SOLANA (SOL/USDT) – TP: 170 - 252 & 295SOLANA (SOL/USDT) is currently trading at $130.17 after rebounding from a well-defined sell-side liquidity zone between $98 and $131. The recent weekly candle shows a strong bullish recovery (+22.93%), suggesting that liquidity has been swept and buyers are stepping in. This level has historically served as a key accumulation zone, and the bounce aligns with oversold conditions on the StochRSI, which is now curling upward — indicating growing bullish momentum. If price sustains above the $125–131 level, the next immediate upside target lies between $170 and $188, where prior supply and consolidation occurred. A confirmed breakout above this range opens the path toward a higher resistance zone between $254 and $295 — a region that aligns with unfilled inefficiencies and previous price distribution.

The ideal swing trade approach would be to enter on a pullback within the $110–125 range, set a stop loss below $98, and scale out at the $170 and $254 levels. This setup offers a favorable risk-to-reward ratio of approximately 1:3.5.

Trade Strategy Suggestion (Swing or Positional):

Entry: Ladder between $115–$125 on retrace

SL: $105–110 (below wick low)

TP1: $170–188

TP2: $254–295

Scaling Out: 50% at TG1, rest at TG2 or trail stops above $200

With macro tailwinds like renewed interest in Solana’s DeFi and meme coin ecosystems, institutional flow returning, and technical confirmation across multiple timeframes, this could be a high-conviction mid-term play for swing traders and positional investors alike.

🔮 Narrative & Fundamentals:

ETH L2 congestion → SOL gets transactional inflows

SOL’s DeFi, NFT, and memecoin activity resurging (e.g., SEED_WANDERIN_JIMZIP900:WIF , SEED_DONKEYDAN_MARKET_CAP:BONK ecosystem)

Institutional flow picking up (Grayscale SOL trust rallying)

SOL remains one of the fastest L1s with growing developer traction

Cryptomarket

Bitcoin following 2013-2017 Fractal UPDATE - have we left it ?This chart remains unchanged from the last time I posted it except for the addition of that yellow Dashed Arrow

As we can see, PA fell below the Fractal in Late February and ever since, we have ranged further away from it.

Does this mean we have left the fractal we have been on since November 2021 ?

Not really.

PA fell below it in 2022 due to pressures from Interest rates making companies collapse and sentiment being negative.

We have fallen below it this time purely because PA was so overbought, it needed to recover.

This can be very clearly seen on the Weekly MACD, where in 2024, we ranged for months because of the same reason.

See how on the weekly MACD, how once we reached near Neutral, we bounced back up to a New ATH and, ever since, BTC PA has ranged while waiting for the MACD to cool off..

And now we are there. MACD is in the bounce zone and has shown some strength in the last few days.

So, The Fractal

For PA to get back above that Fractal, we need PA to make a very strong push higher. and as you can see from the Bold Arrow, this is achievable by end of May if PA rises Strong and continually

form here.

I am not to sure this will happen.

We have so many Macro events destabilising the markets...

I am more inclined to think PA will hit that circle , and we will likely follow the Dashed Arrow to a cycle ATH of near 300K, by the end of the year at the latest.

This is the Path of safety.

Things can always change for the better or for the worse and so we have to be ready for all occasions.

But BULLISH is the word - BUT BITCOIN ON SPOT, HOLD IT AND RELAX

SOL/USDT – Potential Final Leg Down Before Major RallyBINANCE:SOLUSDT 🚀📉🔁

We are likely approaching one of the final moves down before a significant push higher. But before that, I expect one last move up to the $142 area, forming what I believe is a Red ABC corrective structure.

🔴 Red Wave A-B-C

Red Wave A has likely already completed, confirmed by a clean White ABC move.

We are now inside Red Wave B.

✅ Ideal Long Entry Zone

The ideal entry would be near the 88.7% Fibonacci retracement, which aligns with Green Wave B around $119.4.

From that level, I expect a drop down toward $100, completing Red Wave B.

🔄 What Comes After?

From the $100 zone, two possible scenarios for Red Wave C (or Wave 1 of a new impulse):

A 1-2-3-4-5 impulsive wave structure to the upside

Or a corrective A-B-C structure

We’ll need to carefully watch the first move out of the $100 zone:

A 5-wave move would suggest a new bullish impulse has begun

A 3-wave move might just be a larger corrective rally

🎯 Upside Target: $142

Once we hit $142, I anticipate another corrective move downward.

This could take the form of:

A clean ABC

A complex correction (A-B + 1-2-3-4-5)

Or even a direct impulsive 5-wave drop

Again, the key is watching the first leg down from $142 – whether it's impulsive or corrective will define the entire next phase.

⚠️ Summary:

Current focus: Entry near $119.4 (88.7% Fib), targeting $142

Caution: Expect volatility – structure will only become clear wave by wave

Watch: Reactions at $100 and $142 for structure confirmation

Let me know what you think below!

