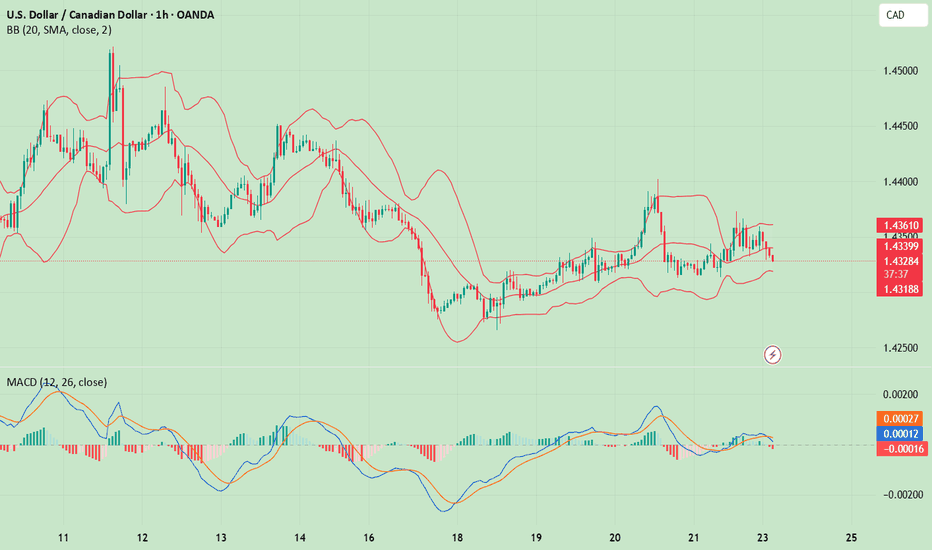

USD/CAD(20250404)Today's AnalysisMarket news:

Countermeasures from many countries against the United States - ① It is reported that Europe will slow down the pace of tariff retaliation; EU member states will vote on countermeasures against US steel and aluminum tariffs on April 9; ② Macron said that the response to US tariffs will be larger than before, and called on French companies to suspend investment in the United States. France may plan to impose retaliatory tariffs on large US technology companies. ③ Canadian Prime Minister Carney: Canada will impose a 25% tariff on all cars imported from the United States that do not comply with the US-Mexico-Canada Agreement.

Technical analysis:

Today's buying and selling boundaries:

1.4147

Support and resistance levels:

1.4436

1.4328

1.4258

1.4036

1.3966

1.3858

Trading strategy:

If the price breaks through 1.4147, consider buying, the first target price is 1.4258

If the price breaks through 1.4036, consider selling, the first target price is 1.3966

Usdcadsell

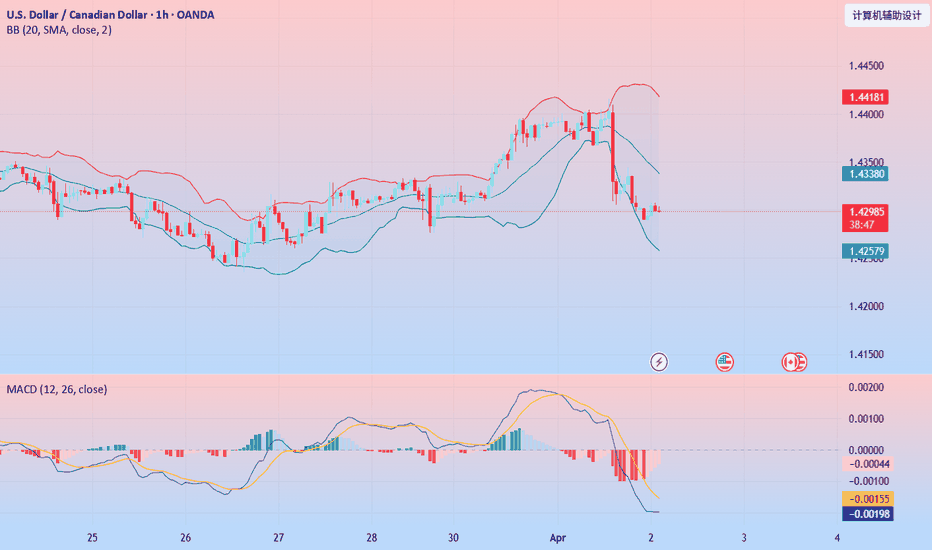

USD/CAD(20250402)Today's AnalysisToday's buying and selling boundaries:

1.4337

Support and resistance levels

1.4454

1.4410

1.4382

1.4293

1.4265

1.4221

Trading strategy:

If the price breaks through 1.4337, consider buying, the first target price is 1.4382

If the price breaks through 1.4293, consider selling, the first target price is 1.4265

USD/CAD(20250325)Today's AnalysisToday's buying and selling boundaries:

1.4294

Support and resistance levels:

1.4357

1.4333

1.4318

1.4270

1.4255

1.4232

Trading strategy:

If the price breaks through 1.4294, consider buying, the first target price is 1.4318

If the price breaks through 1.4270, consider selling, the first target price is 1.4255

USD/CAD(20250325)Today's AnalysisToday's buying and selling boundaries:

1.4318

Support and resistance levels:

1.4379

1.4356

1.4342

1.4295

1.4280

1.4257

Trading strategy:

