Potential Bull Flag in General Electric as Industrials ClimbIndustrial stocks have come to life since early October as investors look for the economy to recover from the U.S. – China trade war. Now one of the biggest and most liquid names in the entire sector is rebounding from a pullback, and a classic bull-flag continuation pattern may be taking shape.

General Electric reported a potentially transformative quarter on October 30. Strong free cash flow dispelled worries about its balance sheet -- similar to the story in Tesla . In both cases, big obstacles that once kept some investors on the sidelines could be going away.

GE gapped higher after that report and then pulled back. It found support at the same $10.70 - $10.80 area that was resistance in June and July. It's climbing again today following an upgrade by UBS, which raised it price target to $14.

It is a strong news-driven move with the potential for brief consolidation, so traders may find some opportunities closer to $11.20.

Energy is another potential catalyst because GE owns about one-third of oil-field servicing company Baker Hughes . This has also been one of the stronger niches in the market over the last week, and also stands to benefit from trade optimism potentially lifting crude.

Tariffs

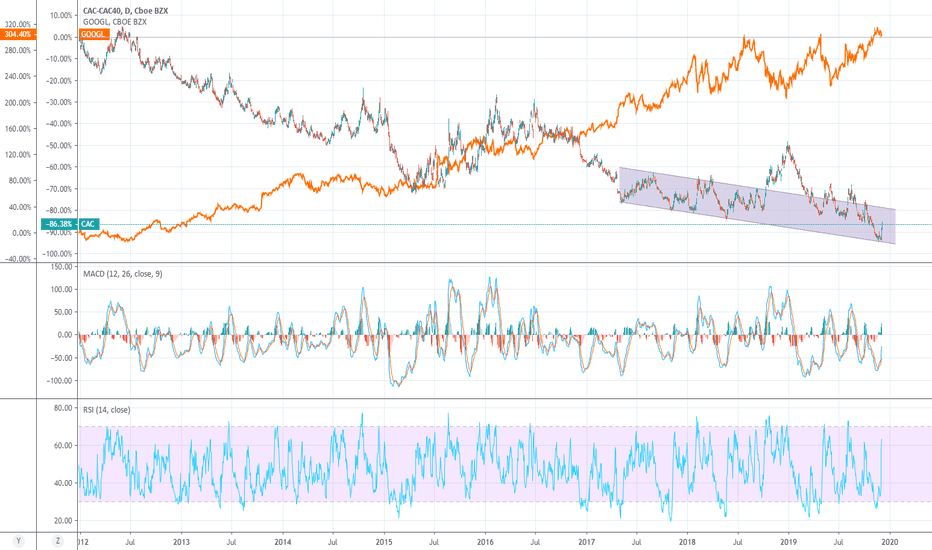

US could impose 100% tariffs on French goods after Google taxWhat was President Macron thinking about designing a tax for tech companies... A quick reminder, it will be separated in two categories — marketplace (Amazon’s marketplace, Uber, Airbnb…) and advertising (Facebook, Google, Criteo…). Despite the fact it wasnt planned specifically for American companies, the vast majority of big tech companies that operate in France are American. Thus, a company that generates more than €750 million in global revenue and €25 million in France, will have to pay 3% of the French revenue in taxes.

As expected, the U.S. Trade Representative claimed that“France’s Digital Services Tax (DST) discriminates against U.S. companies, is inconsistent with prevailing principles of international tax policy, and is unusually burdensome for affected U.S. companies.” And, as a result, now we might see tariffs that could be as high as 100% on French goods (wine, cheese, handbags…).

What is going to happen now? Frnce will say that the response will be equally damaging, but i personally doubt they manage to impose significant tariffs unless the whole European Union agrees to cooperate and istart acting. However, even in this case no one can guarantee that th EU will achieve something worthwhile... So, with a high probability we will see another decrease in the Cac-40.

ORBEX: Weekend Trade News Likely to Affect SPX, DXY!In today’s marketinsights video recording, I talk about SPX and DXY .

SPX takes a breather from all-time highs offering some pocket-relief to short-term bulls, however, with weekend trade headline news the rally could continue higher.

The US index looks bid too despite the medium-term bearishness as the economy performs incredibly well, supporting the dollar.

From a technical perspective, there's more room to the upside for both. The index, however, will most likely have a harder trip moving higher as its upside is limited. Unless if of course a sharp bullish move occurs, taking out breakeven stops and then reversing rapidly to everyone's surprise.

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice.

DXYThe heavily correlated DXY and EURUSD are trading in the complete opposite direction. This doesn't give enough reason to see why the trend would continue, but we do have a lot of bull-ish momentum as price continues to trade in a channel toward the upside. I'm looking to see The Dollar break resistance levels, and push higher.

