BTC/USDT 1DAY CHART UPDATE !!A downward trend line indicates resistance; the price is struggling to move above this line.

The green line at around 78,000 to 79,000 USDT is a crucial support level, providing a base for the price movement.

Recent fluctuations: The price shows a recent bounce, indicating a potential bullish reversal if it breaks the trend line.

Future forecast: The upward arrow indicates a bullish outlook; if the upward movement continues, then targets around 102,500 to 110,000 USDT can possibly be set.

If you have specific questions or need further analysis on certain aspects, feel free to ask!

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

Crypto

Bitcoin - What's Next?We have seen a major 3 Wave (Minor Wave I, II, III) Bullish completion on Bitcoin. What do you think the next move is? For those who understand the BASICS of the Elliott Wave Theory, will easily know what is happening next. I have explained for free plenty of times in this channel, how many waves are in a full bullish or bearish cycle🔥

BTC - Rejection from Fair Value Gap (FVG) Incoming?This 4-hour BTC/USDT chart highlights a key resistance zone where Bitcoin is approaching a Fair Value Gap (FVG) near the 0.618-0.65 Fibonacci retracement level.

Key Observations:

🔹 FVG Resistance: Price is nearing an area of unfilled liquidity, a common reversal zone.

🔹 Potential Rejection: A move into the FVG could trigger sell orders, leading to a downturn.

🔹 Bearish Outlook: If resistance holds, BTC may resume its downward movement, possibly targeting lower support levels.

Will Bitcoin push through or face rejection? Let me know your thoughts! 🚀📉

Déjà Vu, BTC's Historical Pattern EncoreIt is possible the pattern that shaped in late 2020 and 2021 might repeat again.

Everything just looks like the previous main high which is selected with the red square in the left of chart.

There is no guarantee even if it happens - movement and ratios of movement can be different.

Déjà vu on the charts isn't by chance.

RENDER ANALYSIS📊 #RENDER Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a good breakout and currently retests from the major resistance zone🧐

Pattern signals potential bullish movement incoming after a breakout of major resistance zone

👀Current Price: $3.455

🚀 Target Price: $4.4-6.0

⚡️What to do ?

👀Keep an eye on #RENDER price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#RENDER #Cryptocurrency #TechnicalAnalysis #DYOR

BTC Dominance Breaks Out Altcoins Set to Bleed, Be CautiousHey everyone, let’s dive into this BTC Dominance chart on the 4H timeframe. As you can see, BTC Dominance has just broken out to the upside from a descending triangle pattern, which is a bullish signal for dominance. Currently sitting at 62.633%, it’s testing a key resistance zone around 62.71% (the recent high). If this level holds as support, we could see BTC Dominance push higher toward the next resistance around 64-65%, a zone that aligns with the upper trendline of the longer-term ascending channel.

What does this mean for altcoins ?

When BTC Dominance rises, it typically signals that Bitcoin is outperforming altcoins, often leading to altcoins bleeding in value relative to BTC. The breakout suggests capital is flowing into Bitcoin, likely due to market uncertainty or a flight to safety within crypto. Altcoins could face downward pressure in the short term, especially if BTC Dominance confirms this breakout with a strong close above 62.71%.

Key Levels to Watch

Support: 62.62% (recent breakout level) – if this fails, we might see a retest of 61.5%.

Resistance: 64-65% – a break above this could accelerate altcoin underperformance.

Invalidation: A drop below 61.5% would negate the bullish setup for BTC Dominance and could signal a potential altcoin rally.

Altcoin Outlook

Altcoins are likely to struggle in the near term as BTC sucks up market liquidity. However, keep an eye on major altcoins like ETH, BNB, or SOL for relative strength – if they hold key support levels despite this dominance move, they might be the first to recover when BTC Dominance cools off.

Final Thoughts

This BTC Dominance breakout is a warning sign for altcoin holders. Consider tightening stops on altcoin positions or hedging with BTC exposure. Also don't forget this is NFP Week as well. Let’s see how this plays out over the next few days – stay nimble and trade safe!

Very Interesting XRPUSDT Update: Did You Know...This is very interesting for many reasons.

How are you doing my friend in the law?

It's been a while, almost a month since we last spoke.

It is truly my pleasure to write again for you and I hope that you find this information useful in someway if not entertaining.

Whatever you do, you are awesome and you are great.

Life is the best thing the Universe has to offer and you are alive... Let's get to the chart.

Cryptocurrency Market About To Boom! —XRPUSDT

This is an XRPUSDT update on the daily (24-Hours per candle) timeframe.

