#USDCAD: Two Major Buying Zones, Patience Pays! As previously analysed, USDCAD is expected to decline towards our predetermined entry point. We anticipate a bearish US Dollar for the remainder of the week, which will ultimately lead USDCAD to reach the entry zone. Three distinct target areas exist, collectively worth over 1100 pips. Each entry point, stop loss, and take profit is clearly defined.

We wish you the best of luck and safe trading.

Thank you for your support.

If you wish to assist us, we encourage you to consider the following actions:

- Like our ideas

- Provide comments on our ideas

- Share our ideas

Kind Regards,

Team Setupsfx_

Much Love ❤️🚀

Usdcadsetup

USD/CAD: Time to Go Long?On the monthly chart, USD/CAD has found strong support, signaling a potential bullish continuation. With anticipated USD strength in the coming weeks, there’s a clear opportunity for the pair to move higher.

We are targeting 1.40180 as the first objective, with the potential to extend towards 1.41500 if momentum continues.

On the daily chart, the price is showing signs of weakness but also bullish intent, suggesting a possible retracement before a move higher. Ideally, a pullback into the 1.38490 – 1.38450 zone would offer a high-probability long entry.

Market Analysis: USD/CAD DipsMarket Analysis: USD/CAD Dips

USD/CAD declined and now consolidates below the 1.3850 level.

Important Takeaways for USD/CAD Analysis Today

- USD/CAD started a fresh decline after it failed to clear the 1.3900 resistance.

- There is a major bearish trend line forming with resistance at 1.3815 on the hourly chart at FXOpen.

USD/CAD Technical Analysis

On the hourly chart of USD/CAD at FXOpen, the pair climbed toward the 1.4000 resistance zone before the bears appeared. The US Dollar formed a swing high near 1.3890 and recently declined below the 1.3850 support against the Canadian Dollar.

There was also a close below the 50-hour simple moving average and 1.3820. The bulls are now active near the 1.3770 level. The pair is now consolidating losses below the 23.6% Fib retracement level of the downward move from the 1.3892 swing high to the 1.3768 low.

If there is a fresh increase, the pair could face resistance near the 1.3800 level. The next key resistance on the USD/CAD chart is near the 1.3815 level.

There is also a major bearish trend line forming with resistance at 1.3815. If there is an upside break above 1.3815, the pair could rise toward the 1.3845 resistance or the 61.8% Fib retracement level of the downward move from the 1.3892 swing high to the 1.3768 low.

The next major resistance is near the 1.3890 zone, above which it could rise steadily toward the 1.3950 resistance zone. Immediate support is near the 1.3770 level.

The first major support is near 1.3720. A close below the 1.3720 level might trigger a strong decline. In the stated case, USD/CAD might test 1.3640. Any more losses may possibly open the doors for a drop toward the 1.3550 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

#USDCAD 1HUSDCAD (4H Timeframe) Analysis

Market Structure:

The price has broken above a key resistance level and is currently showing signs of a retest. A successful retest of the broken resistance as support indicates that buyers are maintaining control, suggesting potential for further upward movement.

Forecast:

A buy opportunity can be considered if the price confirms the retest and starts to show bullish momentum, supporting the continuation of the breakout move.

Key Levels to Watch:

- Entry Zone: Look for buying signals around the retest area of the previous resistance turned support.

- Risk Management:

- Stop Loss: Placed below the retest support zone to manage downside risk.

- Take Profit: Aim for higher resistance zones or key Fibonacci extension levels as potential targets.

Market Sentiment:

The breakout followed by a retest suggests a shift toward bullish sentiment. However, proper confirmation through bullish candlestick patterns or momentum indicators is advised before entering the trade.

#USDCAD: 1000+ Pips Big Bullish Move With Three TargetsThe USDCAD is currently in a bearish trend since the day has dropped significantly and is still falling. We anticipate the price to drop slightly more before it reaches our entry zone. There are two entry points, and you can choose either one that aligns with your views. There are three targets, and you can set take profit targets that suit you best.

Good luck and trade safely.

