PNUTUSDT UPDATEPNUT

UPDATE

PNUT Technical Setup

Pattern: Falling Wedge Pattern

Current Price: $0.0944

Target Price: $0.1616

Target % Gain: 70.20%

Technical Analysis: PNUT is showing a breakout from the falling wedge pattern on the 4h chart, indicating potential bullish momentum. The price has surged above the resistance trendline, supported by an increase in trading volume. This setup is becoming more reliable as the price approaches key resistance areas.

Time Frame: 1D

Risk Management Tip: Always apply proper risk management.

PNUTUSDT

PNUT / USDT : Breakout from channel could ignite a strong rally

PNUT / USDT is moving cleanly within a descending channel and has now bounced from the mid-zone, heading towards the upper resistance line.

A confirmed breakout with volume could trigger a strong rally towards $0.18 - $0.22 in the coming days.

Watch for confirmation and manage risk wisely.

PNUTUSDT — That the Bottom? Liquidity Grab at Key Support Zone?📊 Overview

The PNUT/USDT (2D) chart is entering a critical phase after a long downtrend followed by a retest of a strong demand zone (yellow box). Current price stands at 0.1503 USDT, after forming an extreme wick down to 0.0660, then pulling back strongly — a clear sign of aggressive buyer reaction (liquidity sweep) from the same demand area seen in March–May earlier this year.

This structure often represents a major market turning point: it could either be a temporary bounce or the early stage of a medium-term reversal, depending on how price reacts within this zone.

---

📐 Structure and Key Pattern

1. Formed Pattern:

A potential Double Bottom is developing around 0.11–0.15.

The long lower wick indicates strong absorption of selling pressure.

Price remains in a horizontal accumulation phase after a sharp decline since late 2024.

2. Main Zone (Yellow Box):

Area between 0.11–0.17 serves as macro support and historical demand base.

It has been tested multiple times without a major breakdown candle.

This means buyers are still defending this level aggressively.

3. Key Signal:

Volume spiked during the liquidity sweep, followed by a strong close above support — a sign of a false breakdown or liquidity grab.

Such setups often become the early stage of an impulsive bullish move if confirmed by structure and volume.

---

🚀 Bullish Scenario (Potential Reversal)

Main condition: price must stay inside or above the yellow box and form a higher low on the 2D structure.

A 2D close above 0.1945 would confirm early reversal signs.

Momentum will strengthen if price breaks above 0.2629–0.3233, opening the path toward 0.4045–0.5000.

A breakout beyond these levels would mark the start of a new expansion phase after prolonged accumulation.

🎯 Bullish Targets:

1. 0.1945 → 0.2629 (minor breakout)

2. 0.3233 → 0.4045 (mid-term rally zone)

3. 0.5000+ (macro reversal confirmation)

Note: Strongest confirmation occurs when a 2D candle closes with full body and high volume above the first resistance.

---

⚠️ Bearish Scenario (Extended Breakdown)

If price fails to hold the yellow box, the bearish case remains valid.

A 2D close below 0.110 signals a loss of structural demand.

Downside targets lie at the 0.0660 wick low, with further risk toward 0.05 psychological zone if selling continues.

This would extend the downtrend and potentially lead to a final capitulation phase.

🎯 Bearish Targets:

1. 0.110 (breakdown confirmation)

2. 0.066 (wick low retest)

3. <0.05 (macro capitulation zone)

---

🧭 Conclusion

Currently, PNUT sits at a historical turning point.

Selling pressure appears exhausted, as shown by the deep wick and rapid buyer reaction.

However, without a confirmed breakout above 0.1945, a reversal cannot yet be declared.

The yellow zone remains the line between survival and collapse for the macro structure.

In other words:

> If PNUT holds the yellow zone, the market could witness one of the sharpest mid-cap altcoin rebounds.

But if this support fails, the next drop could be brutal — and fast.

