increased.

Amid declining users, Bitcoin dominance has increased;

Matrixport shows that Bitcoin dominance has increased to a new high of over 61%. The analytics platform put the dominance higher, which was stronger than expected in the US jobs report. It said that the increased job rate indicates that the economy is recovering. COINBASE:BTCUSD BITSTAMP:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSDT

Btctrend

Heiken Ashi Bitcoin chart shows us near Bottom of Range I have posted this chart before so this is an UPDATE

As we can see, PA has come down and now bumped into the rising line of long term support and at the expected % of drop ( -24 )

Does this mean that PA will bounce ?

NO but it does have a higher chance of doing so as the lower Timef rames are now oversold.

The weekly MACD is still falling Bearish and has a few more weeks to go before reaching Neutral.

The Lower Oversold time frames should give PA the energy to rise off this trend line and aim towards Range high

However, as we saw in 2023, PA can drop below and so we need to remain cautious and watch PA closely.

Tomorrow , March 12, we have the USA inflation data being released and this will most likely act as a catalyst to a move in either direction, depending on the data

So, Hang on , Be optimistic while being cautious.. Bitcoin is at a turning point....We are just notto sure in which direction.

Cold thinking on Bitcoin's "pullback moment"This morning, Bitcoin prices fluctuated again, falling below the $77,000 mark and currently fluctuating around $80,000. The market seems to have entered the "pullback moment" again. Faced with price fluctuations, I believe many friends are thinking about the same question:

Is it "getting off the train to avoid risks" or "entering the market at a low point" now?

This question seems simple, but it is actually complicated. Especially in the cryptocurrency market, short-term fluctuations are drastic, and various information noises are intertwined, which can easily make people lose their way. When we are in the "pullback moment", we need a calm thinking, and we should take our eyes off the price fluctuations in front of us and put them into the larger "trend" and "cycle" framework to examine.

Let's take a closer look at what a trend is and what a cycle is.

1. What are trends and cycles?

To understand any market, we should first distinguish between the two key concepts of "trend" and "cycle", and the crypto market is no exception.

Trend: Trend is the long-term direction of the development of things and a grand and lasting force. It represents the most essential and core trend of things, just like a surging river, once formed, it is difficult to reverse.

Cycle: The cycle is the short-term fluctuation in the development of things, and it is the rhythmic change of swinging around the trend line.

Simply put, the cycle is in the trend. However, simple inclusion is not enough to express the complex relationship between them. If the "trend" is compared to the trunk of a tree, the "cycle" is like the rings on the trunk.

When 96% of the world's population does not yet hold Bitcoin, when sovereign funds begin to include crypto assets in their balance sheets, and when blockchain technology becomes a new battlefield for the game between major powers - this galloping "digital ark" has just sailed out of the dock where it was built. COINBASE:BTCUSD BITSTAMP:BTCUSD BYBIT:BTCUSDT.P PEPPERSTONE:XAUUSD BINANCE:BTCUSDT