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

usdcad buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

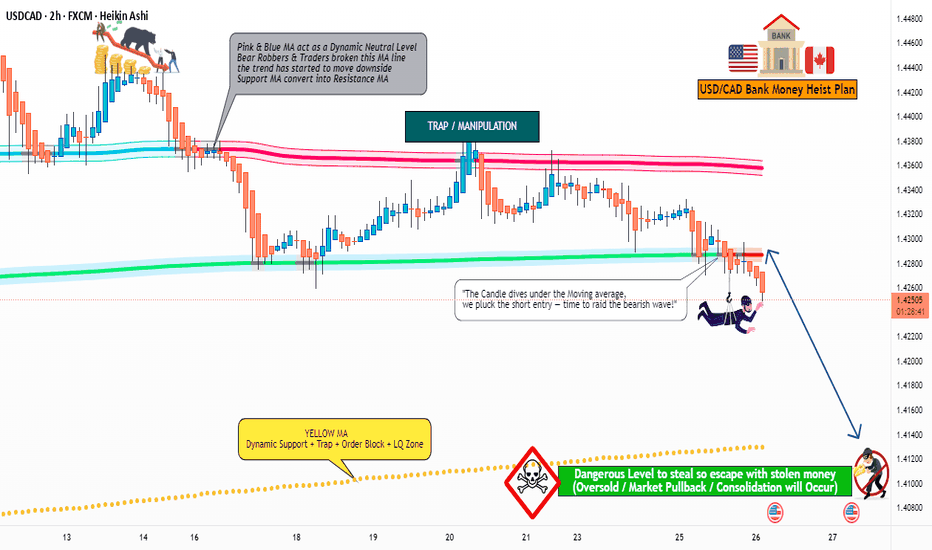

USD/CAD "The Loonie" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD "The Loonie" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (1.41400) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the MA level Breakout Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 1H timeframe (1.42800) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.40000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💸💵USD/CAD "The Loonie" Forex Bank Heist Plan (Swing/Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"USD/CAD Short Setup – Supply Zone Rejection & Bearish Target 🔵 Supply Zone

📍 Marked between 1.39039 and 1.39624

🔥 Strong selling pressure area

🧱 Price previously dropped from here — possible resistance again.

🎯 Trade Setup

🟢 Entry Point

⚡ 1.39039 (just below supply zone)

Waiting for price to tap the zone and show bearish confirmation

❌ Stop Loss

🚫 1.39624 (above supply zone)

Break above invalidates the setup

🏁 Target Point

🎯 1.36510

Based on previous support area

Potential profit of ~245 pips

📊 Risk-to-Reward Ratio

📉 Risk: ~58 pips

💰 Reward: ~245 pips

🧮 R:R = 1:4.3 — excellent!

📈 Trend Confirmation

📉 Price below EMA (7) — short-term bearish

🧠 Momentum supports sell setup

🗓️ Economic Events Incoming

📢 News icons suggest upcoming events that may cause volatility

⚠️ Be cautious with timing — news may shake the market!

USDCAD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

USD/CAD "The Loonie" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD "The Loonie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.40500) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.36000 (or) Escape Before the Target

USD/CAD "The Loonie" Forex Market Heist Plan (Day / Swing Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

#USDCAD: We took the Swing Sell, Now let's focus on Swing Buy! The USD/CAD exchange rate experienced a significant decline, reaching its all-time high against the USD. This decline is primarily attributed to the ongoing trade dispute between China and the United States, which has led to a depreciation of the USD and resulted in a yearly low.

However, we anticipate a potential reversal in the price trajectory. We identify a favourable area where the price may stabilise and address the liquidity gap it has created.

We have established three targets, and to effectively utilise these targets, we recommend executing small entries with each target set based on a predetermined take-profit level.

We extend our sincere gratitude for your unwavering support throughout this journey within this community. Additionally, we appreciate the contributions of each individual who has supported our endeavours. We are pleased to announce that we have garnered 20,000 followers.

Much Love,

Team Setupsfx_

❤️🚀

#USDCAD: Two Big Target Accumulating of 800+ Pips! **USDCAD **

Following the US President’s decision to impose a 25% tariff rate on Canada, the USD/CAD exchange rate experienced a significant surge, reaching approximately 1.49. However, as the market has stabilised, we anticipate a gradual decline in the exchange rate, which may help bridge the liquidity gap.

