Nasdaq 100 Eyes New ATH if CPI Undershoots ExpectationsUSNAS100 – Overview

The Nasdaq will trade under CPI pressure today, with volatility expected around the release.

📉 Bearish scenario: While below 23,870, momentum favors a move toward 23,695, with further downside risk to 23,510 → 23,280.

📈 Bullish scenario: A reversal and stabilization above 23,870–23,940 would open the path toward 24,090 and a new ATH near 24,240.

⚠️ CPI impact:

Below 2.9% → supports bullish continuation for indices.

Above 2.9% → likely triggers bearish momentum.

Key Levels

Pivot: 23,870

Resistance: 24,090 – 24,240

Support: 23,695 – 23,510 – 23,280

Usnas100

USNAS100 Holds Above 23,690 – Bulls Eye 23,870 ATHUSNAS100 – Overview

The Nasdaq 100 remains in bullish momentum while trading above the pivot at 23,690, with the next target near the ATH at 23,870.

Technical Outlook:

📈 As long as price holds above 23,690, bullish momentum is expected toward 23,860 → 23,940 → 24,090.

📉 A confirmed 1H close below 23,690 would shift bias bearish, opening the way to 23,600 → 23,500 → 23,280.

Key Levels:

Pivot: 23,690

Resistance: 23,860 – 23,940 – 24,090

Support: 23,600 – 23,500 – 23,280

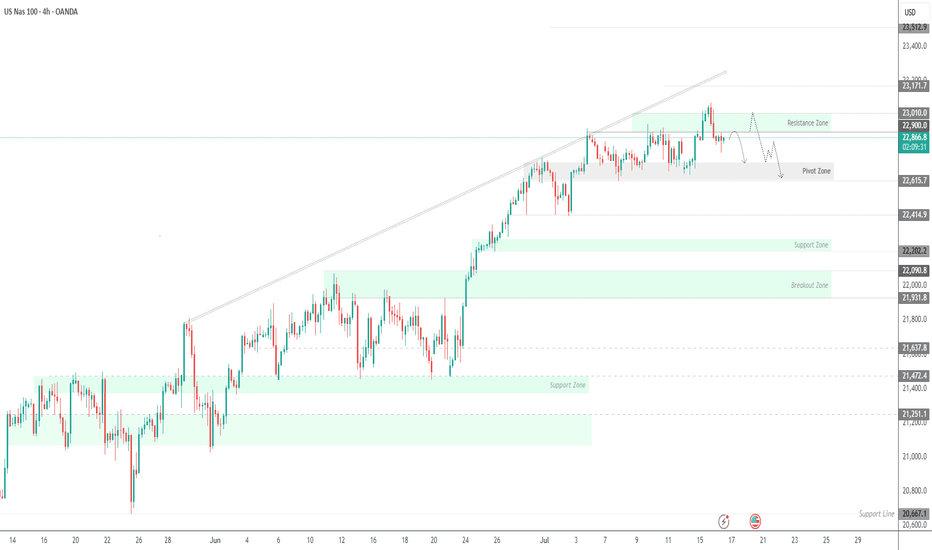

Nasdaq 100 Holds Pivot Zone 23,280–23,360USNAS100 – Overview

The Nasdaq 100 reversed from the 23,045 support highlighted yesterday and is now trading above the pivot zone at 23,280–23,360.

Technical Outlook:

📈 Bullish scenario: As long as price holds above 23,280–23,360, upside momentum may extend toward 23,510 → 23,620 → 23,720. A confirmed breakout above 23,770 would strengthen the bullish trend and open the path to a new ATH near 24,090.

📉 Bearish scenario: On the downside, failure to hold above 23,280 would expose 23,045, with full bearish confirmation only if the index stabilizes below 22,990, targeting 22,720.

Key Levels:

Resistance: 23,510 – 23,620 – 23,720

Support: 23,280 – 23,045 – 22,720

USNAS100 Update | Fed Pressure Keeps Market Under Bearish BiasUSNAS100 – Overview

Tech fright calms but Fed pressure grows

U.S. tech stocks appear to have stabilized after two sessions of sharp declines, but uncertainty persists as the Treasury market reacts to the latest Federal Reserve developments ahead of the central bank’s annual Jackson Hole symposium in Wyoming.

Technical Outlook

USNAS100 maintains a bearish setup while below 23,295.

