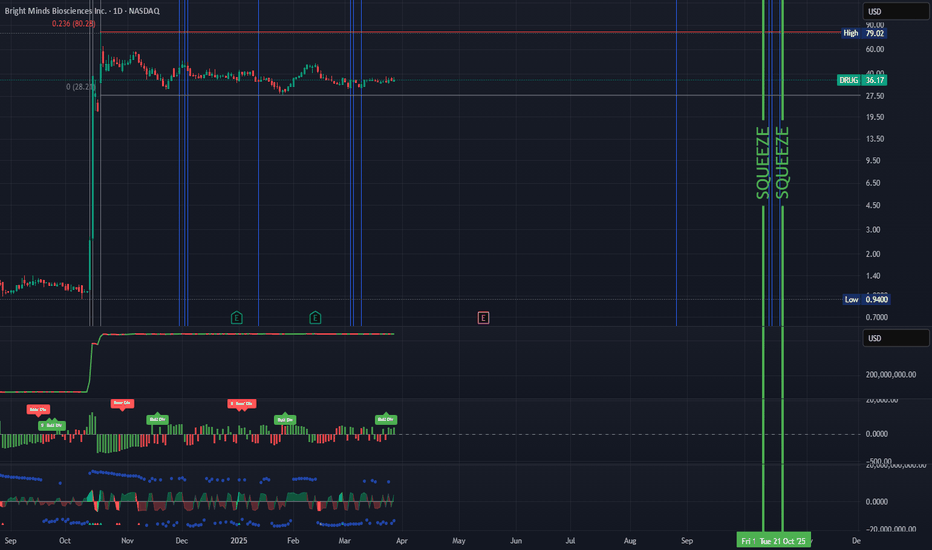

Squeeze

From Scanner to Trade: Full Workflow GuidesFrom Scanner to Trade: Full Workflow Guides

Table of Contents

Introduction

Why a Full Workflow is Crucial for Consistent Trading

Step 1: Defining Your Edge-What to Scan For

Step 2: Setting Up Scanners in TradingView

Step 3: Filtering & Ranking Potential Trades

Step 4: Deep Analysis-Technical, Fundamental, and Sentiment Checks

Step 5: Planning the Trade-Entries, Exits, and Risk

Step 6: Executing the Trade and Real-Time Adjustments

Step 7: Trade Management-Monitoring and Adapting

Step 8: Post-Trade Review and Journaling

Step 9: Tips, Case Studies, and Advanced Workflows

Conclusion: Making the Scanner-to-Trade Workflow Your Own

Introduction

What separates a consistent trader from someone who hops between strategies, never seeing results? Workflow.

The difference is as dramatic as preparing a gourmet moussaka with carefully layered ingredients versus tossing random ones into a pan.

As passionate trading tool creators, we know the power of process . Yet, most TradingView users stop at scanning for new tickers, rarely following a structured approach from scanning to trade selection , execution , and review . That’s where this in-depth guide comes in.

This article will walk you through a step-by-step workflow , using TradingView’s powerful features and easy-to-follow frameworks to help you transform from a chart-hopper into a methodical trader.

Let’s get started!

Why a Full Workflow is Crucial for Consistent Trading

Before we break down the process, let’s understand why a workflow matters.

Eliminates Guesswork : A workflow ensures every trade passes the same high standards, reducing emotional decisions.

Saves Time : Systematic filtering and ranking quickly highlight the best opportunities.

Improves Results : Backtests show that traders using a structured workflow outperform those who pick trades impulsively.

Enables Review : Every step can be reviewed post-trade, so you always know what worked and what didn’t.

The workflow is your trading “recipe.” Follow it, tweak it, and the results will come.

Step 1: Defining Your Edge-What to Scan For

Your workflow begins before you scan. First, define what you want to find. Are you a breakout trader, mean-reversion specialist, or a momentum chaser? Your edge -the reason you believe you can profit-should drive every scan.

Ask Yourself:

Do I want to catch squeeze breakouts with momentum?

Am I seeking multi-timeframe trend alignment?

Are volume spikes important for my entries?

