Crypto Risk Management: The Most Overlooked EdgeIn the thrilling yet unforgiving world of crypto, profit potential is massive—but so is the risk. Every trader or investor enters the space with dreams of 10x gains, but without a solid risk management strategy, many exit just as fast—with a trail of losses.

Risk management is the art of protecting your capital while giving yourself the best shot at long-term profitability. It’s not just a skill; it’s a survival strategy.

What Are the Risks in Crypto?

Crypto markets are unique—24/7, global, and driven by emotion, hype, and tech disruption. With that come several risk categories:

Market Risk – Volatile price swings can wipe out unprepared traders.

Liquidity Risk – Low-volume coins can be hard to exit during dumps.

Regulatory Risk – Government crackdowns or bans (e.g., Binance or XRP cases).

Security Risk – Hacks, rug pulls, phishing scams, and smart contract bugs.

Operational Risk – Mistakes like sending funds to the wrong address or using faulty bots.

These risks aren’t just theoretical—think of the LUNA/UST collapse or the FTX debacle. Billions were lost due to poor risk management at multiple levels.

🧠 Core Principles of Risk Management

To stay in the game long-term, you need to adopt some fundamental principles:

Preserve capital first, profit later.

Risk small, aim big.

Never risk more than you can afford to lose.

Think in probabilities, not certainties.

Be consistent, not lucky.

Even the best traders lose—but they survive because they manage their downside better than the rest.

🛠️ Tools & Techniques That Can Save Your Portfolio

1. ✅ Position Sizing

Don’t bet your whole stack on one trade. A common approach is to risk 1–2% of your portfolio per trade. That way, even a streak of bad trades won’t destroy your capital.

2. 🛑 Stop-Loss & Take-Profit

Always have predefined stop-loss levels to cut losses, and take-profit targets to lock in gains. Trading without a stop-loss is like driving without brakes.

3. 📊 Diversification

Spread your investments across different sectors (DeFi, AI, Layer 1s, etc.). Don’t rely on one narrative or one coin.

4. ⚖️ Leverage Control

Leverage can amplify gains—and losses. Avoid high leverage unless you’re an experienced trader with a tight plan.

5. 🔁 Portfolio Rebalancing

Adjust your allocations periodically. If one asset balloons in value, rebalance to lock in gains and manage exposure.

6. 💵 Using Stablecoins

Stablecoins like USDT, USDC, or DAI are great for hedging during volatility. Park profits or prepare dry powder for dips.

🧠 Psychological Risk: The Silent Killer

Many traders don’t lose due to bad analysis—they lose to emotions.

FOMO leads to buying tops.

Fear leads to panic selling bottoms.

Revenge trading after losses leads to bigger losses.

Greed blinds you from taking profits.

The key is discipline. Create a plan, follow it, and review your mistakes objectively.

🚫 Common Mistakes to Avoid

Going all-in on one trade or coin

Holding through massive drawdowns hoping for a recovery

Ignoring stop-losses

Overleveraging small positions to “win it all back”

Risk management is about avoiding unnecessary pain, not killing your gains.

🧭 Final Thoughts

The best traders in crypto aren't those who win big once—they're the ones who survive long enough to win over and over. Risk management is your edge in a market that respects no one.

Whether you’re a scalper, swing trader, or long-term HODLer, never forget: capital is your lifeline. Guard it with your strategy, protect it with your plan, and grow it with patience.

✍️ By Green Crypto

Empowering traders with analysis, tools, and education. Stay sharp. Stay profitable.

Tradingstrategy

Why the current section is important

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

It is not easy to explain everything with just chart analysis.

Therefore, it is true that interpretation of various issues is necessary.

However, I am only explaining the chart.

The reason is that interpretation of various issues other than the chart is not easy for individual investors.

-

(NAS100USD 1W chart)

In order to continue the uptrend, the price must be maintained above the M-Signal indicator of the 1M chart.

If not, there is a high possibility of continuing the downtrend.

Therefore, if the price is maintained above 18693.7, I think it is highly likely that the uptrend will continue.

However, this is a medium- to long-term perspective.

-

(1D chart)

In the short term, the price should be maintained above the M-Signal indicator on the 1D chart.

In that sense, we can see that the current price position is an important section.

However, in order to continue the short-term upward trend, it should rise above the M-Signal indicator on the 1W chart.

In that sense, the support around 19848.3 is an important key point.

-

Currently, the StochRSI indicator has entered the overbought section.

Therefore, even if it continues to rise further, it is expected to show a downward trend in the end.

Therefore, if it is not supported near 19848.3, I think you should prepare for a decline.

At this time, you should check whether it can be supported near 18428.8 and rise.

The reason is that the HA-Low indicator of the 1D chart is formed.

-

The HA-Low and HA-High indicators are indicators created for trading on the Heikin Ashi chart.

The fact that the HA-Low indicator was created means that it rose from the low point section.

Therefore, if it is supported near the HA-Low indicator, then that is the time to buy.

If it falls without being supported by the HA-Low indicator, there is a possibility of a stepwise decline, so you should think about a countermeasure for this.

However, there is a difference between a downward trend following the HA-Low indicator and a simple downward trend.

A stepwise decline following the HA-Low indicator is likely to eventually form a bottom section.

The next volatility period is expected to be around April 29th.

-

Thank you for reading to the end.

I hope you have a successful trading.

--------------------------------------------------

Breakout trading

(Title)

Breakout trading starts with finding support and resistance points

-------------------------------

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

I will take the time to talk about breakout trading.