A break and sustained close above this level would signal a potential bullish reversal.

📍 Key Levels

Pivot: 23,295

Support: 23,165 – 23,045 – 22,850

Resistance: 23,430 – 23,540 – 23,690

previous idea:

USNAS100 | Geopolitical Tensions & Fed in Focus – Pivot at 23690USNAS100 Overview

Geopolitics dominates before the Fed takes the stage.

Putin’s position remains that Ukraine should cede all territory Russia has occupied — and even areas it has failed to capture in more than three years of fighting. This has been firmly rejected by Zelenskiy and European leaders, who will stand alongside him in Washington when he meets Trump later today.

Technical Outlook:

Price looks set to stabilize below 23690, which would extend the bearish trend toward 23435 and 23295.

A 4H close above 23690 would shift the outlook bullish, targeting 23870.

Pivot: 23690

Support: 23550, 23435, 23295

Resistance: 23870, 24090

USNAS100 | Geopolitics in Play – Key Pivot at 23870USNAS100 Overview

Geopolitical developments currently influence the price.

Technical Outlook:

While below 23870, the price is expected to drop toward 23690. To confirm continuation of the bearish trend, it needs a 1H close below 23690.

A 4H close above 23870 would shift momentum bullish toward 24090.

Pivot: 23870

Support: 23690, 23540, 23440

Resistance: 23940, 24090

USNAS100 | CPI Day Setup – Breakout or Pullback Ahead?USNAS100 Overview

Markets found some relief after the U.S. and China extended their tariff truce until November 10, avoiding the imposition of triple-digit duties on each other’s goods.

Today, attention is firmly on the U.S. CPI release, which is expected to drive market direction:

A reading above 2.8% would likely support a bearish move toward 23440 and 23295.

A reading below 2.8% could fuel bullish momentum toward a new ATH at 23870.

Technical Outlook:

As long as the price trades below 23690, downside targets remain 23440 and 23295.

A 1H close above 23695 would turn the bias bullish toward 23870.

Support: 23440, 23295, 23045

Resistance: 23700, 23870

USNAS100 | Consolidation Before CPI –Breakout or Pullback Ahead?USNAS100 Overview

The index reached its all-time high ahead of recent speculation about a potential Fed rate cut. This week’s CPI data will be a key driver, indicating whether the Fed may cut rates in the near term.

Technical Outlook:

As long as the price trades below 23640–23690, a decline toward 23530–23435 is expected. A break below this zone could extend the drop toward 23295.

A 1H close above 23695 would turn the outlook bullish, targeting 23870.

Support: 23535, 23435, 23295

Resistance: 23870, 24040

previous idea:

USNAS100 Gains on Tariff Exemption Hopes – 23690 in SightUSNAS100 – Market Overview

Tech shares lift Wall St futures on tariff exemption hopes

U.S. stock index futures rose on Thursday as optimism grows that major tech companies may be exempt from President Trump’s latest tariffs on chip imports, supporting continued strength in the tech sector.

Technical Outlook

USNAS100 has gained nearly +400 points since yesterday, maintaining strong bullish momentum.

As long as the price holds above 23440, the uptrend is expected to continue toward 23690, with potential to extend to 23870.

However, a 1H close below 23440 would suggest weakening momentum and could trigger a correction toward 23295.