Like & follow if you enjoy deep EW breakdowns!

TradeCityPro | ARB: Key Levels in DeFi Coin’s Descending Channel👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ARB coin for you. It's one of the DeFi coins, currently ranked 54 on CoinMarketCap with a market cap of $1.41 billion.

⏳ 4-Hour Time Frame

In the 4-hour time frame, as you can see, we're witnessing a downtrend within a descending channel, and the price is moving downward.

✔️ There is a very important support at the 0.2501 level, which is the main support, and the price has already reacted to it once, bounced from the bottom of the channel, and is now positioned above the channel’s midline.

🔽 If the price fails to reach the top of the channel and gets rejected from lower levels such as the 0.3172 resistance, the probability of the channel breaking to the downside increases, and more bearish momentum may enter. When the price gets rejected before reaching the channel top, it indicates weakening buyer strength.

✨ So, if the price gets rejected from the 0.3172 resistance, we can open a suitable position. The lower the rejection, the higher the probability of a drop. A rejection from the channel top or even a fake breakout can also act as a valid trigger.

📉 The main trigger for a short position is the break of the 0.2501 level, which is a very strong support, and its break can lead to a significant bearish leg.

⚡️ For a long position, the first trigger is the break of 0.3172, which is a good area but very risky, because just above it lies the channel ceiling, and the price might get rejected from there and move downward.

🔼 Therefore, it's better to wait for the channel to be broken first and then look for a long trigger. Currently, the most reliable trigger for a long position after a channel breakout is at 0.4018, but this level is quite far. So, for a long position, we can also enter on a pullback to the channel or after getting confirmation from Dow Theory.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

BTC Breakout or Bull Trap? Key Confirmation Levels Ahead

If you're leaning bullish, it's more prudent to wait for a confirmed breakout above 88,000, followed by a weekly close above the 86,000 level. Ideally, a successful retest should hold within the 85,000–86,000 range to validate the breakout structure. Any failure to hold this zone on the retest would likely signal a fake out which, given current price action and resistance pressure, remains a high-probability scenario in my view.

Bitcoin faced a sharp decline to the 75,000 level following the announcement of tariffs, which triggered panic and heightened uncertainty across the crypto market. Currently, BTC is attempting to reclaim the key 85,000 resistance zone. However, a descending trendline is capping upward momentum, adding to the difficulty of a clean breakout. A decisive weekly close above 86,000 could invalidate the bearish setup and open the door for bullish continuation till 100-108K. Conversely, failure to break and close above this level would likely lead to a swift drop toward the 71,000 support zone, with minimal structural support in between.

A weekly close below the 85,000 level would confirm bearish continuation, opening the door for a retest of the 72,000 support zone — a key structural level that previously acted as a demand area. Failure to hold above 72,000 could invalidate the current range and trigger a deeper correction toward the prior macro support around 55,000. Based on current momentum and price structure, a move toward the 55,000 region appears increasingly probable in the near term.

Bitcoin BTCUSDT – 4H Technical Analysis

Bitcoin is currently approaching a key downtrend resistance line that has been respected several times since early February. The price action suggests a potential rejection from this level, which could lead to a move toward the lower boundary of the broader descending channel.

🔹 Bearish Scenario: If the resistance holds, we may see a continuation of the downtrend with possible targets near the $71K– FWB:73K region.

🔹 Bullish Invalidator: A confirmed breakout above the trendline would invalidate the bearish setup and could signal a shift in market structure.

⚠️ Watch price action closely around this level for potential rejection or breakout confirmation.

Bitcoin Nears $85K as Strategic Talks Grow. Where To Next?Bitcoin, the king crypto, is currently trading at $84,848.36. It has gained 3.10% in the last 24 hours, with a daily trading volume of $30.09 billion. Bitcoin’s market capitalization now stands at $1.68 trillion.

Globally, Bitcoin continues to gain attention at the policy level. In the U.S., there are growing discussions about recognizing Bitcoin as a national strategic asset. A U.S. Senator recently suggested the country acquire 1 million BTC, reinforcing the idea. Florida has introduced legislation allowing public funds to invest in Bitcoin.

North Carolina is considering recognizing Bitcoin as a legal payment method. Arizona’s Senate is evaluating the creation of a home-based Bitcoin activity policy and the possibility of a state reserve. Meanwhile, New Hampshire passed a bill allowing up to 10% of its state funds to be invested in Bitcoin. In Europe, Sweden is assessing the idea of adding Bitcoin to its national reserves for financial stability.

Technical Analysis

From a technical view, Bitcoin has been in a bearish phase since reaching its all-time high of $109,358 on January 19. Since then, the price has been forming an internal structure of lower highs and lower lows, a clear sign of a downtrend. It dropped to a low of $74K after Trump-era tariffs hit the market but has since rebounded to current levels.

