Accurately capture the gold pullback, shorting is the right timeDuring this period, spot gold has been like a rocket, advancing all the way and firmly in the upward channel. I have repeatedly reminded everyone before that once the US tariff stick is swung, the gold price will definitely rush up like a chicken blood. No, the facts prove that our prediction is quite reliable!

Tonight, the market ushered in another "big news" - the release of CPI data. As soon as this data came out, it directly gave the gold price a "heart shot", and the gold price was instantly pushed to around US$3160. This rise is too crazy! Interpret this data as soon as possible and pay close attention to the reaction of the gold market.

However, when the gold price rose to the previous high of US$3158-3168, it was like hitting a wall and began to "struggle". From my technical analysis point of view, there is a relatively strong resistance level in this range. It's like a person climbing a mountain, climbing to a certain height, and encountering a steep cliff. If you want to continue to go up, you have to work hard. At present, the gold price is under pressure at this position, and there are some signs of a correction. This provides us investors with a small opportunity to consider trying a short position here and earn some spread profits. I also suggest that investors can properly seize this short-term opportunity.

For example, the current gold market is like a fierce football game. The long team is strong and has been attacking all the way, and is in a dominant position. The short team can only seize the opportunity occasionally and make a quick counterattack. We investors are like coaches, and we must arrange tactics reasonably according to the situation on the field. When the long side is dominant, we can use short selling to increase our profits in a timely manner. I hope everyone can accurately grasp the market rhythm like an excellent coach.

Trend Lines

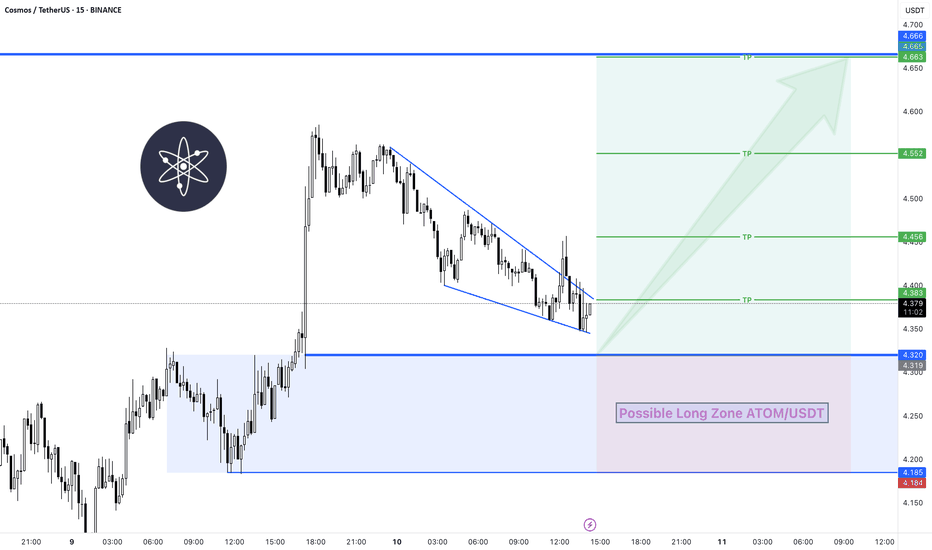

Long Position ATOM/USDT🚀 ATOM/USDT – Falling Wedge Breakout in Progress

The price just broke out of a falling wedge for retesting the major support zone (🔵 4.32 to 4.185). This is a classic bullish reversal setup forming at the right spot.

📈 Long Bias Activated

Momentum is building for a potential multi-TP run if the breakout holds.

🟢 LONG Position Entry: 4.32 to 4.185

✅ Target1@ 4.383

✅ Target2 @ 4.456

✅ Target3 @ 4.552

✅ Target4 @ 4.663

🔴 Risk Level: Invalid below 4.185

🧠 Why it matters:

Wedge formations often lead to explosive breakouts. With the structure forming at demand, this could be a liquidity sweep followed by a rally.

POINT: Next Possible 🔴 Short Zone could be around 4.666

EUR/USD keen to go LONG.1/ The last quarter of 2022 printed an Engulfing Bull Candle before price went into a 28 month Range.