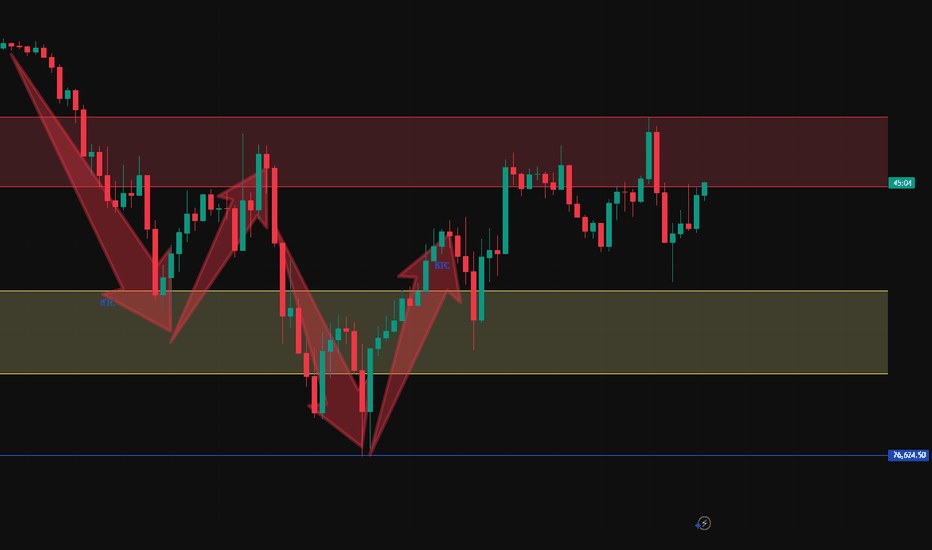

Tips to make a profit of 5000+ on BTCUSDShort-term accurate signal analysis shows support near 76300. The current price rebounded to a maximum of 82000, with a profit margin of 5000+. The current price has rebounded to a maximum of 82,000, and the profit margin has reached 5,000+. There is no chance or luck in the transaction, and only strength can lead to victory.

If you don’t know when to buy or sell, please pay close attention to the real-time signal release of the trading center or leave me a message, so that you can quickly realize the joy of profit. COINBASE:BTCUSD BITSTAMP:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSDT

BTCToday's strategyShort - term Trend

Recently, the price of Bitcoin has been fluctuating significantly. On March 11, it rebounded from the oversold area but struggled to rise when facing the resistance level. If the bulls can continue to exert force and break through the current resistance level of $80,375.59, it may further climb to $84,119.82. If it fails to break through, it may decline again and even fall below the key support level of $76,605.75.

Long - term Trend

From a long - term perspective, since its inception, Bitcoin has generally shown an upward - trending price, despite experiencing several significant pullbacks on the way. Some financial institutions and experts are also optimistic about the long - term value of Bitcoin. For example, Standard Chartered Bank predicts that Bitcoin could reach $500,000 by 2028.

Market Sentiment and Capital Flow Analysis

Market Sentiment

Investors' attitudes towards Bitcoin are divided. On one hand, companies like MicroStrategy continue to increase their Bitcoin purchases, demonstrating the firm confidence of some investors in its long - term value. On the other hand, the market's sharp fluctuations have also made some investors worried and cautious, remaining on the sidelines.

Yesterday, I bought near 79,000, and then the lowest fell near 76500, and then increased the position at 77000, and now sell at 81500, waiting for the next buy point

BTCUSD sell @81500-82000

tp: 78000-78500

BTCUSD Buy @77500-78000

tp: 81500-82000

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

If you also aspire to achieve financial freedom,Follow the link below to get my daily strategy updates

BTC/usdtFirst, the decline reaches the 66,865 range, then the 87,000 range to fill the CME gap, and then the decline continues until the liquidity accumulation at the price of 45,000. From this price, we are accompanied by an upward wave of excitement to the 133,000 range, which is the target of the cup and holder pattern that was formed in the past. The final visit to the middle of the channel and the discount that Bitcoin will give us for the last time, and flight and flight and flight...

BTCUSD latest important newsThe U.S. government recently announced that it will not sell nearly 200,000 Bitcoins obtained from the Silk Road case. Instead, these holdings will be included in the strategic reserve.

The decision eased concerns about a potential large-scale sell-off that could add further pressure to the market. Meanwhile, large investors, often referred to as “whales,” continue to accumulate Bitcoin despite the market’s continued volatility.

Some market observers believe this may be a sign of confidence in the asset’s long-term potential. However, the continued volatility shows that uncertainty remains a key factor in the current crypto landscape. COINBASE:BTCUSD COINBASE:BTCUSD BINANCE:BTCUSDT BYBIT:BTCUSDT.P

El Salvador Increases Bitcoin Reserves Despite IMF RestrictionsDespite IMF restrictions, El Salvador Bitcoin Investment continues to grow and expand, demonstrating President Nayib Bukele’s current strong commitment to cryptocurrency policy. At the time of writing, the Central American country has managed to increase its Bitcoin holdings to 6,111.18 BTC, worth approximately $504 million in current markets, while also engaging in complex relationships with various major international financial institutions.