The recent lower high stands at $88,996. The trend remains bearish until that level is broken with a strong candle close above it. If Bitcoin breaks and closes above this point, analysis show a potential move toward new highs. Without that breakout, bearish pressure may resume, possibly pushing the price back down to test support near $73K.

XRPWeekend continuation for XRP.

Over the weekend I believe we will retest the $2.25 FVG and continue moving up towards $2.50, unless we get some negative news.

I expect a sharp move upwards with news coming at any moment over the following days. All gaps have been filled on the bearish spectrum, now were DCA as we move towards ATH.

Have a blessed weekend.

Cardano (ADA) - 1DADA has recently broken out of a Falling Wedge pattern, which is a bullish technical pattern. After trading within this pattern for some time, ADA successfully surpassed the resistance level, indicating potential upward momentum. This breakout suggests that buyers are gaining control, and the price may continue to rise in the near term.

targets to watch:

- $0.6652

- $0.8413

- $1.1337

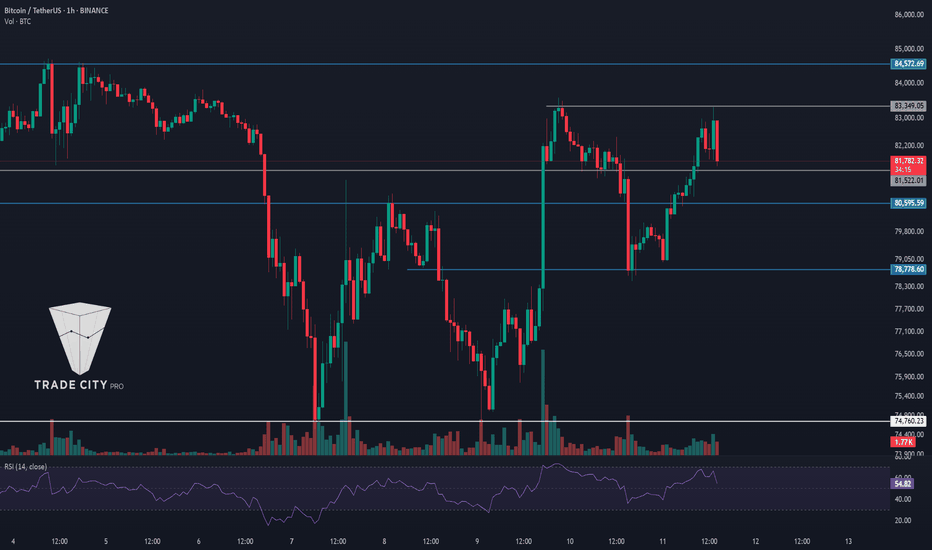

TradeCityPro | Bitcoin Daily Analysis #59👋 Welcome to TradeCity Pro!

Let’s move on to the analysis of Bitcoin and key crypto indices. In this analysis, as usual, I’ll review the futures session triggers for New York.

🔄 Yesterday, one of the long triggers was activated, and the price moved up to the 83899 zone. Let’s see what triggers we can identify from today’s price action.

⏳ 1-Hour Time Frame

In the 1-hour time frame, as you can see, the price broke through the 83349 level yesterday and moved up to 83899. However, the candles weren’t strong enough to break this zone, and the price reached the resistance range between 83899 and 84572, then got rejected.

✨ An ascending trendline that started from the 74760 low has been accompanying the price, and each time the price has touched this trendline, the following bullish leg has been shorter, indicating a gradual weakening in bullish momentum.

✔️ Currently, the price is near the trendline, and if bearish momentum enters the market and selling volume increases, breaking the trendline trigger can give us a short position.

💫 The current trendline trigger is at 83813, and if it breaks, the price could open positions down to 80595 or even 78778.

💥 As mentioned, there is a resistance zone above the current price, which seems quite strong. The first trigger to break this resistance is 83899, and the second is 84572. The first trigger is riskier and more likely to hit the stop-loss. The second trigger, being higher, might not give a good candle setup, making it harder to enter a position, but it’s more reliable.

📊 If buying volume increases, a bullish move toward 88502 is likely. If selling volume increases, the likelihood of the trendline breaking also rises.

🔑 The RSI oscillator is also oscillating in the upper half. Entering the overbought zone could be a signal for long positions, while a break below 50 would be suitable for shorts.

👑 BTC.D Analysis

Let’s take a look at Bitcoin Dominance. Yesterday, BTC.D had a bullish move up to 63.80 but got rejected from that area and has now returned to the range between 63.30 and 63.50.

⭐ Today, a bearish confirmation for BTC.D comes with a break below 63.30, while a bullish continuation is confirmed with a break above 63.50.