2/ The Range Low has recently been 'swept' by January 2025's low, while at the same time respecting the afore mentioned '22 final quarter 50% level and breaking out of the (almost 20 year old) decending Channel.

3/ I believe price is about to Break Out Long from the 2 year Range and target the quartly Fair Value Gap at 1.3 - 1.35.

Possible Mid-Term Long Position BTC/USDT before Short to 73,700🔥 BTC/USDT – Key Demand Zone Holding

Bitcoin tapped into a high-probability long zone (78,318 - 77,979) after a sharp retracement — and we’re already seeing signs of a short term bullish reaction.

🟣 Zone to Watch:

“Possible Long Zone” marked in Red — structurally aligned with previous breakout demand.

Price tapped into the “Possible Long Zone” with precision — strong reaction confirms it’s a high-probability entry area for bulls.

🟢 Key Zone Support: 78,318 - 77,979

🎯 Take-Profit Zones:

✅ TP1: 79,417

✅ TP2: 80,526

✅ TP3: 81,839

✅ TP4: 83,510 (Final Zone)

❌ Invalidation Level: 75,783

(Break below this = setup fails)

🚀 Momentum is building.

🧠 Narrative:

This looks like a retest before continuation. If price consolidates above 78,800 with volume, the next impulse could send us toward new local highs.

🎲 Context:

This looks like a smart money move — liquidity grab below support, followed by a strong rejection.

Bull market hides falling crisis!Gold rose sharply to around 3170 in the short term. Gold is in an obvious bull market. I think we should not be too optimistic! Don't blindly chase gold in trading!!!

Although it is only one step away from the previous high, it not only faces the psychological resistance of 3200, but also multiple integer resistance. After the fundamental positive factors are exhausted, it is difficult for gold to have enough power to continue to rise and break through the heavy resistance.

So the sharp rise of gold is likely to be a bull market trap, in order to confuse more people to chase gold, and large institutional funds take the opportunity to sell! So in terms of short-term trading, I still will not vigorously chase long gold, I will start to short gold gradually in batches! The faster gold rises, the faster it may collapse!

Bros, I am not afraid of shorting gold now. I think short trading can also bring me huge profits. The retracement target first focuses on the area around 3135.The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Bitcoin Trendline support soon can pump it to 83K?Trendlines are one of the major supports or resistances and on this Bitcoin chart we can see few examples which price react well to them and start to pump from green trendlines and sometimes dump from red trendlines and it is easy to draw one just and simple like drawing support line this time try to find support line which is Diagonal and one or two touch with this trendline you can find next support which is third touch and you can set your buy there like below example:

also sometimes trendline broke and their support turn to resistance and after retest of breakout you can enter sell like example:

there are so many rules about trendline like when it can break or after how many touches trendline lose it's power and ... we can discuss in comments more about them so ask any questions there and lets discuss.

Also this is educational post and Bitcoin right now may respect this trendline and hit 83K$ as target or in this bear market this support can also break and we can expect next bear targets like 69K$ then.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

AUDJPY Elliott Wave Analysishello friends

In the AUDJPY currency pair, we see the formation of a 5-wave pattern in the dominant wave (B). Before these 5-waves, we see a strong downward movement. which we call wave (A).

These 5 waves have modified the previous powerful movement, and the corrective movements are always more complicated and time-consuming than their previous wave.

Therefore, it is more likely that the price will return to its original movement.

Therefore, with the hypothesis of continued downward movement, we are waiting for the break of the trend line drawn at the 5-wave bottom (wave B) and with the break and pullback, we can enter into a sale transaction.

To support me, I recommend you install Trading View software on your phone and see my analysis and support me with your comments and Boost. Be successful and profitable.

NIFTY taking support ! Signs of REVERSAL!!?Following the global cues, the gains has been nullified by today’s fall in global market which can lead to not so strong of a opening but in a broader view NIFTY seems to be taking support at the falling wedge structure which is a potential signs of REVERSAL and strength hence as long as NIFTY maintains itself above the structure, every dip can be bought despite of global volatility so keep watching everyone and plan your trades accordingly.