El Salvador’s government has persisted and even accelerated its Bitcoin accumulation strategy despite an agreement with the International Monetary Fund, which has significantly restricted its cryptocurrency activities. The December 2022 deal, which was established after lengthy negotiations, involves a $1.4 billion loan as part of a broader financial package of more than $3.5 billion. ]

At the time of writing, El Salvador Bitcoin Investment has catalyzed and spearheaded an increase from 6,072 BTC in February to 6,111.18 BTC in March 2025. This strategic acquisition, such as it is, demonstrates the government’s unwavering resolve to maintain and optimize its cryptocurrency policy despite external pressure from various major financial institutions as well as a number of key regulators that have implemented several restrictions in the current market environment. BITSTAMP:BTCUSD COINBASE:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSDT

Bitcoin crash to $80K is normal, not the start of a major declinData confirms that the latest Bitcoin crash may be the result of a natural correction, rather than the start of a major downtrend.

Bitcoin has once again fallen below $80,000 for the second time this year, sparking investor panic. As fear spreads, many are questioning whether this drop marks the end of the Bitcoin bull run or if it is just a natural correction in the ongoing uptrend. The decline in peak losses shows Bitcoin in a natural correction; in recent analysis, even though Bitcoin has revisited the $80K range, the extent of realized losses is still significantly lower than previous corrections.

While CRYPTOCAP:BTC has revisited the $8.0K range, peak losses are still significantly lower than the late February to early March correction.

Total peak losses:

February 25: $933M

February 26: $897M

February 28: $933M

BITSTAMP:BTCUSD BINANCE:BTCUSDT COINBASE:BTCUSD BYBIT:BTCUSDT.P

Bitcoin at Critical Support: Technical Analysis and Trade Idea📊 Bitcoin (BTC) is currently trading at a critical support zone, offering potential opportunities for both counter-trend trades and short setups! 🚀 In this video, we break down Bitcoin's price action and market structure on the daily and four-hour timeframes, focusing on key areas such as liquidity zones, bearish imbalances, and Fibonacci retracement levels. Discover how to identify higher highs, higher lows, and potential trade setups for both long and short positions. 💹 Whether you're an experienced trader or just getting started, this analysis will give you the tools to navigate Bitcoin's current market dynamics with confidence. 🔄 As always, this content is for educational purposes only—trade wisely and stay safe! 💡

(BTCUSD) – Bearish Continuation or Institutional Accumulation?Technical Analysis:

Bitcoin is currently trading within a descending channel, struggling to break above resistance. The price has rejected the upper boundary and could continue its downtrend toward $72,000 - $73,000 if support around $83,000 fails.

Key observations:

• Lower highs & lower lows confirm a bearish structure.

• A break below $83,000 - $82,000 could accelerate selling pressure.

• The next major support zone is $72,000 - $73,000.

Fundamental Analysis – Institutions and Governments Increasing Reserves:

• The U.S. government now holds around 200,000 BTC (~$17 billion), primarily seized from criminal cases. Their decision to maintain these holdings instead of liquidating suggests a potential shift in long-term Bitcoin adoption.

• MicroStrategy continues to accumulate BTC, now holding 423,650 BTC (~$42.43 billion), reinforcing corporate adoption of Bitcoin as a treasury asset.

• Coinbase now custodies 12% of the total Bitcoin supply, making it the largest Bitcoin custodian. This highlights institutional confidence in Bitcoin’s long-term value.

• Despite these bullish fundamentals, ETF inflows have slowed down, and macroeconomic uncertainty (such as potential Fed rate hikes) could put pressure on Bitcoin in the short term.

Will BTC reach 80,000 or 90,000? 10,000-point trading signalBTCUSD analysis and observation, 88600, 89800, 90500 are short-term resistance, and 86500, 86000, 84200 below are support. If this structure is broken, the market will enter the next stage.

BTCUSD 91000 trading opportunity has been opened, and tonight will usher in a 5000-10000 point fluctuation range

Trading is risky, positions should be reasonably controlled, when the opportunity comes, if you don’t know when to enter the market, want to get accurate transactions and huge profits in advance, please leave me a message, I will make you feel t COINBASE:BTCUSD INDEX:BTCUSD BITSTAMP:BTCUSD BINANCE:BTCUSDT hat this is true.

Bearish scenario for BTCIn trading and crypto world you have to be open to all possibilities. As we are seeing significant drop among alts and market makers manipulation. Money is withdrawed from markets and price is failing.

