Btcusdtanalysis

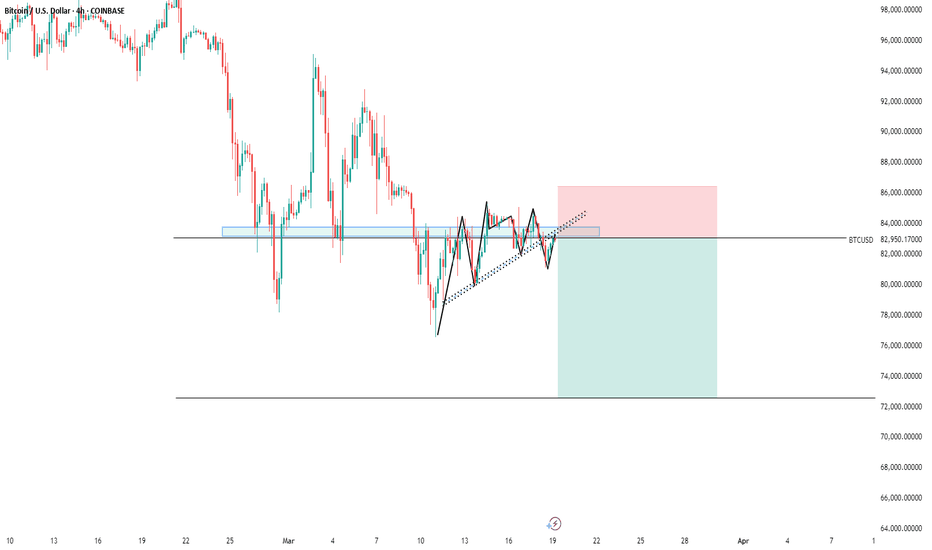

BTC Today's strategyToday, BTC trading is relatively stable and has been fluctuating in the 80K-85K range. We are still buying near support points and selling near resistance points. Once there is a new breakout range, we can simply adjust it

Today's BTC trading strategy:

btcusdt sell@85K-87K

tp:83K-81K

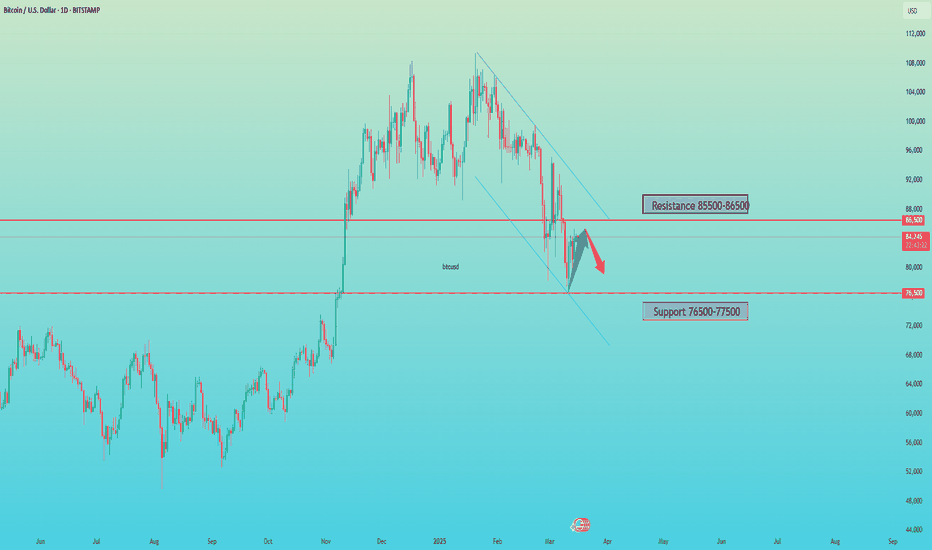

BTC/USD - Bearish Break & Retest SetupMarket Overview :

Bitcoin (BTC/USD) has broken below a key consolidation zone after trading in a range between $90,000 - $108,000 for several weeks. The price is now attempting a retest of the previous support, which has turned into a resistance (supply zone) before a potential continuation to the downside.

Chart Pattern & Technical Setup:

📉 Break & Retest Structure: The price has broken below the previous range and is now testing the $87,000 - $91,000 resistance zone.

📉 Lower High Formation: BTC is expected to create a lower high before continuing its downward trend.

📉 Bearish Wave Projection: The chart suggests a zigzag movement, forming successive lower highs and lower lows, targeting $67,399 as the next support level.

