Ethereum TA 25.4.5Hello everyone, I hope you are doing well. Ethereum on the 4-hour timeframe got rejected after hitting a strong order block and started forming new lows. Given the current chart conditions, we have two order blocks in the high price area and we expect the price to return to these levels. If we see a short setup, we will enter a short position with a target of 1750. For now, I am not suggesting a long position and will wait until the pullback on the chart is complete.

⚠️ This Analysis will be updated ...

👤 Sadegh Ahmadi: GPTradersHub

📅 25.Apr.5

⚠️(DYOR)

❤️ If you apperciate my work , Please like and comment , It Keeps me motivated to do better

Gold

Assignment for GOLD next weekBase on what happened this week. My idea for GOLD is simple and straight forward next week. After that strong expansion to the downside, i am expecting to see a retracement towards .5 or .62 of fib level before price will continue to go down and mitigate that big weekly imbalance below. Base on the structure of next weeks high impact news, my idea would be a simple consolidation for Monday till Wednesday since we got no high impact news on those given days. Then Thursday and Friday would be the expansion since we got FOMC,CPI and PPI for those 2 remaining days of the week... My entry would still be the same. Top down analysis using my multi timeframe strategy and wait for all timeframes to align and enter in 5m timeframe once it aligns with the overall higher timeframe. Good luck to us all and Happy trading...

XAUUSD Market Recap – “Sniper Entry + NFP Chaos = Full TP Party”📊 XAUUSD Market Recap – “Sniper Entry + NFP Chaos = Full TP Party” 🎯💣

✅ Sniper Sell @ 3135 – Textbook Execution

The daily plan's sell scenario from 3135–3145 played out perfectly:

Premium zone + valid OB

FVG rejection + bearish PA (M5/M15 CHoCH)

Three take-profits hit: 3120 → 3086 → 3054

Structure respected, price never looked back 🔫

🔥 Post-NFP Breakdown – April 5, 2025

📉 NFP (Actual): 228K vs. 140K Expected

📈 Strong surprise to the upside – job creation smashed expectations

📉 Unemployment Rate: 4.2% (vs 4.1%)

📉 Slight increase – softens the impact of strong jobs number

💬 Market Reaction?

Gold dumped hard post-data, as strong NFP spooked the market

Algorithmic move: sweep → push down → bounce on deep FVG

Market front-ran deeper demand (below 3054), tagging 3036 briefly

🔁 What Got Mitigated:

✅ Premium supply zone @ 3135–3145

✅ 3086–3100 OB demand fully tapped

✅ 3054–3040 imbalance filled

✅ Final reaction wick @ 3036–3038 bounced right off deeper imbalance

🧲 Still in Play / Unmitigated:

🟦 3029–2985 = untouched D1 imbalance

🟡 Small rejection gap @ 3081–3085 (may act as intraday retest zone)

🔴 Possible liquidity below 3000 still untouched

🧠 Summary:

✅ Plan respected

✅ NFP added fuel

✅ Gold respected PA structure to the pip

🎯 Sniper sell from 3135 = perfect execution

XAUUSD | Sniper Entry Zones Ready – Eyes on 3145 & 3086 Reactio🔍 Daily Bias: Neutral with Bearish Intraday Tilt

Price is reacting to a previously unmitigated zone and potentially retesting a premium area, suggesting sell-side interest may return before any bullish continuation.

🧠 Key Context from Your Marked Chart

✅ Marked Sell/Retest Zone @ 3135–3145:

Clearly defined premium zone with imbalance and prior bearish reaction — confluence with OB + FVG, potential sniper entry for shorts.

✅ Unmitigated OB @ 3086–3095:

Valid demand zone where price bounced aggressively — still active liquidity + FVG.

✅ Major Imbalance Below @ 3054–3040 & 3040–3029:

Heavy drawdown target area. If price breaks 3086, expect it to fill imbalance and potentially bounce at 3040 or deeper around 3029.

