Two tempting short setups — but one is hiding real dangerWhich pair would you short?

We’re looking at JCPB/BAB and AGG/GTO , both showing positive deviation and riding the upper Bollinger Band.

At first glance, both look ripe for a short… but dig deeper, and you'll see very different stories.

🔹 JCPB/BAB

Chart:

Low ADX, balanced DI+ / DI− → classic setup for a mean-reversion short.

But the last daily candle is a strong bullish bar — big, green, and decisive.

This could be the start of a breakout , and shorting into fresh upside momentum is dangerous.

Looks neutral — but hides bullish potential.

🔸 AGG/GTO

Chart:

Clear uptrend: DI+ dominates, price marching upward.

Also touching upper Bollinger Band, so yes — shorting here is fighting the trend.

But at least the risk is obvious , and you can frame the trade accordingly.

Transparent trend = measurable risk.

🧠 Bottom line:

JCPB/BAB may seem safer — but that green candle changes everything.

AGG/GTO is clearly trending — risky to short, but less deceptive.

👇 So, if you had to short one of these — which would it be?

Drop your take below. Let’s hear your reasoning.

Candlestick Analysis

Gold Daily Update - Looking Bullish!Gold has successfully broken above the critical 3030 level, at least on the shorter time frames of 30 minutes and 1 hour. It has closed above this level and is now retracing slightly, possibly to test the area again. If the price holds above this level during the London session, further upward momentum is likely. The first target could be a retest of the 3050 level, and depending on the volume during the New York session—particularly at the New York Stock Exchange's opening at 9:30 AM EST—it might even attempt to retest its all-time high.

Given this price action, the downside appears limited for now, and I wouldn't recommend shorting this market at the moment. Even though we're approaching the end of the month and quarter, when fund managers often rebalance portfolios or book profits from recent gains, the momentum currently seems firmly bullish. Shorts would only become a consideration if the price closes decisively below 3030, fails to reclaim that level, and gradually breaks below 3015. Until we see such developments, the current trend favors the bulls.

Wishing you a great day and week ahead! Don't forget to like and subscribe to my channel to keep receiving free analysis and content.

Russell 2000 Futures: Bearish Reversal in Play?Russell 2000 futures may resume the bearish trend established earlier this year, trading below wedge support following the completion of an evening star reversal pattern on Wednesday.

Shorts could be established on the break with a stop above the former uptrend for protection. Support may be encountered around 2050, although 1994.8 looms as a more appropriate target for those seeking greater risk-reward.

RSI (14) has rolled over, while MACD remains negative despite grinding higher over the past fortnight, painting a picture of waning momentum that complements the bearish price signals.

If RTY were to reclaim the former uptrend, the bearish setup would be invalidated.

Good luck!

DS

UK100 Technical Analysis 🔹 Trend Overview:

UK100 is currently consolidating between key support and resistance levels, suggesting a potential breakout scenario.

🔹 Key Levels:

📈 Resistance: 8,727 – A breakout above this level could push price toward 8,818.

📉 Support: 8,627 – If broken, price may drop toward 8,475.

🔹 Market Structure:

✅ Price is in a range-bound phase, with a possible breakout in either direction.

🚀 Bullish scenario: Break above 8,727 → Retest → Target 8,818 → 8,912.

⚠️ Bearish scenario: Rejection at 8,727 → Drop to 8,627 → Break → Target 8,475.

🔹 Trade Idea:

Bullish above 8,727 with targets at 8,818 and 8,912.

Bearish below 8,627 with targets at 8,475.

📌 Risk Management: Wait for confirmation of breakout or rejection before entering trades.

SELL TO GAP IN MARKETOn the 24th of March, there was a gap in the market. This gap needs to be filled in the near future. Fortunately for today, the upward movement has to an for now. Which signaling, the possibility that GAP will be filled soon. Given the recent drop in price from today's highest price, down to 42500. This price level is also a support level on the 25th of March. Price will definitely drop to 42000.

US OIL SHORT & LONG TRADESAs I stated yesterday after price rejected from the Diagnonal resistance, I said price could retest and dump further or breakout to higher levels.

I did ioen a short for the dump, but then I checked the trade this morning and realized it's in a breakout trend.

So I closed the short in a small los and capitalized on the long at the point of resting the Trendline which is still running.

Let's see how high price can climb now, currently at a strong zone.