BTC price action reminds me 2021 year when after ATH there was a 50% drop.

Lot of similarities there - completed 5 waves, bearish div on higher timeframes, greed above 70/75, bullish sentiment, news etc.

On the other hand, current drop already liquidated more than 2b usd in one day...

We need to watch it closely and do not overtrade or do stupid FOMO.

In these time lev trades are not recommended.

THIS IS NOT A FINANCIAL ADVICE

MANAGE YOUR RISK AND ALWAYS USE STOPLOSS

Trading opportunities tonight have started at 91000Despite recent market concerns, whales continue to withdraw BTC from exchanges.

Volatility in crypto markets continued as the broader market saw 24-hour liquidations of over $500 million, with long liquidations accounting for $400 million.

The source of the US strategic reserve is the confiscated Bitcoin. The market has been prepared for this and it is not lower than expected. In the long run, it will have a great impact. BINANCE:BTCUSDT INDEX:BTCUSD BITSTAMP:BTCUSD COINBASE:BTCUSD

Trump established a Bitcoin reserve, but why did Bitcoin plummetOn March 7, Bitcoin plunged in the short term, falling below $85,000 during the session. Then it quickly rose again. More than 150,000 people were liquidated in the past 12 hours, with a liquidation amount of $540 million.

On the news, the White House cryptocurrency director said that US President Trump has signed an executive order to establish a strategic Bitcoin reserve. The strategic reserve will be capitalized by about 200,000 bitcoins owned by the federal government, and the government will not purchase additional assets for the reserve except for assets acquired through asset confiscation procedures. This is different from what the currency circle expected. Previously, the market expected the Trump administration to buy cryptocurrencies, but now it seems to be just "storage", which disappoints people.

The market is waiting for the upcoming White House cryptocurrency summit, during which Trump is expected to announce more details of the crypto reserve. On Thursday local time, US President Trump signed an executive order to establish a strategic Bitcoin reserve, the day before he met with cryptocurrency industry executives at the White House.

Sachs wrote that the order authorizes the Treasury and Commerce secretaries to develop "budget-neutral strategies" to acquire more Bitcoin, provided that it does not increase costs to American taxpayers. Sachs said that no taxpayer money would be spent to buy cryptocurrencies, so the price of Bitcoin and other tokens fell.

People at the White House cryptocurrency summit on Friday expected the event to be the stage for Trump to formally announce plans to establish a strategic reserve containing Bitcoin and four other cryptocurrencies. BINANCE:BTCUSDT COINBASE:BTCUSD BITSTAMP:BTCUSD ICMARKETS:XAUUSD

BTCUSD short trading, expected profit 3000-5000BTCUSD is now planning to trade short, with big non-farm data and the Fed meeting, and expected profits of 3000-5000

Buy: 88800, 89300,90500

TP: 87800, 87300, 86200, 83800

SL: 89800

Trading is risky, control your position reasonably.

The market is changing rapidly, please leave me a message for accurate profit signals for buying and selling.

Recently, I have made an in-depth analysis of the BTCUSD and XAUUSD signal recommendations, which can be regarded as the key to making profits in this complex market. I don't know how many traders have achieved this goal. Although I can't make you all make profits like me, the only thing I can do is to give you a road to success. I can't force you to hold your hand, but I think those who can walk on my road must be much stronger than their own road without direction and full of bumps. The trading market is a battle of real money and silver. Everyone wants to win, but you have never considered whether your strength and experience team meets the conditions for victory. Follow me and witness the future together

BINANCE:BTCUSDT BINANCE:BTCUSDT

BTCUSD trading plan to make 5000 pips profit soon

BTCUSD91500 plans to continuously generate profitable trading signals, currently reaching around 88600, and continue to generate profit of 2800+

BTC is about to usher in a 5000-10000 point big shock trading signal

On March 7, the big non-agricultural data and the next Federal Reserve meeting will be released. These data and meetings will bring epic trading opportunities for market shocks. Everyone should understand in advance and control this risk. This will be another opportunity for ordinary traders to turn over. If you want to get accurate trading signals and this lucrative profit in advance, please leave me a message. BINANCE:BTCUSDT BITSTAMP:BTCUSD BITSTAMP:BTCUSD BINANCE:BTCUSDT COINBASE:BTCUSD

Do you know the calm before the big wave of BTCUSD?At present, the BTCUSD market is in a calm before the wave, which is nothing more than the release of the next non-agricultural data and the subsequent Fed meeting. Every trader knows the importance of this impact. Of course, this fluctuation may present large-scale trading opportunities. Every trader should be aware of it. During this period, trading must control risks.