📅 Total2 Analysis

Moving on to Total2: today this index continued its bullish movement and even broke the 957 trigger. If this move continues up to 989, altcoins could experience significant growth—especially considering the weakening momentum in BTC Dominance.

🧲 Today, there is no long trigger for Total2, but if this move turns out to be a fakeout, the 934 zone will be a good trigger for a short position.

📅 USDT.D Analysis

Now for Tether Dominance: its short trigger has been activated. The next support level is at 5.41, and if this zone breaks, we could see a sharp downward move.

⚡️ For a bullish reversal in dominance, the first trigger is the 5.59 area, and if dominance stabilizes above this level, we can consider opening short positions on Bitcoin and altcoins.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

BTC/USDT Monthly Outlook📊 BTC/USDT Monthly Outlook – Smart Money Perspective

Bitcoin is currently trading around $83,565, with price consolidating after a Market Structure Shift (MSS) on the higher time frame.

🔹 Key Highlights:

A strong bullish impulse led to a break of monthly structure (MSS), creating Fair Value Gaps (FVG) both above and below.

Price is currently within a monthly FVG, showing indecision and potential for either continuation or deeper retracement.

Liquidity buy side rests near $110,000, marking a logical target if price respects current FVG support.

On the downside, a deeper retracement could aim for the lower FVG and sweep sell-side liquidity around $48,000–52,000.

📌 Scenarios:

Bullish case: Rejection from current FVG zone, followed by continuation toward the buy-side liquidity.

Bearish case: Break below current FVG, targeting the next zone and filling imbalances below.

🧠 Watch how price reacts to the current FVG. Smart money will likely seek liquidity before committing to a clear direction.

⚠️ This analysis is for educational purposes only and not financial advice.

TradeCityPro | STX: Watching for a Breakout in Bitcoin’s L2 Star👋 Welcome to TradeCity Pro!

In this analysis, I want to review the STX coin for you. This coin is one of Bitcoin’s layer-2 projects and, with a market cap of $933 million, ranks 67th on CoinMarketCap.

📅 Daily Time Frame

In the daily time frame, as you can see, this coin has been in a downtrend. Its most recent upward move began after breaking 1.332, and then it dropped within an expanding triangle structure down to the 0.533 area.

🔍 Currently, the main price support is at 0.453, which the price hasn't reached yet, but the 0.533 area is also strong and could mark the end of the downtrend.

✨ If the price bounces from the 0.533 area and starts moving upward, the likelihood of the triangle breaking to the upside increases. Since the price hasn’t reached the triangle’s bottom and could form a higher low, bullish momentum may enter.

📊 Market volume during the last bearish leg was decreasing, and now with supportive candles forming, volume is increasing—which, if it continues, also increases the likelihood of the triangle breaking.

🛒 If this happens, the buy trigger in spot is at 0.731, which, besides being suitable for a spot entry, can also provide a good futures position in lower time frames.

✔️ The RSI oscillator is also near the 50 level, and if it breaks above that and moves up, the price can head toward higher targets.

📉 On the other hand, for short positions, the 0.533 support is very important, and breaking it could justify opening a short. But note that this area is very close to 0.453, so if you're opening a short, be aware it's very risky and the price could reverse at any moment.

❌ If you already hold this coin and are looking for a good stop-loss level, a break and confirmation below 0.453 is appropriate. However, keep in mind that if your stop-loss is triggered and the price moves back above the support area, you should find a new trigger and buy again so you don’t miss the move.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

BTC Is Going to 85k...

Description:

Timeframe: 15m

Pair: BTC/USD

Bias: Short term Bullish (after liquidity sweep & imbalance fill)

---

Analysis:

Price is currently in a distribution phase, targeting sell-side liquidity just below recent consolidation.

We can clearly see:

Liquidity Pool: Multiple equal lows — perfect trap for retail longs.

Imbalance Zone: Price is likely to dip into the imbalance to grab orders.

Expected Move: After the sell-side liquidity is taken and imbalance is filled, a bullish reversal targeting external liquidity at higher levels (~85,000) is expected.

This setup aligns with a typical “Trap the Trapper” scenario — where smart money triggers panic selling, fills long positions, and then aggressively pushes price up.

---

Trade Plan (Example):

Entry: After confirmation near imbalance (~82,500 zone)

Stop Loss: Below 82,200

Take Profit: 84,800 / 85,000 zone

---

Hashtags:

#BTCUSD #Bitcoin #SmartMoney #LiquidityGrab #Imbalance #TrapTheTrapper #PriceAction #Forex #Crypto

Ethereum - The Perfect Crypto Trade!Ethereum ( CRYPTO:ETHUSD ) is retesting massive support:

Click chart above to see the detailed analysis👆🏻

For the past four years, Ethereum has overall been trading sideways with significant swings towards the upside and downside. As we are speaking, Ethereum is retesting a significant confluence of support and if the bullrun actually continues, Ethereum will rally parabolically.