Why interesting? Because I am still using the same chart I used back in February and XRPUSDT continues to trade above the 3-February low point. It is hardly necessary to highlight this on the chart but, I've done it for your convenience.

So here is the thing, I will recap because it's been a while. As long as XRPUSDT trades daily, weekly, etc., above $1.70, market conditions are strongly bullish. The longer it trades above this level the better the situation for buyers. The longer the consolidation phase, the stronger the bullish wave that follows.

Even with the upswing in January XRPUSDT has been sideways since late 2024.

We can say since December 2024 so sideways for four months. How much longer will it stay sideways?

Not much longer. Worst case scenario it goes into consolidation for another 60-90 days. That's the worst case.

Normal scenario would be 30-45 days before a major bullish impulse.

Best and most likely scenario is that the next bullish wave will start within 30 days. We are in-between the last two, the first one is out of the question for now.

Caution: If the market drops, tests and pierces $1.70 the bullish bias remains. In this type of scenario, we look at the weekly and monthly timeframes.

There was a low in early February and higher-low mid-March.

On a short-term basis, trading above $1.89, the 11-March daily low, is considered bullish. (Which means that the inverse would be considered bearish.)

There are no indications or signals coming from the chart pointing towards a new bearish-trend. None. The market has been sideways after a very strong period of growth. Current action is the consolidation of the previous move. When a bullish phase ends, we tend to see a strong decline right afterward, this happens with Crypto. When a bullish move makes a pause, we see sideways and this is what we have here. Actually, this chart is a strong one but still neutral. Neutral is the accumulation period for whales whom need months to load up. Since they purchase billions worth of Crypto, it takes time to plan and to move this money around and that's why it takes so long between each phase.

I am tracking whale alerts all of the time. Most of the money is in place. After the money exchanges hands and is positioned, there is always a small pause before the action starts. Money always moves before the action and never within the action. So the money moves, pause and then lots of price movements. While prices are moving, no big transactions are taking place, these are taking care of beforehand.

Consider the fact that there are hundreds of exchanges and everything moves simultaneously and at the same time. The only way this is possible is through long-term coordination and group planning.

What to expect?

Expect the market to heat up slowly. And after a slow rise and heating up then the bullish impulse and bull-run. It will be a long process and it will develop in many months.

If you are reading this now timing is great.

Spot traders can continue to buy and hold.

For leveraged traders, I have to look at some more charts before giving any suggestions. I will feel more comfortable when I read at least 100 charts.

Market conditions are changing and improving and it will do so long-term, but we still have one more month before May when the force will be in our favor, we are still in the sideways period, accumulation/consolidation. Boring? No! Time to study and prepare. The market gives us time to be at our best before the really good action starts and this is only good, don't you agree?

A bear-market means lower lows and lower highs long-term.

2025 is a bull-market year, likely to be the strongest ever. There is a huge difference. It is like calling night when it is day. It is like saying the sun is about to go up when the sky is ready to rain.

We are about to a see and experience a rain of cash flowing into the Cryptocurrency market and this will in turn send everything up. There is no bear market, we had a correction after a major advance and this is normal. After the correction is over we get consolidation, after consolidation prices will grow. Mark my word.

I appreciate you now and always.

Thanks a lot for your continued support.

Namaste.

EOSUSDT Breakout with Strong Volume: Bullish Momentum BuildingEOSUSDT has recently completed a breakout, demonstrating strong bullish momentum with significant volume backing the move. The breakout from the previous resistance level indicates a potential trend reversal, and with the volume surge, it confirms that investors are actively participating in this rally. Market sentiment appears positive, and the pair is well-positioned to capitalize on this momentum.

With the current bullish outlook, EOSUSDT shows promising potential for gains ranging from 90% to 100% or more. The increasing interest from investors further supports the likelihood of continued upward movement. If the buying pressure sustains, we may witness a robust rally that could attract more attention from the trading community.