---

🔖 Key Technical Levels

Current Price: 0.1503

Demand Zone (Strong Support): 0.11 – 0.17

Resistance 1: 0.1945

Resistance 2: 0.2629

Resistance 3: 0.3233

Resistance 4: 0.4045

Extreme Low: 0.0660

Historical High: 2.5000

---

#PNUT #PNUTUSDT #CryptoAnalysis #Altcoin #TechnicalAnalysis #SupportAndResistance #LiquiditySweep #ReversalZone #SwingTrade #CryptoTrading #MarketStructure #PriceAction #CryptoSetup

Above 20%PNUUSDT is setting up for an interesting move. If the price can manage to hit a 20% gain for a long position, it could indicate strong bullish momentum. Furthermore, if it breaks above the trend line resistance, we might see a significant rally that could push the gains well above 300%. It's essential to keep an eye on the market sentiment and volume as we approach these key levels.

PNUT/USDT – Ready for Takeoff? Bullish Setup Ahead!🚀 Trade Setup Details:

🕯 #PNUT/USDT 🔼 Buy | Long 🔼

⌛️ TimeFrame: 1D

--------------------

🛡 Risk Management:

🛡 If Your Account Balance: $1000

🛡 If Your Loss-Limit: 1%

🛡 Then Your Signal Margin: $25.38

--------------------

☄️ En1: 0.2404 (Amount: $2.54)

☄️ En2: 0.2033 (Amount: $8.88)

☄️ En3: 0.1805 (Amount: $11.42)

☄️ En4: 0.1602 (Amount: $2.54)

--------------------

☄️ If All Entries Are Activated, Then:

☄️ Average.En: 0.1924 ($25.38)

--------------------

☑️ TP1: 0.3606 (+87.42%) (RR:2.22)

☑️ TP2: 0.4884 (+153.85%) (RR:3.9)

☑️ TP3: 0.7182 (+273.28%) (RR:6.94)

☑️ TP4: 1.1731 (+509.72%) (RR:12.94)

☑️ TP5: 2.0164 (+948.02%) (RR:24.06)

☑️ TP6: Open 🔝

--------------------

❌ SL: 0.1166 (-39.4%) (-$10)

--------------------

💯 Maximum.Lev: 1X

⌛️ Trading Type: Swing Trading

‼️ Signal Risk: 🙂 Low-Risk! 🙂

🔎 Technical Analysis Breakdown:

This technical analysis is based on Price Action, Elliott waves, SMC (Smart Money Concepts), and ICT (Inner Circle Trader) concepts. All entry points, Target Points, and Stop Losses are calculated using professional mathematical formulas. As a result, you can have an optimal trade setup based on great risk management.

📊 Sentiment & Market Context:

PNUT, the native token of the Peanut DeFi ecosystem, is showing signs of a potential reversal after a prolonged downtrend. As a micro-cap DeFi project focused on yield farming and liquidity provision, PNUT remains under the radarmaking it a high-risk, high-reward opportunity.

With the overall crypto market regaining bullish momentum and small-cap tokens starting to catch up, PNUT is positioned well for a possible breakout. Low liquidity means sharp moves are possible, and current price action suggests accumulation at key support zones.

This technical setup aligns with a bullish swing trade, targeting a strong upside while maintaining disciplined risk management.

⚠️ Disclaimer:

Trading involves significant risk, and past performance does not guarantee future results. This analysis is for informational purposes only and should not be considered financial advice. Always conduct your research and trade responsibly.

💡 Stay Updated:

Like this technical analysis? Follow me for more in-depth insights, technical setups, and market updates. Let's trade smarter together!

PNUUSDT — Descending Triangle Accumulation Zone: Major Breakout?🔎 Full Analysis

The PNU/USDT (1D) chart shows a clear Descending Triangle pattern that has been forming since May 2025. Price is currently trading around 0.2216 USDT, moving closer to the apex of the pattern — a sign that a big move is likely approaching.

⚙️ Pattern Details

Strong Support (Accumulation Zone): 0.19 – 0.24

This area has been tested multiple times and continues to attract buyers.

Descending Resistance: A downward sloping trendline from May’s high is pressing price lower, forming consecutive lower highs.

Characteristics: While this pattern is typically seen as a bearish continuation, it can also turn into an accumulation base if buyers step in with strong volume.

---

🚀 Bullish Scenario

Confirmation: Daily close above 0.3027 with strong volume.

Step-by-step targets:

First breakout level: 0.3027

Next targets: 0.3774 → 0.415 → 0.4403

Extended target if momentum accelerates: 0.5951

Measured Move Potential: A confirmed breakout projects a move toward 0.415 – 0.44 USDT.