Long trade

30min TF overview

1min TF Entry

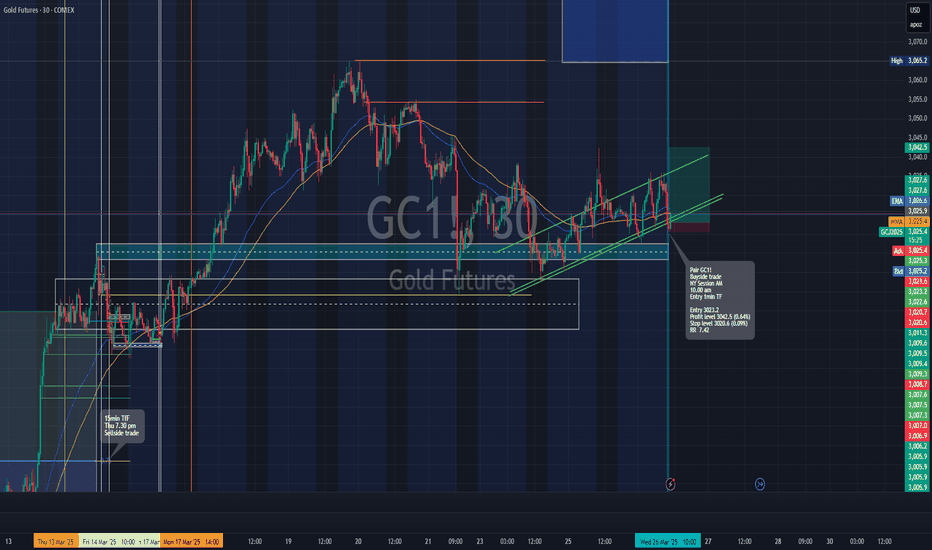

Pair GC1!

Buyside trade

NY Session AM

10.00 am

Entry 3023.2

Profit level 3042.5 (0.64%)

Stop level 3020.6 (0.09%)

RR 7.42

Reason: Looking left at previous price action and respected levels along with the Periodic Volume Profile (PVP) indicator and ascending channel seemed to suggest we were at a prime demand level indicative of a buyside trade.

GBPJPY: Time to Grow?! 🇬🇧🇯🇵

GBPJPY looks strongly bullish after the release of the today's fundamentals.

Bullish accumulation on an hourly time frame looks completed

and the price has just formed a high momentum bullish candle.

I expect a bullish movement at least to 194.6 level now.

❤️Please, support my work with like, thank you!❤️

GBPCAD Wave Analysis – 26 March 2025

- GBPCAD reversed from resistance zone

- Likely to fall to support level 1.8230

GBPCAD recently reversed down from the resistance zone between the resistance level 1.8625 resistance trendline of the weekly up channel from 2023 and the upper weekly Bollinger Band.

The downward reversal from this resistance zone created the weekly Shooting Star candlesticks reversal pattern – which started the active wave iv.

Given the strongly bearish sterling sentiment and the overbought weekly Stochastic, GBPCAD can be expected to fall to the next support level 1.8230.

Long Trade

1Hr TF overview

Trade Breakdown – Buy-Side

Date: Tuesday, March 25, 2025

Time: noon NY Time (London to NY PM session)

Trade Direction: Long (Buy)

Trade Parameters:

Entry Price: 0.18921

Take Profit (TP): 0.20725 (+9.35%)

Stop Loss (SL): 0.18652 (-1.42%)

Risk-Reward Ratio (RR): 6.71

Reason: Observing price action since 23rd March, and momentum to the upside, I decided to place another buyside trade.

Nifty Coming back to test its supports.After a proper breakout and a rally which stretched above 1900 points from the March 4 lows, Nifty was clearly overbought on the hourly chart. It might be coming down for one or more of the following reasons:

1) Retesting support from where it can launch fresh move.

2) Correcting the RSI which had gone into the overbought zone.

3) Pressure due to upcoming Monthly and Financial year closing approaching on 28th March 2025.

3) The rally might have fizzled out.

4) Tax harvesting being done by retail investors.

5) Pressure due to upcoming Monthly and Financial

The first 4 options seem to be more likely of the 5 points mentioned above. FII was again on the buying side today so DII and Retail were the major selling parties.

Nifty Supports currently remain at:

1) Strong support zone of 23398 and 23309 (Hourly Mother Line support). This zone also includes the formidable mid channel support.

2) Next support is at 23145.

3) The next critical support for the rally remains at (Father line of the hourly chart) which is at 22959.

4) Final support for the rally will be at Channel bottom which is at 22801.

Nifty Resistance currently are at:

1) 23602 which is now a resistance.

2) 23749 a formidable resistance.