🔽 Sell Scenarios

🟥 Sell #1 — Retest of Supply Sniper Entry

Entry Zone: 3135–3145

Confluences: Valid OB, FVG, Premium, Bearish PA from last touch

Target: 3086, then 3054–3040 imbalance zone

RSI: Check for overbought on M15–H1

🎯 "Classic sniper setup — get in, get out. No overthinking required."

🟥 Sell #2 — Break and Retest Below 3086

Trigger: Bearish close below 3086 + BOS on M15

Retest Entry: 3086 zone from below

Target: 3054 (first FVG), then 3029

EMAs: 5/21/50 flip short on M15 for confirmation

🟩 Buy Scenarios

🟩 Buy #1 — Bounce from 3086–3095 (Unmitigated OB)

Entry: Clean reaction + bullish PA in zone

Target: 3135 retest, partials at 3114

Sniper Confluence: BOS on M5/M15 + RSI divergence

🟩 Buy #2 — Deep Bounce from 3040 or 3029 Imbalance Zone

Entry: Only on strong PA confirmation (no early knives)

Target: 3086 first, 3135 secondary

RSI + EMA: Look for EMA 100–200 confluence, bullish divergence on RSI M15/M30

🧾 Technical Confluences Summary

✅ SMC: BOS + CHoCH present across M15–H1

✅ FVG: 3135–3145 (upper), 3054–3040 (lower)

✅ GAPS: Visible in 3054–3029 zone

✅ LIQUIDITY: Above 3145 + below 3029

✅ OB VALID: 3086–3095 still unmitigated

✅ RSI: Overbought earlier, neutral now. Watch intraday shifts.

✅ EMA Clusters:

EMA 5/21 flat after rebound

EMA 50/100 just below 3100

EMA 200 near 3050–3040 (high confluence for bounce)

⚠️ News & Fundamentals

Trump conference added USD volatility, but gold didn’t rally — watch for Fed speakers & JOLTS data tomorrow.

If dollar strengthens intraday again → watch sell setups more closely.

🧨 TradingView Title Suggestion:

“🎯 XAUUSD | Sniper Entry Zones Ready – Eyes on 3145 & 3086 Reactions!”

NFP & Unemployment Rate Preview – April 4, 2025📉 NFP & Unemployment Rate Preview – April 4, 2025 🧨

Today traders will be waiting for one of the most overhyped news releases of the month — Non-Farm Payrolls (NFP). Buckle up for some wild swings, maybe even caused by… 10 fewer McDonald’s hires. 🍔💥

🧠 What’s Expected?

Jobs added: Around 135K, down from 151K.

Unemployment rate: Steady at 4.1%.

Average hourly earnings: Expected +0.3% MoM, +4.0% YoY.

🧨 What’s brewing?

Trump’s new import tariffs (yes, again) are shaking markets, pushing fears of inflation and recession to the surface.

Economic data has been mixed — some cracks are showing, and traders are ready to overreact either way. 🙃

🎙 Powell speaks — so if NFP doesn’t move the market, maybe a few carefully chosen Fed words will.

😏 Reminder for the impatient ones:

If the first 5-minute candle after NFP doesn’t go your way… maybe wait for the second one before tweeting “market is broken.” 🫠📉

#NFP #XAUUSD #Forex #Powell #GoldScalping #FOMC #VolatilityDay #PatienceNotPanic

GOLD 3000$ Key Level Ahead! Buy!

Hello,Traders!

GOLD is making a bearish

Correction just as pretty

Much everything else on

The market, but Gold is

Trading in a long-term

Uptrend so after the

Price hits an important

Psychological level

Around 3000$ a local

Bullish trend-following

Rebound is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAPHey Everyone,

Following on from yesterdays update on our mid/long term route map after completing the 1h, 4h and daily chart route maps. We completed 3094 target and stated that we will now need this weeks candle to finish and close and/or ema5 lock above 3094 to open the gap above.

- Looking like no close above 3094 on the weekly candle, if price stays below this level on market close. Amazing to see the weighted levels levels being respected like this to allow us to identify new range gaps or rejections.