Bullish Narrative: A breakout above the descending trendline could signal the start of a major reversal from long-term accumulation. Buyers regaining control may drive PNU/USDT back toward the 0.40 – 0.60 zone.

---

📉 Bearish Scenario

Confirmation: Daily close below 0.19 with high volume.

Step-by-step targets:

Conservative target: 0.10 USDT (chart low label)

Aggressive measured move target: 0.08 USDT

Bearish Narrative: If 0.19 fails as support, the descending triangle would act as a continuation pattern of the previous downtrend, potentially triggering a deeper breakdown toward 0.10 or even lower.

---

📌 Conclusion

PNU/USDT is at a critical decision point:

Bullish case: Breakout above the trendline could unlock a reversal and rally toward 0.40+.

Bearish case: Breakdown below 0.19 could extend the downtrend to 0.10 or lower.

With price approaching the apex, volatility is expected soon. Traders should wait for daily close + volume confirmation before committing to a position and apply strict risk management to avoid false breakouts.

---

⚡ Key Levels to Watch

Support zone: 0.19 – 0.24

Critical resistance: 0.3027

Breakout targets: 0.3774 → 0.415 → 0.4403 → 0.5951

Breakdown targets: 0.10 – 0.08

---

#PNUT #PNUTUSDT #PeanutTheSquirrel #TechnicalAnalysis #DescendingTriangle #CryptoAnalysis #Altcoin #Breakout #BearishOrBullish #CryptoTrading

PNUTUSDT UPDATE#PNUT

UPDATE

PNUT Technical Setup

Pattern : Bullish Falling Wedge pattern

Current Price: $0.2268

Target Price: $0.38

Target % Gain: 60.48%

Technical Analysis: PNUT has broken out of a falling wedge pattern on the daily chart, signaling bullish momentum. Price is retesting the breakout level, and a sustained close above resistance could fuel a move toward $0.38.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

PNUT/USDT – On the Edge of Rebound or Breakdown?📌 Overview:

PNUT/USDT is currently at a major inflection point, following a prolonged downtrend and months of consolidation. The price is once again testing the key demand zone that has acted as a solid support since February 2025. Will this be the beginning of a strong bullish reversal, or the start of a deeper breakdown?

---

🧠 Price Action & Market Structure:

Since peaking around $2.50, PNUT has undergone a sharp decline, now hovering near the critical support area of $0.21–$0.23.

This zone has repeatedly acted as a historical accumulation zone, providing strong bounce reactions in the past.

A potential double bottom pattern is forming – if confirmed, it could ignite a bullish trend.

Multiple resistance levels lie ahead, creating a clear roadmap for staged recovery if momentum shifts.

---

🔼 📈 Bullish Scenario – Potential Reversal in Sight:

If the support holds and bullish structure forms (e.g., bullish engulfing, morning star, or higher high breakout), we could see:

1. A strong rebound from the demand zone ($0.21–$0.23), signaling buyer strength.

2. Upside targets:

$0.3027 (initial resistance and trend reversal confirmation)

$0.4403

$0.5951 (strong historical resistance)

$0.7674 to $1.0797 (major psychological zones)

3. A breakout with strong volume and MA crossover (if used) would further validate the trend change.

---

🔽 📉 Bearish Scenario – Breakdown Risk:

If the support zone fails and price breaks below $0.21, the bearish trend could continue:

1. A clear breakdown below the demand zone opens room to:

$0.1700 (minor support)

$0.1300

$0.1000 (historical low and key psychological level)

2. This would invalidate the potential reversal and reinforce the broader distribution phase.

---

📊 Identified Patterns:

Range-Bound / Accumulation Phase: Price has moved sideways between $0.21–$0.44 since February, suggesting accumulation by long-term players.

Potential Double Bottom: Still forming – confirmation needed via a breakout of the neckline.

Descending Trendline Resistance: Remains overhead and may act as a strong barrier if price attempts to climb.

---

🧭 Key Things Traders Should Watch:

Monitor price reaction in the current demand zone over the next few candles.

Look for volume confirmation on any breakout.

Stay aware of Bitcoin’s trend and macro sentiment, as it may influence volatility in altcoins like PNUT.