ORBEX: GBPUSD, AUDUSD: Trade And Brexit Deals Fall Short!In today's #marketinsights video recording I analyse #GBPUSD and #AUDUSD

Pound Lower on:

- Highly complex proposal for a double customs system

- Nothing substantial or "workable" submitted to EU

Aussie Lower on:

- Tradewar shift, again, as tariffs part of the limited deal

- Phase one not documented, China needs confirmations

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice

XAUUSDGold, coming off a interesting key level here. Previous levels of resistance off the monthly chart. Federal Chairman speaks on lowering the alarms for a recessives period, this gives U.S markets strength and sends stocks for a rebound and the Dollar finds artificial strength. In correlation, precious metals become less appealing as a way to hedge inflation.

SPY Triple BottomPotential for a triple bottom on SPY. Depending on incoming news later tonight/tomorrow morning, I suspect a large move monday. Technicals would suggest that spy should be making a move upwards towards 293. If 293 rejects, then down we go again. If it breaks and retests as support, then we may make new highs. However, with the fear in the market, it is hard to say that's going to happen....except, "be greedy when others are fearful?"...

Currently in a long straddle.

Delayed tariffs "for Christmas" might help HASBRO

News/fundamental

The USTR says that the tariffs on some items, including “certain toys,” will be delayed until Dec. 15.

September is a key shipping month for those companies as they prepare for the holiday shopping season, when the majority of the industry’s business occurs.

Hasbro told CNBC earlier this month that it would have “no choice but to pass along the increased costs to our U.S. customers” if the tariffs were put into place.

--

Great risk reward ratio.

TRADERSAI - A.I. Powered Model Trades for Today, MON 08/12Bears Getting Emboldened?

The apparently mis-managed, mid-judged, and mis-publicized trade war appears to begin to take its toll on the confidence of businesses and investors - not only on the confidence, but could very well be on their bottomlines. And, this could be emboldening the bears to slowly emerge from their hiding.

Nevertheless, if you are itching to go short this market you need to tread carefully - there is still scope for stoking (baseless) hope and exuberance in the markets around the trade war agreement/developments (mass memory is said to be very short and politicians know this very well) - so, account for "short squeeze" spikes up when going short. Keep enough powder dry and do not jump all in.

Our medium term models have not formed any near term directional bias, yet, and are in an indeterminate state, waiting for further analyses of today's (Monday's) daily close. In the mean time, read below for our models' trading plans for the day.

tradersai.com

#ES #ESMINI #SP500 #SPX #SPY #Fed #China #Yuan #Yields #Rates #Tariffs #Tradewar

$EEM - Emerging Markets Under PressureAs volatility has come back to the global markets with a vengeance, one headwind that continues to blow even stronger continues to be the US-China trade war. On August 2nd, the US unexpectedly imposed additional tariffs on Chinese goods, with the Chinese now threatening to retaliate in kind. As a result of this renewed volatility, Emerging Market stocks ($EEM) have been rattled heavily over the past few trading sessions.

On a technical basis, $EEM prices are below all three of its EMAs, with a death crosses forming on i) the 10-Day and 50 & 200-Day EMAs, and ii) the 50-Day EMA and the 200-Day EMA, something that has not been seen since May. Further, its RSI continues to fall, indicating that momentum is quickly increasing to the downside as global investors lose faith in Emerging Markets. Lastly, $EEM prices seem to to be in a downward trend since July 25th, with the EEM/SPY price ratio continuing its march lower, as global investors (continue to) invest in the US over Emerging Markets.

Given the increase in rhetoric between the two economic giants, Emerging Market stocks are currently under heavy bearish pressure, with no end in sight. If these pressures continue on the space, we see $EEM heading lower to $38.45 as its next stop.

$SPY - S&P 500 Bull Flag Forming?The S&P 500 was hit hard this week after macro headwinds such as the less than dovish Fed meeting, and more China tariffs, the $SPY has taken a beating over the last few trading days.

However, despite this short-term rough path, it appears that a "Bull Flag" ("Flag") seems to be forming at the moment. If prices can bounce off the bottom of the Flag at $288, move higher, and breach $302,the rally would continue. If it fails to do so, more selling could be right around the corner.

Investors should watch this space.

QQQ -Nasdaq Bull Flag forming?After a volatile week, $QQQ has been hit by some short-term selling pressure. This in turn, has made its technical patterns look quite bearish at the moment.

However contrary to this, it may appear that a "Bullish Flag" pattern may be forming. If the price can bounce of the bottom of the channel pattern ("Flag") at $186.31, move higher and breach the top of the Flag at $192.89, we could see prices move higher. If it fails to do so however, we could see more selling.