This is my opinion, so the content may be lacking.

The reason I did not explain what other people say with examples is because trading is a psychological battle.

Most of the content in books or on the Internet is explained with patterns.

However, it is not easy to find patterns when checking the movement of a real-time chart.

Therefore, I think it is more important to understand why such movements occur than to explain them with patterns.

Therefore, I think it is better to create a trading strategy by finding support and resistance points and checking whether or not they are supported by the support and resistance points rather than memorizing patterns.

Breakout trading refers to starting a transaction after checking whether there is support at a point or section when the price rises above a certain point or section, and there is a possibility of a larger rise.

If you do a breakout trade incorrectly, you may end up buying at a high point, which could result in a large loss, so it is recommended to always keep a stop loss point when trading.

In order to reduce the stop loss, you need to make an effort to lower the average purchase price by selling in installments when the price rises after purchasing and buying in installments when the price falls again.

Therefore, the stop loss point is when it is beyond the range you can handle.

-

Let's take the BTCUSDT 1D chart as an example.

It has fallen after renewing the ATH.

Looking at the current price position, it feels like it will fall further.

However, if the price rises to around the HA-Low indicator on the 1D chart, that is, around 89294.25, you will feel like it will turn into an uptrend.

Even if you think that you won't feel that way now, you will feel that way after it rises.

Therefore, the most important thing in breakout trading is to find important support and resistance points.

To find support and resistance points, you need to basically understand candles.

Any book or video about candles will do.

I recommend that you don't try to memorize the content in it, but read or watch it repeatedly several times.

In my case, after watching the video about candles about 3 times, my understanding of the chart became easier.

The reason for finding support and resistance points is to select a trading point.

What you need to find support and resistance is a horizontal line.

It is not easy to start trading with chart tools that are not horizontal lines but diagonal lines or curves.

The reason is that when you try to start a trade, you are more likely to miss the timing because your psychological state is added.

-

You can see that the uptrend started when it broke through the 73072.41 point.

Therefore, you can see that it is possible that the uptrend will start when it breaks through the 106133.74 point this time as well.

However, in this case, since it is rising while renewing the ATH, it is a point where it is thought to be difficult to actually start trading.

In other words, it is likely that you will be reluctant to trade because it is thought to be a high point.

Therefore, as I mentioned earlier, the actual breakout trade will be conducted when it breaks through the 89294.25 point.

Then, even if it rises to around the 106133.74 point, you will be more likely to respond stably without feeling much psychological anxiety.

-

However, there is one problem.

That is, the StochRSI indicator is currently in the overbought zone.

Therefore, when it rises near the 89294.25 point and confirms support, the StochRSI indicator should show a downward trend from the overbought zone.

Otherwise, the 89294.25 point is likely to act as a resistance point.

Even if the market is messy and difficult to predict, you should not be too busy finding support and resistance points.

After all, you need to have a standard for creating a trading strategy to start trading.

It is better to create a trading strategy and respond at the support and resistance points you have selected if possible.

Even if you suffer a loss, if you continue to trade, you will be able to better organize the support and resistance points.

For reference, the indicators that can create a trading strategy on my chart are the HA-Low and HA-High indicators.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

This volatility period is expected to last until April 18

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

I looked for cases where HA-Low > M-Signal on the 1W chart > M-Signal on the 1D chart in the entire range, but I could find similar movements, but I couldn't find anything like the current one.

I think it's difficult to understand the current movement.

-

HA-Low and HA-High indicators are paired indicators that show contraction and expansion like Bollinger Bands.

Currently, the HA-Low and HA-High indicators are in a contracted state.

Therefore, if it rises near the HA-Low indicator and maintains the price, it is likely to lead to an attempt to break through the HA-High indicator.

However, since the HA-Low and HA-High indicators are defined and used as indicators that serve as the basis for trading strategies, the most important thing is whether there is support near the HA-Low indicator.

When it rises near the HA-Low indicator and shows support, if the M-Signal of the 1D chart > M-Signal of the 1W chart, that is, if it maintains a proper arrangement, the possibility of an upward trend will increase.

Therefore, what we need to do is check whether there is support near the HA-Low indicator.

-

This volatility period is expected to last from April 13th to 18th.

At this time, the key is whether it can rise near 89294.25 and receive support.

If it touches the 89294.25 point and falls, we should see if the price can be maintained around the Fibonacci ratio 2.24 (83646.12) and rise along the rising trend line (2).

The maximum decline is expected to be around the left Fibonacci ratio 1.618 (76787.43) that the finger is pointing to.

If it fails to rise along the rising trend line (2), it is likely to fail to reverse the trend.

In any case, I think it is highly likely that the uptrend will be restricted because the StochRSI indicator is expected to enter the overbought zone.

-

The Fill HA Close 1W-1M indicator is an indicator that displays the Close of the 1W and 1M charts of the Heikin Ashi chart.

This was created for the purpose of identifying the point where an uptrend or downtrend turns from a mid- to long-term perspective.

The HA Close on 1W 1M Mid indicator is an indicator that displays the middle value of the Close of the 1W and 1M charts of the Heikin Ashi chart.

I think you can tell why the HA Close on 1W 1M Mid indicator was added by looking at the price movement.

In other words, it was added because it can act as a support and resistance point.

However, it is recommended that these indicators be used for analyzing charts.

In my chart, the only indicators used to create trading strategies are the HA-Low and HA-High indicators.

-

(30m chart)

If you bought (LONG) when the HA-Low indicator was created and showed support near it, you would be currently making a profit.