---

📝 Conclusion:

PNUT/USDT is now trading at a crucial technical level. The price reaction here will determine the mid- to long-term direction of this asset. Traders should prepare for either a strong reversal or a significant breakdown. This area offers a strategic opportunity to assess both risk and reward potential.

#PNUTUSDT #CryptoBreakout #TechnicalAnalysis #AltcoinSetup #CryptoReversal #PriceAction #SupportAndResistance #CryptoUpdate #BullishVsBearish

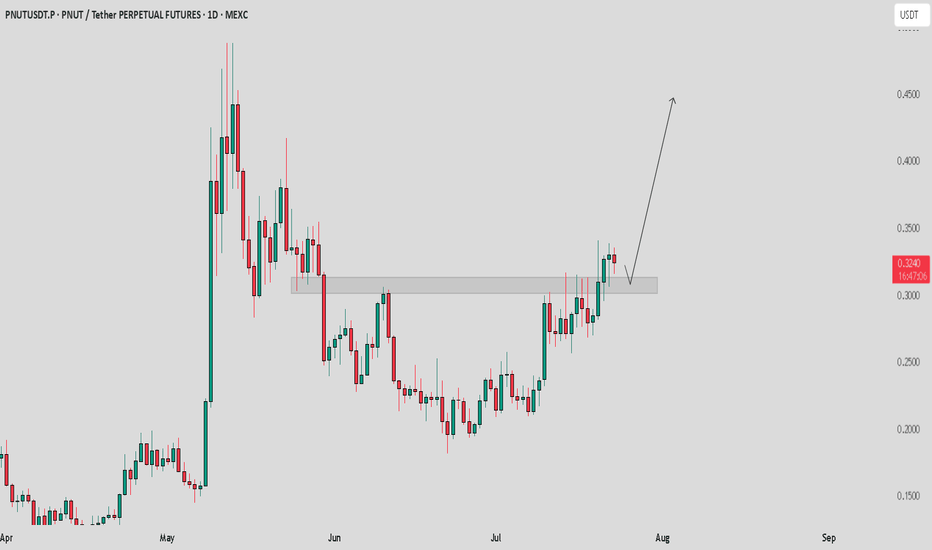

PNUT / USDT Breakout and retest analysisPnut/USDT - Breakout & Retest Analysis

Pnut/USDT has broken out from horizontal resistance, and a retest is currently in progress. If the retest holds, we can expect a strong move towards $0.4 - $0.5.

Bullish Scenario:

Successful retest and holding above the resistance zone should confirm further upside towards $0.4 - $0.5.

Bearish Scenario:

If price fails to hold the breakout level, we may see a pullback and retest of lower levels.

Pro Tip:

Avoid excessive longs. Wait for clear retest confirmation before entering.

Set proper risk management to protect your trades.

Peanut the Squirrel 1315% Profits Potential · Technical AnalysisI noticed that most of the memecoins have a strong growth potential. Here we have PNUTUSDT and the potential goes easily beyond 1,300%. An easy target is set to 467% so you can imagine. The chart looks strong and you know we focus only on TA.

Good evening my fellow Cryptocurrency trader, I hope you are having a wonderful day.

Peanut the Squirrel. Who am I to judge? RWA, Layer 1, POW, Gaming, DeFi, Infrastructure, NFT, AI... The choice is yours.

Here we have the classic and more than classic higher low. The bottom low and the bullish breakout ending its retrace higher is as easy and simple as it goes. The beauty of TA. You can know where the market is headed based on how the candles behave.

And then, we are back to the EMAs. Notice the blue one because it is the main one I'll be using on the daily timeframe. The huge big candle happens to break above this level. Once this level is conquered as resistance we know the bulls are on. Now the market can rest but it can also move ahead. We have a higher low, PNUTUSDT, and the action happening above EMA89, EMA55 and EMA13; in short, the bulls win.

The next higher high and first target is $1.03. This is followed by $1.59, 467% potential for growth and then the market can continue higher, easily, because we are entering the strongest ever Cryptocurrency bull market.

Namaste.