We will be looking for support and bounce on the channel half line or a cross and lock below the half line will open the lower range for the channel low Goldturns.

This is the beauty of our channels, which we draw in our unique way, using averages rather than price. This enables us to identify fake-outs and breakouts clearly, as minimal noise in the way our channels are drawn.

We will now come back Sunday with our updated Multi time-frame analysis, Gold route map and trading plans for the week ahead and also a new Daily chart long term chart idea, now that this one is complete.

Have a smashing weekend!! And once again, thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Gold’s Wild Ride: Is the Correction Over?Yesterday was an insane day for Gold—while I expected a strong drop to at least 3,080, I didn’t anticipate such a sharp reversal after the sell-off.

Now, the big question is: Has Gold finished correcting, or is more downside coming?

________________________________________

Why I Expect Another Wave of Selling

📉 Gold Still Looks Vulnerable – Despite the rebound, I don’t believe the correction is over.

📉 Key Resistance Established – The 3,135–3,140 zone has now formed a strong ceiling, limiting upside potential.

📉 Selling Rallies Remains the Plan – Even with yesterday’s bounce back above 3,100, my outlook remains unchanged.

________________________________________

Trading Plan: Selling Spikes During NFP

🔻 Looking for price spikes during the NFP report as opportunities to sell into strength.

🔻 Targeting a new leg down toward the 3,030 support zone.

The correction is likely not done yet—let’s see if the market confirms it. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

GOLD corrects after hot rally, conditions remain optimisticOANDA:XAUUSD has retreated from an all-time high of $3,167.67/oz as investors began to take profits after a “parabolic” rally. While the rally was initially fueled by safe-haven demand stemming from US President Donald Trump’s plans for higher tariffs, questions are starting to arise about the sustainability of the rally as buying pressure wanes and the Relative Strength Index (RSI) moves into overbought territory.

Gold has rallied 19% so far in 2025 and this correction could be temporary

Gold prices have rallied 19% this year, supported by multiple macro uncertainties, historic central bank buying and continued inflows into ETFs. Despite the current pullback, from a fundamental perspective, this does not impact the overall bullish fundamental trend and the likelihood of near-term technical consolidation has begun to increase.

Trump’s tariffs a “catalyst” supporting the physical gold market?

Trump's proposal to impose 10% tariffs on most imports has stoked market concerns about slowing economic growth and rising business costs, while risk aversion has pushed gold prices higher.

However, the White House later clarified that "critical raw materials" including gold, copper and energy would be exempt, alleviating some concerns about supply chain disruptions and providing some support to the physical gold market.

Market sentiment remains bullish, with strong buying momentum on dips

Although the technical side is currently under some pressure, the market's optimism remains unshaken. It is difficult to try to assess the peak near the historical high, but it is clear that every pullback is quickly absorbed by buyers, which shows that the underlying bullish sentiment in the market is still strong.

Described by the sharp drop on Thursday, gold recovered very quickly after the drop.

Technical Outlook Analysis OANDA:XAUUSD

Gold may enter a correction phase after a long period of hot growth, depicted by the Relative Strength Index (RSI) falling below the overbought level, breaking the blue bullish channel. In the short term, if gold breaks below the short-term channel, converging with the 0.50% Fibonacci extension level, it will be in a position to correct further with the next target level around $3,066 in the short term, more than $3,040.

However, overall, gold still has a bullish technical outlook with the price channel as the long-term trend and the main support from the EMA21. As long as gold remains within the price channel and above the EMA21, the declines should be considered as corrections and not a trend. On the other hand, once gold recovers from the 0.50% Fibonacci extension and holds above the raw price point of $3,100, it will signal the end of the correction cycle, then the upside target will be the 0.786% Fibonacci extension in the short-term.

During the day, the long-term uptrend with the possibility of a short-term correction will be noticed again by the following positions.

