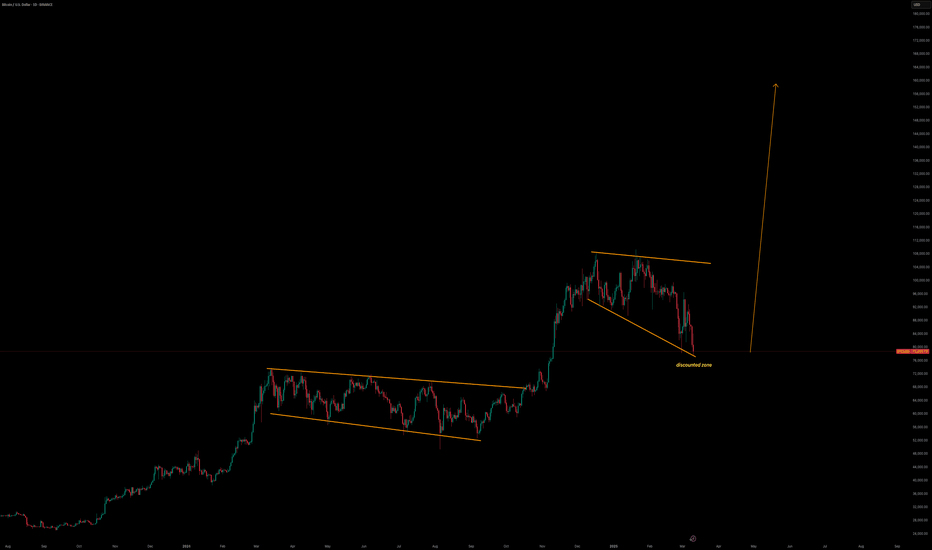

Bitcoin will reach $221,000The chart explicitly labels a "Breakout" point around December 15, 2024, where the price moves above the $80,000 resistance level of the ascending triangle. This breakout is a significant technical event, suggesting strong buying pressure and a continuation of the uptrend. Following the breakout, the chart notes a "Retracement" phase, where the price pulls back to test the breakout level (now acting as support at approximately $80,000). This behavior is common in technical analysis, as prices often retest previous resistance levels after a breakout to confirm support.

As of March 14, 2025, the current price of $80,228.30 is just above the $80,000 level, suggesting the price may be in the early stages of this retracement or has recently stabilized after testing the support. This positioning indicates potential buying opportunities for traders looking for entry points near this level, with expectations of further upward movement.

Projected Price Target: $221,000

One of the most notable annotations on the chart is the "TG $221,000" label, which stands for "Target Price" of $221,000. This target is projected based on the breakout from the ascending triangle, likely calculated by taking the height of the triangle (the difference between the resistance at $80,000 and the lowest support at $55,000, which is $25,000) and adding it to the breakout level ($80,000 + $25,000 = $105,000). However, the chart's projection to $221,000 suggests a more aggressive target, possibly involving a multiple of the height (e.g., 3x the height, $80,000 + $75,000 = $155,000, still not reaching $221,000) or a Fibonacci extension beyond standard calculations.

Given the significant gap between the current price ($80,228.30) and the target ($221,000), this projection is an unexpected detail, implying a potential multi-fold increase in Bitcoin's value. It aligns with the chart's bullish patterns but involves considerable uncertainty, as market conditions, macroeconomic factors, and adoption rates could influence actual price movements.

Additional Technical Observations

Beyond the ascending channel and triangle, the chart includes several other technical elements:

Support and Resistance Levels: The $80,000 level, initially a resistance during the triangle, becomes a key support level post-breakout. The lower trendline of the ascending channel also acts as dynamic support throughout the uptrend, providing a floor for price corrections.

Volume Indicator (Implied): While not explicitly shown, breakouts like the one labeled are often accompanied by increased volume, which would confirm the strength of the move. Without a visible volume histogram, this remains an inference.

Fibonacci Retracement (Potential): The retracement after the breakout could be analyzed using Fibonacci levels (e.g., 38.2%, 50%, 61.8%) to identify key support zones, though these are not drawn on the chart.

Momentum and Moving Averages (Implied): Although not visible, momentum indicators like RSI or MACD could provide additional insights. For instance, a strong breakout might correlate with overbought RSI, while the retracement could indicate a return to neutral levels. Moving averages (e.g., 50-day, 200-day) might have supported the uptrend earlier, with the price potentially approaching these for support during retracements.