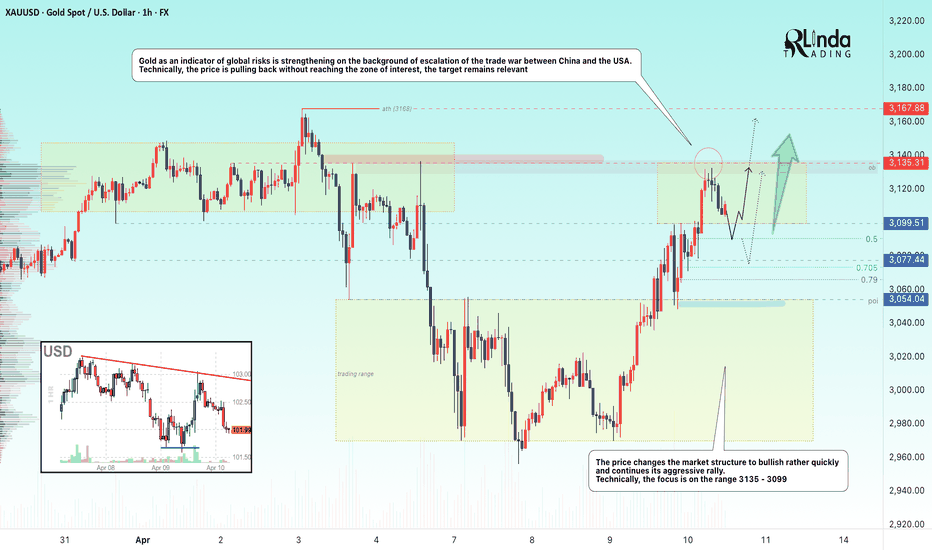

GOLD → Global economic risk indicator consolidates ahead of CPIFX:XAUUSD , rather quickly changes the market structure to bullish and continues its aggressive rally. The economic risk indicator is working perfectly. Technically, the focus is on the range 3135 - 3099

Gold is consolidating around $3,100 in anticipation of US inflation data. The escalating trade war between the US and China keeps demand for defensive assets alive despite the pause in price gains. Trump imposed 125% tariffs on Chinese goods and China retaliated with duties of 84% on U.S. imports. Increased tariff tensions are raising recession expectations and encouraging bets on a Fed interest rate cut, which supports gold. However, a rise in March CPI inflation (expected 2.6% y/y) could trigger a downward correction, although the impact could be short-lived - tariff news remains the main driver

Technically, the price failed to reach the 3135 liquidity zone and reversed, which attracted the crowd willing to sell (deceptive maneuver). But, after correction the price may return to the target quite quickly

Resistance levels: 3135, 3167

Support levels: 3100, 3090, 3077

Emphasis on the range boundaries, possible retest of 3100-3090- 3075 before continuation of growth. On the news or before the opening of the American session there may be a long squeeze before the continuation of growth.

Regards R. Linda!

Comprehensive Research - McDonald’s Stock Set to SoarQuick read:

McDonald's stock is poised for a bullish move, with Wave 3 likely starting and strong support near 290.50–295.00. Traders should long on dips within this range, for next resistance levels, 326.00 and 348.00 with a invalidation below 276.00. This setup offers a solid risk-to-reward in a long-term uptrend. Alternative safe entry is possible after the break of corrective channel breakout of wave (2).

Elliott Wave Forecast:

TF - Daily

The chart suggests that McDonald’s stock is in the middle of a larger upward move known as Wave C, which comes after completing a complex correction. Wave C is expected to unfold in five smaller waves, a pattern that usually points to a strong uptrend. It appears the correction is behind us, and a fresh bullish phase is underway.

Starting from the low at 276.53 , marked as Wave B, the price climbed to 326.32 , forming Wave one. After that, the stock pulled back to 290.50 , forming Wave two. This pullback followed a typical ABC pattern within a corrective channel, which often signals the end of a downturn and the beginning of an upward move.

