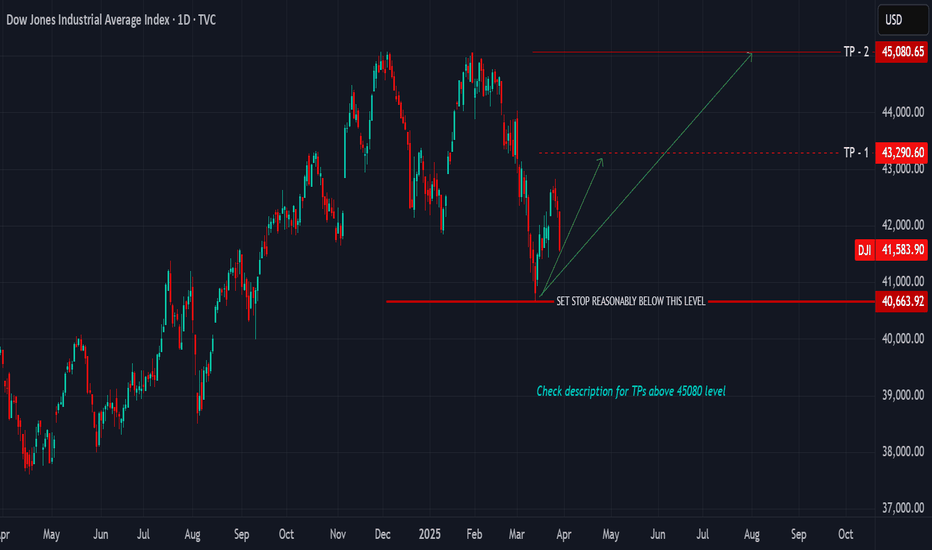

BUY EVERY DIP, HOLD FOR THE NEXT 7-MONTH CYCLE UNTIL OCTOBERThere are the current turmoil by tariffs and perceived recession, yet, the cycles strongly support a further advance from the March lows until October 2025. The bottom in March 2020 formed the base for the 5 year bull cycle nested within the larger 13 year cycle.

PRICE

The 2020 crash low formed at 18213.65, the decline in 2022 formed a bottom at 28660.94. We would have a price range Low - Low of (+10447.29 pts)

(28660.94 - 18213.65) = 10447.29 units

By projection if the range between the first two bottoms is 10447.29 we would expect the third bottom connecting three expanding points to be at 1.618 of 10447.29 points from 28660.94

28660.94 + (10447.29 x 1.618) = 45564.66

This makes the current top at 45073.63 through 45564.66 level a major support whereas its also a minor resistance for some correction and we expect price to move through this level.

TIME

Time connecting the three points 23/03/2020 - 03/01/2022 - 10/10/2022 with March 2020 as starting point would give us a time count (0.0 - 651 days - 931 days).

We find that between the two bottoms the top in Jan 2022 came in at 651 days. By projection we expect the next bottom to be at least 209 weeks or 1463 days from 10/10/2022 with a top located at a Phi variation of 651.

We would project a time range 1064 - 1099 days for a top and a decline into the third bottom 1463 days from 10/10/2022 and 2394 days from 23/03/2020. Trade safe, good luck.

Gann

BUY EVERY BIG TECH, BUY AND HOLD UNTIL OCTOBERBuy the pivot level. hold for the last 7-month bull run until October 2025.

Price and time cycles suggest that price will peak in October 2025 and a second swing high in March 2026 for the midcycle correction. We would look for the top at 26k

Buy every big tech, buy the major stocks, buy, buy......

The 7-month cycle from March to October 2025 will be the second largest swing within the 5-year bull run from 2020 crash low

Trade safe, good luck.

Inflation 2022 trendline now is the keyAs you can see this trendline is acting as a major resistance. Once Spx break it out it is highly probable that that trendline turns into a support.

Spx will test is and if it holds we can see 7000/7050 pips by the end of November 2025. That is a 4% gain.