Technical analysis highlights that the successful breakout combined with consistent volume influx may serve as a solid foundation for future growth. Traders should keep an eye on key support and resistance levels to make the most of potential price surges. As the momentum builds, managing risk effectively and staying updated with market conditions will be crucial.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

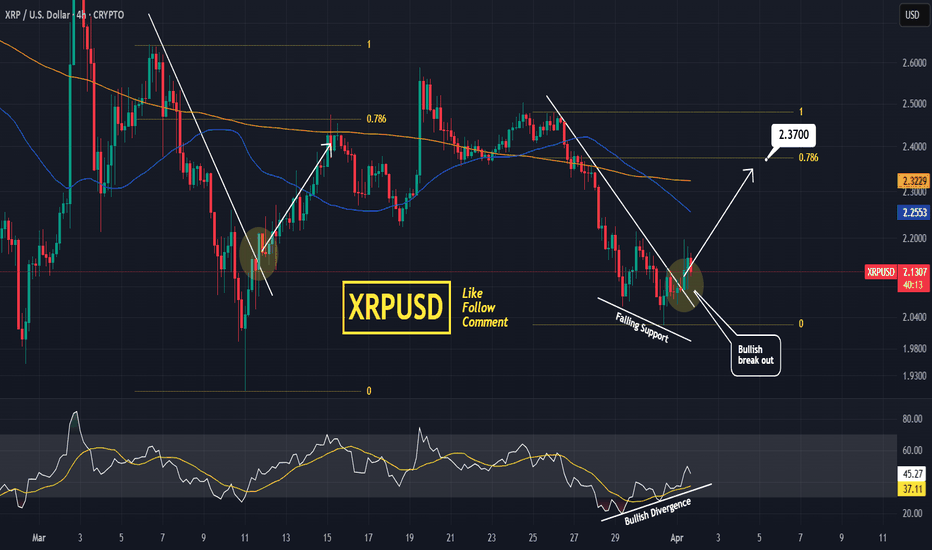

XRPUSD Falling Wedge bullish break out. Target 2.3700XRP broke above its Falling Wedge pattern. Being under the MA50 (4h) means that this is still a good short term buy opportunity.

Last time it had a break out like today's (March 11th), it hit the 0.786 Fibonacci retracement level.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 2.3700 (the 0.786 Fibonacci retracement level).

Tips:

1. The RSI (4h) has been on a Rising Support while the price was on a Falling Support. This is a bullish divergence signal that prompted early today's break out.

Please like, follow and comment!!

Notes:

Past trading plan:

BITCOIN Will it finally break the 2 month Resistance?Bitcoin / BTCUSD is having an impressive 1day candle,recovering the losses of the last 3 days and with the 1day RSI bouncing on its Rising Support.

Now it faces the most important Resistance of all, the Falling trend line that started on the January 20th ATH.

This is just under the 1day MA50 and this will be the 5th test.

If successful, it will be an early validation that the trend has finally shifted to long term bullish again.

The first technical target will be the 2.0 Fibonacci extension. Aim a little bit lower at the top of February's Resistance Zone at $100000.

Follow us, like the idea and leave a comment below!!

DOGE The only chart that matters. $5 final target.Dogecoin / DOGEUSD is about to start the final and most aggressive rally of its Cycle.

As this ultimate historic chart shows, we are on DOGE's 3rd Cycle and with the Rising Support that's been supporting since the Bear Cycle bottom making its 3rd low, this is going to kickstart the rally.

This is whar happened on both previous Cycles with the rallies extending fairly close to the top of the Cycle.

This tells us that $5.000 is a very achievable target by the end of this year, if not higher.

Follow us, like the idea and leave a comment below!!

EOSUSD: Channel Up bottomed. Starting bullish leg to 1.500.EOS is about to turn overbought on its 1D technical outlook (RSI = 69.362, MACD = 0.013, ADX = 39.380) indicating a strong bullish momentum that shouldn't go away anytime soon as the 1W RSI is only neutral (RSI = 51.171). This is because just today it managed to cross over the 1D MA200 on a technical rebound that started at the bottom of the 1 year Channel Up. Essentially we've initiated the new bullish wave. Our estimate for the next HH and most likely Cycle peak is 1.500.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Primer: Solana - A Blazing BlockchainCME Group’s newly launched Solana futures enable institutional grade access to the cryptocurrency, offering investors access to compelling relative value opportunities.

This paper provides a background to Solana in relation to other major blockchain networks and cryptocurrencies. Mint Finance will outline the execution of crypto market spread trades using CME futures in an upcoming paper.

Solana is a high-performance public blockchain launched in 2020 by Solana Labs, founded by Anatoly Yakovenko (a former Qualcomm engineer). Yakovenko first proposed Solana’s novel Proof of History (PoH) concept in 2017 as a solution to blockchain scalability. He assembled a founding team including former Qualcomm colleague Greg Fitzgerald and others and named the project after a California beach town.

Backed by early venture funding, Solana’s mainnet launched in March 2020. The vision was to enable ultra-fast, low-cost transactions for decentralized applications (e.g. DeFi, gaming), addressing limitations of Bitcoin & Ethereum in speed and fees.