Now, Wave three seems to be starting, and this is usually the strongest part of Wave C. The price is expected to move above 335 , take a small pause for Wave four, and then rise again to complete Wave five somewhere around 345 to 350 dollars. This positive outlook remains intact as long as the price stays above 290.50 . With the breakout from the corrective channel, the setup looks strong and clear for buyers.

Fibonacci levels:

Fibonacci Extension Targets:

1.000 extension: 326

1.618 extension: 348

Correction Retracement Levels:

Wave 2 retracement: 78.6%

A = C in A-B-C correction: 289.21

Price Action & shifting of value:

TF: Weekly

McDonald’s stock has been steadily climbing inside a rising channel since late 2020, showing a clear long term uptrend. The price has respected both the top and bottom edges of this channel very well, and interestingly, the middle line has acted like a pivot, providing support or resistance multiple times over the years.

Recently, the stock made a higher low at 276.53 and bounced back strongly, keeping the bullish structure intact. It then pulled back to 290.50 , right around the middle line of the channel, and held above an upward sloping trendline. This kind of price action shows strength and suggests buyers are stepping in.

The sharp move from 276.53 up to current levels looks like a strong bullish leg, possibly driven by accumulation. If the stock can break above its recent high of 326.32 , it could head toward the upper end of the channel. As long as the price stays above 290.50 and especially above 276.53 dollars, the bulls remain in control. Even if the price dips a bit, the long term trend stays positive unless the lower boundary of the channel breaks down.

I will update more Information here.

DOGE → Will the market hold strength or lose it all?BINANCE:DOGEUSDT is testing the liquidity and resistance zone amid a downtrend as part of a news-induced rally. Will the market hold this trend or return to a sell-off?

The downtrend continues. As part of the correction triggered by the news backdrop, bitcoin strengthened and pulled the altcoins with it. But the market may lose all its growth quite quickly, as bearish pressure on the market is still very strong (There are no fundamental positive changes for the market). The fall of BTC may be followed by DOGE as well.

Technically, the price is forming a false break of the resistance zone 0.1622 - 0.15700, consolidation of the price below this zone will provoke the continuation of the fall to the nearest zone of interest 0.13646.

Resistance levels: 0.157, -0.1622

Support levels: 0.13646, 0.1277, 0.1154

A retest of the trend resistance is possible, but price consolidation below the key zone will be a good signal indicating the seller's strength, the decline may continue. On the weekly timeframe we have a trigger at 0.14217, break of which will open the way to 0.1277 - 0.1025.

Regards R. Linda!

I Came Back As A Gold TraderThis is a short detailed video about my journey and transition from PEPPERSTONE:NAS100 to NASDAQ:XAU . For Gold, I see a very big push for a new all time high at 3189-3200. All this is possible if the previous high gets a solid break since there's been a major resistance in the area. I'm currently in the trade and added another just incase. Let's see how this plays out..

Will gold fall after a strong rise Goldmarket analysis referenceAnalysis of gold market trend: Today's gold is still fluctuating greatly under the influence of tariffs. Today, we have analyzed that gold has the risk of callback, and long positions are also falling back to lows! Trend realization analysis and ideas! From the surge on Wednesday, it can be seen that the risk aversion sentiment of gold has heated up again. The current highest is 3132, which is the first target point for the rise. If it continues to rise, it can see 3150 above, so there is still a lot of room above. Everyone should pay attention to trading with the trend as much as possible. In addition, there is another uncertain factor today. The US market will release CPI data, which will also bring abnormal fluctuations in gold. Therefore, the market will also fluctuate greatly today. Everyone should pay attention to controlling risks and managing positions well.