Implications for Traders

The analysis suggests Bitcoin is in a robust bullish trend, supported by the ascending channel, triangle breakout, and projected target. Traders may consider the following strategies:

Buy on Pullbacks: Look for buying opportunities near the $80,000 support level, especially if volume and other indicators confirm buying pressure.

Target Setting: Use the projected target of $221,000 as a long-term goal, but be mindful of market volatility and external factors that could affect price.

Risk Management: Given the significant gap to the target, set stop-loss levels below key support (e.g., below $80,000) to manage risk.

Cryptonews

Uniswap will reach 150$Technical Analysis of Uniswap Chart

Overall Trend and Structure:

The chart shows a multi-phase trend: an initial upward move in mid-2024, a consolidation phase with lower highs and lower lows forming a descending pattern, and a sharp bullish breakout in early 2025 (around March 2025).

The recent steep upward movement suggests strong buying pressure, potentially indicating a breakout from a corrective pattern (e.g., descending triangle or wedge).

Key Trendlines and Levels:

Descending Trendline: The orange descending trendline connects the lower highs during the consolidation phase, acting as resistance. The price breaking above this trendline in early 2025 is a bullish signal, suggesting the end of the corrective phase.

Horizontal Support/Resistance: The orange horizontal line near the middle of the chart likely served as support during consolidation (possibly around $10–$12 on an adjusted scale). The breakout above this level reinforces bullish momentum.

Recent Surge: The vertical orange line on the right indicates a rapid price increase, potentially pushing UNI from the $10–$12 range to $15–$20 (adjusted from the $16,000,000 mark on the y-axis, assuming a $0–$30 scale).

Candlestick Patterns and Momentum:

The candlesticks show volatility, with green candles dominating the recent surge, indicating strong bullish momentum. Red candles during consolidation suggest profit-taking or selling pressure that has now been overcome.

The steepness of the rise suggests high volume or a catalyst (e.g., news, DeFi adoption, or Ethereum ecosystem developments), though volume data isn’t visible.

Potential Technical Patterns:

The chart resembles a descending triangle or wedge breakout. A descending triangle typically signals a bearish continuation, but an upward breakout (as seen here) can indicate a reversal to a bullish trend, especially if supported by volume.

The breakout above the trendline suggests a potential target measured by the height of the triangle base (e.g., if the base is $5 wide, add $5 to the breakout point, targeting $20–$25).

Support and Resistance Levels:

Support: The broken trendline and horizontal line (now support) around $10–$12 are critical. A pullback to retest this level would be a common post-breakout behavior.

Resistance: The next resistance might be at the recent high (e.g., $20) or a psychological level like $25, based on historical UNI peaks (e.g., its all-time high of $44.97 in May 2021).

Overbought conditions could emerge if the rally continues unchecked, warranting caution.

Market Context and Sentiment:

Uniswap, as a leading DeFi protocol, benefits from Ethereum’s ecosystem growth, protocol upgrades (e.g., Uniswap v4 or Unichain), and increasing DeFi adoption. The recent surge might reflect such developments in early 2025.

Web-based price predictions for March 2025 vary widely: averages range from $6.30 to $12.69, with highs up to $13.58–$25.75, suggesting the chart’s surge aligns with an optimistic scenario. Posts on X indicate mixed sentiment, with some noting bearish pressure earlier in March (-30% reported) but others highlighting bullish potential if demand zones hold.

The chart’s bullish breakout contrasts with some bearish technical indicators (e.g., RSI oversold at 34.69 noted on X), suggesting a possible short-term correction after the rapid rise.

Interpretation and Outlook

Bullish Case: The breakout above the descending trendline and horizontal support signals a strong bullish reversal. If momentum continues, UNI could target $20–$25 in the near term, supported by DeFi growth and market sentiment. A retest of $10–$12 as support would confirm the breakout’s validity.

SEI will reach at 1.4$

Price Movement and Trend:

The chart shows a significant upward movement starting around mid-2024, peaking at a high (likely around $1.14-$1.20 based on the vertical scale), followed by a sharp decline.

After the peak, the price enters a consolidation phase with lower volatility, fluctuating around the "Accumulation zone" marked at approximately $0.196746.