Solana has grown rapidly to become one of the most used networks and amassed a market cap of USD 64 billion, making it one of the largest digital assets. What is behind the massive surge? Is it due to flip ETH as the home of DeFi?

How Does Solana’s Blockchain Rank?

While Solana’s low fees and fast transaction speeds have driven high trading volume, transaction count, and wallet growth, it still trails ETH in Total Value Locked (TVL). To achieve its high transaction throughput, Solana has made certain compromises on decentralization.

In terms of ecosystem development, Solana is seeing rapid growth. The Electric Capital 2024 developer report found Solana attracted the most new developers in 2024 – more than any other ecosystem (even Ethereum’s, despite Ethereum’s broader base).

Solana now has ~2,500 monthly active developers, second only to Ethereum’s ~8,900 (which includes many working on Layer-2s). This loyal & expanding developer base has been a key factor behind Solana’s explosive growth.

DEX Surge and Meme Coin Mania

Solana’s early growth was driven by NFTs, supported by low fees and a loyal community that made it a hub for NFT trading. These factors continued to attract users even after the NFT boom subsided. Its fast, low-cost blockchain and strong developer base have enabled the launch of many user-friendly and popular applications. More recently, Solana’s growth has been fuelled by surging decentralized exchange (DEX) volumes and a wave of meme coin minting.

By November 2024, meme coin trading accounted for an all-time high 65% of monthly DEX volume on Solana’s largest DEX, Raydium. Raydium even overtook Uniswap in monthly volume that month.

Solana’s advantages in cost and speed have been pivotal in this trend. Transaction fees on Solana are negligible and on-par with L2 chains. This cost advantage makes minting and trading low-value tokens (like meme coins) economically feasible on Solana but prohibitively expensive on Ethereum layer-1. Similarly, Solana’s block times (~0.4 seconds) and high throughput enable rapid trading. Traders can execute many rapid swaps on Solana DEXs without the delays and slippage that Ethereum’s ~12-second blocks and occasional congestion introduce. Solana’s speed and low fees thus attracted a flood of retail speculators for meme coins and high-frequency trading strategies.

Ethereum’s ecosystem still offers deeper liquidity and broader dApp selection, but Solana capitalized on specific niches (e.g. meme coins, real-time trading) where Ethereum’s costs are a barrier.

However, this explosive growth was not without turbulence. In early 2025, a “meme coin meltdown” saw activity cooling off after several scam tokens collapsed. By February 2025, Solana’s share of total on-chain DEX volume, which had topped 51% in January, retreated to 24% as some froth cleared.

Data Source: Artemis

Scandals like a fake “Libra” token (which vaporized $4.4B in market cap) and a Trump-themed token rug pull dented retail sentiment. Even so, Solana’s DEX volumes remain on par with Ethereum’s entire ecosystem (L1 + L2), a remarkable feat. VanEck’s Feb 2025 report noted that despite an 80%+ drop in new meme token launches since January, Solana DEX activity “is still holding its own – roughly matching the entire ETH ecosystem”.

In short, the meme coin mania has demonstrated Solana’s capacity to manage massive retail-driven bursts of activities that might overwhelm other chains.

Market Metrics For BTC, ETH, and SOL

Since the bottom of the bear market following the FTX collapse. Solana has delivered a stunning recovery, far outperforming both BTC and ETH, but the massive gains were partly explained by the much sharper decline following FTX.

During 2024, SOL performance moved in lockstep with BTC with both assets delivering stunning returns. However, the performance diverged sharply after Jan/2025, coinciding with the collapse in DEX trading volume. The sharp correction since has erased most of the 2024 gains while BTC has remained resilient.

Solana has, nevertheless, managed to outperform ETH which has suffered an even deeper correction over the past few months.

Data Source: TradingView

Historical volatility for all three assets shows a similar trend but differ in magnitude. SOL has the highest volatility while ETH follows second and BTC is least volatile. During spikes, the differences become exaggerated, but during lows, the values can reach similar lows.

For traders, higher volatility can be both an opportunity and a risk.

While SOL’s performance is positively correlated with both ETH and BTC, this correlation breaks frequently (more commonly with ETH) and these periods of divergence present compelling spread opportunities.

The trend for implied volatility (IV) is like HV with SOL’s IV the highest and Bitcoin’s IV the lowest. Recently, IV has started to edge up again following a decline through March.