3) Recent rally top at 23869.

4) The zone between 24071 and 24267. (The areas that can be new channel top).

If you want to learn more about Mother, Father and the Small child theory designed by me about the stock market, Parallel Channels, charts, Candlestick analytics, Fundamental analysis, Mother and Father line importance, How to book profits, how to find a balance between Technical and fundamental analysis through Happy Candles Numbers, understand Behavioral Finance and other interesting topics by learning which you can make your money work harder you should read my book THE HAPPY CANDLES WAY TO WEALTH CREATION which is available on Amazon in paperback and kindle version. E-version of the same is available on Google Play Books too.

More volatility can be expected int the next 2 days due to ongoing Ukraine-US-Russia announcements, Financial year expiry and Trump Tarif updates. Trade with caution.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

NAS still charging for bullish targets but currently retracingWe are looking at a retest of break points on the session. Going into this session we will monitor what happens at the previously broken levels.

We do have bearish imbalances in LTFs that have yielded neat entry on shorts. Stay sharp in this range.

Share with someone in need on true levels 🔑

Nifty Futures Short Setup – Targeting 23,561-23,539📉 Nifty Futures Short Setup – Targeting 23,561-23,539 📉

🔹 Trade Setup:

Entry Zone: here

Target: 23,561 – 23,390

Exit Zone (Invalidation): Above 23,765

Trade Rationale:

Rejection from resistance

Weak momentum signals further downside

Ideal for intraday or short-term traders

🚨 Watch for confirmation before entry!

#Nifty #NiftyFutures #StockMarket #TradingSetup #PriceAction #TechnicalAnalysis #IntradayTrading #NSE #MarketAnalysis #OptionsTrading

Gold Faces Repeated Rejections, Bearish Outlook RemainsAlthough gold has yet to confirm a significant downtrend, it has faced multiple rejections around the 3030-3040 resistance zone in recent sessions. Notably, after touching 3036 yesterday, gold experienced a sharp pullback, forming a long upper shadow on the candlestick chart. This price action has diminished the supportive effect of the underlying W-bottom structure.

If gold continues to struggle to break above the 3030-3040 zone, the current seemingly strong price action may prove to be a false signal, merely a setup for a subsequent decline. Additionally, with geopolitical risks easing and no significant fundamental drivers supporting further upside, I remain optimistic about a bearish continuation in gold.

We can consider scaling into short positions within the 3028-3038 range, patiently targeting a retest of the 3010-3000 zone. A confirmed break below 3000 could accelerate further downside toward the 2995-2985 region.

I would make more detailed trading plans and trading signals every day according to the real-time market situation, which is also the testimony of every successful transaction and profit of mine; the article has a certain lag, if you want to copy the trading signals to make a profit, or master independent trading skills and thinking, you can choose to join the channel at the bottom of the article

EURAUD: Bearish Correction Continues EURAUD formed a huge cup and handle pattern and has broken through its neckline on a 4-hour time frame.

This breakout confirms a change in market sentiment and suggests a potential bearish reversal in the near term.

It is possible that the market will continue to decline and could soon reach the 1.7000 level.

CADJPY: Intraday Bearish Reversal?! 🇨🇦🇯🇵

There is a high chance that CADJPY will retraced from the

underlined blue resistance.

I see strong bearish confirmation on an hourly time frame:

a formation of a bearish imbalance and a change of character.

I expect a bearish move to 105.05

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold is eyeing highs after a bullish daily candleThis is def a consolidation range so keep your eyes sharp and pay attention to what happens as we break into the highs. Will we displace with longs or will be be saturated by the bearish imbalances above the current hourly range?

Share with a friend in need 🔑

Gold is expected to rise to the 3030-3040 zone againGold encountered a clear rejection signal after reaching around 3036, indicating the presence of resistance and a technical need to retest support. Currently, gold is undergoing this support retest.

Within the current structure, gold has established a notable W-bottom pattern, with key support formed around the 3000 and 3003 levels. This structural support remains relatively strong. If gold manages to hold above the 3015-3005 support zone during the retest, a renewed upward move is likely. In that scenario, gold could resume its ascent, potentially retesting the 3030-3040 resistance range.

So in terms of short-term trading, if gold pulls back to the 3015-3005 zone, we can consider going long on gold in moderation.I would make more detailed trading plans and trading signals every day according to the real-time market situation, which is also the testimony of every successful transaction and profit of mine; the article has a certain lag, if you want to copy the trading signals to make a profit, or master independent trading skills and thinking, you can choose to join the channel at the bottom of the article