A recent upward trend is suggested, with the price appearing to approach or break above the $1.143922 level (labeled as "Target 1.4$"), indicating potential bullish momentum.

Accumulation Zone:

The "Accumulation zone" is identified around $0.196746, which seems to act as a support level where the price has stabilized after the decline. This zone likely represents a range where buyers have been accumulating the asset, potentially preparing for the next upward move.

The prolonged consolidation in this range suggests a period of low selling pressure and possible buying interest.

Target 1.4$:

The chart highlights a target price of $1.4, with the current price nearing $1.143922. This suggests that the analyst or trader anticipates a potential rise to $1.4 if the current upward trend continues.

The upward arrow and the proximity to this target indicate a bullish outlook, possibly driven by a breakout from the accumulation phase.

Volume and Candlestick Patterns:

While the chart doesn’t explicitly show volume bars, the candlestick patterns (green for bullish, red for bearish) indicate periods of buying and selling pressure. The recent green candles suggest increasing buying interest.

The sharp drop after the peak and the subsequent consolidation could indicate profit-taking followed by a base-building phase.

Timeframe and Context:

The chart covers a period from mid-2024 to March 2025, with the current date being March 14, 2025. This long-term view suggests the analysis is focused on a medium-to-long-term trend rather than short-term fluctuations.

The upward trajectory toward $1.4$ might be based on technical analysis (e.g., resistance levels, Fibonacci extensions, or historical price action), though specific indicators are not visible.

Interpretation:

The chart suggests that SEI/USDT has undergone a significant rally, followed by a correction and consolidation in the accumulation zone around $0.19-$0.20. The recent upward movement toward $1.14 indicates a potential breakout or continuation of an uptrend.

The target of $1.4$ could represent a resistance level or a projected price based on the analyst’s strategy (e.g., a measured move from the accumulation range).

Traders might interpret this as a buying opportunity if the price holds above the accumulation zone, with a stop-loss potentially set below $0.19, aiming for the $1.4 target.

Bitcoin (BTCUSD) Rejection – Bearish Move Incoming?📉 Key Observations:

Resistance Zone (Purple Box): Price has tested this area and faced rejection.

Bearish Projection (Gray Box & Arrow): The chart anticipates a drop towards the $76,800 - $77,000 range.

Liquidity Grab? Price might consolidate before a sharp decline.

⚠️ Possible Scenarios:

Rejection Confirmation 🔻: If BTC fails to reclaim $84,470, selling pressure could increase.

Breakout Fakeout? 🤔: A deviation above resistance followed by a dump remains a risk.

🎯 Levels to Watch:

Resistance: $84,470 - $85,078

Support: $80,000 and $76,825

🔥 Final Take: If BTC struggles below resistance, a short setup could play out. Confirmation is key!

Bitcoin’s Wild Ride: Up or Down, I’m Watching!Hey there, trading family—just chilling and watching Bitcoin like it’s my buddy on a rollercoaster. It’s hanging out near that FWB:83K spot, and I’m like, “Dude, if you bust through, I can see you tearing up to $120K-$130K—time for a high-five and a snack!” But if you start slipping with those lower lows, no biggie. You might drop to $79,600, then maybe $78,700, $77,000, or even $73,500. I’m just kicking back, enjoying the show—up or down, it’s all good vibes! If you liked this, comment below, boost, or follow—let’s keep the trading love going!

Kris/ Mindbloome Exchange

Trade Smarter Live Better

Bitcoin’s Fair Value Gap Filling – Will Trendline Hold?Bitcoin is currently trading at its rising trendline support, which has been a key level for price action. On the 5D timeframe, BTC is respecting this strong upward trendline, indicating that buyers are stepping in to defend it. The previous resistance has now turned into support, adding confluence to this critical level. If BTC holds here, it could signal a bullish continuation, while a breakdown may trigger further downside.

On the 1D timeframe, BTC is filling the Fair Value Gap (FVG), a liquidity zone where price typically seeks balance before making the next move. The Stoch RSI is in the oversold region, suggesting that a bounce could be on the horizon if demand picks up.

Bullish Scenario : Holding above the trendline and reclaiming $81,500+ could trigger another leg up.

Bearish Scenario : Losing the trendline support and breaking below $76,000 could lead to deeper correction.