Levels to watch: $2.000, $4.000

Keep your long term vision,

Philip (BasicTrading)

ONDO Range Play: Breakout Confirmed, Eyes on $1.20+ONDO/USDT – 2D Chart Analysis

ONDO has broken above a falling trendline while continuing to trade within a broader sideways range. The breakout occurred near the mid S/R zone around $0.90–$0.95, which is now acting as a potential pivot level.

The price is attempting to reclaim momentum after a period of lower highs and sideways compression. A sustained move above the mid-range could open the path toward the upper resistance zone near $1.20–$1.30. However, if the breakout fails and price falls back below $0.90, it may revisit the lower range support around $0.70.

This is a key zone to watch for continuation or rejection.

DYOR, NFA

Solana Update: To Buy Or Not To Buy? Hold Or Sell?Here is an update on Solana.

The chart has the same numbers as before but the support line has been moved to match the 5-August 2024 low. The action is happening right above this level.

While Solana trades above its August 2024 low, the action is considered bullish. Below this level and we are certainly bearish. Being bearish in this way does not change the long-term outlook, bias and perspective, we are set to grow long-term based on a broader trend and bigger cycle. This is a closer look.

The low in April is a shy lower low compared to March. This is always important. Notice the steep decline. This is a bearish impulse, prices tend to move down fast and strong. When bearish momentum starts to die down, we see patterns like the one we have on the chart above. Some shaky action and then a lower or higher low. The market (SOLUSDT) is preparing to change course.

The correction is present since November 2024. For Solana, the higher high in January 2025 is part of a complex correction, an extended flat. 3-3-5 wave in Elliott terms.

This is irrelevant. The point is that once the correction is over prices tend to grow.

Consider this, between June and September 2024 we have more than three months of consolidation. The market garnered enough strength to produce a bullish wave. It took a while but it happened. Then there is a correction and this bullish wave was erased by more than 100%.

If buyers showed up at a price of $100, $120, $130 and even $150 in the past, they can definitely show up again. Now that the bullish move has been erased, we are back to square one, the starting point, the base; from this point forward Solana can grow again.

Solana looks weak right now on the very, very short-term. But do not let this deceive you, we are going up next. Focus on the long-term.

Accumulation can be done each time prices hit support.

What happens if I buy and prices move lower?

Wait patiently. If you have capital available, buy more.

And if it drops again? Keep waiting, continue buying.

You will be happy with the results once the market turns.

Thank you for reading.

Patience is absolutely key.

If you didn't sell at $290, $280 or $250, why would you sell when prices trade at $100? It makes no sense.

Buy when prices are low and hold.

Only sell when prices are moving higher.

Namaste.

Bitcoin Weekly Update: Support Found (With Updated 2025 Targets)I want to highlight both, EMA55 and the 0.5 Fib. retracement level for the August 2024 - January 2025 bullish wave. These two levels have been tested and so far hold as support.

Good Thursday my fellow Cryptocurrency trader, how are you feeling today?

Things are good and everything is good. Bitcoin is back above 80K.

Bitcoin first pierced below 80K in early February, a long lower shadow on a candle with a high close. The close happened at 94.

Then again Bitcoin moved below 80K in the 10-March session but closed at 82K.

Last week Bitcoin closed below 80K. I mentioned that this is indeed a major development but market conditions do not change, we continue bullish. Last week, the first time ever below 80K, this week back above 80K. The week is not yet over so this signal is not confirmed.

The 0.5 Fib. retracement support level stands at $78,000. Any trading below 80,000 is a super strong buy opportunity. The market gave us a second chance and we took it with confidence and force.

EMA55 sits at $76,195 and was challenged for the first time since September 2024. It was challenged this same week and it holds. Bitcoin right now is safe and strong on the weekly timeframe.

Bitcoin is safe.

Lower is the least likely scenario.

Impossible for Bitcoin to hit 40K. Please ignore these people because they don't have a clue about Crypto and how the market works or behaves. Anybody calling for 40K must be ignored because this is either an attempt at some bad joke or indeed, complete insanity.

From the ~$74,000 March 2024 market high, after 5 months of distribution Bitcoin crashed and bottom at 49K. After reaching $110,000, only 3 months of distribution, a crash cannot lead to 40K. We still have all previous ATH as support and of course, we are going up. Let's not waste anymore time on something that doesn't make any sense at all but I still wanted to mention this to avoid and remove any confusion. Some people are just evil.

Let's consider the worst case, bearish scenario. If Bitcoin were to continue lower, it would find support in the blue zone on the chart. That is between 0.786 and 0.618 Fib. retracement. This is also the same range in which Bitcoin consolidated for months in 2024. So, in the worst case scenario, Bitcoin has strong support between $62,000 and $71,000; the truth is Bitcoin is going up.