Do I care about a stock’s fundamentals or just the chart?

Case Study: Finding Squeeze Momentum Setups

Suppose you love the squeeze momentum strategy. Your scanner should look for:

Low Bollinger Bandwidth (market coiling up)

Rising momentum (e.g., MACD turning up)

Volume spike confirming interest

This is your “ingredient list”-customize it to your taste and strategy.

Step 2: Setting Up Scanners in TradingView

TradingView’s Stock Screener is powerful, yet many traders barely scratch the surface. Here’s how to go beyond the basics.

2.1 Launching the Screener

Open any TradingView chart.

Click the Screener tab (bottom panel).

Choose Stocks , Crypto , or Forex according to your focus.

2.2 Customizing Your Filters

Set market (e.g., NASDAQ, NYSE, Crypto Top 100).

Add technical filters: price change %, RSI, MACD, volume, volatility, and, if available, squeeze momentum values (e.g., your custom script output).

Add fundamental filters if needed: EPS growth, P/E ratio, market cap, etc.

Example Setup: Squeeze Momentum Breakout Scan

Market: US stocks (selected in the screener)

Liquidity Filter: Volume × Price > 100M USD (focuses on liquid stocks and avoids thinly traded names)

Volatility & Momentum Filter: Vol Change > 10% (captures stocks with significant recent movement)

Minimum Price Filter: Price > 10 USD (to avoid penny stocks and illiquid tickers)

Volatility Squeeze Condition: 1. Bollinger Bands (20, 1 day) Lower above Keltner Channels (20, 1 day) Lower, and 2. Bollinger Bands (20, 1 day) Upper below Keltner Channels (20, 1 day) Upper (classic squeeze setup: BB inside KC highlights contraction/ready-to-expand momentum)

Calibration isn't about being perfect-it's about making your tools work better for specific markets.

2.3 Saving and Automating Your Scanner

Save your screener settings as a preset ( Save Screener Template ).

Set up alerts (once this feature becomes available in TradingView) so you’ll be notified when a new ticker matches your criteria.

Step 3: Filtering & Ranking Potential Trades

Your scanner likely spits out dozens of results. Time to filter and rank them, so you focus only on the “cream of the crop.”

3.1 The First Pass-Eliminate Noise

Skip tickers with low liquidity (e.g., daily volume < 100,000 shares for stocks).

Ignore assets with unreliable price action (wide spreads, frequent gaps).

Check for major news events or earnings that could cause unexpected volatility.

3.2 Ranking Your Candidates

Prioritize by:

Strength of signal (e.g., squeeze + multi-timeframe trend alignment)

Volume surge (higher is better)

Relative strength vs. benchmark (e.g., SPY, BTC)

Proximity to strong support/resistance (closer is often better for risk/reward)

Pro Tip: Create a Scorecard

Assign 1–5 points for each criterion and total up scores for each ticker. Focus on the top 3–5 results.

Don’t just “feel” your top picks-score them for objective clarity!

Step 4: Deep Analysis-Technical, Fundamental, and Sentiment Checks

With ranked candidates, now perform a deeper dive. This is where your experience and favorite tools come into play.

4.1 Charting and Technicals

Apply your key indicators (e.g., Squeeze Mom, Power Trends, Volume Profile).

Check price structure: higher highs/lows, base breakouts, wedges, etc.

Look for confluence: do different indicators and patterns agree?

4.2 Multi-Timeframe Confirmation

Check setup validity on daily, 4H, and 1H charts.

Does the larger trend support your trade, or are you trading against momentum?

4.3 Optional: Fundamental & Sentiment Checks

Is the company reporting earnings soon? Any big news?

For crypto, is there on-chain or social sentiment you should know about?

Example Workflow:

Chart 1: Daily Squeeze setting up, MACD positive, volume picking up.

Chart 2: 1H uptrend confirmed, minor pullback for entry.

News: No earnings for two weeks-less risk of surprise.

Step 5: Planning the Trade-Entries, Exits, and Risk

Now that you have a shortlist of well-vetted opportunities, it’s time to craft a plan. Failing to prepare is preparing to fail-so we layer in precise entries, realistic targets, and robust risk management.