Trading Solana and Crypto Spreads

With the launch of CME’s Solana and Micro Solana futures, investors can express views on Solana’s growth and take tactical positions that benefit from relative outperformance. Mint Finance will outline the execution of crypto market spread trades using CME futures in an upcoming paper.

CME Solana futures provide exposure to 500 SOL per futures contract and reference the CME CF Solana-Dollar Reference Rate.

CME Micro Solana futures offer a smaller notional value to create more balanced spreads and for fine-tuning exposure. The micro contract provides exposure to 25 SOL.

Additional details about the contract including margins, calendars, and specifications are available on the CME Solana product page .

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

HelenP. I Bitcoin will break support level and continue to fallHi folks today I'm prepared for you Bitcoin analytics. Previously, Bitcoin was moving inside a triangle pattern, consistently reacting to the resistance zone between 88500 and 89300 points. Each time the price approached this level, sellers stepped in strongly, pushing the price back down. After multiple unsuccessful attempts to break this resistance, BTC ultimately lost bullish momentum, resulting in a decisive breakdown below the trend line. This breakout confirmed that sellers were taking control of the market. Following this bearish impulse, the price rapidly declined, eventually reaching the key support level at 81500, which coincided with the strong support zone between 81500 and 80800 points. At the moment, Bitcoin is trading near this support zone, showing a weak reaction and limited bullish interest, signaling continued bearish pressure. Considering the recent price action, the clear bearish breakout from the triangle, and the weak response at the current support, I expect that BTCUSDT will continue to decline and break the support level. That's why I set my goal at 79000 points. If you like my analytics you may support me with your like/comment ❤️

ETH - When will this downtrend finally stop?Ethereum (ETH) has been stuck in a prolonged downtrend, and the bearish scenario is now playing out. On the 4-hour chart, ETH recently broke below its rising trend line after forming a rising wedge that typically signals further downside. This breakdown confirms the potential for further downside.

At the same time, on the weekly timeframe, ETH has perfectly retested its resistance and failed to push higher, reinforcing overall market weakness. With failing to break resistance it is likely that ETH could face continued weakness and move towards the weekly support area at 1500.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

DOGEUSDT | 1H | NOW IN SUPPORT ZONEHey traders

📉 Right now, Dogecoin is at a key support level. The 0.17514 zone is a critical support area, and we need to 👀 watch how it reacts from here.

📊 I believe this sharp drop happened due to the breakdown of the Head and Shoulders pattern.

⚠️ No need to panic—just wait for my analysis update!

⭐ Don’t forget to like 👍 so you don’t miss the next Dogecoin update! 🔔

BTC - 1H Clean Liquidity Hunt & Bearish Continuation BINANCE:BTCUSDT - 1H Update

Bitcoin remains in a bearish trend on the 4H and daily timeframes. After hunting the liquidity above the resistance zone, price began to drop exactly from our shared short entry at 83,700—and it's now on the move toward deeper targets.

🔹 Key Insights:

BTC grabbed liquidity just above resistance before reversing.

Price is now likely heading toward the liquidation zone below the support, aligning with the broader downtrend.

This setup offered a perfect short opportunity from $83,700, with clearly defined targets and risk.

🎯 Last Target: 80,200

💡 Congrats to all who followed our signal! The move is unfolding as expected.

📊 Stay locked in for the next big setups—follow for precise, real-time trade ideas! 🔔

ETH - 4 Red Monthly CandlesThis is the second time we’ve seen four consecutive red monthly candles for ETH. The last occurrence was during the 2018 bear market, where ETH crashed 88% from its peak.

This time, the four-month decline has resulted in a 57% drop so far. However, with the price now at a key support zone, I anticipate that the April 2025 candle will be green, signaling a strong recovery—potentially exceeding the previous month’s losses.

If April turns out to be another red month, we could see ETH dropping further toward the $1,300 level before finding a stronger bottom.

Let’s see how this plays out!

Cheers,

GreenCrypto

ETHEREUM BULLISH BIAS|LONG|

✅ETHEREUM fell again to retest the support of 1760$

But it is a strong key level

So I think that there is a high chance

That we will see a further bullish

Move up given that we are already

Seeing a bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EOS ANALYSIS📊 #EOS Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a good breakout and currently retesting the major resistance zone🧐

Pattern signals potential bullish movement incoming after a breakout of major resistance zone

👀Current Price: $0.6235

🚀 Target Price: $0.9200

⚡️What to do ?

👀Keep an eye on #EOS price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#EOS #Cryptocurrency #TechnicalAnalysis #DYOR