I would like to highligh that because the liquidity in the system is so high is very probable to see this happen... and yes... this is only the beginning because then at 7000 pips there is a Fib ring which could provide us the real progression of the Sp500

Gold strategy! Buy long in the 3925-3935 area!The market is always full of possibilities. There is no so-called "highest point", only higher possibilities. When the trend is clearly upward, going with the flow is the core strategy to achieve stable profits. Avoid trading against the trend or based on emotions, especially in the current volatile market environment. Trading without clear thinking and discipline can easily lead to unnecessary losses. This is something I've been emphasizing. For those who are still on the sidelines and haven't yet developed an effective trading strategy, please follow my channel. We will continue to provide professional market analysis, comprehensive trading plans, and precise buy and sell instructions to help you better grasp the market's rhythm.

I am not surprised by the sharp rise in gold prices at the opening. Those who have read my views know that the current trend is basically consistent with my prediction, and reaching 3900 is within expectations. Since last week, we have been emphasizing that the bullish trend of gold remains unchanged. On Thursday and Friday, we established long positions in gold at 3840-3855-3874, including buying at 3893 at the beginning of the opening. This is based on the technical analysis and news analysis, which makes us dare to be so firmly bullish.

Last Friday, despite a surge and then a decline, gold prices remained volatile at high levels. Market expectations of further Federal Reserve rate cuts, coupled with high uncertainty regarding global geopolitical risks and the economic outlook, continued to provide stable support for gold prices, maintaining their upward trend. In particular, the recent US government shutdown crisis has stimulated rising risk aversion sentiment, helping gold prices to rise further, and the market's concerns about a long-term US government shutdown have intensified.

Judging from the gold daily chart, gold prices rebounded sharply last Friday and recorded a large real body positive candlestick pattern. Although the sharp rebound in prices last Friday failed to break through the previous high, gold prices continued to rise after opening high this week. In addition, the moving average cluster maintained a bullish arrangement, and the MACD indicator double lines maintained a golden cross operation process, indicating that the current trend is under the control of bulls.

The short-term trading strategy continues with last week's buy-on-low strategy!

There are many areas in 393-3925, the target is 3945, pay attention to the breakthrough of 3950, if it breaks through, look higher!

Astro Nakshiralife Pressure DatesI want to show how Astro leading tools helps one catch great momentum in trading. People think astro tools don't work. Here i am showing Nakshiralife astro pressure dates. It been absorb that if you trade these astro dates properly you will have trading edge in the market as these dates are leading indicator. All you have to do wait for Nakshiralife pressure date. than take it high and low and mark it. next day in which ever direction market moves you trade that direction. These dates give Good momentum in market. Simply shows that Astro tools work beautifully in market

EURGBP Daily Forecast - Q4 | W41 | D6 | Y25|

📅 Q4 | W41 | D6 | Y25|

📊 EURGBP Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:EURGBP

BTC 4-hour - PumpTober- ATH outlook for OCT 2025 It's Friday. It's been pumping PA. While I was making this chart this morning's PA was moving with very healthy volatility. Bulla's are pushing for the ATH. At the same time, if my 12345 leg is correct.. we are waiting for the finalized #3.

Oddly with the ATH at the #3 level... we have no clue what PA will do around the area.

We could have a normal healthy drop to #4 or a very very shallow drop to #4 .... and then ... not realize PA is already on it's way to #5.

With the weekend almost here, we might see the ATH crushed for a Friday's close, with lots of activity.

I will add that, weekends are usually dead, I don't except anything other than, low volatility with PA looking to correct into the #4 low position.

That's my bias for now... if PA doesn't follow this, then my bias will change.

Lastly with this Chart, I used the GannBox again and have some notable FIB targets for #5 (130K - 165K) and timeline is end of Pumptober into November.

There are two future fib target lines graphs.

One is extreme the other is minimal, and thus there is the posted forecasted regions. Until the 3-4 settles, it's still a guess, might as well take a look.