Trade Setup:

Bias: Bearish

Entry: Sell limit at $87,000 - $91,000 (Supply Zone)

Stop Loss: Above $95,000 (Invalidation Level)

Take Profit: $67,399 (Next Key Support)

Confluences Supporting Bearish Bias:

✅ Supply Zone Rejection: The resistance area is likely to attract sellers.

✅ Market Structure Shift: A break below the previous range indicates a trend reversal.

✅ Lower High Confirmation: A rejection at resistance will confirm the bearish outlook.

Risk Management:

Risk-Reward Ratio (RRR): 1:3+

Position Sizing: Adjust based on risk tolerance.

Alternative Scenario:

A break and close above $95,000 would invalidate the bearish setup, signaling a potential bullish continuation.

📌 Disclaimer: This analysis is for educational purposes only. Always manage risk properly before entering a trade.

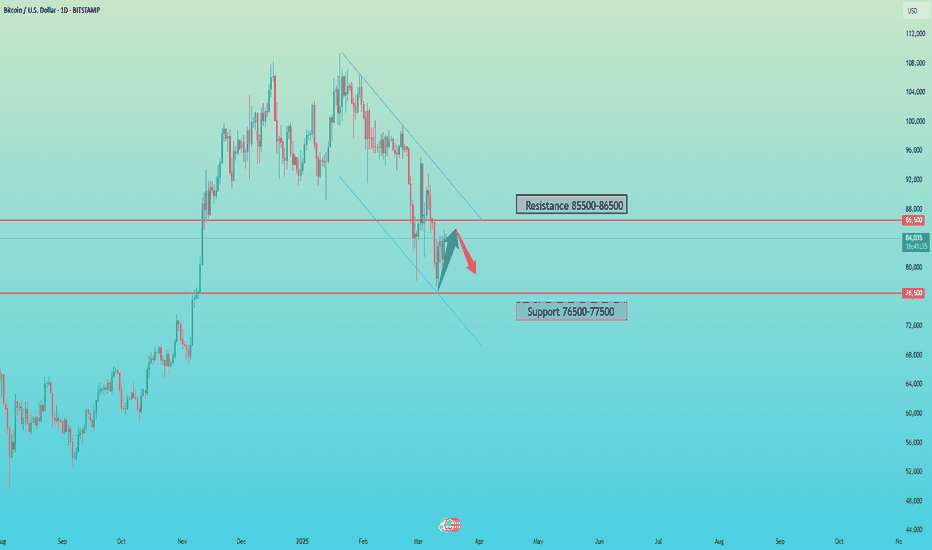

Bitcoin Correction & Accumulation Phase!#Bitcoin is in a correction and accumulation phase, something we’ve seen multiple times in this cycle.

As long as we don’t see any bearish confirmation on the higher time frame, this remains a normal correction within the bull run

We’re near the range's lower bound, which could be a good spot for short-term long setups on lower timeframes.

The next bullish breakout requires a weekly close above $110,000 🚀

History repeats itself—stay patient, accumulate smartly

What’s your strategy during these corrections? Let’s discuss it! 👇

DYOR, NFA

BTCUSD SELL signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

BTC:Today's Trading StrategyThis morning, BTC has challenged the 84,000 price level. Currently, it has been fluctuating around 83,000 for a certain period. There is a high likelihood that it may witness another wave of upward movement at any moment. Today, I still adhere to the long-position trading strategy.

BTC Trading strategy:

buy@82600

TP1:83600

TP2:84500

I always firmly believe that profit is the sole criterion for measuring strength. I will share accurate trading signals every day. Follow my lead and wealth will surely come rolling in. Click on my profile for your guide.

Probability o Rising WedgeBINANCE:BTCUSDT BTC/USDT is currently "forming a rising wedge pattern" , which could indicate a continuation of the downtrend. Since the last peak at $110,000, Bitcoin has been experiencing a decline.

At the moment, BINANCE:BTCUSDT BTC/USDT is highly volatile, with daily price swings of up to 10%. This volatility increases the likelihood of fake breakouts and rapid reversals, especially due to external factors like news.

BTC Today's strategyThe support level of Bitcoin has begun to move upward. Currently, the market is still trading in the range of $80,000 to $85,000. The short-selling strategies I continuously provided have also made profits many times.

This week's BTC trading range could be broken at any time. We just need to wait for the market to show a new direction and then adjust our strategy

Today's BTC trading strategy:

btcusdt sell@85K-87K

tp:83K-81K

We will share various trading signals every day. Fans who follow us can get high returns every day. If you want stable profits, you can contact me.