5.1 Entry Strategies: The Art of Timing

Your scanner found potential, but your entry determines your reward-to-risk. Here’s how to approach it on TradingView:

Breakout Entry: Place buy-stop orders just above resistance or the squeeze “release” point.

Pullback Entry: Wait for a retrace to moving average or previous support, then enter on bullish reversal candle.

Confirmation Entry: Wait for indicator confirmation (e.g., Squeeze firing, MACD cross, volume surge) before pulling the trigger.

Great entries are less about prediction and more about preparation and confirmation.

Visualizing Your Entry

Draw horizontal lines at anticipated entry points ( Alt + J hotkey). Use TradingView’s “long position” tool to visualize profit/loss zones.

5.2 Setting Targets: Aim for Realistic Wins

Don’t hope-measure! Define exits before entering so emotion doesn’t sabotage your plan.

Price Target: Project a move based on past squeeze breakouts (e.g., last breakout ranged $4, set target for similar move).

ATR (Average True Range): Use ATR to estimate typical moves and avoid setting targets too far or too close.

Fibonacci Extensions: Use Fibs to find likely resistance/support for partial profits.

5.3 Stop Losses: Defend Your Capital

Risk management is your lifeline. Set stops where the trade idea is invalidated-not just at arbitrary numbers.

Below previous support or swing low (for long trades).

At technical invalidation-e.g., squeeze fails and price dips below the setup.

ATR-based stop (e.g., 1.5x ATR below entry).

Trade Example:

Entry: Breakout above $100.

Stop Loss: $97 (previous support, 1.5x ATR).

Target: $104 (measured move from last squeeze).

5.4 Position Sizing: How Much to Risk?

Golden Rule: Risk only a small percentage of your trading capital per trade.

Standard: 1–2% of account per trade.

Use TradingView’s position tool to measure.

Calculate shares/contracts based on distance from entry to stop.

Position sizing is the invisible lever that controls your trading destiny.

Step 6: Executing the Trade and Real-Time Adjustments

Execution bridges planning and reality. Even the best plans need discipline, fast reflexes, and the willingness to adapt if markets shift.

6.1 Entering the Trade: Be Precise

Use limit or stop orders, not market orders, to avoid slippage-especially in fast-moving assets.

Review your parameters one last time.

Set alerts using TradingView’s Alarm Clock icon for your entry, stop, and target.

// Basic Alert Example in Pine Script

if (ta.crossover(ta.sma(close, 9),ta.sma(close, 21)) )

alert("Bullish crossover detected", alert.freq_once_per_bar)

6.2 Monitoring During the Trade

Keep emotions out-let the process work. However, always watch for:

Sudden news events or market shocks.

Volume surges against your position.

Reversal candles (e.g., bearish engulfing at target zone).

6.3 Adjusting On-the-Fly

Sometimes, price action demands flexibility:

Move stop to break-even once price moves in your favor.

Scale out (sell a portion) at first target, let the rest run.

Exit early if your setup is invalidated (e.g., heavy volume reversal).

Adaptation is not abandoning the plan-it’s respecting the market’s message.

Step 7: Trade Management-Monitoring and Adapting

Trade management is an art that separates amateur from pro.

7.1 Trailing Stops and Locking Profits

Use trailing stops (fixed % or ATR-based) to lock in gains if price runs well past your target.

TradingView’s “long/short position” tool helps visualize your risk/reward as price moves.

7.2 Scaling In/Out

Scale in: Add to winners on confirmed strength (e.g., after strong breakout retest).

Scale out: Sell partial positions at key resistance/fib levels.

7.3 Dealing With Adverse Moves

If stop hit, close trade-review, don’t revenge trade.

If setup changes dramatically (e.g., news reversal), consider exiting early.

The best traders protect profits, not egos.

Step 8: Post-Trade Review and Journaling

By now, you’ve completed the trade-but the learning (and edge-building) is just beginning.

8.1 Review Every Trade: The Secret to Improvement

Did you follow your plan? If not, why?

What worked? What didn’t?

