Risk-averse funds drive BTC higher.The sharp collapse of the DXY has triggered violent fluctuations in the global monetary system. As risk aversion heats up, investors are adjusting their asset allocations, with substantial capital flowing into "digital gold," which has enabled BTC to break last week's sideways consolidation and initiate an upward trend.

BTCUSD

buy@86500-87500

tp:88500-89500

I hope this strategy will be helpful to you.

When you find yourself in a difficult situation and at a loss in trading, don't face it alone. Please get in touch with me. I'm always ready to fight side by side with you, avoid risks, and embark on a new journey towards stable profits.

Btcusdtshort

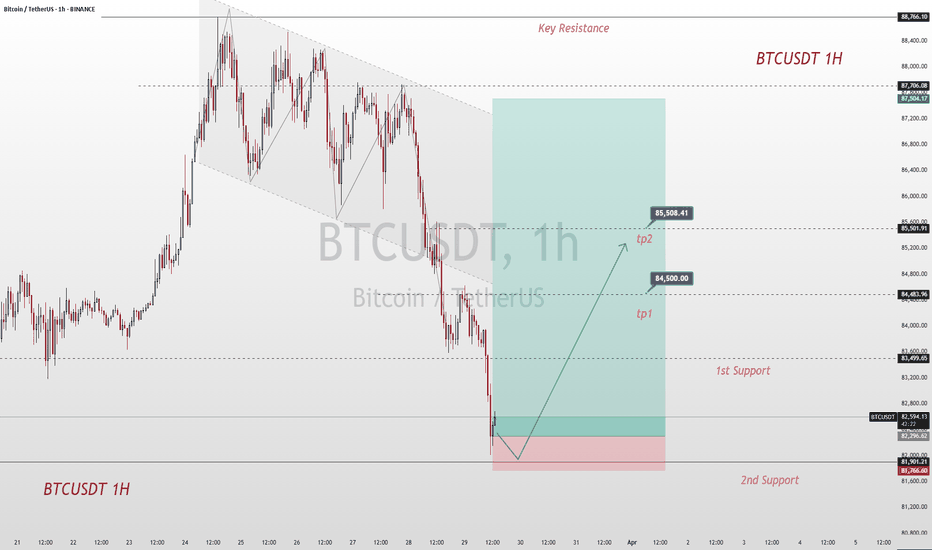

BTCUSDT at daily resistance, likely to head to 84kThe price has hit the daily resistance as expected in the quoted post. I see a pullback here which is already started. A short trade setup is favorable gere, We take a short in this zone and target towards daily support DS1. The correction can go upto weekly suppor WS1 but lets focus on this short trade first. risking 1.5% for 4.5% win.

Consolidation Divergence - Range Trading StrategyLast week, BTC continued to oscillate in the 83K-86K range. Technically, the daily MACD showed increasing volume but a deviation from the price. At the same time, the Bollinger Bands narrowed sideways, and the market entered a typical "pre-breakout momentum" stage.

Before an effective breakthrough, you can rely on the range to sell high and buy low, strictly set stops, and pay close attention to changes in volume and energy and confirmation of the breakthrough direction.

BTCUSD

sell@86500-85500

tp:84500-83500

buy@83000-84000

tp:85000-86000

I hope this strategy will be helpful to you.

When you find yourself in a difficult situation and at a loss in trading, don't face it alone. Please get in touch with me. I'm always ready to fight side by side with you, avoid risks, and embark on a new journey towards stable profits.

"Bitcoin vs Tether" Crypto Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "Bitcoin vs Tether" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (81000) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 70000 (or) Escape Before the Target

"Bitcoin vs Tether" Crypto Market Heist Plan (Scalping/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

Detailed Point Recap 📋

Fundamentals 📊: Strong network + adoption ✅ offset regulatory risks ⚠️—moderately bullish 📈.