If the HA-Low indicator shows support and the price rises above the Trend Cloud (or M-Signal on the 1D chart) indicator and maintains, there is a high possibility that an uptrend will begin.

Then, if it shows resistance near the HA-High indicator and falls below the Trend Cloud (or M-Signal on the 1D chart) indicator and maintains the price, there is a high possibility that a downtrend will begin.

Therefore, if you bought near the HA-Low indicator, the first sell period will occur when you meet the HA-High indicator.

This movement will be conducted within the HA-Low ~ HA-High range.

Most of the time, you will trade within the HA-Low ~ HA-High range.

Otherwise, there will be cases where the price falls below the HA-Low indicator or rises above the HA-High indicator and shows a trend.

At this time, you will either gain a bigger profit or incur a bigger loss.

Therefore, it is important to stabilize your psychological state by guarding the first split sell section.

-

The body color of the candle indicates the status of the OBV indicator.

That is, dark green means that the OBV is located above the upper line.

Dark red means that the OBV is located below the lower line.

Therefore, when dark green or dark red appears, you can see that there is a high possibility that a change in trend will occur.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire section of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio section of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

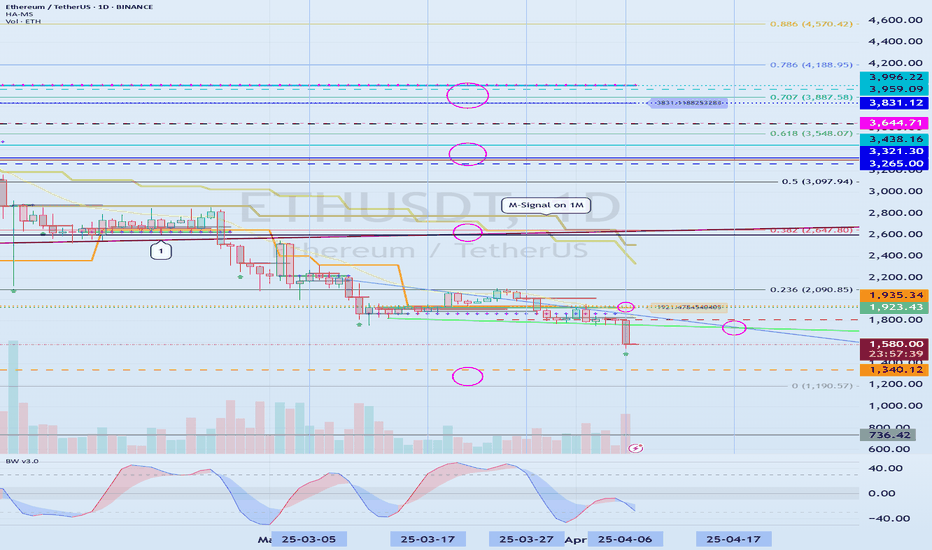

Support zone: 1340.12-1935.34

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(ETHUSDT 12M chart)

I can't get on the plane and it's falling.

The maximum decline zone is expected to be around the Fibonacci ratio 0 (1190.57).

-

(1M chart)

Since it has fallen below the support and resistance zones, I think it's a good idea to check the turn with a relaxed mind.

In order to continue the uptrend, it must rise above the M-Signal indicator on the 1M chart.

If it falls to around 736.47, it is better to buy without thinking from a long-term investment perspective.

The minimum holding period is 1 year.

-

(1W chart)

When looking at the 1W chart, the HA-Low indicator on the 1W chart is formed at the 1340.12 point.

Therefore, if it shows support around this area, it is a time to buy.

If it falls below 1340.12, it is a time to buy when it rises again and support is confirmed.

In the explanation of the 1M chart, I said to buy unconditionally if it falls to around 736.42.

This is a condition for holding for at least 1 year, so if not, it is recommended to buy when it is confirmed to be supported by rising near 1340.12.

-

(1D chart)

ETH's volatility period is from April 5 to 7.

ETH's next volatility period is around April 17 (April 16 to 18).

-

The most important thing on the ETH chart is the rising trend line (1).

Therefore, volatility is likely to occur when it passes the rising trend line (1).

-

Let's look at the chart from a short-term perspective.

Currently, the HA-Low indicator on the 1D chart is formed at the 1935.34 point.

Therefore, from a short-term perspective, when it is confirmed to be supported by rising near 1935.34, it is the time to buy.

Therefore, you should think about the average purchase price of the coins you currently own and think about how to respond.

-

The best method is to increase the number of coins (tokens) corresponding to the profit.

This method is most efficient when used during a downward trend.

You write down the purchase price and amount separately, and if the purchase price rises more than the purchase price and a profit is generated, you sell the purchase amount within the purchase amount range to leave the number of coins (tokens) corresponding to the profit.

The reason why this method is explained from a short-term perspective is because you have to conduct day trading or short-term trading.

If you continue to trade until the upward trend turns like this, you will make a large profit when the upward trend turns.

In addition, since the pressure on funds has decreased, you will also have the opportunity to seize the opportunity to make a full-fledged purchase.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

To check the entire range of BTC, I used TradingView's INDEX chart.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year upward trend and faces a 1-year downward trend.

Accordingly, the upward trend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

The key to trading is finding support and resistance points

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

If the price is maintained above the M-Signal indicator on the 1D chart, there is a high possibility that it will turn into a short-term uptrend.

However, since the HA-High indicator on the 1D chart is formed at the 89294.25 point, it can be interpreted that it has not yet escaped the low point.