From a technical point of view, a positive line on the daily line directly changed the extremely weak adjustment state in the previous period. Now the positive line breaks the middle track of Bollinger and pulls up the moving average. Then, gold has entered an extremely strong state of bullish trend. In this state, it will continue to rise to the previous high of 3150. Therefore, the main direction today is definitely bullish. It is normal for the small cycle to adjust under the pressure of 3100. Now the Bollinger of the 4-hour cycle has just opened, and the unilateral trend has just taken the first wave of strength. There is no problem in the next wave to rise to the high point of the daily cycle. Therefore, as long as the 4-hour cycle falls back to the support of the unilateral moving average, it is an opportunity to do more. The support below is around 3070, and the rise of the hourly cycle is around 3060. Therefore, today's gold bullishness is expected to consider 3080 or 3070. The rise in the Asian and European sessions is still at 3130. If the US session breaks through 3136, consider seeing the high point of 3150. On the whole, today's short-term operation strategy for gold is to short on rebounds and to buy on pullbacks. The upper short-term focus is on the 3136-3155 resistance line, and the lower short-term focus is on the 3080-3078 support line. Friends must keep up with the rhythm. You must control your positions and stop losses, set stop losses strictly, and do not resist single operations. The specific points are mainly based on real-time intraday trading. Welcome to experience and exchange real-time market conditions.

Gold operation strategy reference: Short order strategy: Strategy 1: Short gold rebounds near 3133-3136, with a target of 3100-3090, and a break to look at the 3080 line.

Long order strategy: Strategy 2: Go long near the 3078-3080 pullback of gold, with a target of 3105-3125, and a break to look at the 3135 line.

Bitcoin -Weekly, Daily, H4, H1 Forecasts, Trading IdeasMidterm forecast, Weekly Timeframe:

While the price is above the support 70550.04, resumption of uptrend is expected.

We make sure when the resistance at 91037.20 breaks.

If the support at 70550.04 is broken, the short-term forecast -resumption of uptrend- will be invalid.

BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

Daily Timeframe:

A trough is formed in daily chart at 74545.70 on 04/09/2025, so more gains to resistance(s) 86499.57 and maximum to Major Resistance (91037.20) is expected.

Take Profits:

86499.57

91037.20

94505.46

98675.19

101430.12

105431.17

109932.89

115000.00

120000.00

125000.00

130000.00

140000.00

H4 Timeframe:

H1 Timeframe:

________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

Dow in relief until MayYesterday's historic bounce reacted a little to perfectly to the monthly trend-line pictured. Whether coincidence or not, this break in momentum will likely provide an interim bottom to the downtrend and give us a few weeks of reprieve before continuing with the bear market. $37,000 the level to watch.

My outlook is generally still flat although it is useful to remember that the biggest pumps happen during a bear cycle. We also have a full blown trade war on our hands so keep risk tight and trade with caution.

ASML - Nailed our short trade! How, Why, and What now?If you watched my video on why I was shorting ASML last week, you'd be quite pleased with the subsequent dump. This wasn't luck - this was understanding the algorithms, the basics of market dynamics and supply and demand, and doing what we do best - sniping a good entry to allow the HTF algorithms to be in control.

Let's keep this momentum up as the market and individual equities continue to offer us excellent trade opportunities!

If you haven't watched my SPY video that I just posted, please check it out as it's extremely important to keep an eye on the broader markets as a gauge as to when these liquidity builds might be happening and to understand if the market's movements are just that, liquidity building, or continuation.

Happy Trading :)

ASML - An exciting short trade I've been preparing forI've been analyzing price action on ASML for a few months and am very excited to finally be entering a position here once all the confluences line up. Lots of chop recently and price is still deciding where it wants to land. Luckily, utilizing algorithms and known S&D, we can get a good picture of which way and where that will be.

Happy Trading :)

Bitcoin Short-Term Setup: Watch $79K Resistance!!!Bitcoin ( BINANCE:BTCUSDT ) started to fall again ,as I expected in the previous post .

This post is also a short-term analysis and is on the 15-minute time frame .

Bitcoin is moving near the Potential Reversal Zone(PRZ) .

In terms of Elliott Wave theory , Bitcoin appears to have completed a 5-wave downtrend on the 15-minute timeframe.

I expect Bitcoin to continue its upward trend in the coming hours , at least to the Resistance zone($79,350-$78,540) .

Note: If Bitcoin falls below $75,470, we can expect further declines.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Trade the range until it breaks Nvidia updateThis video is a quick recap on the previous video after the levels I gave produced 30% move to the upside after patiently waiting for the move down to 90$.

So what now is the big question after the unprecedented move we had yesterday .

I outline the next best Short/Long setup and define why I think we stay inside of the range until Earnings Data .