Why we need not worry about this scenario?

Look at the volume on the chart.

A lower low and the lowest price in years and trading volume is really low. Both sessions producing the lowest prices, 10-March and 7-April closed green. This means that buyers were ready and waiting. If bears start selling, the bulls are happy to buy everything quick.

Since the downside is not our concern, we can focus on the future, higher prices which is what will happen next and long-term. Bitcoin is going up for a long while, until late 2025 minimum. It can extend and go into early 2026, we will know soon.

Now that we have a new low we can project more accurate and new targets. These can be seen on the chart and below:

1) $96,377 (Very easy)

2) $131,777 (Easy)

3) $145,300 - $167,177 (Strong)

4) $202,577 (Potential ATH)

5) $237,977 (Strong bull market)

With a strong market, which is standard for Crypto, Bitcoin can easily hit $167,000. Just a little more and we have $202,577. For this level market conditions should be really good. If things are great, Bitcoin can move and grow beyond 200K. Here we have 238,000 based on the most recent and accurate numbers.

Everything is pointing up.

We have long-term higher highs and higher lows.

The recent correction is very small compared to the past, but still reached beyond 30%. A 30% correction in a bull market is a strong correction, do not expect lower prices, we are going up next.

Bitcoin cannot go down 50% nor 60%, too much interest, too many people ready to buy, way too many people are aware. Bitcoin is solid and ready now, soon to trade beyond 100K.

The proof is in the chart.

Not only Bitcoin but also the stock market will grow.

The correction is over!

This is good.

Thanks a lot for your continued support.

Technical analysis made simple.

Consider hitting follow if you enjoy the content.

Leave a comment to show your support.

Namaste.

RNDR Long Swing Setup – Double Bottom at Key SupportRNDR has formed a textbook double bottom at the $3.00 high-timeframe support, hinting at a potential trend reversal. The strong bounce off that level shows bullish intent, and we’re now eyeing the $3.50–$4.00 zone for a potential throwback entry, turning old resistance into new support.

📌 Trade Setup:

Entry Zone: $3.50 – $4.00

Take Profit Targets:

🥇 $5.25

🥈 $6.60

Stop Loss: Daily close below $2.70

TradeCityPro | Bitcoin Daily Analysis #58👋 Welcome to TradeCity Pro!

Today, we'll delve into the analysis of Bitcoin and key crypto indices. As usual, I want to review the triggers for the New York futures session.

🔄 Yesterday, the price broke through the support zone between 80,595 and 81,522, retracing down to 78,778. Let's see what triggers the market could offer us today.

⌛️ 1-Hour Timeframe

On the 1-hour timeframe, as you can see, after breaking the 78,778 level, the price quickly recovered and climbed back above the 81,522 zone. Currently, it is hovering near 83,349.

🔍 Today, for a long position, we can consider opening a trade upon breaking the 83,349 resistance. The next resistance level at 84,572 could act as the following trigger point.

🔽 For short positions, we need to wait for a new market structure to form and observe whether the 81,522 or 80,595 zones can serve as our triggers.

⭐️ The RSI oscillator is near the Overbought zone, and a breakout above 70 into Overbought territory would provide good confirmation for a long position.

📊 Market volume has been increasing since the bullish leg started from 78,778. If this volume growth continues, the probability of breaking through the 83,349 resistance will rise.

👑 BTC.D Analysis

Now, let's move to Bitcoin Dominance (BTC.D). Yesterday, the 63.50 resistance was broken, and as Bitcoin's price climbed, its dominance also rose. This has caused altcoins to underperform compared to Bitcoin.

🔼 Currently, the next resistance for BTC.D is at 63.86. A break above this level would confirm the next bullish leg in Bitcoin Dominance.

📉 For a bearish move in dominance, the Futures triggers are at 63.50 and 63.30. However, for a confirmation in spot trading, we would need a break below 62.65.

📅 Total2 Analysis

Moving on to the Total2 (altcoin market cap excluding Bitcoin), I've slightly adjusted the zones and updated the triggers for altcoins.

✨ As I mentioned in the Bitcoin Dominance analysis, altcoins have been lagging behind Bitcoin. Even though Bitcoin reached 83,349, Total2 failed to retest its previous highs and instead formed a lower high.

✔️ For long positions on altcoins, a break above 940 would be ideal. For short positions, you can look for confirmation if 903 is broken.

📅 USDT.D Analysis

Finally, let's analyze USDT Dominance (USDT.D). Yesterday, it bounced from the 5.53 support level, climbing to 5.84 before starting a new downtrend, now approaching 5.53 again.

⚡️ To continue the bearish move, a break below 5.53 would be significant. Conversely, for a bullish move, the first trigger is at 5.84.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | GALA: At Key Support, Wait for Bitcoin Dominance👋 Welcome to TradeCity Pro.