Therefore, it is recommended to trade with a short and quick response such as scalping or day trading until the price rises above 89294.25 and maintains.

I think the rising trend line (2) is an important trend line that changes the trend.

Therefore, we need to check whether it can rise along the rising trend line (2).

Therefore, it is important to see whether it rises above the rising trend line (2) after passing the next volatility period, around April 14 (April 13-15).

If it fails to rise, that is, fails to rise above the M-Signal indicator on the 1W chart, it is expected that it will eventually show a downward trend again.

Since the StochRSI indicator has risen above the midpoint, it is better to start focusing on finding a selling point rather than a buying point.

In summary, in order to rise above 89294.25, I think it is possible if the StochRSI indicator shows a wave that moves from the overbought zone to the oversold zone and from the oversold zone to the overbought zone, and it is supported near the M-Signal indicator on the 1W chart.

If not, and it goes up right away and touches the area around 89294.25, there is a possibility that the area around 89294.25 will act as resistance.

-

(30m chart)

I think the important thing is where to start and where to end the trade.

The indicators used to find the answer are the HA-Low and HA-High indicators.

When the HA-Low indicator is first created, if it receives support and rises and the Trend Cloud indicator shows an upward trend, it is a buying period.

In other words, when it shows support near the HA-Low indicator, it is an aggressive buying period.

Then, when it rises and meets the HA-High indicator, that is the first selling period.

The HA-High indicator, like the HA-Low indicator, also receives resistance and falls when the HA-High is newly created and the Trend Cloud indicator shows a downward trend, it is a selling period.

In other words, when it shows resistance near the HA-High indicator, it is the first selling period.

In the case of futures trading, it is the aggressive selling (SHORT) period.

Therefore, the HA-Low and HA-High indicators can be used as criteria for creating trading strategies.

Most of the trading is in the sideways and box sections within the HA-Low ~ HA-High indicator range.

If it falls below the HA-Low indicator or rises above the HA-High indicator, you should switch to a trading strategy in the trend.

Therefore, if you bought near the HA-Low indicator, you can sell first near the HA-High indicator and then respond according to the situation.

-

Rather than thinking about how far it will rise or fall before starting a trade, it is more important to find out which points are important support and resistance points.

Once you find that point, you can boldly start trading and respond to the rest according to the situation.

I use the HA-Low, HA-High indicators as the standard.

The most important indicators for creating a trading strategy are, of course, the HA-Low, HA-High indicators.

I use the Trend Cloud indicator and the M-Signal indicators on the 1D, 1W, and 1M charts as reference indicators for buying or selling from the HA-Low, HA-High indicators.

The remaining indicators are auxiliary indicators for conducting detailed corresponding transactions.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

Support Zone: 106.19

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(NVDA Chart)

The HA-Low indicator on the 1D chart was formed at 106.19.

Therefore, the key is whether it can receive support and rise near 106.19.

-

(30m chart)

If it falls below 106.19,

1st: M-Signal indicator on 1M chart

2nd: HA-Low indicator on 30m chart

You need to check if it is supported near the 1st and 2nd above.

In order to continue the uptrend, the price must be maintained above the M-Signal indicator on the 1M chart.

-

(1D chart)

Since the HA-Low indicator on the 1D chart has been newly created, the key is whether it can be supported near this area and rise above the M-Signal indicator on the 1D chart.

If so, it is expected to turn into a short-term uptrend.

If not, there is a possibility of a stepwise downtrend, so the current position is an important section.

-

Thank you for reading to the end.

I hope your transaction will be successful.

--------------------------------------------------

The key is whether it can rise after receiving support at 0.2349

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(MANAUSDT 1D chart)

It receives support near 0.2349

1st: 0.2636

2nd: 0.3136

The key is whether it can rise to the 1st and 2nd above.

An important volume profile section is formed in the 0.1066-0.1547 section.

Therefore, from a mid- to long-term perspective, the 0.1066-0.1547 range can be considered the last buying range.

-

In order to continue the upward trend, the price must be maintained above the M-Signal indicator of the 1M chart.

Therefore, a way to increase the number of coins (tokens) corresponding to profits with peace of mind is needed.

-

MANA coins are used for Collectibles & NFTs, Gaming, Play To Earn, and Payments.

In addition, it belongs to the Ethereum Ecosystem, Solana Ecosystem, Polygon Ecosystem, Gnosis Chain Ecosystem, and Fusion Network Ecosystem.

Therefore, it seems that it can be used in various ways.

I don't think the future outlook is that bad, but since it is currently being used for Gaming, I don't think there is much merit in terms of price.

This is because it is not easy for the Gaming business to continue to develop.

I think the business needs to expand a bit more.

-

(30m chart)

- HA-High indicator rises above,

- Trend Cloud indicator is rising,

- Rising near the M-Signal indicator on the 1D chart,

- StochRSI indicator enters the overbought zone,

Under the above conditions, there is a possibility that support will be confirmed near the HA-High indicator again.

Accordingly, the key is whether it will be supported near 0.2349, which is the M-Signal indicator point on the 1D chart.

It cannot be ruled out that it will rise to around 0.2636, but it is judged that there is not enough trading volume for that to happen.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015 and has been rising.

In other words, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it shows up to 3.618 (178910.15).

Fibonacci ratio 0.618 (44234.54) is not expected to fall again.

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

Check support near the M-Signal indicator on the 1D chart

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(BTCUSDT 1M chart)

-

(1W chart)

Indicators indicating lows on the 1M chart and 1W chart, i.e. BW(0), DOM(-60) indicators, are not created.