Support: 3,086 – 3,066 – 3,040USD

Resistance: 3,100 – 3,106 – 3,135USD

SELL XAUUSD PRICE 3147 - 3145⚡️

↠↠ Stoploss 3151

→Take Profit 1 3139

↨

→Take Profit 2 3133

BUY XAUUSD PRICE 3061 - 3063⚡️

↠↠ Stoploss 3057

→Take Profit 1 3069

↨

→Take Profit 2 3075

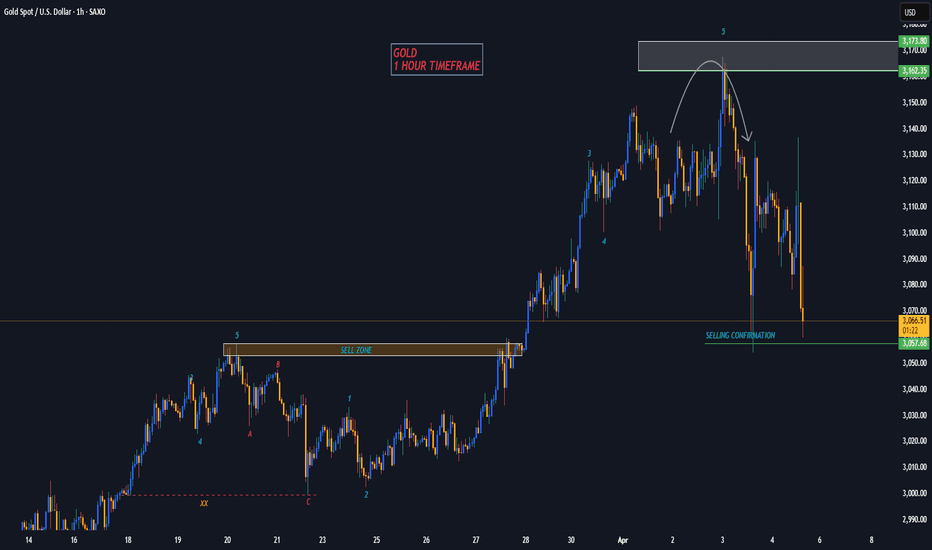

GOLD - 1H UPDATEGold sell running 900+ PIPS in profit, within the Gold Fund for my investors. Price is dropping today again to the downside as we said would happen yesterday.

I'm hoping to get a close below the ‘Selling Confirmation' zone today, so we can get a strong confirmation for a longer term sell off.

gold after the inertviez of jerome todayAs of April 4, 2025, gold prices have experienced significant volatility amid escalating trade tensions and market uncertainties. Following President Trump's announcement of new tariffs and China's subsequent retaliation with 34% tariffs on U.S. goods, investors have increasingly turned to gold as a safe-haven asset. This surge in demand propelled gold prices to record highs, surpassing $3,130 per troy ounce

SPY/QQQ Plan Your Trade For 4-4 : Breakaway PatternToday is a very interesting day because my MRM investment model turned BEARISH on the Daily chart. That means we have broken through major support because of this tariff war and the markets are not OFFICIALLY (based on my models) into a Daily BEARISH trend (or a Daily Broad Pullback Phase).

What that means is we need to start thinking of the markets as OVERALL BEARISH and trying to identify support - or a base/bottom in the near future.

This is no longer a BULLISH market - everything seems to have flipped into a BEARISH primary trend (OFFICIALLY).

So, watch this video to understand how Fibonacci price levels will likely play out as the SPY targeting the 500-505 level (possibly lower) and where the same Fibonacci price levels will prompt the QQQ to target 395-400.

BUCKLE UP. This is a BIG CHANGE related to overall market trend.

Gold is holding up much better than Silver. But I still believe this is a PANIC selling phase in Gold/Silver and they will both base/recovery and RALLY much higher.

The funny thing about the cycles in Gold/Silver is this:

In 2007-08, just after the major expansion phase completed, the Global Financial Crisis hit - prompting a large downward price rotation in metals.