Macro 🌍: Inflation aids BTC 🥇, but tight policy/USD weigh ⚖️—mixed 🤔.

COT 📈: Institutional longs 📈 vs. leverage risks ⚡—cautiously bullish ✅.

On-Chain 🔗: LTH bullishness 📈 vs. STH selling 📉—leans positive but capped ⚖️.

Intermarket 🔄: Short-term bearish (equity/USD) 📉, long-term hedging 📈—mixed ⚖️.

Sentiment 😊: Neutral across cohorts ⚖️—lacking conviction 🤷.

Trends 🎯: Short-term downside ($70K) 📉 vs. long-term upside ($129K) 📈—context-driven 🔮.

Outlook 🌟: Neutral now ⚖️, tilting bearish short-term 📉, bullish long-term 📈.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BTC | FAKE REVERSAL - Here's WhyI'm not convinced of the recent "bullish" price action. In fact, I say it's likely the calm before the next bearish move down.

In a downtrend, there are a few tale tell signs that the price has gone into full bear mode . In this video, I discuss two of them.

Make sure you catch up on ALTCOINS, and their ideal buying zones HERE 👀👇

__________________

BINANCE:BTCUSDT

Shorting Analysis on Bitcoin - Fxdollars- {15/04/2025}Educational Analysis says that BTCUSD may give countertrend opportunities from this range, according to my technical analysis.

Broker - BITSTAMP

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) External pushback to fill the remaining fair value gap

Let's see what this pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS ONLY EDUCATIONAL PURPOSE ANALYSIS.

I have no concerns with your profit and loss from this analysis.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

BTCUSDT shortBTCUSDT has notably deviated from the 4-hour EMA50 — by as much as 2.8%, which is a significant move for this asset.

Additionally, the daily EMA50 is acting as strong resistance, holding the price down.

I expect a pullback within the next couple of days — key levels are marked on the chart.

Want to track such deviations automatically? Send me a DM — I’ll grant you access to the indicator.

BTCUSD Today's strategyYesterday, the price of Bitcoin increased, but the trading volume decreased, weakening the short-term upward momentum. However, in the long run, the market has sufficient liquidity. The active trading of a large number of investors supports price discovery, and it is likely to drive up the price when there are favorable factors.

It should be noted that the cryptocurrency market is highly volatile and uncertain. Although we are bullish on the price of Bitcoin today, unexpected factors may change its trend. When making investment decisions, investors should assess their risk tolerance and operate with caution.

BTCUSD

buy@83500-84500

tp:85500-86500

I hope this strategy will be helpful to you.

When you find yourself in a difficult situation and at a loss in trading, don't face it alone. Please get in touch with me. I'm always ready to fight side by side with you, avoid risks, and embark on a new journey towards stable profits.

Keep a close eye on the downward movement of BTC at all times.Today, BTC is in a sideways trend, with its price fluctuating in the range of 83,000 to 86,000. 📊

At present, there are no significant new developments in the area of tariffs. 👍

However, what we need to be vigilant about is that if the tariff situation deteriorates and triggers the market's safe - haven mechanism, a large amount of capital is highly likely to flow into the relatively stable gold and foreign exchange markets. 😟

This, in turn, could lead to a large - scale sell - off in the Bitcoin market. 💥

Therefore, it is recommended to consider short - selling at relatively high price points. 📉

The accuracy rate of our daily signals has remained above 98% throughout a month 📈! You are warmly welcome to follow us and join in on the success 🌟.

💰💰💰 BTCUSD 💰💰💰

🎯 Sell@84500 - 85500

🎯 TP 82500 - 81500

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

At present, a selling phenomenon has emergedAt present, a selling phenomenon has emerged😰, and a large number of traders are waiting for the market to open⏰.