Key Levels to Watch:

✅ Bounce from $76,000-$78,000 → Potential bullish reversal

⚠️ Break below $76,000 → Risk of further downside

Ethereum will move to the upside1. Current Price and Context

The current price of ETHUSD is $1,848.22, as indicated by the red label at the bottom right of the chart.

This price represents a significant decline from earlier highs, suggesting a corrective phase following a prior uptrend.

2. Price Movement and Trend

The chart shows a sharp upward movement starting in early 2024, with the price reaching a high near $4,000 (orange horizontal line).

After this peak, the price entered a correction phase, dropping steadily. The downward movement is marked by a descending triangle pattern, a bearish continuation pattern characterized by lower highs and a flat or slightly declining lower trendline.

The upper trendline of the descending triangle slopes downward, while the lower support level was initially around $2,100 (orange horizontal line labeled "Correction").

3. Breakdown and Support Levels

The price has recently broken below the $2,100 support level, which could indicate a continuation of the bearish trend or a potential exhaustion point.

The current price of $1,848.22 is near a significant low, with the chart suggesting this as an "Opportunity to go for long" (yellow annotation). This implies that some traders might see this as a potential reversal point to enter a long position, anticipating an upward move.

4. Potential Targets and Resistance

The chart projects a potential upside target near the previous high of $4,000 if the price reverses and breaks out of the descending triangle pattern.

The vertical orange line at $4,071 suggests a psychological or technical resistance level that the price approached earlier in the trend.

5. Technical Observations

Descending Triangle: This pattern often signals a continuation of a downtrend unless a strong bullish reversal occurs. The breakdown below $2,100 supports the bearish case, but the current low at $1,848.22 could act as a support zone if buying interest emerges.

Volume (not shown): Without volume data, it’s hard to confirm the strength of the breakdown or potential reversal. Typically, a breakout with high volume would carry more significance.

Timeframe: The 12-hour chart suggests this is a medium-term analysis, suitable for swing traders looking for opportunities over days or weeks.

6. Possible Scenarios

Bullish Scenario: If the price holds above $1,848.22 and starts to recover, it could test the $2,100 level again. A break above $2,100 with strong momentum might signal a return to the $4,000 range, aligning with the "Opportunity to go for long" annotation.

Bearish Scenario: If the price fails to hold $1,848.22 and continues to decline, it could test lower support levels (e.g., $1,500 or below), indicating further correction.

Bitcoin will reach at $221,0001. Overview of the Chart

Asset: Bitcoin (BTC) / USD

Timeframe: Daily (D)

Platform: TradingView

Date Range: Approximately mid-2023 to March 11, 2025

Current Price (as of Mar 11, 2025): $76,697.39 (shown in the top right corner)

2. Price Movement

Historical Trend: From mid-2023 to late 2024, Bitcoin shows a steady uptrend with some corrections. The price rises from around $25,000–$30,000 to a peak near $100,000 by late 2024.

Recent Action: After hitting a high around $100,000 in late 2024, the price corrects downward, dropping to around $75,000–$80,000 by early 2025. The current price as of March 11, 2025, is $76,697.39, indicating a slight recovery or stabilization after the correction.

3. Technical Patterns

Ascending Triangle

Formation: The chart shows an ascending triangle pattern from mid-2024 to late 2024. This pattern is characterized by:

A flat resistance line around $95,000–$100,000 (the horizontal line where the price struggles to break through multiple times).

An ascending support line (sloping upward), indicating higher lows as buyers step in at progressively higher prices.

Breakout: In late 2024, the price breaks above the resistance of the ascending triangle, reaching a high near $100,000. This breakout is typically a bullish signal, often leading to a continuation of the uptrend.

Target Calculation: The target for an ascending triangle breakout is often calculated by measuring the height of the triangle (from the base to the resistance) and projecting it upward from the breakout point. The height of the triangle appears to be roughly $30,000 (from the base around $65,000 to the resistance at $95,000). Adding this to the breakout point of $95,000 gives a target of approximately $125,000. However, the price only reached around $100,000 before correcting, suggesting the breakout may not have fully played out or was interrupted by market conditions.

Trendline

Upward Trendline: A long-term upward trendline (drawn in orange) connects the higher lows from mid-2023 onward. This trendline has acted as support during the uptrend.