Two prominent red lines serve as potential entry and stop-loss points. Additionally, two designated targets are set as swing take-profit areas.

We appreciate your unwavering support. Should you have any inquiries regarding the strategy or any trading-related questions, please do not hesitate to provide feedback.

Team Setupsfx_

USD/CAD "The Loonie" Forex Bank Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD "The Loonie" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑: Thief SL placed at 1.43600 (scalping / Day Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.41300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/CAD "The Loonie" Forex Bank Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/CAD "The Loonie" Forex Bank (Swing Trade) Heist Plan 🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD "The Loonie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on! profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (1.44500) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Primary Target - 1.41500 (or) Escape Before the Target

🏴☠️Secondary Target - 1.39500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

USD/CAD "The Loonie" Forex Bank Heist Plan (Swing Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/CAD Very Near Buying Area , Are You Ready To Get 200 Pips ?This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

USD/CAD "The Loonie" Forex Market Money Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the USD/CAD "The Loonie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (1.44500) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.39500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook before start the plan.

USD/CAD "The Loonie" Forex Market is currently experiencing a bearish trend,., driven by several key factors.

1. Fundamental Analysis

Fundamental analysis evaluates the economic indicators of the United States and Canada that directly impact the USD/CAD exchange rate.

United States Economic Indicators:

GDP Growth: Forecasted at 2.0% to 2.5% for 2025, suggesting steady but slowing economic expansion.

Inflation: Stable at approximately 2.5% to 3.0%, with recent data showing no significant surprises.

Interest Rates: Currently at 4.50%, with the Federal Reserve potentially considering cuts later in 2025 if economic growth weakens.

Trade Balance: The US maintains a persistent trade deficit, though it remains manageable given the broader economic context.

Canada Economic Indicators:

GDP Growth: Projected at 1.0% to 1.5% for 2025, indicating moderate growth heavily tied to commodity exports.

Inflation: Around 2.0%, stable but sensitive to fluctuations in energy prices.

Interest Rates: Set at 3.0%, with the Bank of Canada (BoC) likely to hold steady or adjust slightly based on incoming economic data.

Trade Balance: Mixed, with oil exports being a critical driver of the Canadian Dollar (CAD).

Key Insight: The interest rate differential (4.50% in the US vs. 3.0% in Canada) currently supports the USD. However, declining oil prices—a key factor for Canada—and potential Fed rate cuts introduce uncertainty into the fundamental picture.

2. Macroeconomic Factors

Macroeconomic conditions provide a broader context for currency movements, encompassing global and country-specific trends.

Global GDP Growth: Expected to range between 3.0% and 3.3% in 2025, reflecting moderate global economic expansion.

US Economy: Exhibits signs of slowing growth, with the Federal Reserve adopting a cautious stance, potentially leading to rate cuts if economic conditions deteriorate.

Canadian Economy: Strongly influenced by commodity prices, especially oil, which has faced volatility due to global supply and demand dynamics.

Central Bank Policies: The Fed is in a wait-and-see mode, while the BoC remains data-dependent, with possible rate adjustments if inflation or growth shifts significantly.

Geopolitical Events: Trade tensions, including US-imposed tariffs, could pressure Canada’s economy, potentially weakening the CAD.

Key Insight: Macroeconomic factors present a mixed outlook. Moderate global growth supports risk assets, but trade tensions and central bank caution create uncertainty for USD/CAD.

3. Global Market Analysis

Global market conditions influence currency pairs through risk sentiment and economic interdependencies.

Equity Markets: US and global equity indices are range-bound, reflecting uncertainty and mixed economic signals.

Commodity Prices: Oil prices are under pressure, a bearish factor for the CAD given Canada’s role as a major oil exporter.

Currency Markets: The USD shows strength against some currencies but weakness against others, lacking a dominant trend.

Key Insight: Weak oil prices act as a headwind for the CAD, potentially pushing USD/CAD higher, though broader market uncertainty moderates this effect.

4. Commitment of Traders (COT) Data

COT data offers insights into the positioning of large traders, shedding light on market sentiment.