In this analysis, I want to review the GALA coin for you. It is one of the first gaming crypto projects, currently ranked 86th on CoinMarketCap with a market cap of 628 million dollars.

📅 Weekly timeframe

In the weekly timeframe, as you can see, a very long-term range box has formed between the zones of 0.01307 and 0.08243, and the price has been ranging between these two areas for quite a while.

🔍 An interesting point regarding the volume within this box is that every time the price moved upward from the bottom to the top of the box, the volume increased, and during the price declines from the top to the bottom, the volume decreased.

📊 However, if we only look at the candles, we can see that the bearish momentum has been much stronger than the bullish momentum, and the probability of the bottom breaking is higher than the top. But this divergence between the price and the volume reduces the probability of the bottom breaking because, in my opinion, volume is more important than candles.

📉 Currently, this coin is located at the bottom area of its box, and we can say that there is a support zone between 0.01307 and 0.01547, which is almost the last support area for the price, and if this zone is broken, a new all-time low will be recorded.

💥 There is also an important area in the RSI, which is the 35.93 zone, and breaking this zone in the RSI increases the probability of breaking 0.01307.

🛒 For buying this coin in spot, the trigger at 0.08243 is suitable, but in my opinion, even if this zone is broken, do not buy any altcoins until Bitcoin dominance becomes bearish. I personally will wait until dominance changes trend and, for now, will not buy any altcoins.

🎯 The main target that the price might be able to reach is the 0.73643 zone, which is the all-time high, but considering that the inflation of this coin has been very high, the probability of reaching its all-time high is very low.

📅 Daily timeframe

In the daily timeframe, we can review the last bearish leg that the price has had in more detail.

🎲 As you can see, after the price reached the 0.06136 resistance and got rejected from this area, the bearish trend started and the price continued along a descending trendline down to the 0.01276 zone.

⚡️ Currently, the 0.01276 support is the most important support for the price, and as we saw in the weekly timeframe, if this zone is broken, a new all-time low will be recorded. The RSI entering the oversell zone brings bearish momentum into the market and helps the break of this zone.

🔼 However, for spot buying in this timeframe, we can use earlier triggers. The best trigger is the break of the trendline, and currently, the trendline trigger is around the 0.01761 zone, and you can buy if this zone is broken.

✔️ An important point, as I mentioned in the weekly timeframe, is that Bitcoin dominance is still bullish, and as long as it does not turn bearish, buying any altcoin is not logical.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Fading Risk Sentiment Supports Solana Amid Crypto SlumpLast week, Mint Finance published a comparison of Solana with other blockchain networks, focusing on speed, transaction costs, network size, and valuation. We emphasized Solana’s unique position in the decentralized application (dApp) space—particularly in NFTs and meme coin trading—where it has cultivated a loyal user base by offering low fees and fast transaction speeds.

While Solana’s network growth has been notable, its token performance tells a more nuanced story. The token generally trades with a high correlation to broader crypto markets, though it has experienced periods of divergence that have presented attractive spread opportunities.

Solana sits further out on the risk curve compared to BTC and ETH, exhibiting higher volatility. It tends to outperform in risk-on environments, delivering stronger returns during market rallies. However, during risk-off periods, it typically underperforms as investors favor more established and resilient assets like BTC.

Amid the current turbulence in crypto markets, this paper examines Solana’s relative outlook versus BTC and ETH, and outlines how investors can position accordingly using CME Solana and Micro Solana futures.

Recap of Solana Performance and Volatility

After a strong recovery from its 2022 lows following the FTX collapse, Solana began trading closely in line with BTC throughout 2024. Both were among the top-performing crypto assets last year. However, since January, this trend has reversed, with Solana surrendering most of its year-to-date gains.

Data Source: TradingView

Historical volatility across SOL, ETH, and BTC follows a similar trend but varies in magnitude. SOL consistently exhibits the highest volatility, followed by ETH, with BTC being the least volatile. These differences become more pronounced during volatility spikes, while during calmer periods, their volatility levels tend to converge.

The trend in implied volatility (IV) mirrors that of historical volatility, with SOL showing the highest IV and BTC the lowest. Recently, IV has begun to moderate, driven in part by the tariff rollback.

Relative Performance During Risk-On/Risk-Off Periods

During periods of risk-off sentiment—indicated by spikes in the VIX index—Solana typically underperforms, often experiencing the steepest declines among major crypto assets.

Conversely, during market rallies, Solana tends to outperform, often posting the strongest gains by a significant margin.

Technicals Sentiment

Technical indicators suggest a weakening bearish trend for Solana. Although prices have been declining since January, a rising RSI and MACD are signaling that the downtrend may be approaching a turning point. While the broader macro environment remains challenging, the postponement of U.S. tariffs has offered some short-term relief. Nonetheless, continued macro stress may weigh further on prices. The USD 100 level could serve as a potential support, offering psychological significance for the market.