Resistance: 23690 – 23870

Support: 23295 – 23045

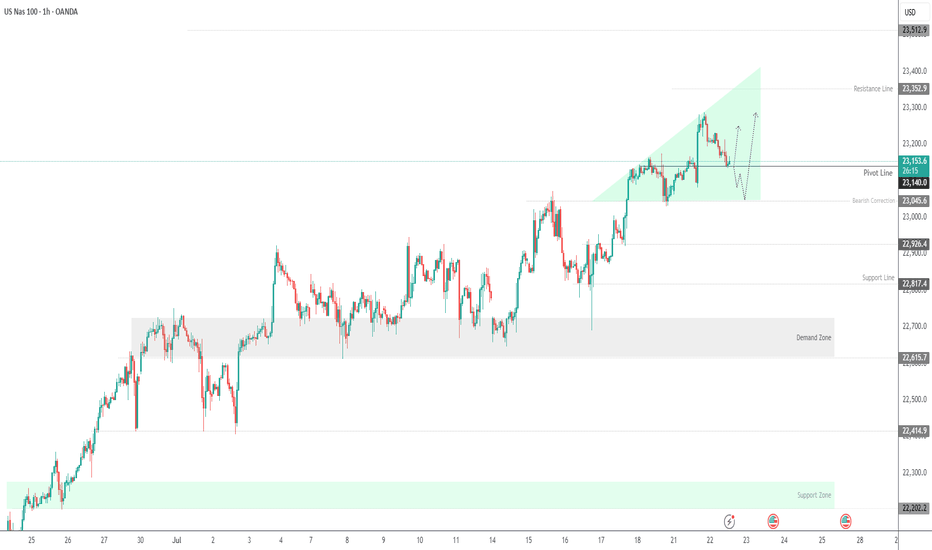

USNAS100 Eyes 23350 Ahead of Powell & Earnings StormUSNAS100

The price maintains bullish momentum, as outlined in the previous idea, with a clean rejection from the 23280 zone. Today, volatility is expected to increase ahead of Jerome Powell’s speech and a wave of key earnings reports.

As long as price holds above 23140, the outlook remains bullish toward 23230 and 23350.

A short-term correction toward 23045 is possible if we get a 1H close below 23140.

Resistance: 23230 · 23350 · 23510

Support: 23045 · 22920

USNAS100 | Bullish Setup Ahead of Tech Earnings & Trade RiskUSNAS100 | Bullish Setup Ahead of Tech Earnings & Trade Risk

U.S. equity markets are entering a pivotal week with big-tech earnings and renewed focus on Trump’s proposed trade tariffs. Both the S&P 500 and Nasdaq are hovering near record highs, but new catalysts are required for continuation.

Technical Outlook:

The price has stabilized above 23140, breaking the pivot and confirming bullish momentum. As long as the price holds above this level, the trend remains bullish, especially if it breaks the green triangle resistance structure.

A sustained move above 23140 opens the path toward 23250 and 23350, with further extension possible to 23510.

However, a 4H close below 23140 may activate a bearish correction toward 23045, and possibly deeper toward 22920 and 22820.

Resistance Levels: 23250 · 23350 · 23510

Support Levels: 23045 · 22920 · 22820

Bias: Bullish above 23140

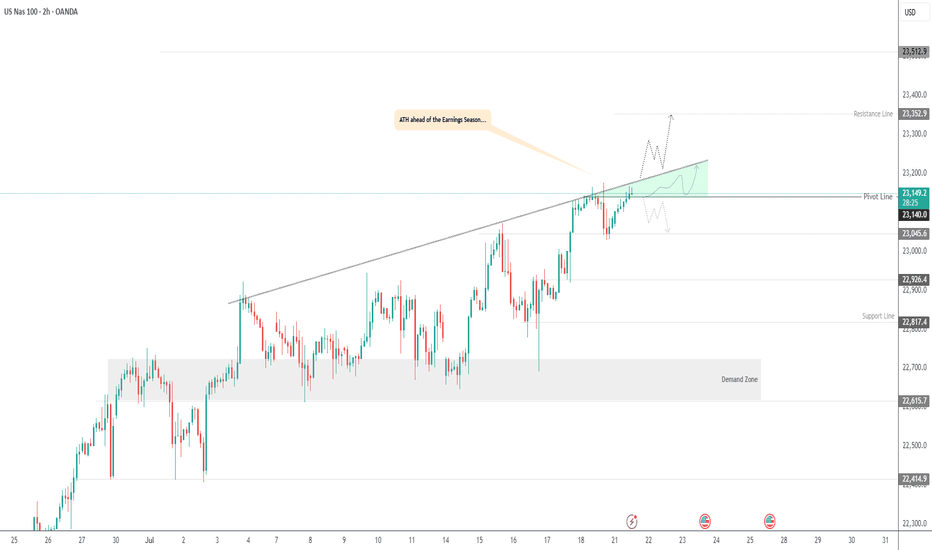

NASDAQ100 Hits Target at 23170 – Watch for Breakout or PullbackNASDAQ100 Tests ATH – Key Decision Zone at 23170

New ATH Achieved:

NASDAQ100 recorded a new All-Time High (ATH), hitting our target at 23170 precisely as projected.

Currently, price is consolidating below 23170. Sustained rejection at this level could trigger a short-term bearish pullback toward 23010. A deeper correction may extend to 22900 or even 22815.

However, a clean breakout above 23170 would confirm bullish continuation, with the next target at 23350.