Were your scanner criteria effective?

Was your sizing/risk on point?

8.2 Journaling Your Workflow

Create a trade journal, either in TradingView’s notes or external tool (Notion, Google Sheets, etc.)

Screenshot entry/exit with annotations.

Log your scanner triggers and reasoning.

Add psychological notes: Were you calm or emotional?

Tag setups: “Earnings Squeeze,” “Breakout,” etc.

A detailed journal is your best trading mentor.

8.3 Performance Analysis

Periodically review your logs to spot patterns:

Which setups yield best R/R?

Where do you most often break your rules?

How does time of day/market impact outcomes?

Step 9: Tips, Case Studies, and Advanced Workflows

9.1 Expert Tips for Workflow Success

Automate alerts for scanner triggers-don’t stare at screens all day.

Batch your research (e.g., scan every evening, then focus only on finalists).

Develop a pre-trade checklist (see sample below).

Refine regularly: Tweak scanner filters as markets evolve.

// Sample Pre-Trade Checklist as Comments

// 1. Is the squeeze setup clear on multiple timeframes?

// 2. Is volume confirming the move?

// 3. Any major news/earnings ahead?

// 4. Stop loss + target realistic?

9.2 Real-World Case Study: Squeeze Momentum on TSLA

Imagine your scanner spits out NASDAQ:TSLA due to a tight squeeze and surge in volume.

Analyze the chart: Daily chart shows a strong squeeze setup with multi-timeframe squeezes firing bullish momentum (see the MTF Squeeze dashboard and green histogram). Volume spikes confirm buying interest. The 4H and daily timeframes are both aligned to the upside.

Check Earnings: Earnings are 30 days away, reducing the risk of event-driven surprises.

Trade Setup: Set entry just above the most recent swing high ( $197.5 ), with stop-loss below the support and squeeze base ( $186 ). The initial profit target is set at a measured move near $220 (prior swing high resistance and typical squeeze expansion).

Manage the Trade: Enter on breakout above $197.5; once price reaches around $208–$210, move stop to break-even. As price hits $220, sell half and trail the remainder using the 4H ATR or dynamic support.

Journal: “Setup fired as per screener and indicator alignment: volume spike, momentum, and squeeze breakout confirmed. Exited partial at target, managed risk throughout.”

9.3 Advanced: Multi-Timeframe, Multi-Asset Workflow

Combine scans across different assets (stocks, crypto, forex) using saved screener presets for catching opportunities globally. Create custom “watchlists” for different strategies, and rotate focus based on market conditions.

Stocks: Focus on squeeze breakouts.

Crypto: Seek mean reversion in sideways markets.

Forex: Look for multi-timeframe trend alignment.

Conclusion: Making the Scanner-to-Trade Workflow Your Own

Trading is not about prediction, but process. The difference between hope and edge is workflow-layered, adaptable, and reviewable.

By mastering the scanner-to-trade workflow, you can:

Act with confidence, not hesitation.

Avoid missed wins and costly emotional losses.

Turn complexity into clarity-one structured step at a time.

Start simple, layer in complexity as your skills grow, and let your journal be your improvement compass. The recipes here are just a foundation-make them your own, adapt them for your tools, markets, and goals.

Your next high-quality trade is just a repeatable workflow away.

Happy trading and happy building!

High-risk, extreme reward event-driven contrarian/squeeze setupBeyond Meat soared in 2019–2021 on blockbuster growth hopes, only to see its stock crater nearly 99% as reality fell short of hype. Sluggish consumer adoption, steep promotional discounts, and margin pressure dragged revenues from a 2020 peak of $419 M into multi-quarter declines. Recently, management has right-sized operations: Q4 2024 net revenues rose 4% YoY, cost-cutting measures are underway, and new product and foodservice partnerships are rolling out—even as the China business is suspended. Trading below 1× forward sales with ~25% short interest, BYND offers one of the most insane high-risk, event-driven contrarian setups I've ever seen ahead of the May 7 Q1 2025 report.

1. Implosion: What Happened?

Peak Hype & Insane Expectations

Investors crowned BYND “the Tesla of food,” pricing in 100%+ growth on only ~$200 M in trailing revenues at IPO.