Watch this space over the next few trading sessions.

CAT Sensitive to Tariffs & Trade WarsHuge growth in 2016 as speculative anticipation of more sales to China & other developing industrialization nations occurred. Unsupported by Fundamental & Technical support and resistance levels. Now in a sideways pattern, inevitably selling down toward a Business Bear Cycle pattern. Weekly chart view.

GOLD-(XAU): Fundamentals and Technicals Support This Next RUN

Fundamental Analysis:

It was always made clear to me that Gold is the "Safe haven" where money is shifted to in times of uncertainty and fear. Gold is also commonly bought to be used as a hedge. Take the tariff war that is currently going on between World Leaders, the increased tariff rates seem to have no limit. In return, the inflation to the US Dollar will have many people with their sights on Gold. A few examples of recent gold bull trends during down markets would be in 2002-2007 when the dollar fell drastically (40% against the euro). Gold also ran 240% in 2008 when the bank treasuries credit giveaways were discovered where gold found itself surging to $1,895 in 2011.

Technical Analysis:

The Markets were hit hard last week and during this time we saw Gold make a strong move to the upside, breaking out of its 3 month falling wedge to finish the corrective Wave 2/5. As we begin our impulsive wave 3 up, my fib measurement on this completion is sitting around 1450, where I believe we will be rejected for a corrective wave. I would like keep a close eye on the volume to see if it will pick up, However I see clear skies concerning the Volume Profile (VPVR).

Trade-war relief - July 2019Trump and Xi Ping have come to a tariff truce at G-20 this weekend.

Trump is now using Huawei (previously blacklisted, banned, etc.) as a bargaining chip, allowing TEMPORARILY, U.S. companies to continue doing business with China's Huawei.

Here is a list of Top 20 U.S. based Huawei suppliers . I believe most of them will rally this month (July 2019).

- Percentage number next to stock symbol is the revenue exposure to Huawei

Intel (INTC) - 1%

Advanced Micro Device (AMD) - 2%

Broadcom (AVGO) - 6%

Qualcomm (QCOM) - 5%

Microsoft (MSFT)

Nvidia (NVDA)

CommScope (COMM) - 2%

Texas Instruments (TXN)

Seagate Technology (STX) - 4%

Micron Technology (MU) - 2%

Qorvo (QRVO) - 11%

Flex (FLEX) - 5%

Skyworks (SWKS) - 6%

Corning (GLW) - 2%

Analog Devices (ADI) - 3%

NeoPhotonics (NPTN) - 47%

Western Digital (WDC)

Lumentum (LITE) - 11%

II-VI (IIVI) - 8%

Finisar (FNSR) - 8%

Maxim Integrated (MXIM) - 4%

Keysight Technology (KEYS) - 2%

Marvell Technology (MRVL) - 1%

Note: Trump can go back on the Huawei deal at any time.

S&P 500 - potential for 2100 by Jan 2020In the upcoming days I'm confident we will see a continued rally in the S&P off of the news that Mr. Trump has solved "the problem" of the Mexico tariffs. While trying to remain as unbiased as possible, it is becoming more and more apparent that the current market news cycle could legitimately be subject to manipulation by Trump's continued belief that a strong market is indicative of his success in guiding the US economy. Seeing repeated bait and switch tactics on key economic policy decisions and the trade talks does not bode well for my confidence in long-term economic strength in both the real economy and the market.

Barring a true resolution of our engagement with China, I believe we are on course to see this head and shoulders pattern playout over the next 6-8 months. If the 2500 level breaks and confirms this pattern, a 38.2% retracement back to the 2100 levels for the S&P is certainly possible.

Keeping in mind that with such a long-term call as this, any major economic events that take place between now and then could drastically alter the circumstances that have preempted this view anticipating a continued decline on the major market indexes. I am by no means absolute on this position, and future developments will certainly be taken into account when assessing whether or not to maintain this position.

In anticipation of this rally, I will be working to assess when there is disparity on the premiums on long-term puts extending into 2020 on SPY. I hope to take advantage of potential price movement back into 290, to get cheap "insurance" on this market as I can cannot be confident in continued bullish momentum at this time.

USDCNY Blown Out and Moving HigherAs the trade tension heats up between the US and China, global traders have been putting pressure on the USDCNY.

On a technical basis,the RSI and MACD are strongly trending higher, indicating strong momentum higher for the USDCNY. Further, with the ADX firmly in trend, there are no signs of the rally in USDCNY slowing down.

If trade talks worsen or even fall apart, expect the USDCNY to move to 6.92.