Large Speculators: Recent trends indicate a net short position on USD/CAD, suggesting bearish sentiment among big players.

Commercial Traders: Positioning is mixed, with some hedging activity reflecting uncertainty in the market.

Market Implications: The net short stance among speculators points to a bearish outlook, but it also raises the possibility of a crowded trade, increasing the risk of a short squeeze if the pair rallies.

Key Insight: Bearish sentiment prevails among large traders, aligning with technical signals, though the concentration of shorts could lead to volatility.

5. Intermarket Analysis

Intermarket analysis examines correlations between USD/CAD and other asset classes.

Oil Prices: A strong inverse correlation exists between USD/CAD and oil prices. Falling oil prices typically strengthen USD/CAD by weakening the CAD.

Commodity Currencies: USD/CAD often aligns with movements in other commodity-linked currencies like AUD/USD and NZD/USD.

Equity Markets: A risk-on environment (rising equities) can pressure the USD downward, while risk-off sentiment bolsters it.

Key Insight: Declining oil prices provide a bullish tilt for USD/CAD, but this is tempered by mixed risk sentiment across global markets.

6. Quantitative Analysis

Quantitative analysis employs technical indicators to assess price trends and momentum.

Moving Averages: The pair is trading below its 50-day and 200-day moving averages, signaling a bearish trend.

RSI (Relative Strength Index): At 45, the RSI is neutral but approaching oversold territory, hinting at potential downside exhaustion.

MACD (Moving Average Convergence Divergence): Positioned in negative territory, indicating bearish momentum.

Chart Patterns: A bear flag pattern has been noted, with a potential downside target near 1.3164, suggesting further declines.

Key Insight: Technical indicators predominantly point to a bearish trend, with the possibility of additional downside if key support levels are breached.

7. Market Sentiment Analysis

Market sentiment reflects the collective psychology of traders and investors.

Trader Sentiment: Surveys and positioning data indicate a bearish bias, with traders anticipating further declines in USD/CAD.

Expert Opinions: Analysts largely recommend selling the pair, citing both technical and fundamental weaknesses.

Social Media Trends: Discussions on platforms like X reveal mixed views, with some predicting a drop to 1.4000 and others warning of potential reversals.

Key Insight: Sentiment leans bearish, consistent with technical indicators and COT data, reinforcing expectations of a downward move.

8. Positioning

Positioning reveals how traders are aligned in the market, influencing potential price dynamics.

Speculative Positions: Likely net short, based on COT data and sentiment surveys, indicating widespread bearish bets.

Institutional Positioning: Mixed, with some institutions hedging against possible USD weakness.

Market Impact: The heavy short positioning could trigger volatility if the pair moves against the consensus, such as in a short squeeze scenario.

Key Insight: Bearish positioning dominates, heightening the risk of a sharp reversal if positive USD catalysts emerge.

9. Next Trend Move

The next likely price movement is derived from current data and market conditions.

Direction: Downward pressure is favored, driven by technical sell signals and bearish sentiment.

Key Levels:

Support: 1.4150; a break below could target 1.4000 or lower.

Resistance: 1.4500; a move above could signal a trend reversal.

Triggers: Upcoming economic data releases, central bank statements, or shifts in oil prices could catalyze the next move.

Key Insight: The next trend move is likely to test lower support levels, potentially reaching 1.39500 if bearish momentum continues.

10. Overall Summary Outlook

Overview: On March 6, 2025, with USD/CAD at 1.43000, the pair exhibits a bearish outlook. Technical indicators, bearish trader positioning, and market sentiment suggest downside risks. However, fundamental factors—such as declining oil prices and potential trade tensions—could provide some support for the pair. The market is at a pivotal point, with price action near key support levels likely to dictate the next direction.

Future Prediction

Trend: Bearish (Short-Term), with Potential for Reversal

Details:

Short-Term: The pair is poised to test support at 1.41500, with a possible decline to 1.39000 if this level breaks. This outlook is driven by technical weakness and bearish sentiment.

Risks: A reversal could occur if oil prices rebound or if US economic data exceeds expectations, potentially pushing the pair toward 1.39000.