Missed Growth Targets

2021 sales climbed just 37% to $464 M—well below the ~50% growth forecast—when heavy grocery promotions eroded prices.

Margin Squeeze

Gross margins plunged from ~28% to ~10% as Beyond funded discounts in retail and co-promotions with foodservice chains.

2. Recent Fundamentals & Stabilization

Q4 2024 Turnaround Signs

Net revenues of $83.1 M, up 4% YoY—the second straight quarterly increase after nine declines.

Cost-Cutting Initiatives

U.S. plant scale-ups and supply-chain optimization trimmed per-unit costs; SG&A fell ~8% YoY.

2025 Guidance

Revenues guided to $320–335 M (flat vs. $326.5 M in 2024); management targets adjusted-EBITDA breakeven by Q4 2025.

3. Recent Initiatives & Partnerships

Product Innovation : Fourth-gen Beyond Sausage (avocado oil formulation), “Beyond Sun” links, new pre-seasoned Beyond Steak flavors (chimichurri, Korean BBQ), and Crispy Nuggets for operators.

Foodservice Expansion : Beyond Burger® and Nuggets added to cafeterias and chains; Veggie McPlant Nuggets at McDonald’s France; smash-burger trials at Tesco UK; Wendy’s Georgia plant-based burger in 19 locations.

International Roll-outs : Retail launch of Beyond Steak in France and UK (Tortilla), expanded Europe/Middle East footprint.

Operational Restructuring : Exiting China by mid-2025, laying off ~6–9% of workforce, consolidating co-packers, automating U.S. plants to chase a ~20% gross margin.

4. Valuation & Sentiment

Trading at ~0.9× forward sales vs. peers at 1.5–5×.

Short interest ~25% of float—one of small-cap’s highest.

China exit & layoffs a margin catalyst; gross margin goal ~20% in 2025.

New products and foodservice deals reinforce R&D and growth narrative.

Q1 2025 earnings (May 7) could ignite a squeeze.

Catalysts

Q1 2025 earnings (May 7) beat/guide-up.

Roll-out of new sausage, steak & nugget products at major retailers.

Further high-profile partnerships (Starbucks, Yum! Brands).

Final words

Beyond Meat’s meteoric rise and fall reflect expectations that outpaced execution. Today, early signs of revenue stabilization, aggressive cost cuts, product innovation, and a clear path to break-even—combined with a sub-1× sales valuation and sky-high short interest—create a classic event-driven contrarian opportunity. The May 7 Q1 2025 report is the next major inflection point.

$2.94 to $16.24 in 3 hours up to 452% on the day $NAOVBANG! 💣 $2.94 to $16.24 in 3 hours up to +452% on the day NASDAQ:NAOV

Shared it in chat for everyone premarket while it was still +170% on the day, a few dollars per share profit keeps the job away, great way to start the day comfortably, life is good 🤑

Another day another strong vertical, told you it never stops no matter what's up with overall market, no matter what Trump says

BIG 1,100% from $4 to $48 $JNVRBIG 1,100% 🚀 from $4 to $48 🤯 Another stock not caring about what overall market does NASDAQ:JNVR

I posted it in chat premarket while it was still 200% on the day, then mentioned in few times again. Hope you saw it on time!

There are ALWAYS stocks that go up no matter the overall market!

WOW Two +2,000% stocks during crash week? $ICCT and $AREBNASDAQ:ICCT from $0.33 to $7.60 🚀

NASDAQ:AREB from $1.15 to $22.80 🚀

🚨 7 Buy Alerts sent out on ICCT this week, first two at $0.75! Wrote and posted about them continually through the week

14 Trades made total this week

12 Wins ✅

2 Losses ❌

TOTAL Week: +121.4% realized profit 💯

Not counting CBOE:UVXY swing pick buy alert at $21.65 reaching $41+ also posted many times in trading view chats

Monday: +46.2%

Tuesday: +17.7%

Wednesday: +34.1%

Thursday: +14.4%

Friday: +9.0%

Total March: +358.0% awesome month thanks to many big movers triggering. The overall market turn is helping bring more volume to our type of stocks which showed nicely with AREB, normally when you see a stock like that do $4 to $20 in a day and drop to $10 it's over, but with all green-hungry traders out there they bought it right back up to new highs bove $20 again. Expect more of such power next week.