From the analysis, BTC can focus on the resistance levels of 91500 and 92300 in the short term, and the support levels of 89600 and 88500 below.

Trading is risky, and positions should be controlled reasonably. The market changes rapidly, and accurate signals are based on real-time.

Grasp the accurate trading signals, when to buy and sell, and seize large-scale profits, leave me a message. BINANCE:BTCUSDT COINBASE:BTCUSD BITSTAMP:BTCUSD INDEX:BTCUSD

Bitcoin follows Fibanacci Leverls PERFECTLY - Easy tradingBitcoin has a habit of moving Rapidly, Randomly and at times, with Huge levels of volatility.

An yet, ALWAYS, it obeys Fibanacci levels to the Key.

The chart above shows this very well on a Weekly time scale.

Since the Low and start of this cycle on 13 Jun 2022, Bitcoin has moved Time and time again with Fib Extensions and Fib Fans providing Support and resistance.

The Diagonal Rising lines are a Fib Speed Resistance Fan and the Horizontal lines are Trend-Based Fib Extension

See how on each "Step" or period of Ranging that Bitcoin has done since the low, it has been perfectly "Contained" by 2 Fib lines.

The Fib Fan can also be seen to act as support or Resistance along the way.

And right now, if we Look at the daily version of this chart, we see the situation unfolding.

Firstly, see that rising Fib resistance line that just rejected PA on sunday - STRONG

It pushed PA back below that 3 Fib extension

That same 3 Fib ext line acted as strong support since we entered this range back in December 2024. It maybe as tough to cross back over and flip back to support.

See how PA has already tested the 2.768 Fib extension below, using the rising Fib Fan and then that Fib extension to stop its fall.

To me, this points towards PA possibly remaining in this Range, between the 3 and the 2.768 fib lines till we meet that next line of rising Fib fan in the later half of March ( Around 21st )

The 50 SMA ( not shown) is rising just below this line currently and I expect PA to bounce higher when the two meet.

And so, for me, I am expecting PA to remain in a range between 91K and a low around 82K with wicks Flashing Lower to around 78K

Obviously, Things can change very Quick with Bitcoin and invalidate all this in no time..but, for now....I have my SPOT Buy Orders from lows at 78600

I am not going to miss the chance of Buying Bitcoin at that price, understanding the real Cycle ATH will be in Q4 and expected to be over 200K

Lets see if this works out

Will this short-term recovery drive Bitcoin to the $100,000 markBitcoin Price Chart

Currently, Bitcoin is trading at $92,358 with a market cap of $1.831 trillion. The completion of the Morning Star pattern on the 200-day EMA line increases the probability of a breakout beyond the resistance trendline. The price of Bitcoin has also violated the 78.60% Fibonacci level at $91,780. With the sudden recovery of Bitcoin, the index has maintained a positive stance since the end of last week due to the increase in market volatility. Additionally, the Directional Movement Index indicates a potential crossover in the VI line. This positive crossover could mark the beginning of an uptrend in Bitcoin, and a potential triangle breakout rally is on the horizon.

Despite the massive recovery in Bitcoin price, institutional support remains weak. On March 5, the US Bitcoin ETF saw a daily net outflow of $22.1 million. Surprisingly, Blackrock saw an inflow of $38.93 million, which was the first inflow after seven consecutive days of outflows.

Bitcoin ETFs, Invesco and Bitwise recorded outflows, while other ETFs maintained net zero flows. Invesco had the largest outflows, with $9.9 million worth of Bitcoin, followed by $6.9 million. BINANCE:BTCUSDT COINBASE:BTCUSD BITSTAMP:BTCUSD INDEX:BTCUSD