Maybe, just maybe, this forced tariff war issue is a disruption that will "speed up" the process of metals rallying above $5000++ over the next 60+ days.

I see this move as PHASES and it appears the tariff disruption may prompt a faster Phase-Shift for metals over the next few months. We'll see.

BTCUSD seems to be in SHOCK. It's really going nowhere on very low volume.

If BTCUSD is a true hedge or alternate store of value - I would think it would have an upward reaction to this selling.

We'll see how this plays out.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Let's cover the action of some instruments as we get the NFPLet's see what's happening with the market as we get the NFP number live.

Let's dig in!

MARKETSCOM:DOLLARINDEX

TVC:DXY

TVC:GOLD

FRED:SP500

FX_IDC:EURUSD

MARKETSCOM:EURUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

GOLD - Bullish Momentum Continues! Key Levels & Trade SetupCurrent Price Action:

Gold (XAUUSD) is showing strong bullish momentum on the 1-hour chart, with clear support levels forming. The price recently tested 3,108.56 and is holding above key psychological support at 3,100.00.

Key Levels & Trade Setup:

Support Zones:

- FVG (Fair Value Gap) acting as support

- Strong base at 3,108.56 (11:35 candle)

- Major psychological level at 3,100.00

Market Context:

The chart shows liquidity pools with clear buy/sell labels, indicating institutional activity. The price is respecting Fibonacci levels, suggesting a structured uptrend.

Final Thoughts:

Gold remains in a strong uptrend, with clear support levels and Fibonacci confluences providing high-probability trade setups. The 3,100 level is critical—holding above it keeps the bullish bias intact.

Disclaimer: Not financial advice. Always do your own analysis. Trade safe! 💡

GOLD Bullish consolidation supported at 3058Gold maintains a bullish sentiment, in line with the prevailing uptrend. Recent intraday price action suggests a corrective pullback, potentially retesting the previous consolidation zone for support.

Key Level: 3058

This zone represents a significant area of prior consolidation and now acts as a key support level.

Bullish Scenario:

A pullback toward 3058 followed by a bullish bounce would confirm continued upside momentum. Immediate resistance targets include 3141, with extended upside potential toward 3167 and 3198 over the longer term.

Bearish Alternative:

A confirmed breakdown and daily close below 3058 would negate the current bullish outlook. This would open the door for a deeper retracement toward 3028, followed by 3000 and 2974.

Conclusion:

Gold remains technically bullish while trading above 3058. A successful retest and rebound from this level would support further upside. However, a daily close below 3058 would shift sentiment bearish in the short term, increasing the risk of a deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GOLD Will Explode! BUY!

My dear friends,

Please, find my technical outlook for GOLD below:

The instrument tests an important psychological level 2788.3

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 2802.9

Recommended Stop Loss - 2780.8

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Today analysis for Nasdaq, Oil, and GoldNasdaq

The Nasdaq closed sharply lower due to the aftermath of tariff impositions. Following a significant gap-down, the index broke below the lower Bollinger Band, intensifying selling pressure. Yesterday’s bearish candlestick confirmed a sell signal, leading to an expanded third wave of selling. The index has now reached the previous support zone near 18,500, with additional volatility expected due to today’s Non-Farm Payrolls (NFP) report and Fed Chair Powell’s speech.

On the monthly chart, the Nasdaq is forming a lower shadow around the 20-month moving average. Given the sharp decline, if further selling occurs, oversold conditions may trigger a strong rebound, making it risky to chase shorts at this stage. The 240-minute chart also shows a sell signal, with heavy selling pressure continuing. However, this is a risky zone to enter new short positions, so it's advisable to monitor short-term price movements before making a move.

Regardless of whether you take long or short positions, due to high volatility, make sure to set stop-loss levels and adjust leverage to a manageable risk level.

Additionally, the VIX surged, forming a large bullish candle and reaching its March 11 high. With the VIX in an uptrend and a buy signal appearing, further volatility expansion is likely. However, since it has reached a key resistance zone, a short-term pullback in the VIX could allow for a Nasdaq rebound. For the VIX to break above its previous high, a period of consolidation may be necessary. Given the strong buying momentum on both the weekly and monthly charts, this should be taken into consideration when forming a trading strategy.