Conclusion: The short-term forecast favors a bearish trend, supported by prevailing technical and sentiment signals. However, fundamental factors like oil prices and trade policies could cap downside or trigger a reversal, warranting close monitoring of upcoming data and events.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

USD/CAD Ready To Go Down Hard , Let`s Sell It To Get 250 Pips !As we see we have a very good daily closure below sideway range and we have avery good retest to the area and the price gave amazing bearish price action , so i`m looking to sell this pair today or tomorrow morning when the price go backa litle to give me a good chance to put a small sl , and i think the price will go down very hard at least 200 Pips .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

Scenario on USDCAD 13.2.2025USDCAD and for this market, I have several alternatives as to how it could probably take place, so first I would look at the long where we have the first sfp below the low at the price level of 1.424 and then there is the last sfp for me if this does not last, then we go to lower values, the value is 1.41850 short in this market I would take the value of 1.43810 where there is resistance and then I have 2 more interesting levels for reaction the last one is for me the monthly level at the value of 1.45792, if we overcome this level, it is quite likely that we will look higher.

USDCAD Long BaisUS Dollar against Canadian Dollar

The USD/CAD pair is currently on a structural support line that has historically demonstrated its ability to hold the pair. Based on this observation, it is reasonable to anticipate that the pair may respect this support level and potentially reverse to the upside, presenting a possible opportunity to enter a long position.

I would be interested in hearing your perspective on the future price action of this pair. As always, it is important to consider conducting further analysis and implementing appropriate risk management strategies before making any trading decisions.

USDCAD Could move 1,064pips up the next month.The reasons why I strongly believe this move will happen are the following:

According to the CFTC non-commercials are shorting CAD.

Non-commercials have 20,388 positions long and 68,914 positions shorts. This means that they are selling more CAD than they actually buying it. According to this info we could expect a move to the upside.

From a monthly perspective there is plenty of buy side liquidity in USDCAD.

If you look at the chart you will see two blue circles and a dollar bill between them . Those highs have not been liquidated yet. The price is aggressively chasing those highs. According to the explanation provided the price is extremely bullish because is moving to a strong liquidity area.

From monthly perspective the price already liquidates sell side liquidity.

If look at the chart you will see a yellow circle . The yellow circle represents the sell side liquidity that was liquidated by the price.

The price has bullish structure.

The price is making higher highs will doing so liquidating sell side liquidity.

There is a lot of optimists about the dollar getting stronger in the near future.

DXY has bullish structure.

The DXY is currently making a retracement. It is currently at 50%. We could assume that is very close to be ready because it took sell side liquidity as well.

In other words, the CAD is getting weaker and the USD stronger.

EURCAD Aggressive Trade with Potential for Huge GainsI'll keep this short and to the point -

Technical Outlook:

Price recently hit a ceiling which has historically served as resistance (1.51750) , however we have been in an uptrend since late 2022. In Nov 2024 we saw bulls rally at strong levels of demand and continued to drive price upwards, creating a demand feed which price reacted off more recently (as shown on the chart).

Once price reached the ceiling level, it took a nose dive UNTIL we saw it decelerate at the latest demand feed, which could potentially have a trove of resting orders ready to be filled.

Trading Considerations:

I will be keeping an eye on the 15m chart during London and NY sessions for bullish momentum to take hold. As it stands right now, a break above 1.49050 would be early signs to get involved. This can always change as new structure is formed on the LTF's but we are deep in discount territory. Watch for liquidity build up and volume to understand which LTF demand levels could hold during high volume sessions.

Final Notes:

As added confluence, this pair is currently oversold on the RSI.

While navigating the LTF's make sure to adapt to changing conditions.

Again, this is another trade which could potentially turn into a swing position (provided demand holds, we could see an upward move that finally breaks the ceiling).

While the Euro continues to weaken against the USD, the Loonie should be able hold its own during this ongoing trade war (based on the fact that they've not just rolled over and do have some fight in them).

We get to witness these scary times unfold - and it makes trading that much more exciting!

Happy hunting predators!

Apex out!

OANDA:EURCAD FX:EURUSD OANDA:USDCAD