Therefore, caution is required when trading as it can fall at any time.

This movement is likely to occur until the trend line corresponding to the trend line (1) on the 1M chart is created as a solid line.

-

(1D chart)

There are several trend lines drawn, but the important thing to consider is whether there is support near the section marked with a circle.

Among them, the section that must be broken to create a trend is 89294.25 and 73499.86.

Therefore, the key is whether the price can be maintained near the M-Signal indicator on the 1D chart and rise above 89294.25.

Therefore, the next volatility period is from around April 14th to 17th, and we need to check whether the price can be maintained above the M-Signal indicator on the 1W chart.

If it fails to rise, there is a possibility of falling again to around 78595.86 and 73499.86.

The important thing to consider is whether there is support near the M-Signal indicator on the 1D chart.

-

(30m chart)

The following applies to all time frame charts.

Trading strategies can be created based on whether there is support near the HA-Low and HA-High indicators.

Here, we refer to the movements of the Trend Cloud and StochRSI indicators.

Currently, the HA-High indicator has risen above it and the Trend Cloud indicator is thick, so it can be interpreted that the upward trend is likely to continue.

However, since the StochRSI indicator has fallen in the overbought zone, the upward trend may be limited.

Therefore, it can be interpreted that the support near the M-Signal indicator on the 1D chart is important.

If it continues to rise further, it is expected to touch the M-Signal indicator on the 1W chart.

If it rises or moves sideways, the Trend Cloud indicator will eventually become thinner.

If the Trend Cloud indicator shows resistance while being thin, the possibility of a decline increases, so at that time, you should refer to the various indicators that are generated and respond according to whether there is support near those indicators.

-

If you predict the movement in advance and proceed with the transaction, you may be subject to psychological pressure and may proceed with the wrong transaction, so you should always be careful.

In the HA-Low ~ HA-High indicator section, a trading strategy in the sideways or box section is required.

If it falls below the HA-Low indicator or rises above the HA-High indicator, a trading strategy in the trend is required.

The current example chart is a 30m chart, so this chart requires a trading strategy in the trend.

Therefore, if it shows support above the HA-High indicator, you can create a trading strategy and proceed with the transaction.

Since it is currently located near the M-Signal indicator of the 1D chart, whether there is support near this area is the first trading strategy period.

-

For reference, HA-Low, HA-High indicators are indicators created to create trading strategies, and M-Signal indicators on 1M, 1W, and 1D charts are indicators created to identify trends.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

That is, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

#BTCUSDT at a Turning Point: Volume, Pattern & Macro Analysis🚀 BYBIT:BTCUSDT.P is potentially entering the final phase of a correction, but key levels have not yet been broken or confirmed — caution and reliance on validated signals are essential.

✅ Technical Analysis:

📈 Overall Timeframe Context:

➡️ 1H (hourly chart): A “double bottom” structure is forming, suggesting potential for a local rebound. Volume is gradually increasing at the second reversal point (Bottom 2), confirming growing buyer interest. A resistance zone is forming near the POC (83,236.9), but the price has yet to firmly break above 77,000.

➡️ 4H (4-hour chart): A more distinct “double top” pattern (Top 1 / Top 2) has already played out. Price broke down from the sideways range, falling below the lower boundary of the rectangle. It is currently trading near the key support level of 74,907.8 with an attempt to bounce back upward.

➡️ 1D (daily chart): A key observation is the breakdown of the ascending wedge, followed by the formation of a falling wedge — a potentially bullish pattern. The price is testing the lower edge of this wedge. A sharp increase in volume may indicate the start of an accumulation phase.

📍 Key Point:

➡️ The 74,907.8 level has been tested twice with strong volume response, reinforcing its role as a critical support zone.

➡️ A large liquidity cluster around the 83,000–84,000 POC zone could act as a price magnet in the event of a reversal.

📊 Volume Profile Analysis:

➡️ Across all timeframes, the POC is shifting toward the upper part of the range, confirming that buyers previously dominated the market. Redistribution now appears to be underway.

➡️ Most of the volume activity has been concentrated in the 83,000–85,000 range — if price returns to this zone, strong resistance is expected.

🔄 Market Structure:

➡️ A transition is underway from a distribution phase to a potential accumulation phase.

➡️ The downtrend remains active on the daily chart, but there are signs of momentum slowing and attempts to form a bottom.

✅ Fundamental Analysis:

🌐 Macroeconomic Outlook:

➡️ In early April, discussions about a potential Federal Reserve interest rate cut are expected to continue — a moderately positive factor for risk assets, including cryptocurrencies.

➡️ BYBIT:BTCUSDT.P remains in the spotlight for institutional investors (with ongoing inflows into BYBIT:BTCUSDT.P ETFs), though geopolitical uncertainty and dollar liquidity pressure persist.

🏦 Capital Flows:

➡️ Trading volume remains high, but there is a lack of significant inflows, suggesting that major players may be adopting a wait-and-see stance.

📢 Recommendations for BYBIT:BTCUSDT.P :

📢 Closely monitor the price reaction in the 74,900–75,000 zone — a breakout or confirmation of support will determine short-term direction.

📢 The 78,279.2 level is a key resistance — its breakout could attract new buyers.

📢 Watch how price behaves within the falling wedge (1D); if the structure tightens and volume increases, a breakout may follow.

📢 Keep monitoring macroeconomic events — particularly U.S. inflation data and upcoming Fed meetings.