Current Position: As of March 11, 2025, the price is testing this trendline around the $75,000–$80,000 level. This is a critical area to watch, as a bounce from this trendline would confirm continued bullish momentum, while a break below could signal a deeper correction.

4. Support and Resistance Levels

Support:

The long-term trendline around $75,000–$80,000 is a key support level.

If this trendline fails, the next significant support could be around the base of the ascending triangle, near $65,000.

Resistance:

The previous all-time high around $95,000–$100,000 is now a resistance zone. The price struggled to break above this level multiple times before the breakout and may face selling pressure if it approaches this zone again.

5. Price Action Analysis

Post-Breakout Correction: After breaking out of the ascending triangle, Bitcoin hit a high near $100,000 but failed to sustain the momentum, leading to a correction. This is not uncommon after a breakout, as markets often pull back to retest previous resistance (now support) or other key levels like the trendline.

Current Position: The price is at a critical juncture as of March 11, 2025. It’s testing the long-term trendline support around $76,000. The fact that it’s holding above this level (at $76,697.39) is a positive sign for bulls, but confirmation of a bounce with strong volume would be needed to signal a resumption of the uptrend.

Bitcoin (BTC/USD) Bearish Breakdown Potential – Key Support Leve:

🔍 Technical Analysis:

Resistance Zones (Purple Rectangles at the Top)

The price recently hit a resistance area around $92,000.

It also tested an ascending trendline (red line) and failed to break higher.

Support Zones (Purple Rectangles at the Bottom)

There are two significant support areas:

First zone around $87,500 - $88,000.

Second zone around $82,000 - $83,000.

Bearish Expectation (Black Arrow)

The price is projected to break down from the current level.

A potential lower high formation suggests further decline.

Target areas: $88,000 first, then possibly $82,000.

🔥 Conclusion

Bearish bias if the price fails to reclaim the resistance.

A breakdown below $88,000 could accelerate the drop.

Watch for rejection signals at resistance zones before confirming short trades.

Analysis of BTC/USDT double top pattern occurring in the market.Hello traders.

As i mentioned before in my analysis when ever the double top pattern occure the market will move downward but still it is not completed when the neckline breacks then it will be the complete double top pattern and it will move btc more download.

If the btc bounce back from the resistance which is making right here on 8600$ it will be more upword.

Shere your valuable thoughs in comments about btc.

ADA/USDT at Decision Point – Major Move Incoming!ADA/USDT is testing a major resistance zone after retesting the 100 EMA and bouncing from the rising support line. The price remains in a long-term symmetrical triangle, with the resistance trendline as a key breakout level.

The Stochastic RSI is recovering from oversold levels, indicating potential bullish momentum. A breakout above resistance could trigger a strong uptrend continuation, while rejection may lead to a pullback toward support.

Potential Reversal of the Trump Coin!Hello Every one ! The Trump coin experienced an 85 percent drop after reaching its highest price, forming a falling wedge pattern. This could indicate a potential reversal point for the coin. Although the chart is limited, it may be worth considering a better entry point below $12 or near $10, although it might not reach that level. Please note that this is not financial advice. BINANCE:TRUMPUSDT BINANCE:TRUMPUSDT.P KCEX:TRUMPUSDT

Did Bitcoin Just Trick the Bears? RSI Says Yes!Bitcoin's recent price action suggests a potential bear trap, as the price sharply dipped below a key support zone before rebounding. The sudden breakdown may have triggered panic selling, but the rapid recovery and bullish divergence on RSI indicate that this could have been a false breakdown designed to shake out weak hands before a stronger upward move.

The price is now reclaiming levels above the previous demand zone, signaling a possible reversal. If Bitcoin sustains momentum and reclaims the $90,000 region, it could invalidate the bearish breakdown and push toward new highs.

Bitcoin Has Dropped $20K in a Single Week! Where’s the Bottom?Hey followers,

Crazy times, huh? I was just looking at the Bitcoin chart, and I don’t see any other week in history with a $20K retracement, absolutely wild.

I haven’t done much BTC analysis lately, but the last time I did, I warned: “Money on your screen won’t feed your family—turn it into real gains.” Well, here we are. Once again, two simple criteria have proven their ability to predict profit-taking areas and potential corrections:

📌 Channel projection

📌 Equal waves

Now, with this massive sell-off, it’s time to hunt for strong support zones. Percent-wise, the weekly drop might not be extreme, but in raw dollar terms, it should be the biggest in BTC’s history. So, where could this madness stop?