When other markets open on Monday, the situation of a large amount of capital flowing out to other trading fields also deserves attention. 😟

Especially the flows to the XAU/USD and USOIL markets, or other foreign exchange markets. 💱 The movement of funds to these areas might be influenced by economic news, geopolitical events, or simply portfolio re - balancing by investors. 📰

💰💰💰 BTCUSD 💰💰💰

💰💰💰 BTCUSD 💰💰💰

🎯 Sell@84000 - 84500

🎯 TP 82500 - 81500

Recently, the market has been extremely volatile 😱, which has led to the clearing of many traders' accounts or significant losses 😫. You can follow my signals and gradually recover your losses and achieve profitability 🌟💪.

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

Short - term Upside & Mon. Outflow RiskAnalysis of the Price Trend of Bitcoin 📈: Short - term Upward Expectations 💰 and the Risk of Capital Outflow on Monday 💸

The current price of BTC is at 84,500 points. 📊

Considering various factors comprehensively, there is a possibility that the price will rise to around 86,500 points tomorrow. 🚀 This could be due to factors like positive market sentiment or recent trends in the cryptocurrency space. 💰

However, when other markets open on Monday, the situation of a large amount of capital flowing out to other trading fields also deserves attention. 😟

Especially the flows to the XAU/USD and USOIL markets, or other foreign exchange markets. 💱 The movement of funds to these areas might be influenced by economic news, geopolitical events, or simply portfolio re - balancing by investors. 📰

💰💰💰 BTCUSD 💰💰💰

🎯 Buy@84000 - 84500

🎯 TP 85500 - 86500

Recently, the market has been extremely volatile 😱, which has led to the clearing of many traders' accounts or significant losses 😫. You can follow my signals and gradually recover your losses and achieve profitability 🌟💪.

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

BTC Today's strategyCurrently, BTC is fluctuating upwards within an ascending channel, which closely resembles its price movement that began on March 10th. This suggests that, barring significant changes in the market environment, BTC prices are likely to continue their upward trend and move towards higher price ranges in the near future.

Meanwhile, investors should closely monitor various risk factors that could impact the market, such as changes in regulatory policies and fluctuations in the macroeconomic landscape, and adjust their investment strategies accordingly.

Buy@ 83,500 - 84,500

tp: 86,000 - 87,000

Hope this trading strategy is helpful to you. If you have different opinions, your feedback is most welcome.

#BTCUSDT shows signs of reversal📉 SHORT BYBIT:BTCUSDT.P from $82,125.0

🛡 Stop loss: $82,976.0

🕒 Timeframe: 4H

✅ Overview:

➡️ The BYBIT:BTCUSDT.P chart shows a rising wedge — a typical bearish pattern.

➡️ Price hit the upper wedge boundary and started to decline, breaking support.

➡️ A second top (Top 2) has formed on weakening volume, signaling a possible reversal.

➡️ The POC at $82,490.8 has been broken — price is holding below it, strengthening the bearish case.

🎯 TP Targets:

💎 TP 1: $81,430.0

💎 TP 2: $80,887.0

💎 TP 3: $80,485.0

📢 Additional scenario notes:

📢 Entry activates upon breakdown and consolidation below $82,125.

📢 Watch for increased volume at key TP levels for confirmation.

📢 A move above $82,976.0 invalidates the setup — stop placed just above key resistance and wedge top.

🚀 BYBIT:BTCUSDT.P shows signs of reversal — a corrective move to the downside is expected.

BTC/USD) rejected point analysis Read The ChaptianSMC Trading point update

This chart presents a bearish short-term technical analysis for Bitcoin (BTC/USD) on the 2-hour timeframe. Here’s a breakdown

---

Key Observations:

1. Downtrend Structure:

Price is forming lower highs and lower lows.

A clear downtrend is marked on the chart.

2. Rejection Zone:

The yellow highlighted area near $83,800–$84,000 is labeled as a “rejected point.”

Price touched this zone and got rejected again, confirming resistance.

