Cryptomarket

FXAN & Heikin Ashi Trade IdeaBINANCE:ETHUSD

In this video, I’ll be sharing my analysis of ETHUSD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

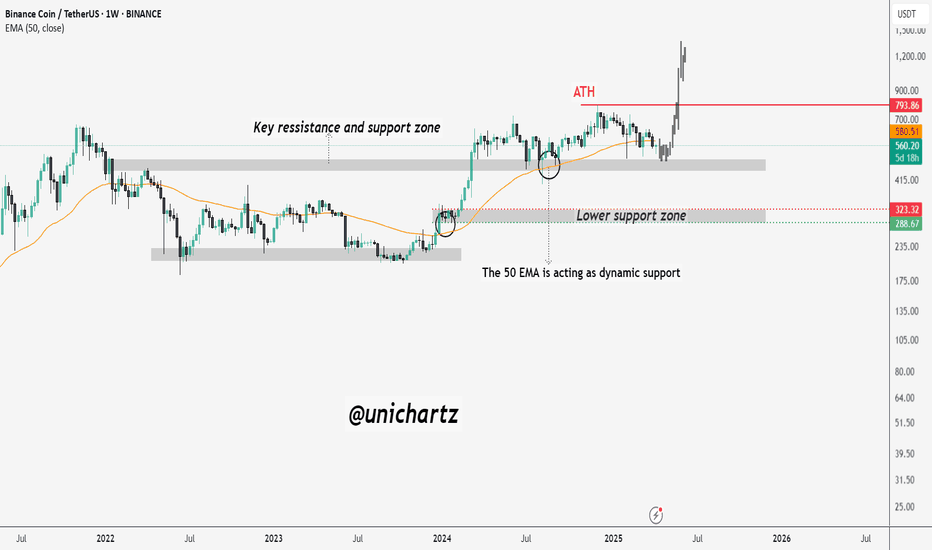

BNB Bulls Must Defend This LevelBNB is currently trading near a key support and resistance zone, a historically significant area that has acted as both supply and demand over the past few years. After reaching its all-time high (ATH) near $793, price has been gradually correcting, and is now approaching a critical point.

The 50-week EMA (Exponential Moving Average) is acting as dynamic support, and so far has played a strong role in providing bounce zones during corrections. This EMA is currently being tested once again, and price action around it will be crucial.

Just below this lies a major horizontal support zone around $415–$430, which previously served as a breakout base in 2023. If this area holds, BNB could see a rebound attempt.

BTCUSD TECHNICALS & FUNDAMENTALSKey Technical Details:

Support: Price is resting on the lower trendline of the channel and right above a potential breakout level.

Resistance: The upper channel line sits around $85,000, which aligns with the previous rejection zone.

Bullish Scenario: If BTC bounces off this level and breaks above the short-term resistance, expect a potential move toward $85K and beyond.

Bearish Scenario: A clean breakdown below the trendline could take BTC back to $77,000–$75,000.

Volume Note: There's a notable decrease in volume, indicating indecision—often a sign of a potential breakout soon.

💡 Bias:

Currently neutral to bullish as long as BTC stays within the channel.

📰 Fundamental Analysis (April 8, 2025)

🧨 What’s Moving the Markets Today:

Fallout from April 7’s Inflation Print:

The U.S. CPI data came in hotter than expected, rekindling fears of delayed Fed rate cuts.

This led to panic selling across equities, forex, and crypto on April 7. BTC dropped sharply in reaction.

🌍 Today’s Probabilities:

Macro Uncertainty Continues:

With the inflation shock still rippling, risk-on assets like Bitcoin are in a sensitive zone.

Traders await Fed speakers and FOMC minutes later this week for further cues.

🏦 Institutional Sentiment:

Cautiously Bullish: Institutions aren’t exiting yet, but are being very selective.

BTC’s long-term structure remains strong unless it breaks down from the channel.

✅ Summary:

BTC is consolidating after a post-CPI dump.

A bounce here could send it toward $85K, but a breakdown risks retesting $75K.

Fundamentally, macro pressure remains, so any bullish breakout must be backed by a shift in market sentiment.

LTC Holding Key Support Zone Within Multi-Year RangeCRYPTOCAP:LTC is currently trading within a well-defined wide range, bound by a strong support zone near $63 and a resistance zone around $130–$140. The price has once again bounced from a rising support trendline that has held firm since 2020, confirming its significance as a long-term bullish structure.

Each time price approached this rising trendline within the support zone, it has historically led to a reversal or a strong upward move. Currently, LTC is showing signs of support around this zone again, suggesting the potential for another bounce.

However, the range-bound nature of the chart implies that until a breakout above resistance or breakdown below support occurs.

DYOR, NFA

#LTCUSDT #Litecoin

SOL (Weekly timeframe): Trend structure Price is approaching a key macro support zone. However, as long as it remains below the $148 level, I cannot rule out the possibility of one more corrective leg toward the $76–$55 range before a medium-term bottom is established and a potential resumption of the broader uptrend begins.