All of trade alerts fully verified with timestamps in chat ✅

$OBLG #OBLG BUY ALERT FOAT IS LOCKED, $17.6+ then $60+ INCOMING!NASDAQ:OBLG #OBLG NASDAQ:OBLG My name is Landon Wogalter & this is the next NYSE:GME #GME NYSE:GME / NYSE:HKD #HKD NYSE:HKD type move, I am also the reason that NASDAQ:CHSN #CHSN NASDAQ:CHSN went to $44 that I called & locked the float from <1.80 & called for $30+, & even emailed the company in August 24’ stating that their stock would see $30+.

Oblong price targets are as follows:

17.6+ , 60+, 150+, 2900 past 404< #FLOAT IS #LOCKED THERE IS NO OTHER SET UPS LIKE THIS ON THE MARKET AND NEVER HAS BEEN. #ZERO #DEBT OBLG wants #parabolic (This is not promotion nor/or financial advice😘) I’m your daddy forever & ever.

313% vertical this morning $0.30 to $1.24300% vertical BOOM 💥 squeezing out shortsellers who were just moments before trying to manipulate downside 👉🏻 Priceless! 🤑

+33% gain realized with 3 Buy Alerts into vertical NASDAQ:ICCT

What red market is everyone talking about? We don't know anything about that 🤷🏻♂️

WC: 21.73 Target: 1800-2400 MOASS: 47k-100K: MOASS PLAYBOOK***I will be releasing a video either tomorrow or Monday. Had to have an emergency procedure on my mouth and am unable to speak clearly at the moment***

Convertible Bonds:

Immediately after the news was released I posted that the interest-free Bonds were a good thing as they were not immediately dilutive because Buyers need price to rise in order to see profit. The Bonds were ultimately priced at approx 29.85.

Why did the price decline so sharply?

In the words of Larry Cheng..Hedge Funds Gonna Hedge or in words Hedges would use: Convertible Bond Arbitrage. Simply said "Arbitrage" plays try to exploit mispricing between two or more correlated assets. In this case...GME Stock price vs The price of the Bonds.

To hedge against the risk of the Bonds not appreciating in value (remember they don't pay interest so they NEED the stock price above 29.85 to see profit) they enter an equivalent SHORT position to essentially make themselves Delta Neutral to any unfavorable moves in the stock price (aka they dont want to be exposed if price never makes it above 29.85 or sees sharp declines at a future date).

The mispricing piece of this comes from volatility and options values and would materialize as the price of the shorts converge with the price of the Bonds (the more volatility the more the potential mispricing and profit potential)

WHAT HAPPENS IF PRICE SQUEEZES THEN?

ALL short sellers are future buyers so they would most likely cover to possibly close the shorts, which on top of what THE CAT is doing could cause MOASS to be even GREATER IN MAGNITUDE...yeah this was a CHECKMATE of a move by Ryan Cohen and the board people.

MOASS PLAYBOOK:

I have been saying for months that I'm fairly certain I have figured out the exact timing of The Cats play. Without saying more than I'm comfortable saying its built around settlement cycles.

Everything I learned I learned from his tweets...literally EVERYTHING is there

And the kicker to all of this is that it works on more than just GME...as he has shown.

What you see on the chart is EXACTLY how MOASS will transpire based on what I've learned.

Could I be wrong? Of Course. You are responsible for your own trading so I would advise you to assume I am and TRADE WHAT YOU SEE...NOT WHAT YOU HOPE FOR

So I have now given you the EXACT timing as I have it laid out on my personal charts AND potential targets for a TOP

This will either be one of the greatest calls of all time or one of the greatest cases of SHEER DELUSION..I'm responsible for my own trading so I'm fine with either outcome

Good trading to you all!

I am Heartbeat Trading..Activist Short Squeezer