Crude Oil

Crude oil plunged following the OPEC meeting, where supply increases became a key issue. While oversupply concerns are a factor, the economic slowdown fears from tariffs have also played a major role in the decline. Previously, $68 was considered a strong support level, but oil collapsed from $72 in a steep decline. The final key support lies around $66.

On the daily chart, the MACD and signal line are converging near the zero line, suggesting that once a new wave begins, it could lead to a strong trend movement. Depending on today's session and Monday’s market, oil could see an aggressive breakout in either direction. Current candlestick patterns indicate that the weekly chart remains bearish, meaning holding long positions over the weekend carries significant risk.

The 240-minute chart also confirms a strong sell signal, with MACD plummeting. Oil may form a temporary sideways range near the $66 support, but if this level breaks, selling pressure could intensify. Ensure you manage stop-loss risks carefully in case of further downside.

Gold

Gold declined, reacting to fluctuations in the U.S. dollar's value. The price failed to hold above $3,200 and dropped below the 5-day moving average. Gold has been in a one-way trend, so a bullish approach remains valid unless it breaks below the 10-day MA. However, it has now entered a range-bound phase, and MACD on the daily chart is nearing the signal line, suggesting potential downside risks. The MACD failed to break its February highs, increasing the likelihood of divergence, which could trigger a strong correction if selling intensifies. With rising market volatility and today's NFP release, further wild swings in gold prices are expected.

The 240-minute chart has shown a sell signal, leading to a sharp decline. However, the price has found support near a key resistance-turned-support zone. Since the MACD and signal line remain above the zero line, gold may continue trading within a range in the short term. On shorter timeframes, candlestick volatility is high, so reducing leverage and widening stop ranges would be a prudent strategy.

During periods of extreme market volatility, technical analysis may become less effective, as market sentiment often overrides chart patterns. As always, trade only within your manageable volatility range. The market is always open, so even if you incur losses, there will always be opportunities to recover. Manage risk wisely, and best of luck with your trades today!

If you like my analysis, please follow me and give it a boost!

For additional strategies for today, check out my profile. Thank you!

DeGRAM | GOLD ready for a declineGOLD is in an ascending channel between trend lines.

The price is moving from the dynamic resistance, which has already acted as a pullback point twice.

The chart has already reached the upper boundary of the channel and dropped below the resistance level after testing the 62% retracement level.

On the 1H Timeframe, the indicators show that XAUUSD has started to work out the formed bearish divergence.

We expect a decline.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

XAUUSD M15 I Bearish ContinuationBased on the M15 chart analysis, we can see that the price could rise toward our sell entry at 3092.56, which is a pullback resistance.

Our take profit will be at 3072, aligning with the 161.8% Fibo extension.

The stop loss will be placed at 3120.64, a swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (fxcm.com/uk):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Stratos Global LLC (fxcm.com/markets):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

GOLD/XAUUSD SWING UPDATESHello folks, Gold are on a trend right now. Waiting for this zone for shorts? 3180 might be the high or 3200.

The Initial targets at 3066 zone.

This idea base on my previous idea on fibonacci, Full updates once price goes 3066 zone.

Idea on the new highs maybe later on High impact news.

The idea here is short.

Trade at your own risk.

Follow for more.

I will update once this zones mitigated. Good luck! pewwpeww

Hellena | GOLD (4H): SHORT to 38.2% Fibo lvl 3050.Dear colleagues, the price has been in an upward movement for quite a long time and I believe .that it is time for a correction in the “2” wave.

I think it is possible that there may be a small update of the maximum of the top of wave “1” to 3176.771, then I expect a correction to the area of 38.2% Fibonacci level 3050.

As usual there are 2 possible entry options:

1) Market entry

2) Entry by pending limit orders, if the price updates the maximum.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!