A breakout and sustained close above the $148 level would serve as the first technical signal that either:

- a corrective wave B (preceding a deeper correction toward the macro support zone) is unfolding, or

- a new long-term bullish trend aiming for all-time highs is beginning.

Monthly outlook:

My previous idea from November 2024 has fully realized its structure:

Thanks for reading and wishing you successful trading and investing decision!

BTCUSDT - It's breakout? What's next??#BTCUSDT - perfect move below our region as you can see our last idea regarding #BTCUSDT

Now market have 81100 as a resistance area and if market sustain below that then we have further drop to downside.

Expected areas below are 74k, 69k and 65k

Good luck

Trade wisely

LTC/USDT: at important resistance Until the price closes below 100, the current trend structure suggests a one more leg down toward the 76–70 macro support zone.

However, if the price successfully clears the 100 resistance level - rising and closing above it with strong volume - the odds will shift in favor of a correction ending and the potential start of a new uptrend toward the 210–270 macro resistance zone.

Macro-structure:

Thank you for your attention!

TradeCityPro | Bitcoin Daily Analysis #54👋 Welcome to TradeCity Pro!

Let's delve into the analysis of Bitcoin and key crypto indices. As usual, I will review the New York futures session triggers for you.

⚡️ The market has experienced a drop since yesterday, and I had identified the triggers for this drop in the previous analysis. Let's analyze today to see what we can do in the market.

⏳ 1-Hour Timeframe

In the 1-hour timeframe, as you can see, the price made a downward move after the triggers at 82633 and 81473 were activated, even breaking the important support at 79120 and now has rebounded from the area of 74760.

✔️ If we draw a Fibonacci from this downward leg, we can find potential resistance levels. A few moments ago, there was also a fake news report from Trump stating that he would give 90 days to all countries except China to start tariffs, which, although fake, had a significant impact on the market.

📊 The market volume is very low, which makes it susceptible to such short and small news about tariffs to react this way.

📰 If such news continues and the market acts emotionally, the technical analysis I perform for you will not be very reliable, and the price will move more emotionally.

🔼 However, if these emotional moves end and the price stabilizes in these areas, the potential resistances we have are the Fibonacci levels of 0.5, 0.618, and 0.786, where the 0.5 and 0.786 areas overlap with static price resistances, and the 0.618 area, being the golden Fibonacci, could prevent further price drops.

💥 The RSI oscillator, after a sharp fall and being mostly in Oversell yesterday, has finally exited this area and now reached around 50. If this area is broken in the RSI, the likelihood of a deeper correction will increase.

📉 Today, for a short position, we only have the break of the 74760 area, which I also suggest not opening a position with this trigger because the market has recently moved and needs to create a new structure.

📈 For long positions, according to the strategy I have, it does not make sense for me to open a position in this trend that has so much downward momentum. The best analogy is that when a knife is falling, you shouldn't try to catch it mid-air because it might cut your hand; you should wait for it to fall to the ground so you can pick it up safely without risk.

Let's look at the indices to take a look at the situation with altcoins.

👑 BTC.D Analysis

Bitcoin dominance has made another upward move after breaking 63.07. This caused altcoins to fall more than Bitcoin during this drop, and short positions on altcoins would have given us more profit compared to Bitcoin.

🚀 In the analyses of Bitcoin and altcoins, I've repeatedly told you that for buying altcoins, we should wait until Bitcoin dominance starts to drop. That hasn't happened yet, and it still has a strong upward trend, so today if the market gives a short trigger, altcoins would be more logical.

📅 Total2 Analysis

As you can see, this index has fallen much more than Bitcoin, experiencing a very sharp downward leg upon activating the trigger at 965.

⭐ Currently, I've only added the 949 line to the chart, which overlaps with the 0.786 Fibonacci of this downward leg, and I haven't added any other lines and am waiting for the price to create its structure.

✨ The nearest support the price has is 816, which is very important, and there is nothing else notable about Total2 yet, and we need to wait until a structure is created that can be analyzed.

🎲 The only opinion I can give for now is that the 816 area is very important, and reaching this area in Total2 could end its downward trend, which is more like a prediction than an analysis and is a gut feeling and currently has no logical reason.

📅 USDT.D Analysis

Let's move on to the analysis of Tether dominance, which is very similar to Total2 but seems like a reverse of it.

👀 Yesterday, the trigger at 5.53 activated simultaneously with 965 in Total2, and the dominance moved upward. There's not much I can analyze about this chart, and the main resistance is in the area of 6.34, which acts like the 816 in Total2.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

TradeCityPro | XVS: Tracking Its Trajectory in the DeFi Space👋 Welcome to TradeCity Pro!

In this analysis, I want to review the XVS coin, which you requested in the comments. This project is one of the DeFi projects with a market cap of $72 million, ranking 346th on CoinMarketCap.

📅 Weekly Timeframe

In the weekly timeframe, as you can observe, the price started a downtrend after reaching a peak in 2021, and this trend is still ongoing.

✨ Currently, there is a consolidation box from 3.34 to 17.61, and the price has been fluctuating between these two areas for almost three years.