📢 Pay close attention to volume activity at local lows — this may be the key to spotting a trend reversal.

Tyree Thomas Jr Buy GBP/CAD Bias 4/8/25I looked at GBP/CAD and checked the pair with the key points of my trading strategy. My trade idea is to enter a buy when the pair breaks out of the Fibonacci Retracement tool and then take profit at the first green line of the Fibonacci Extension tool. My name is Tyree Thomas Jr, and this is my bias of GBP/CAD for a buy.

Important support and resistance zone: 0.6678-0.8033

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(EOSUSDT 1M chart)

In order to continue the uptrend, it must rise above the M-Signal indicator on the 1M chart.

Currently, the HA-Low indicator on the 1M chart is formed at the 2.8769 point, so if the HA-Low indicator is not newly created, it will rise to around 2.8769 and show support, which is the time to buy.

However, since it is far from the M-Signal indicator of the 1M chart, it is important to check whether the price is maintained above the M-Signal indicator of the 1M chart for now.

-

(1D chart)

The 0.6678-0.8033 section is an important support and resistance section.

Therefore, the key is whether it can be supported and rise near this section.

If it falls, you should check whether it is supported near 0.5255-0.5820.

If it starts to rise, it is likely to rise to the HA-Low indicator of the 1M chart.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire section of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015 and has been rising.

In other words, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it shows up to 3.618 (178910.15).

Fibonacci ratio 0.618 (44234.54) is not expected to fall again.

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain the details again when the downtrend begins.

------------------------------------------------------

Bitcoin Signal for Short Lets Make Some Real GameThis is an educational trading setup for Bitcoin (BTC/USD), focusing on a short position opportunity between the $82,000 and $80,000 price levels. The analysis is based on technical indicators, price action strategies, and current market sentiment. Please note: this is not financial advice, strictly for learning purposes!

📉 Trade Concept:

Entry Zone: $82,000

Target Zone: $80,000

Setup Type: Short / Sell

Timeframe: Short-term / Intraday

Market Context: After an extended bullish rally, BTC/USD is showing signs of exhaustion near key resistance. High probability retracement expected towards the $80,000 support area.

🔍 Educational Insights:

Technical Indicators: Overbought RSI levels, bearish divergence, and candlestick reversal patterns around $82,000 zone.

Psychological Levels: $80,000 is a major psychological number where buyers may step in.

Risk Management: Always use stop-losses and proper risk-reward ratios in live trades.

💡 Purpose of Sharing:

This setup is shared purely for educational purposes to help traders understand how to spot potential short opportunities in volatile markets like Bitcoin. Learn how to analyze resistance zones, manage risk, and read price action effectively.

📢 Disclaimer:

This is not financial advice. For educational purposes only. Always do your own research and consult with a professional before making financial decisions.

#Bitcoin #BTCUSD #CryptoAnalysis #ShortTrade #BitcoinSignal #PriceAction #Educational #TradingStrategy #TechnicalAnalysis #CryptoEducation #LearnTrading #RiskManagement

The key is whether it can rise to around 136.74

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(SOLUSDT 1M chart)

In terms of Fibonacci ratio, the key is whether it can rise after receiving support near 0.5 (98.71).

In order to continue the uptrend, the price must be maintained above the M-Signal indicator on the 1M chart.

Accordingly, we need to see whether it can rise above 136.92 and receive support.

If not, and it falls, you should go up again and check if it is supported near the Fibonacci ratio 0.5 (98.71) or if the HA-Low indicator on the 1M chart is generated, and then create a trading strategy.

-

(1D chart)

Therefore, if possible, it is more important to check if it is supported near the HA-Low indicator on the 1D chart, that is, near 136.74.

-

Fibonacci ratio 0.5 (98.71) should be interpreted as having an important meaning because it is in the middle of the overall chart.

Fibonacci ratio is a chart tool that helps with chart analysis, but it is not recommended to trade with it.

-

(30m chart)

The indicator that can create a trading strategy on my chart is the HA-Low, HA-High indicator.

Therefore, you can create a trading strategy by looking at the movement of the HA-Low, HA-High indicator formed on the time frame chart that you mainly view and trade.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902(101875.70) ~ 2(106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

NASDAQ, S&P 500 and CoinMarketCap movements, Bitcoin chart

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

We need to check the movement after a new candle is created.

USDT, USDC should gap up to know that funds have flowed into the coin market.

On the other hand, if there is a gap down, I think funds have flowed out of the coin market.

Therefore, I think USDT or USDC are showing the size and flow of funds in the coin market.

-

(BTC.D 1M chart)

If BTC dominance is maintained above 62.47 or continues to rise, altcoins are likely to show a large decline.

Therefore, in order for an altcoin bull market to begin, it must fall below 55.01 and remain there or continue to decline.

-

(USDT.D 1M chart)

USDT is a fund that has a large influence on the coin market.

Therefore, if USDT dominance rises, it means that the coin market is likely to show an overall decline.

On the other hand, if it falls, it can be interpreted that the coin market is likely to show an overall rise.

In order for the coin market to start an upward trend, it must fall below 4.97 and remain there or continue to decline.

In particular, if the Fibonacci ratio rises above 0.618, the coin market is likely to plummet.

If it remains above the Fibonacci ratio of 0.618, it is likely to rise to around 7.14.

-------------------------------------------

(NAS100USD 12M chart)

It has currently entered the most important support and resistance zone.

-

(1W chart)

Therefore, the maximum decline point is expected to be around 14922.2.