PNUT Just Broke Out – Can It Hold 0.2400?Pair: PNUT/USDT

Timeframe: 4H

Pattern: Symmetrical Triangle (Breakout Confirmed)

PNUT has broken out of the symmetrical triangle, showing early signs of bullish momentum. To confirm strength, price must now hold above the breakout zone near 0.2400.

Bullish continuation:

If it holds, we could see upside targets around 0.2700–0.3000 in the short term. Volume confirmation will be key.

Fakeout risk:

If PNUT fails to sustain above 0.2400, the breakout may fail. Stay patient for a clean retest or follow-through to avoid getting trapped.

Wait and manage risk wisely — the next few candles will confirm the move.

Falling Channel Breakout on PNUT/USDT – Next Stop: $0.76?📊 Pattern Analysis:

Falling Channel (Descending Channel): PNUT formed a clear falling channel from early May to late June 2025. This pattern typically signals a potential bullish reversal once a breakout occurs.

Confirmed Breakout: The price has successfully broken above the upper boundary of the falling channel, which is an early sign of a potential bullish trend.

Strong Support Zone: The horizontal zone around $0.20 – $0.26 USDT has acted as a solid demand base, as seen multiple times from March to June.

✅ Bullish Scenario:

If the breakout continues with momentum, the price could move upward gradually, aiming for the following resistance levels:

1. Target 1: $0.2986 – Minor resistance

2. Target 2: $0.3774 – Previous consolidation area

3. Target 3: $0.4403 – Major historical resistance

4. Target 4: $0.5951 to $0.7674 – Recovery zone from the falling channel

5. Extended Target (Long-Term): $1.0797 to $1.7957 (if a full rally occurs with strong bullish sentiment)

❌ Bearish Scenario:

If the price fails to hold the breakout and re-enters the channel:

Potential drop back to the support zone of $0.2000 - $0.1600

A breakdown below this range may lead to further downside toward $0.1300 to $0.1000 (previous historical low)

🔍 Summary:

The chart displays a classic bullish reversal pattern with a confirmed breakout from the falling channel.

The $0.26–$0.29 area now acts as a key confirmation zone. If the price holds above it and completes a successful retest, the bullish continuation is likely.

However, traders should stay cautious of false breakouts.

#PNUTUSDT #CryptoBreakout #AltcoinSeason #ChartAnalysis #BullishReversal #TechnicalAnalysis #BreakoutTrading #CryptoSignals #DescendingChannel

PNUTUSDT Forming Falling Wedge — Breakout Incoming?NUTUSDT is forming a falling wedge pattern, a classic bullish reversal setup. Price action is tightening, and if momentum builds, a breakout to the upside could follow. Traders are watching closely to see if PNUT can break resistance and push toward higher targets, signaling a potential trend shift.

PNUT/USDT – Breakout Watch from Symmetrical TrianglePNUT/USDT – Breakout Watch from Symmetrical Triangle

Chart pattern: Symmetrical Triangle

Timeframe: 4-Hour

Published: June 20, 2025

PNUT/USDT is nearing the apex of a symmetrical triangle that has been forming over several weeks. The price is tightening between rising support and descending resistance, indicating a breakout is likely approaching soon.

Price is currently testing the upper boundary near 0.24. A breakout from this level with strong volume may trigger a bullish move, while rejection could keep price inside the range a little longer.

Bullish scenario

Entry: 4H close above 0.245 with volume

Target 1: 0.28

Target 2: 0.33

Stop-loss: Below 0.22

Bearish scenario

Entry: Break below 0.215

Target 1: 0.18

Target 2: 0.14

Stop-loss: Above 0.24

Wait for confirmation before acting — momentum will likely follow once the triangle breaks.

PNUTUSDT Forming Falling WedgePNUTUSDT is presenting a compelling falling wedge pattern, signaling a high-probability bullish reversal. This technical formation typically occurs after a sustained downtrend and is characterized by converging trendlines sloping downward. In the case of PNUTUSDT, the wedge is nearing its apex, indicating that a breakout is likely imminent. The setup is further supported by healthy volume levels, adding credibility to the expected move. Historically, falling wedges often lead to explosive upside moves, and this pair is currently projecting a potential gain of 90% to 100%+ if the breakout confirms.