For me, the 48K–$66K range is where things get interesting. Somewhere inside this zone, I expect a reaction, and I’ll be looking for possible reversal setups. Let’s break down the key reasons why this area is a potential landing spot:

🔹 1. Previous yearly highs acting as support

In 2021, Bitcoin saw two major sell-offs in the $60K–$70K range. Then, in early 2024, the same zone acted as a strong resistance before BTC finally broke through.

When a zone like this is left untested, it often pulls the price back like a magnet for a retest, a classic case of liquidity seeking validation. That’s why this area forms the foundation of my support box.

🔹 2. Short-term trendline alignment

This trendline, drawn from wick touches, is valid because the third touch happens higher than the peak between the first and second touches, comes to retest the trendline from higher high levels (HH). Even though it’s short-term, it perfectly aligns with the horizontal support zone, adding extra confluence.

🔹 3. 50% retracement from the all-time high

From my past crypto analysis, BTC loves its 50% retracements from all-time highs—like clockwork. And guess what? This level perfectly overlaps with the marked support zone, reinforcing its strength.

🔹 4. The psychological $50K level

Round numbers play a big role in trading, humans love them. Back in August 2024, $50K acted as a key level. I even mentioned on a local radio station earlier that year that buying the dip around here could be a smart move… and, well, lucky me, it worked out. :)

So once again, this simple but effective criterion strengthens the case for this area.

Putting all these criteria together:

Summary:

The more confluences in a single price zone, the stronger it is. Sure, we could add some fake trendlines or EMAs, but for me, price action and human psychology tell the real story. Think of it like tracking footprints in the snow, BTC leaves clues, and it’s our job to follow them.

- For long-term believers, this zone could be a solid place to accumulate more BTC.

- For those looking to enter Bitcoin for the first time, this is the area to watch.

What do you think? Are we heading lower, or...

🚀If you like the analysis, hit the boost as well🚀

Cheers,

Vaido

---------------------------

📢 Want more in-depth technical analysis?

I post similar insights on my Substack channel, where I break down technically strong stocks worldwide by saving you time and helping grow your portfolio. I do the technical analysis, so you don’t have to!

🔗 Find the link in my BIO (under the Website icon) , or if you're using mobile just scroll down to my signature to choose your preferred language.

See you there!

NEARUSDT on a bullish climb!

🚀 The price BINANCE:NEARUSDT.P is moving steadily inside an ascending channel, testing *3.080 USDT* resistance. If the breakout holds, we could see a push toward higher levels!

🔑 *Key Levels:*

**Support:**

*3.051 USDT* – main level keeping the trend intact.

*3.000 USDT* – deeper support if retracement kicks in.

**Resistance:**

*3.094 USDT* – key breakout point.

*3.150 USDT* – potential next stop for bulls.

🚀 *Trading Strategy:*

*Long Entry:* After confirming a breakout above *3.094 USDT*.

*Stop-Loss:* Below *3.051 USDT* – protecting against fakeouts.

*Profit Targets:*

*3.120 USDT* – quick scalp target.

*3.150 USDT* – solid take-profit zone.

*3.200 USDT* – full bullish extension if momentum builds.

📊 *Technical Outlook:*

Price respecting the channel = continuation likely.

Volume picking up – signals increasing bullish interest.

Failure to break resistance could lead to a pullback to support.

💡 *What to Watch?*

Watch for volume confirmation on breakout!

If resistance rejects, look for a retest at lower support before re-entering.

Bulls in control, but risk management is key.

Are we heading for a breakout or a pullback? Drop your thoughts! 🚀🔥

Ethereum’s Accumulation Phase Ends – What’s Next?Ethereum has successfully broken above the accumulation zone, indicating a potential bullish continuation. The price is now approaching a critical descending trendline resistance (blue line), where a breakout could trigger further upside momentum.

Key Observations:

Breakout from Accumulation: The price has cleared a consolidation phase, suggesting renewed buying interest.

Next Resistance (Green Box): The immediate hurdle is the descending trendline resistance within the green box. A breakout and successful retest of this level could push the price toward the next major resistance.