In order to continue the uptrend, the price must be maintained above the M-Signal indicator on the 1M chart.

Therefore, the key is whether it can receive support near the most important support and resistance zone and rise above the M-Signal indicator on the 1M chart.

---------------------------------------------

(SPX500USD 1W chart)

The key is whether it can be supported around 4773.4-4846.1 and rise above the M-Signal indicator on the 1M chart.

If not, the maximum decline is expected to be around 3875.1-4116.0.

---------------------------------------------

(BTCUSDT 1M chart)

As I mentioned before, since the dotted trend line (1) is not acting as a clear trend line, there is a high possibility of volatility.

Therefore, when the StochRSI indicator creates a peak in the oversold zone and rises this time, there is a possibility that a trend will be formed as a trend line between lows is created.

However, the high-point trend line and the low-point trend line must be formed in the same direction.

In other words, since the current high-point trend line is creating an upward trend line, the low-point trend line that will be created this time must also create an upward trend line.

In that sense, the 69000-73199.86 section can be seen as an important support and resistance section.

If it falls below 69000, it is likely to touch the Fibonacci ratio section of 0.886 (56227.18) ~ 1 (61338.93), which was the previous high point section.

-

(1D chart)

On the last day of this volatility period, it fell below the upward trend line (2), showing a large decline.

Since it fell below the downward trend line, there is a possibility that it will continue to fall further.

At this time, the key is whether it can rise with support near 73499.86.

The next volatility period is around April 25 (April 24-26).

The point of interest is whether the price is maintained near 73499.86 or 89294.25 after the next volatility period.

-

The 73499.86 point is the HA-High indicator point on the 1M chart.

The M-Signal indicator on the 1M chart is rising to around 73499.86.

Therefore, if support is confirmed near the M-Signal indicator on the 1M chart, I think it is an aggressive buying period.

If it falls below the M-Signal indicator on the 1M chart, it is a buying period until it rises again and supports near the M-Signal indicator on the 1M chart.

The next time to buy is when it shows support near the Fibonacci ratio range of 0.886 (56227.18) ~ 1 (61338.93) that I mentioned in the 1M chart explanation.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

That is, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

Example of how to draw a trend line using the StochRSI indicator

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

I have explained how to draw a trend line before, but I will take the time to explain it again so that it is easier to understand.

-

When drawing a trend line, it must be drawn on the 1M, 1W, and 1D charts.

However, since I focused on understanding the concept of drawing a trend line and the volatility period that can be seen with a trend line, I will explain it only with a trend line drawn on the 1D chart.

Please note that in order to calculate a somewhat accurate volatility period, support and resistance points drawn on the 1M, 1W, and 1D charts are required.

I hope this was helpful for understanding my thoughts on the concept of drawing trend lines and how to interpret them.

The main reason for drawing trend lines like this is so that anyone who sees it can immediately understand why such a trend line was drawn.

Then, there will be no unnecessary disagreements about the drawing, and each person will be able to share their opinions on the interpretation.

--------------------------

When drawing trend lines, the StochRSI indicator is used.

The reason is to secure objectivity.

When the StochRSI indicator touches the oversold zone and rises, the low corresponding to the peak is connected to draw a trend line between low points.

And, when the StochRSI indicator touches the overbought zone and falls, the Open of the downward candle corresponding to the peak is connected to draw a trend line between high points.

If the peak is not a downward candle, it moves to the right and is drawn with the Open of the first downward candle.

If you refer to the candlesticks of the arrows in the chart above, you will understand.

The trend line drawn as a dot is a high-point trend line, but it is a proper trend line because it does not touch the overbought zone between highs.

Therefore, you can draw a trend line corresponding to trend line 1.

Accordingly, around March 25-29, around April 8, and around April 14 correspond to the volatility period.

-

You can see how important the low-point trend line (2) is.

If the high-point trend line is properly created this time and the low-point trend line and the high-point trend line are displayed in the same direction, the trend is likely to continue along that channel.

If the StochRSI indicator rises and a peak is created in the overbought zone, you will draw a high-point trend line that connects to point A.

-

Thank you for reading to the end. I hope your transaction will be successful.

--------------------------------------------------

Real Reason Most Strategies Fail–“Overfitting” Explained Simply!Hello Traders!

Have you ever seen a strategy work amazingly on historical charts, but fail badly in live markets? You’re not alone. One of the biggest reasons this happens is due to something called Overfitting . Today, let’s understand this concept in the simplest way — so you can avoid falling into this trap and build smarter strategies.

What is Overfitting in Trading?

Overfitting means your strategy is too perfect for past data:

It works great on old charts, but only because it was made to match that exact data.

It fails in real-time because the market changes:

The strategy doesn’t adapt well to new price behavior — it’s not flexible.

Example:

A strategy with 10 indicators giving perfect backtest results may be too specific and only fits that period — not future ones.

Signs Your Strategy Might Be Overfitted

Too many rules or filters:

If your strategy has too many conditions just to improve past results, that’s a red flag.

Works only on one stock or timeframe:

A good strategy should work on different stocks and market conditions.

Great backtest, bad live performance:

If your real trades don’t match the backtest, it might be too customized to the past.

How to Avoid Overfitting in Trading

Keep it simple:

Use fewer indicators and rules. Focus on clean price action and proven setups.

Test on different stocks/timeframes:

See if your setup works across Nifty, Bank Nifty, stocks, or different timeframes.

Use forward testing:

Try the strategy on live charts (paper trade) before putting real money into it.