✔️ In the previous weekly candle, the support at 5.45 was broken, and now the price is moving towards the support at 3.34. This support is very crucial, and its breach could trigger another sharp drop.

🔽 There is also a descending trend line that the price has touched twice, and after being rejected by this trend, a significant amount of selling volume entered the market and induced a momentum that led to the breach of the 3.34 support.

📈 For XVS to turn bullish, the only trigger we have for now is the break of the trend line and the activation of its trigger. The trend line trigger is currently at 9.09. However, if the price creates a new structure, we might confirm a bullish turn sooner.

🛒 For buying in spot, the first trigger is the break of 9.09, which is considered a risky trigger in this timeframe. The main trigger is after 17.61.

⚡️ However, as I have mentioned in recent Bitcoin analyses, altcoin triggers and even the Total2 in spot don't currently hold much significance. For buying altcoins in spot, we should wait until Bitcoin dominance turns bearish.

📅 Daily Timeframe

Let's move to the daily timeframe to observe the details of the price movement more closely.

🧩 In this timeframe, we have a curved trend line that the price has hit several times and fallen.

⭐ Currently, after breaking 4.95, we can apply a Fibonacci Extension to find potential support areas. The price has reached the 0.618 level and has tested it. This area might be able to prevent further price falls. Otherwise, the next supports will be at the 0.786 and 1 Fibonacci levels, with the 1 area overlapping with the 3.34 support.

💥 The RSI oscillator is close to oversell and if this oscillator break the 30 level,it will support the bearish movement.

🔼 For buying or a long position, a suitable trigger is the 6.25 area, which is both a significant support and the last peak formed after breaking the 4.95 floor. The main trigger for the start of the primary bullish trend will be at 11.79.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

#BTCUSDT.. single supporting area, holds or not ??#BTCUSDT. perfect move as per our last couple of ideas regarding #btcusdt

Now market have current supporting area that is around 82300

Keep close that level because if market clear that level then we can expect a further drop towards downside next areas.

Good luck

Trade wisely

Bitcoin is at a decision point.I would not be surprised if Bitcoin started correction waves from the Fibonacci 1.618 point.

RSI also looks weak.

Less likely, correction waves may begin after Fibonacci rises to 2.618 levels.

Harmonic patterns often target Fibonacci 1.618 levels.

Trump has had a major impact on the world economy and politics recently. This impact has also affected the crypto markets. Therefore, it makes sense to revise our analysis.

* What i share here is not an investment advice. Please do your own research before investing in any digital asset.

* Never take my personal opinions as investment advice, you may lose all your money.

Bitcoin Technicals Flash Warning – Smart Money Watching!Bitcoin has been forming a series of lower highs and lower lows since its all-time high (ATH) of $109,568, indicating a potential downtrend. The support level, which previously held strong, has now been broken and is acting as resistance. The recent price movement suggests a retest of this broken support, which could confirm further downside if rejected.

The 100 EMA is positioned above the price, reinforcing bearish pressure. If BTC fails to reclaim this level, the price may continue to decline. RSI is hovering around 41.51, indicating weak momentum, with no strong bullish signals yet.

Bullish Scenario: A reclaim of the broken support and a move above $90,000 could invalidate the bearish setup.

Bearish Scenario: A rejection from this level could lead to further downside, potentially targeting $75,000-$72,000.

BTC/USDT 4H Chart Update. Current Price: ~$78,336

BTC has broken below the symmetrical triangle and is testing the key horizontal support between $78,424 and $79,183.

A wick is visible below the support, but the candle closed within the area, indicating a potential fakeout or demand absorption.

Resistance (downtrend line): ~$85,500

Support Zones:

Primary: $78,424

Secondary: $79,183

Immediate Resistance: $82,000 – $83,000 (recent breakdown zone)

Outlook & Scenarios:

Bullish Reversal Scenario (Green Arrow):

The green arrow projection suggests a potential bounce from this demand zone.

If BTC reclaims $80K+ with strong momentum, it could aim for the descending trendline near $85K.

A bullish confirmation would be a 4H candle close above $80.5K–$81K.

Bearish continuation (if support fails):

If the price fails to hold this support zone, the next downside targets could be:

$76,000

$73,500

Sentiment factor:

The previous sentiment (Fear & Greed Index: 28 – Fear) reflects ongoing market caution.

Price action near key support in the fear zone could trigger a short squeeze or panic sell-off, depending on volume and reaction.

Summary:

BTC is at crucial support, and unless volume confirms a deeper breakdown, the bounce is likely to be short-lived.

Moving back above $80K would signal that bulls are regaining control.

Want any strategy ideas for trading this setup?

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

The Case for $XLMA laggard compared to its sister, XRP.

XLM showing potential for a breakout. XRP & XLM once traded together almost systematically, XRP was able to break out of its wedge repeating its performance of 2017. Although past performance does not indicate future performance its important to reference.

XLM seems ready to sweep sell side liquidity one last time before its next leg up out of its wedge.

Ill continue to add to this thread as the days go on.