Market interest in PNUTUSDT is steadily growing, as indicated by rising trading activity and increased visibility across community forums and social platforms. This surge in attention aligns with the volume spike seen during recent trading sessions — a classic precursor to bullish breakouts. As more investors start to take positions in anticipation of a breakout, price momentum can accelerate rapidly, creating ideal conditions for short- to mid-term gains.

From a technical standpoint, a confirmed breakout above the wedge’s upper resistance line could open the door to rapid price expansion, especially with limited overhead resistance. Traders should watch for confirmation signals such as strong bullish candlesticks, increasing volume, or a retest of the breakout level. PNUTUSDT is shaping up as an exciting opportunity for swing traders looking to capitalize on pattern-based moves in the altcoin space.

With bullish sentiment, clear technical structure, and improving market participation, PNUTUSDT could be on the verge of a significant breakout. It’s a setup that combines strong technicals with growing investor interest — a powerful combination in crypto trading.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

$SSV/USDT has broken out$SSV/USDT has broken out of a key ascending triangle on the daily chart, clearing resistance around $11.90 with strong momentum.

The breakout targets an 84% potential upside toward the $21+ zone.

As long as it holds above the breakout level, the trend remains bullish with further gains likely.

Watch for a retest for possible entry.

DYRO, NFA

$PNUT in Freefall – Can $0.20 Hold as Support?$PNUT is dropping like a falling knife!🚨

Technically, we have support around $0.22 and $0.20.

According to the Fibonacci levels, the 0.786 level may

act as strong support near $0.20, making that area a key zone to watch.

So unless this support range is reached, the price may continue to drop toward that zone.

If you're currently stuck in this coin, you could consider adding funds and setting your liquidation point below $0.18 for safety.

If you're looking to enter or accumulate, the range between $0.22 and $0.20 is ideal for accumulation.

However, even with these support levels, we still need to wait for clear reversal patterns before expecting a trend reversal in the shorter time frame.

Thank you so much for reading, I hope my updates help you in your trading journey.

DYOR, NFA

PNUT/USDT – Bullish Breakout from Falling Channel!PNUT Breakout Alert – 200% Potential on the Table

Hey Traders — if you're into high-conviction setups with real momentum, this one’s for you.

PNUT has officially broken out of a textbook falling channel after a healthy consolidation. This pattern often signals trend reversal and renewed bullish momentum — and PNUT looks ready to move.

🔹 Pattern: Falling Channel

🔹 Breakout Confirmation: Clear candle close above resistance

🔹 Previous Move: +204% before entering the channel

🔹 Current Setup: Long entry with defined risk-to-reward

🔹 Target: ~0.85

🔹 Stop: Just below the breakout zone

🧠 Technical Perspective:

Volume uptick during breakout confirms buyer strength

Strong support retest zone around 0.28–0.29

Holding above this range could fuel a significant leg higher

📌 This setup offers a clean structure with a high R:R potential. PNUT has proven it can move fast — now it’s about following the breakout with tight risk management.

📥 Add to your watchlist and let price action lead the way.

PNUT/USDT (4H) – Bull Flag Breakout Setup PNUT/USDT (4H) – Bull Flag Breakout Setup

Pattern: Bull Flag 📉📈

Timeframe: 4-Hour ⏱️

Pair: PNUT/USDT 💱

Published: June 10, 2025 📅

Technical Overview:

PNUT/USDT is forming a classic bull flag on the 4-hour chart following a strong impulsive rally. The price has been consolidating inside a descending channel — a typical continuation structure in bullish trends. Currently, the price is testing the upper trendline resistance, signaling potential breakout pressure building up 🔥

Potential Trade Setup:

Bullish Scenario ✅

Entry: On a confirmed breakout and close above the flag resistance (\~0.3000)

Targets:

* First target at 0.4200 🎯

* Second target at 0.5000–0.5200 zone 🎯

Stop-loss: Below recent swing low (\~0.2500) 🛑

Risk Management ⚠️

If PNUT gets rejected at the upper trendline and fails to break out, it could revisit the lower channel support near 0.2300. Look for a volume spike on breakout for added confirmation 📊

Conclusion:

PNUT is at a key decision point. A clean breakout above the descending channel could unlock a fresh bullish wave. As always, wait for confirmation and manage your risk accordingly 🔍📈