3. 200 EMA (Exponential Moving Average):

The 200 EMA is at $82,291, acting as dynamic resistance. Price is currently below it, reinforcing bearish momentum.

4. Support Level / Target:

The yellow box at the bottom around $74,559 is marked as the support zone and target level.

This is the previous low and aligns with the lower boundary of the descending channel.

5. RSI (Relative Strength Index):

RSI is showing a potential bearish divergence and is pointing downward, suggesting weakening bullish momentum and a likely move lower.

Mr SMC Trading point

---

Trade Idea:

Bias: Bearish

Entry: Around $81,300–$82,000 (after rejection confirmation)

Target: $74,559 (support level)

Stop-loss: Could be placed just above the rejection zone, around $84,000

---

Pales support boost 🚀 analysis follow)

BTCUSD:You need to refer to this strategyPresident Trump of the United States suddenly announced the suspension of tariffs, which led to a significant change in market sentiment.

Since tariffs play a crucial role in global economic relations and market expectations, this unexpected move has caused investors to adjust their investment portfolios.

As the new tariff suspension policy has reduced market uncertainties to a certain extent, gold, which is usually regarded as a safe-haven asset, has been sold off.

Conversely, the price of BTC has soared, reflecting the market's rapid response to this major policy change.

If you're at a loss right now, don't face it alone. Please get in touch with me. We are always ready to fight side by side with you.

BTC | BEARISH Cycle Begins | $71KThere are a few tell signs that BTC has entered the bearish market.

If the price fails to maintain closing daily candles ABOVE the 70k area, there is a likelihood for a nasty Head and Shoulders pattern to form.

A key point to watch are the Bollinger Bands, which gives you an indication of the next possible zone to watch.

_____________________

BINANCE:BTCUSDT

Bitcoin: Breaking Below $80K Soon,10% Correction on the Horizon?Hey Realistic Traders, Bitcoin is consistently hitting new lower lows. Could this signal that the bear market is here to stay? Let’s dive in.......

On the H4 chart, Bitcoin is clearly in a bearish phase. It consistently trades below both the trendline and the EMA 200, reinforcing the downtrend. Additionally, a rising wedge pattern has formed and broken out, and the MACD has shown a bearish crossover. This crossover is a key indicator, signaling that momentum is shifting from buyers to sellers.

Together, these signals suggest that Bitcoin may drop toward our first target at 79,081. After reaching this level, a short pullback is expected as traders take profits before the price continues its descent toward a new low at 73,633.

This outlook remains valid as long as the price moves below the stop-loss level at 89,557

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on Bitcoin.

U.S. Econ Shocks: Bitcoin & Profit SignalsThe latest U.S. economic data has brought significant impacts. The core PCE inflation witnessed a 0.4% month - on - month increase, hitting the highest growth in a year, with a year - on - year rise of 2.8%, exceeding market anticipations. Meanwhile, the long - term inflation expectation from the University of Michigan has soared to a 32 - year high, intensifying market concerns about inflation's resurgence. Currently, the market remains enveloped in macro - risks, pending a softening of market sentiment.

Turning to the Bitcoin market, as depicted in today's price trend (the current BTCUSDT price is $82,338.01, dropping by $2,086.37, a 2.47% decline), the K - line chart analysis indicates a downward trend. The Williams indicator signals an oversold condition. Additionally, trading volume has contracted recently, with both price and volume decreasing, suggesting a sluggish and inactive market.

Nevertheless, if Bitcoin can stabilize above $82,000 and there are signs of capital reflux, gradual position - building may be considered, with a target price set above $90,000. Investors must recognize that the Bitcoin market brims with uncertainties. Variables such as forthcoming U.S. economic data, regulatory policies, and geopolitical scenarios will all sway Bitcoin prices. In this volatile financial landscape, meticulous analysis and judicious decision - making are of utmost importance for investors navigating the Bitcoin market.

BTCUSDT

buy@82000-83000

tp:84500-86500

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.