BTC:Wait for opportunities and continue to go longToday, Bitcoin has experienced relatively limited price fluctuations, oscillating within a range of around 1,000 points. It has consistently failed to break through the resistance level of 84,000.

However, I believe that after a period of retracement, it will make another attempt to breach the resistance level. We can wait for the retracement to go long.

Trading strategy:

buy@82600

TP1:83600

TP2:84500

Bitcoin's local perspective 17.03.2025In Friday's analysis "How Trump's Policy Will Impact the Crypto Market", we presented a bearish model for the medium-term perspective👇

Today, our key focus is on the $78,300 level (the 4th point of our model), which serves as significant support.

It's important to note the presence of an unfilled gap on CME at the $85,905 level ($85,943 in index terms)👇

We assess the probability of closing this gap in the near term as high – either from current positions or after retesting the $78,300 level.

How will we act?

If price moves toward $85,943 from current levels, we plan to partially close our #ETH position that was accumulated during the March 11 decline.

In the scenario of a retest of $78,300, we will consider opening a long position on #BTC with a target of $85,943.

BTC Today's strategyThe support level for Bitcoin has started to move upwards. Currently, the market is still trading in the range of 80K to 85K. The consecutive short bets I have offered have also been profitable many times

If you are currently unsatisfied with the bitcoin trading results and are looking for daily accurate trading signals, you can follow my analysis for potential assistance.

Today's BTC trading strategy:

btcusdt sell@85K-87K

tp:83K-81K

BTCUSDT TRADING POINT UPDATE >READ THE CHPTAIANBuddy'S dear friend

SMC Trading Signals Update 🗾🗺️ crypto Traders SMC-Trading Point update you on New technical analysis setup for crypto BTC USDT. ) list time post signals 💯 reached target point ) 👉 New technical analysis setup BTC USDT looking for bullish trend 📈 FVG level support level. 83k 82k support level 87k 88k resistance level ). Guys 🤝 good luck 💯💯

Key Resistance level 87k + 88k

Key Support level 83k - 82kà

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

BTC:The latest trading strategyPreviously, BTC continued to decline after approaching the resistance level.

However, it has now started to recover, and a small upward rally is expected in the short term. We can seize this opportunity and go long.

The latest trading strategy for BTC:

buy@82600

TP1:83600

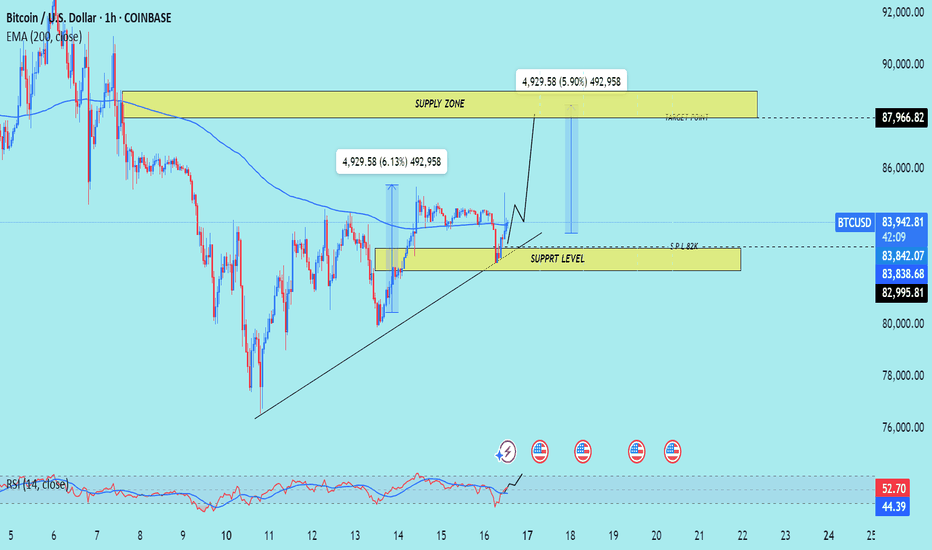

BTC:In the short term, it may start to rise continuouslyAs I analyzed yesterday,The chart shows a bullish reversal pattern, likely an inverse head and shoulders or a bullish triangle breakout.

After a brief pullback, BCT has started to rise. We can still buy below 84,500. However, it should be noted that if it rises to 85,500, it may reach the resistance level. At this time, we can stop making purchases.

Today's trading strategy for BTC:

buy@83710

SL: 83256

TP1:84500

TP2:85500

I always firmly believe that profit is the sole criterion for measuring strength. I will share accurate trading signals every day. Follow my lead and wealth will surely come rolling in. Click on my profile for your guide.