Rahul’s Tip

A perfect backtest doesn’t mean a perfect future. Build your strategy to be reliable — not just impressive on history.

Conclusion

Overfitting is like memorizing old exam answers and failing the new paper. Don’t build strategies that only look good on past data. Make them strong, simple, and adaptable to real market conditions.

Have you faced this issue before? Let’s discuss in the comments and help each other improve!

Important section: 155.69-180.14

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost".

Have a nice day today.

-------------------------------------

(AAVEUSDT 1M chart)

The important support and resistance section is 155.69.

If it falls without support at 155.69, it is likely to fall to around 81.44.

If it rises with support at 155.69, it is expected to rise to around 332.71.

The 155.69 point is the HA-High indicator point on the 1M chart.

-

(1W chart)

If it falls from 155.69,

1st: 115.70

2nd: 64.26-81.44

We need to check for support near the 1st and 2nd above.

If it rises from 155.69,

1st: Fibonacci ratio 0.236 (202.92)

2nd: 302.67

We need to check for support near the 1st and 2nd above.

This shows that the area around 155.69 is an important support and resistance area.

-

(1D chart)

Therefore, the area we should be interested in is checking for support near 155.69-180.14.

Since the OBV indicator is renewing the low line, the key is whether it can rise above 155.69 this time.

Therefore, if possible, when it is confirmed to be supported near 180.14, it is the time to buy.

An aggressive buy is when it rises above 155.69 and receives support.

If it fails to rise above 155.69, if possible, it is recommended to not buy and watch the situation.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

The key is whether it can rise above 2.2582

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(XRPUSDT 1D chart)

Important support and resistance areas are

- 2.5641,

- 1.9513,

- 1.5467.

Among them, the 1.9513 point corresponds to the volume profile area, so it can be seen as an important support and resistance area.

A trend is created when the 2.5641 or 1.5467 point is broken, so the trend is expected to be determined depending on which of these points is broken.

-

What you should pay attention to is that the OBV indicator is renewing the low.

This time, if it rises above 2.2582 and maintains the price, we should see if the OBV rises and renews the high.

If not, it is expected to fall below 1.9513.

-

Therefore, the first purchase period is when support is confirmed around 2.2582.

The second purchase period is when support is confirmed around 2.5641.

An aggressive purchase is when it falls below 1.9513 and then shows support again around 1.9513.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015 and has been rising.

In other words, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it shows up to 3.618 (178910.15).

Fibonacci ratio 0.618 (44234.54) is not expected to fall again.

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

The key is whether it can rise to around 0.18951

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(DOGEUSDT 1D chart)

Most coins (tokens) are below the M-Signal indicator on the 1D chart.

In order to turn into a short-term uptrend, the price must be maintained above the M-Signal indicator on the 1D chart at least.

-

In order to continue the uptrend, the price must be maintained above the M-Signal indicator on the 1M chart.

Therefore, what we should be interested in is whether there is support around 0.18951.

Then, if it rises above 0.21409 and maintains the price, an uptrend is expected to begin.

-

If not and it falls, it is important to find support near 0.13377.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902(101875.70) ~ 2(106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an uptrend following a pattern since 2015.

That is, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

Check if it can rise along the rising trend line (2)

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

We need to see if USDT and USDC can continue the gap uptrend.

-

(BTC.D 1M chart)

If BTC dominance rises above 62.47 and maintains or continues to rise, altcoins are likely to record a larger decline.

Therefore, you should think about how to respond to the altcoins you are trading.

If the uptrend continues, it is expected to rise to the Fibonacci ratio range of 0 (73.63) ~ 1 (77.07).

In order for the altcoin bull market to begin, it must fall below 55.01 and be maintained or show a downward trend.

-

(USDT.D 1M chart)

In order for the coin market to begin an upward trend, the USDT dominance must fall below 4.97 and be maintained or show a downward trend.

If it does not, and it rises, the coin market is likely to show a downward trend.

We need to see if it can meet resistance near the Fibonacci ratio of 0.618 and fall.

If not, the coin market will show a large downward trend as it rises to around 7.14.

-

USDT is likely to continue to rise.

This is because it is the fund that supports the coin market.

Due to this, USDT dominance is also likely to continue its upward trend.

Therefore, rather than following the overall flow of USDT dominance, it is better to look at where it starts to decline.

-----------------------------------------

(BTCUSDT 1D chart)

Whether the price can be maintained above the M-Signal indicator on the 1D chart while maintaining the price above the upward trend line (2) and passing through April 4-6 is the key.

In order to continue the upward trend, it must rise above 89294.25, so if possible, we should also look at whether it can rise above 89294.25.

If it does not and falls along the downward trend line, it is possible that it will touch around 73499.86 during the volatility period around April 25.

-

The most recently formed high-point trend line is trend line (3).

And, the recently formed low-point trend line is the (2) trend line.

Since these two trend lines are not moving in one direction, we can see that we are currently in the volatility zone.

If the StochRSI indicator rises this time and forms a peak in the overbought zone and then falls, the high-point trend line will draw an upward trend line like the low-point trend line.

When that happens, it seems likely that the trend will start.

Therefore, the point of interest is whether the two volatility periods in this April, around April 5 and around April 25, will become turning points.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire BTC range.

I rewrote the previous chart to update it by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year upward trend and faces a 1-year downward trend.

Accordingly, the upward trend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

Fibonacci ratio 0.618 (44234.54) is not expected to fall again.

(BTCUSDT 12M chart)

Looking at the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.