If the price breaks through 1.4342, consider buying, the first target price is 1.4356

If the price breaks through 1.4295, consider selling, the first target price is 1.4280

USD/CAD(20250324)Today's AnalysisToday's buying and selling boundaries:

1.4345

Support and resistance levels:

1.4404

1.4382

1.4368

1.4322

1.4308

1.4286

Trading strategy:

If the price breaks through 1.4345, consider buying, the first target price is 1.4368

If the price breaks through 1.4322, consider selling, the first target price is 1.4 308

USD/CAD Ready To Go Down Hard , Let`s Sell It To Get 250 Pips !As we see we have a very good daily closure below sideway range and we have avery good retest to the area and the price gave amazing bearish price action , so i`m looking to sell this pair today or tomorrow morning when the price go backa litle to give me a good chance to put a small sl , and i think the price will go down very hard at least 200 Pips .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

USD/CAD Full Analysis , Best Place To Sell&Buy To Get 250 Pips !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

Potential Short on USDCADOANDA:USDCAD had been caught up in a consolidation phase for a while, trapped within the range at 1.4465 and 1.43424. We saw a breakout to the lower side and its retest which can potentially lead to a drop in the market. I will place my target at 1.38799.

Do your Due diligence, past results does not guarantee future results

Massive Reversal Incoming? USDCAD Showing Exhaustion Signals!(Apologies if the video is hard to understand—I bit my tongue during boxing sparring this morning!)

USDCAD has been on an incredible 17-week rally, but the price now appears extremely overextended and is showing signs of exhaustion.

Yesterday's NFP report brought a huge upside surprise, fueling a strong USD rally against all major currencies. While EURUSD, GBPUSD, NZDUSD, and AUDUSD all hit multi-year lows, USDCAD initially spiked higher but then sold off sharply, closing the day just above 1.44.

This marks the first clear sign of buying exhaustion—despite USD strength across the board, USDCAD failed to make new highs.

Additionally, this week’s candle formation caught my eye. It looks like a classic hanging man pattern, which typically appears at the top of a move, signaling an imminent reversal.

Zooming into the daily charts, we can see a clear distribution range forming, with sideways price action after a strong rally. The MACD is showing divergence, and recent price increases have been accompanied by negative volume—another strong indicator of a potential reversal.

As explained in the video, I see two likely scenarios for entering this trade:

False Breakout: A spike above the distribution range, potentially towards or just above 1.45, followed by a sharp sell-off. This would be my preferred entry.

Big Red Candle: A strong bearish candle early next week, signaling it’s time to enter short.

For this position, my first target is the previous monthly resistance at 1.405, and my second target—more likely—is 1.385, which is now a support level.

While I expect some bounce at these levels, I believe the longer-term move will see USDCAD fall back into its range, with a potential drop toward 1.32 very much on the cards.

Let me know your thoughts below!

USDCAD - ShortUSDCAD Analysis - SHORT 👆

In this Chart USDCAD DAILY Timeframe: By Nii_Billions.

❤️This Chart is for USDCAD market analysis.

❤️Entry, SL, and Target is based off our Strategy.

This chart analysis uses multiple timeframes to analyze the market and to help see the bigger picture on the charts.

The strategy uses technical and fundamental factors, and market sentiment to predict a BEARISH trend in USDCAD, with well-defined entry, stop loss, and take profit levels for risk management.

🟢This idea is purely for educational purposes.🟢

❤️Please, support our work with like & comment!❤️

USDCAD SELL | Idea Trading AnalysisUSDCAD is moving on Resistance zone..

The chart is above the support level, which has already become a reversal point twice.

We expect a decline in the channel after testing the current level.

We expect a decline in the channel after testing the current level

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity USDCAD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

Key Support in Focus: USD/CAD Downside Ahead?USD/CAD Analysis (4H) :

USD/CAD is forming a bearish wedge pattern, with price breaking below the ascending trendline. The pair is currently testing a support zone near 1.4350. If this level fails, further downside toward 1.4200 is expected.

RSI also signals weakening momentum, supporting the bearish outlook. Watch for a confirmed breakdown for potential short setups.

USDCAD - Long after filling the imbalances !!Hello traders!

‼️ This is my perspective on USDCAD.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. My point of interest is if price fills the imbalance lower and then rejects from bullish OB.

Fundamental news: On Tuesday (GMT+2) we will see results of CPI on CAD and on Wednesday Interest Rate on USD, followed by FOMC Conference.

Like, comment and subscribe to be in touch with my content!

USDCAD scalp short on exhaustion reversal

As always, we like to keep it clean and simple, with technicals and analysis that's easy to see and understand. Let's get into it:

1. Wave 5 exhaustion on mult timeframes

2. Overbought 30m/1h/1D

3. Shooting star candle printed on 1h

Analysts note that USDCAD is trading within a rising channel since late September, recently peaking at 1.4178. The bullish momentum suggests potential for further gains, but short-term corrections (ie. why we're scalping) are common as traders take profits and reassess positions.

Market Sentiment and Data Releases: With key U.S. and Canadian employment data released recently, markets may experience volatility as traders digest the information. This can often lead to short-term corrections as the market adjusts to new economic indicators.

Be Alert.

Trade Green.