BTC Today's strategyAt present, BTC is still fluctuating in the range of 80K-85K. This week, after reaching around 85K many times, it started to fall, and the consecutive short bets I provided also made profits many times.

If you are currently unsatisfied with the bitcoin trading results and are looking for daily accurate trading signals, you can follow my analysis for potential assistance.

Today's BTC trading strategy:

btcusdt sell@85K-87K

tp:83K-81K

BTC: Daily AnalysisThe chart shows a bullish reversal pattern, likely an inverse head and shoulders or a bullish triangle breakout.

The price has broken out of the triangle formation, indicating a potential continuation of the uptrend.

The setup suggests a bullish outlook with a well-defined entry, stop loss, and take-profit levels.

If the price holds above the entry level and breaks resistance, the next targets could be achieved.

If BTC drops below the stop loss, the trade would be invalidated, signaling a potential downtrend or retest of lower support.

Trading Plan:

BUY@83,710 USDT

SL: Placed around 83,256 USDT to manage risk.

Targets:

1st Target: ~84,500 USDT

2nd Target: ~85,500 USDT

I always firmly believe that profit is the sole criterion for measuring strength. I will share accurate trading signals every day. Follow my lead and wealth will surely come rolling in. Click on my profile for your guide.

BTC/USDT "Bitcoin vs Tether" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BTC/USDT "Bitcoin vs Tether" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 93000

🏁Sell Entry below 84000

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 88000 (swing Trade Basis) for Bullish Trade

🚩Thief SL placed at 92000 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers TP 11000 (or) Escape Before the Target

🏴☠️Bearish Robbers TP 68000 (or) Escape Before the Target

📰🗞️Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future Prediction:

BTC/USDT "Bitcoin vs Tether" Crypto market is currently experiencing a Neutral Trend (slightly Bearish🐼),., driven by several key factors.

1. Fundamental Analysis⭐⚡🌟

Fundamental analysis evaluates Bitcoin’s intrinsic drivers:

Adoption Trends:

Institutional inflows via Bitcoin ETFs remain strong, with $1.5 billion added in Q1 2025. MicroStrategy holds 300,000 BTC, reinforcing corporate adoption—bullish.

Regulatory Environment:

The U.S. signals a pro-crypto stance with talks of a strategic Bitcoin reserve, boosting confidence—bullish. However, global regulatory uncertainty (e.g., EU tax proposals) adds mild bearish pressure.

Halving Impact:

Post-2024 halving (April), supply issuance dropped to 450 BTC/day. Historical patterns suggest price appreciation 12-18 months later, supporting a bullish outlook for 2025.

Network Usage:

Transaction volume is up 10% year-over-year, driven by Layer 2 solutions (e.g., Lightning Network)—bullish for utility and value.

Inflation Hedge Narrative:

With U.S. inflation at 3.0%, Bitcoin’s appeal as a store of value grows—bullish, though tempered by short-term risk-off sentiment.

Detailed Explanation: Fundamentals are strongly bullish long-term due to adoption, supply scarcity, and macro trends. Short-term bearish pressures from regulatory uncertainty and profit-taking explain the current dip to 87,000.

2. Macroeconomic Factors⭐⚡🌟

Macroeconomic conditions influencing BTC/USD:

U.S. Economy:

Fed rates at 3.0% with no immediate cuts signal tighter conditions—bearish short-term as capital favors yield-bearing assets.

Unemployment steady at 4.2% supports economic stability—neutral.

Global Growth:

China’s GDP growth slows to 4.2%, reducing demand for risk assets like Bitcoin—bearish.

Eurozone PMI at 47.8 indicates contraction, pressuring global markets—bearish.

Currency Markets:

USD strength (DXY at 106) weighs on BTC/USD, as a stronger dollar reduces Bitcoin’s appeal—bearish short-term.

Commodity Prices:

Oil at 668/BBL

and gold at $2,950 reflect a mixed risk environment—neutral for Bitcoin.

Geopolitical Risk:

Middle East tensions elevate safe-haven demand, but Bitcoin’s correlation with gold is weakening—neutral to mildly bearish.

Detailed Explanation: Macro factors tilt bearish short-term due to USD strength and global slowdown, countering Bitcoin’s long-term bullish fundamentals. This tension explains the current downward trend from higher levels.