Good Luck

EURUSD Daily Forecast -Q4 | W41 | D6 | Y25|📅 Q4 | W41 | D6 | Y25|

📊 EURUSD Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:EURUSD

AUDUSD Daily Forecast -Q4 | W41 | D6 | Y25|📅 Q4 | W41 | D6 | Y25|

📊 AUDUSD Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:AUDUSD

GBPUSD Daily Forecast - Q4 | W41 | D6 | Y25|📅 Q4 | W41 | D6 | Y25|

📊 GBPUSD Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:GBPUSD

Continuation of the previous idea based on the Harmonious EnergyThe consolidation phase is coming to an end. The market structure is gradually moving into the next stage of the energy cycle, where a new flow direction is forming.

At the moment, I am observing a continuation of the energy movement with a noticeable manifestation of buyer strength. The key focus is on price behaviour near the resistance level — this is where it will become clear whether buyers will be able to maintain control and continue the upward momentum, or whether the market will enter a redistribution phase.

According to the GPE concept, this moment reflects the transition from balance to energy release — when the accumulated potential turns into real movement.

📌 Observation: price reaction to resistance and confirmation of the flow's strength.

💬 If you have any questions or would like to discuss the idea in more detail, I am always open to dialogue.

Trading idea based on the Harmonious Energy Flow (HEF) conceptAt the current stage, there is a clear manifestation of buyers’ strength, even though the market environment is changing rapidly without any significant price movement. This forms a state of consolidation, where energy is being accumulated for the next impulse.

According to the HEF concept, consolidation represents a transitional phase — the market is searching for balance before initiating a new wave of directional movement. My current expectation is focused on the moment of breakout from consolidation, when the market will reveal the true side of strength.

📌 Main focus: observing how buyers maintain their advantage within this narrow structure and waiting for a signal confirming the exit from balance.

If you find my charting approach interesting, you are welcome to connect and discuss further. I’m open to communication and collaboration.

Would you like me to refine this version for maximum stylistic alignment with TradingView’s publication tone (slightly shorter, more analytical, and visually structured)?

How far Spx can go? My guess is 9000 point by March 2027Gann cycles are telling me that if the liquidiy in the system carries on we can see a bullish 2026 and the top of the market in March 2027.

After that I expect a major crash. Therefore, I could tell that 1929 crash is on the horizon but this time a little bit earlier.

If I am Ok, we could see 2027 top and two years of sell off in the market.

KEY AREASLiquidity is on the system. That will allow Spx continue growing. Now, the question is: How far Spx will go? and the most important. Until when?

Spx is clingin between very important support and resistance zones: Covid 2020, Oil 2016, previous tops (2021) and Inflation (2022).

The Gann cycle allows me to point out a date: 20th November as a key date. Cycles as this allows me to see a major break out.

We could see 7000 pips by the end of November and then a continuation.

Just have a look at this support and resistance areas which so far are playing out beautifuly.

CRSP Stock Technical Outlook | Key Levels, Momentum & MarketDescription:

CRISPR Therapeutics AG (NASDAQ: CRSP) — a leading gene-editing biotech firm — continues to attract investor attention as the company advances its CRISPR-Cas9-based therapies targeting severe genetic diseases. Despite volatility in the biotech sector, CRSP remains one of the top innovators with strong long-term growth potential and institutional interest.

In this analysis, I focus on key technical levels, market structure, and momentum indicators to assess potential price reactions. Watching closely for trend continuation or reversal setups.

⚠️ Disclaimer: This is not financial advice. The content provided is for educational and informational purposes only. Always do your own research before making any trading or investment decisions.

#CRSP #CRISPR #BiotechStocks #NASDAQ #StockMarket #TechnicalAnalysis #TradingView #SwingTrading #Investing #GeneEditing #Biotech #CRSPStock #StockAnalysis #MomentumTrading

#ALICE /USDT — Descending Triangle at Demand Zone!

#ALICE

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.3040, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.3070

First target: 0.3180

Second target: 0.3272

Third target: 0.3385

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#KDA/USDT bullish structure formed at the chart#KDA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.3540, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.3735

First target: 0.3813

Second target: 0.3916

Third target: 0.4045

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.