Sbinanalysis

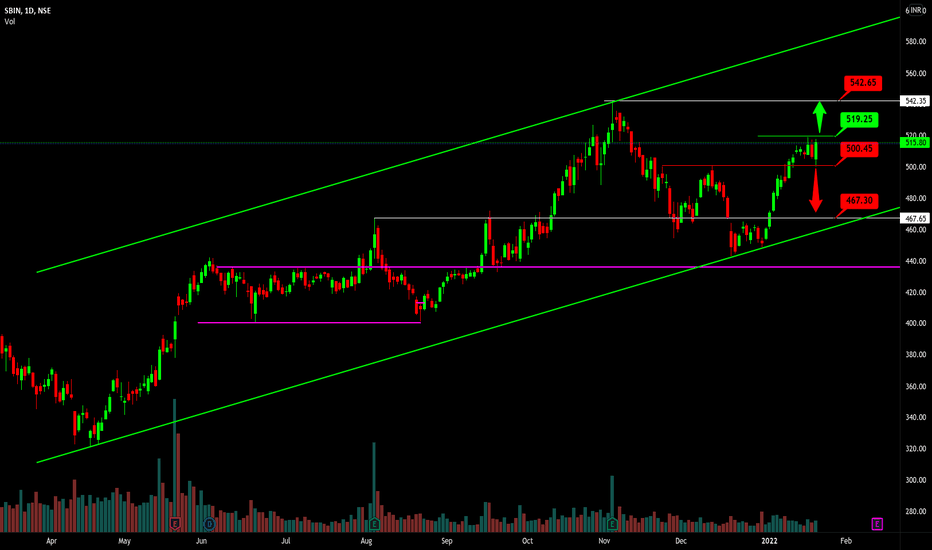

SBIN | Good Short Opportunity.When it comes to the technical analysis of SBIN, you might get an impulse to the downside. Based on my technical analysis, you might see a fall to the downside. If you are going in, better find a pullback. I have marked a good entry area on the chart; you may use it as an entry area. And also don't forget to place the stop just above the entry area.

What do you think is more likely to happen? Please share your thoughts in comment section. And also give a thumbs up if you find this idea helpful. Any feedback & suggestions would help in further improving the analysis.

If you find this technical analysis useful, please like & share our ideas with the community.

Good Luck!

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

Simple Trade Setup | SBIN | 18-04-2022 [INTRADAY]NSE:SBIN

Trade Setup for 18-04-2022

1) Don't Jump in to trade at the beginning of the market. Let it get settle for 15-20min first and judge the price action.

2) Everything is mentioned on the chart. I hope it is easy to understand.

3) All the levels will work as support, resistance, entry and exit w.r.t price action near that level.

4) Avoid gap up or gap down chase. Wait and trade between levels.

Please refer below chart for levels.

Hope I made it easy to understand it.

Do comment your doubt or suggestion.

Note: Trade with Strict SL. It may or may not hit all the levels. So one can book profit / loss at respective level considering how price action works near that level.

SBINHello and welcome to this analysis on STATE BANK OF INDIA

On FEB 15, it showed a very strong reversal after 5 days of steady decline from 550 to sub 500.

Currently on the hourly time frame it is completing a bullish flag and pole pattern suggesting upside levels of 535-540 as long as it does not break below 510.

Good Risk Reward set up here

SBIN | Good Sell Opportunity. Go Short!If you find this technical analysis useful, please like & share our ideas with the community.

What do you think is more likely to happen? Please share your thoughts in comment section. And also give a thumbs up if you find this idea helpful. Any feedback & suggestions would help in further improving the analysis.

Good Luck!

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

Short $SBIN CMP ₹475.30Short $SBIN CMP ₹475.30. Falling channel pattern. Stock price recently broke 50 SMA with volume. It may retest 50 SMA but MACD is showing no signs of positive volume so it may not be successful. Lowers lows on day chart. Intermediate support ₹450 area. Short term target is 200 SMA which is ₹420 area.

SBIN | Go long | Use the Pull Back.When it comes to SBIN , the stock is still in good uptrend. Last day market closed near 460 & likely to reach 464 soon. Though it is not a good idea to take the position right now since price is too far from previous support area and it is also expensive now. I think you might get a good pull back to get in. You could use the support area to get in when price falls. When market opens next day, if the price gaps down & break S1, make sure to go long from S2; which is a demand area. Once you are in, make sure to place the stop below the nearly support area .

If you find this technical analysis useful, please like & share our ideas with the community.

What do you think is more likely to happen? Please share your thoughts in comment section. And also give a thumbs up if you find this idea helpful. Any feedback & suggestions would help in further improving the analysis.

Good Luck!

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

SBIN| Good for go long | Get ready for a buyIf you find this technical analysis useful, please like & share our ideas with the community. Coming to the technical analysis of SBIN, I think we are going to see a gap down when market opens next day. That doesn’t mean price going to keep falling. Since we have a demand area as well as a support area near 464; where price gapped up, the price likely to get support there and bounce back to move upwards. So get ready to go long.

What do you think is more likely to happen? Please share your thoughts in comment section. And also give a thumbs up if you find this idea helpful. Any feedback & suggestions would help in further improving the analysis.

Good Luck!

Disclaimer!

This post does not provide financial advice. It is for educational purposes only! You can use the information from the post to make your own trading plan for the market. But you must do your own research and use it as the priority. Trading is risky, and it is not suitable for everyone. Only you can be responsible for your trading.

BUY SBIN AROUND 432-433 TGT 465/520 SL BELOW 398It is making a morning star pattern and taking the support of 50 week moving average. Looks good for a short term buy, especially when the government is planning to speed up bad bank process, also the previous quarterly results were good and the stock didn't make any wild move yet.

SBIN - LONG setupThis has been my fav stock in the PSU banks space.

Chart looks great on both Weekly and Daily charts. At a very critical stage right now and at resistance zone. Nice strong candle for closing and firmly up at the resistance zone, but RSI on both Weekly and Daily charts bullish and no where near overbought zones.

200 daily MA below should be strong support and positive trending stock.

Keep an eye on the whole PSU space for action.

SBIN DAILY TIMEFRAMESNIPER STRATEGY

This magical strategy works like a clock on almost any charts

Although I have to say it can’t predict pullbacks, so I do not suggest this strategy for leverage trading.

It will not give you the whole wave like any other strategy out there but it will give you huge part of the wave.

The best timeframe for this strategy is Daily, Weekly and Monthly however it can work any timeframe above three minutes.

Start believing in this strategy because it will reward believers with huge profit.

There is a lot more about this strategy.

It can predict and also it can give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.