3. Commitments of Traders (COT) Data⭐⚡🌟

COT data reflects futures positioning:

Speculative Traders:

Net long positions at 15,000 contracts, down from 25,000 at the 95,000 peak. Reduced bullishness suggests caution—bearish signal.

Commercial Hedgers:

Net short at 20,000 contracts, stable. Hedgers locking in gains indicate no panic—neutral.

Open Interest:

45,000 contracts, down 10% from February highs. Declining participation hints at fading momentum—bearish.

Detailed Explanation: COT data supports a bearish short-term view. Speculators unwinding longs and falling open interest align with the downward trend, though hedgers’ stability prevents a sharper collapse.

4. On-Chain Analysis⭐⚡🌟

On-chain metrics provide insights into Bitcoin’s network activity:

Exchange Balances:

2.6 million BTC on exchanges, up 5% in March. Rising supply suggests selling pressure—bearish.

Transaction Volume:

Daily volume at $10 billion, flat month-over-month. Lack of growth signals reduced buying interest—neutral to bearish.

HODLing Behavior:

70% of BTC unmoved for over a year (13.8 million coins). Strong holder conviction limits downside—bullish long-term.

Miner Activity:

Miners hold 1.8 million BTC, with minimal outflows. Stable miner behavior supports price floors—mildly bullish.

Realized Price Levels:

Realized cap indicates a cost basis of 78,000 for recent buyers, acting as support—bullish if held.

Detailed Explanation: On-chain data is mixed. Short-term bearish signals from exchange inflows contrast with long-term bullishness from HODLing and miner stability, suggesting a correction rather than a collapse.

5. Intermarket Analysis⭐⚡🌟

Correlations with other markets:

USD Strength:

DXY at 106 pressures BTC/USD inversely—bearish short-term.

S&P 500:

At 5,900, down 2% this week, reflecting risk-off sentiment. Bitcoin’s 0.6 correlation with equities adds downward pressure—bearish.

Gold:

At $2,950, gold rises as a safe haven, decoupling from Bitcoin—neutral to bearish.

Bond Yields:

U.S. 10-year yields at 3.8% attract capital away from risk assets—bearish.

Altcoins:

ETH/BTC ratio at 0.035, with altcoins underperforming Bitcoin, reinforcing BTC’s relative strength—mildly bullish.

Detailed Explanation: Intermarket signals are bearish short-term due to USD strength, equity declines, and yield competition. Bitcoin’s resilience versus altcoins offers some support, but broader risk-off trends dominate.

6. Market Sentiment Analysis⭐⚡🌟

Investor and trader mood:

Retail Sentiment:

Social media analysis shows 45% bullish sentiment, down from 60% at 95,000. Fear of further drops prevails—bearish.

Analyst Views:

Consensus targets range from 80,000 (short-term support) to 100,000 (Q3 2025), reflecting uncertainty—mixed.

Options Market:

Call/put ratio at 0.9, with balanced positioning. No strong directional bias—neutral.

Fear & Greed Index:

At 40 (neutral), down from 70 (greed) in February, indicating cooling enthusiasm—bearish shift.

Detailed Explanation: Sentiment has turned bearish short-term as retail investors react to the decline from 95,000. Analysts’ mixed views and neutral options activity suggest a wait-and-see approach, aligning with the current trend.

7. Next Trend Move and Future Trend Prediction⭐⚡🌟

Price projections across timeframes:

Short-Term (1-2 Weeks):

Range: 84,000 - 88,500

Likely to test support at 86,000-84,000 if selling persists; a bounce to 88,500 possible on relief rally.

Catalysts: U.S. economic data (e.g., CPI on March 12), ETF flows.

Medium-Term (1-3 Months):

Range: 80,000 - 92,000

Below 84,000 targets 80,000 (realized price support); above 88,500 aims for 92,000 if risk appetite returns.

Catalysts: BOJ policy update, institutional buying.

Long-Term (6-12 Months):

Bullish Target: 100,000 - 110,000

Driven by halving cycle, adoption, and inflation hedging—65% probability.

Bearish Target: 70,000 - 75,000

Triggered by global recession or regulatory crackdown—35% probability.

Catalysts: U.S. strategic reserve decision, Q3 GDP data.

Detailed Explanation: Short-term downside to 84,000 aligns with current bearish momentum. Medium-term consolidation reflects macro uncertainty, while long-term upside to 100,000+ hinges on fundamentals prevailing over temporary setbacks.