XRP Weekly Summary: February 15–21, 2025Welcome back to my weekly XRP roundup! As of February 21, 2025, the XRP market has been buzzing with activity, reflecting both its resilience and the broader crypto landscape’s volatility. Here’s what’s been happening with Ripple’s flagship cryptocurrency this week.

Price Action: A Rollercoaster Ride

XRP kicked off the week with a notable surge, climbing over 20% to hit $2.76 by midweek. This rally was a breath of fresh air for holders, fueled by whispers of regulatory clarity and renewed investor confidence. However, as Bitcoin and other major cryptocurrencies faced downward pressure, XRP cooled off slightly, trading around $2.50–$2.60 by Friday morning. Posts on X highlighted this pullback, noting resistance near all-time high volume-weighted average price (VWAP) levels, suggesting the market might be testing a critical ceiling. Despite the dip, XRP’s weekly gains remain impressive, hovering around 15–17% depending on the hour—a solid performance amid a shaky broader market. Or, if 15-17% doesn't impress you much in one week, you always have the alternative to put your money in a CD at your local bank for 4.7% per year.

Legal Winds Blow in Ripple’s Favor

The big story this week? Legal developments surrounding Ripple’s long-standing battle with the SEC. Sentiment on X and crypto news circles suggests growing optimism that the tides are turning. Speculation is rife that the SEC’s case could weaken further, especially with chatter about the agency acknowledging Grayscale’s XRP ETF filing. While no official resolution has dropped as of Friday morning, the narrative of “SEC overreach” is gaining traction, boosting XRP’s appeal as a “sleeping giant” ready to awaken. If these legal clouds clear, analysts see a path to $3 or higher in the near term—exciting times ahead!

ETF Hype Heats Up

Speaking of ETFs, the XRP ecosystem is abuzz with ETF-related developments. Multiple firms have been pushing XRP exchange-traded fund applications, and this week, the buzz intensified. The idea of a BlackRock-backed XRP ETF even popped up in some enthusiastic X posts—though it’s still speculative at this stage. The potential for an approved ETF continues to drive bullish sentiment, with analysts suggesting it could unlock a “liquidity cascade” and propel XRP past its previous all-time highs. For now, it’s a waiting game, but the anticipation is palpable.

Another Financial Institution Connects to the XRP Ledger

On February 19, 2025, Braza Group, an international payment firm with over 15 years in the banking sector, announced the launch of its BBRL stablecoin on the XRP Ledger. Braza Group, while not a traditional bank itself, is a BACEN (Central Bank of Brazil) interbank player, meaning it operates within Brazil’s regulated financial ecosystem and facilitates interbank transactions. The BBRL stablecoin, pegged to the Brazilian Real, aims to provide a secure and efficient digital transaction option for individuals and businesses, leveraging XRPL’s capabilities.

Making Closer Ties Where Its Important

Brad Garlinghouse, the CEO of Ripple has been active in the public sphere recently, but the most notable events occurred earlier in February. On February 14, 2025, he shared on X about engaging with U.S. policymakers in Washington, D.C., including meetings with figures like Senator Tim Scott (Chairman of the Senate Banking Committee) and Representative Ritchie Torres. Photos from these meetings were posted, showing him alongside lawmakers such as Representatives William Timmons, Bill Huizenga, Bryan Steil, Zach Nunn, and French Hill. These discussions focused on advancing crypto regulatory clarity, but they fall just outside this week’s timeframe (February 15–21).

Market Sentiment and On-Chain Moves

On-chain data paints a picture of accumulation, with significant XRP outflows from exchanges reported earlier in the week—think tens of millions of dollars’ worth. This suggests big players might be stacking their bags, betting on a breakout. Meanwhile, X users are hyping up technical patterns like the “cup and handle,” hinting at a possible 18% jump to $3.30 if XRP clears key resistance around $2.82. The mood? Bullish, but cautious—everyone’s watching Bitcoin’s next move and the Fed’s hawkish stance for cues.

What’s Next?

As we wrap up this week, XRP stands at a crossroads. Will it smash through resistance and reclaim its glory above $3, or will market headwinds force a deeper correction? With legal clarity on the horizon, ETF speculation simmering, and strong community support, XRP is poised for a potentially historic moment. Stay tuned for next week’s update—we might just see fireworks!