A review of near-term technical indicators reflects a similar outlook, with multiple signals aligning toward a Buy summary. However, the 1D timeframe still shows a Sell signal, indicating that further downside may be possible before a definitive bottom is established.

In contrast, the near-term outlook for ETH remains bearish, with a Sell signal across most timeframes. Any sentiment improvement has yet to materialize for ETH.

Hypothetical Trade Setup

Solana sits further out on the risk curve compared to assets like ETH and BTC, as reflected in its higher implied and historical volatility, as well as its more extreme price movements. It typically experiences the steepest declines during market corrections but also leads gains during bullish periods.

Since the start of the year, Solana’s price has been in steady decline. However, early technical signals suggest the downtrend may be approaching a turning point, though some near-term weakness could persist.

BTC continues to serve as the crypto market’s safe haven. Despite a 20% correction since January, it has significantly outperformed both SOL and ETH. While Solana has been the weakest performer among the three for most of the downturn, it has recently begun to close the gap with ETH as the correction appears to be nearing its end.

With the performance gap between ETH and SOL narrowing as the correction approaches its end, a tactical long SOL / short ETH position may be attractive. If prices continue to rise or consolidate, SOL is likely to outperform ETH due to its higher beta.

Alternatively, for investors expecting further downside in crypto markets, a long BTC / short SOL position could be compelling. This setup aims to capture relative strength in BTC, which tends to benefit from safe haven flows during periods of market stress.

In order to express these views, investors can deploy CME futures which offer compelling margin offsets for inter-market spreads involving cryptocurrencies which can enhance capital efficiency.

Long Micro SOL, Short Micro ETH

Long 1 x Micro SOL April futures: 117.2 x 25 SOL/contract = notional of USD 2,931

Short 19 x Micro ETH April futures: 1554 x 0.1 ETH/contract x 19 = notional of USD 2,952

This trade requires margin of USD 2,185 as of 11/April (USD 1,255 for 1 x MSL and USD 931 for 19 x MET (49/contract)

CME offers 40% margin offset for this trade as of 11/April reducing margin requirements to USD 1,311

A hypothetical trade setup with a 2x reward to risk ratio is described below:

Long Micro BTC, Short Micro SOL

Long 1 x Micro BTC April futures: 81,250 x 0.1 BTC/contract = notional of USD 8,125

Short 3 x Micro SOL April futures: 117.2 x 25 SOL/contract x 3 = notional of USD 8,793

This trade requires margin of USD 5,678 as of 11/April (USD 1,913 for 1 x MBT and USD 3,765 for 3 x MSL (1,255/contract)

CME offers ~25% margin offset for this trade as of 11/April reducing margin requirements to USD 4,261

A hypothetical trade setup with a reward to risk ratio of 1.6x is described below:

To access the standard size contract spreads, investors can use the ratios of 1 x BTC to 6 x SOL and 2 x ETH to 3 x SOL.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

$BCH Rebounds Strongly – Is a Breakout Toward $540 Coming?SET:BCH is showing a strong bullish reversal from a key ascending trendline on the weekly chart. After retesting the support zone near $250, the price bounced with 9% gains, signaling renewed interest. The structure forms a symmetrical triangle, and BCH is now eyeing resistance near $309. A breakout could target the $440–$540 zone.

This move aligns with Bitcoin’s current consolidation at higher levels. If BTC remains strong in Q2 2025, BCH could follow with further upside. Holding the $225–$250 support is crucial to maintain this bullish setup.

DYOR, NFA

Swell: Your Altcoin ChoiceThis is a good choice. If you are already in and waiting for a recovery, the wait is almost over. If you are out and looking to buy, then timing is great. SWELLUSDT is trading at a new All-Time Low with early reversal signals.

We have a reversal signal coming from the candles as well as a rounded bottom still in the making.

The initial drop, is a full down-move, a down-wave or bearish impulse. The last and second drop is very small. It is more likely a flush, rejection or stop-loss hunt. The second drop from late March indicates that there is no longer a bearish wave. This is the last bearish action before the market produces a change of trend.

"The bottom is in" is not necessarily a sure thing. Always be prepared for some more shaking before prices grow, just as a precaution. What is certain, is that the next major phase is a bullish cycle, anything lower would be short-lived and a manufactured market move. The downtrend is over. After going down, the market tends to grow.

I am mapping some targets for you. These are not necessarily the All-Time High, there can be more growth by the end of the 2025 bullish cycle. These can happen in the mid-term. Within 3 months. When considering the long-term, prices can go off the chart.

This is a good pair.

Thanks a lot for this Altcoin Choice.

Namaste.