8. Overall Summary Outlook⭐⚡🌟

BTC/USD at 87,000 is in a short-term bearish correction within a broader bullish cycle. Fundamentals (adoption, halving) and on-chain HODLing support long-term gains, but macro headwinds (USD strength, global slowdown), COT unwinding, and risk-off sentiment drive the current downward trend. Exchange inflows and declining sentiment reinforce near-term weakness, with support at 84,000-80,000 likely to hold. Medium-term recovery to 92,000 and long-term growth to 100,000+ remain plausible if catalysts align.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BTC Today's strategyThe balance of long and short power in the market suggests that there may be explosive movements in the short term. At present, the price of Bitcoin is fluctuating in the range of 82,000-85,000 US dollars, and the short-term resistance is at 86,000 US dollars. A break through 86,000 US dollars could trigger a new round of gains

Bitcoin ETF funds have seen net outflows for five consecutive weeks, with demand falling to the lowest level in 2025, indicating that institutional funds are withdrawing and market sentiment is turning cautious. However, institutions such as MicroStrategy continue to buy, providing some support for bitcoin prices

The market is worried about the risk of possible liquidity tightening before the FOMC meeting in March, the uncertainty of the global economic situation and the signs of monetary policy adjustment in some major economies, making traditional financial marekts more attractive, and there is a trend of capital flowing back from the cryptocurrency market to the traditional financial field, which has some pressure on the bitcoin price

btcusdt sell@85500-86500

tp:83K-81K

We will share various trading signals every day. Fans who follow us can get high returns every day. If you want stable profits, you can contact me.

BTC Today's strategyIndustry News: Japanese listed company Metaplanet increased its holdings of 162 BTC, which to some extent reflects institutional optimism towards Bitcoin, and may have a positive impact on market sentiment, attracting more investors to pay attention and buy. However, Bitcoin's real-world application is still relatively limited, and its fundamentals are still relatively weak, which may limit the price of Bitcoin in the long run.

From the supply side, after bitcoin hit its highest price in history, short-term holders (STH) increased their holdings, while long-term holders (LTH) decreased their holdings. This change in supply pattern reflects the growing speculative atmosphere in the market, and short-term traders are more sensitive to price fluctuations, which may lead to increased volatility in bitcoin prices. From the demand side, despite the continued increase in bitcoin holdings by institutional buyers and ETFs, actual spot demand continues to decline. If demand does not recover, bitcoin's continued rally may be difficult to maintain.

Overall, the price of Bitcoin on March 14, 2025 is currently showing a certain upward trend, but the overall trend is still facing many uncertainties. A variety of factors such as the macroeconomic environment, the Federal Reserve's monetary policy, industry dynamics, and market supply and demand are all having an impact on the trend of Bitcoin.

buy:77K-79K

tp:83K-85k

We will share various trading signals every day. Fans who follow us can get high returns every day. If you want stable profits, you can contact me.

BTCUSDT SHORT (FIXED 1-ST target NOW) I fix the 1st take at $80,913 and move the stop order to breakeven .

1- the position itself is correct, but such manipulations with the news background and constant volume shift do not allow to correctly assess the moment of price reversal

2- Key markings before opening the position also took the format of price manipulation and should not have reached the value of $84,000 again in a normal market

In this regard, I decide to secure the position and take part of the profit in order to calmly continue trading while respecting the risks .

Main overview:

Further targets remain unchanged

BTCUSDT UPDATE....What we can expect next????Things are going accordingly. We are currently probably forming ending diagonal which indicates a trend reversal. If things go even, we can expect reversal from 74-69k region which is also PRZ of bat harmonic pattern. Also golden fib. level (61.8) of micro wave (iii) is aligning in PRZ zone.

BTCUSD SURELY DOWN Counter-Analysis (Disrupting the Bearish Outlook)

Bullish Continuation Instead of Rejection

If BTC breaks through the resistance zone near $87,792 instead of reversing, it could aim for $92,305 or higher.

A breakout with strong volume could lead to a new uptrend rather than a drop.

Strong Demand at Support Levels

The suggested bearish drop assumes that support levels will fail, but BTC could see significant buying pressure around $78,000–$74,000.

If buyers step in aggressively, the price may consolidate and push higher rather than continue downward.

Higher Low Formation Instead of Breakdown

The chart suggests BTC will drop below $70,000, but if it forms a higher low above $75,000, it could confirm an uptrend instead.

Trendline support or moving averages could prevent a deep correction.

Fundamental Factors Supporting BTC

Macroeconomic conditions, ETF inflows, or institutional demand could prevent a major sell-off.

If the Federal Reserve signals dovish policies, BTC could stay strong rather than droP