Key Levels

• Pivot: 23170

• Resistance: 23250 / 23350

• Support: 23010 / 22900 / 22815

Outlook:

• Bullish above 23170

• Bearish below 23170 (short-term pullback zone)

USNAS100 | Consolidation 23010 - 22900, Bearish or Not Yet...USNAS100: Cautious Consolidation as Powell Uncertainty Lingers

Following political noise around Fed Chair Powell — with Trump admitting he floated the idea of replacing him — tech markets have entered a cautious consolidation. While no immediate action was taken, the underlying uncertainty continues to weigh on sentiment, especially in rate-sensitive sectors like tech.

Technically: Consolidation Before the Break

The price is currently consolidating between 22900 and 23010.

A confirmed 1H close below 22900 would signal the start of a bearish trend, targeting 22700 and 22615.

Conversely, a close above 23010 would open the path toward a new all-time high (ATH) at 23170.

Key Levels:

Support: 22700, 22615

Resistance: 23010, 23170

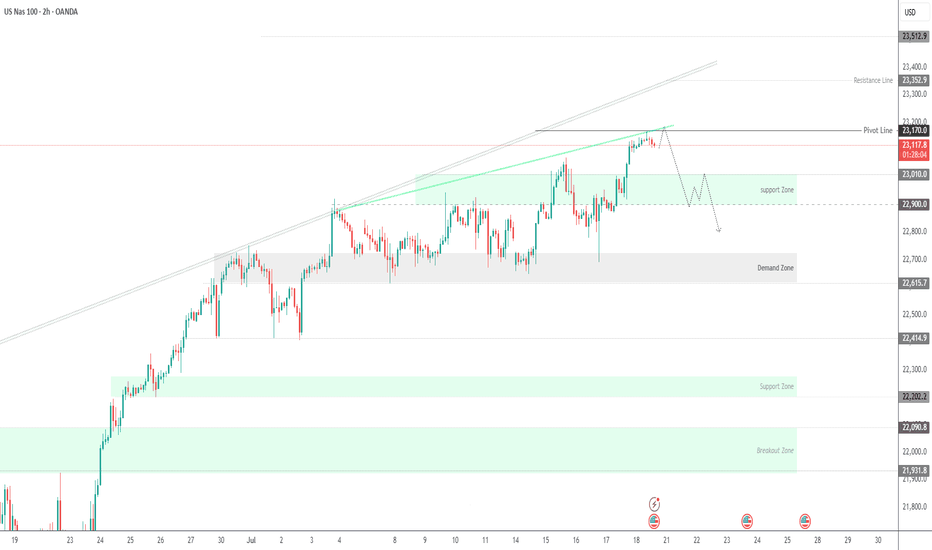

USNAS100 – Bearish Below 22900 as Earnings & Tariffs Hit MarketUSNAS100 – Bearish Bias Ahead of Earnings, PPI & Tariff Tensions

S&P 500 and Nasdaq futures are slightly lower as traders weigh rate outlook, tariff developments, and major earnings reports.

📊 Earnings in Focus:

Goldman Sachs NYSE:GS , Morgan Stanley NYSE:MS , and Bank of America NYSE:BAC are set to report today.

JPMorgan Chase NYSE:JPM and Citigroup NYSE:C posted strong results yesterday, but expressed caution over U.S. tariff policies.

🌍 Tariff Watch:

Trump announced a 19% tariff on Indonesian goods, with more deals anticipated ahead of the August 1 tariff deadline. The EU is reportedly preparing retaliatory measures if negotiations stall.

🔧 Technical Outlook:

The Nasdaq100 shows bearish momentum as long as it trades below 22900 and 23010, with potential downside targets:

Support: 22720 → 22615 → 22420

Resistance: 23010 → 23170

To shift back to a bullish trend, price must stabilize above 22900 and break 23010.

Key Events Today:

• Corporate Earnings

• Tariff Developments

• U.S. PPI Report

USNAS100 Outlook – CPI Data to Confirm Breakout or PullbackUSNAS100 – Bullish Momentum Holds Ahead of CPI

USNAS100 continues to show strong bullish momentum, trading above 22,905 and recently printing a new all-time high (ATH).

As long as price remains above this level, the next upside target is 23,170, followed by 23,300.

Market Focus – CPI Data Today:

• Expected: 2.6%

• Below 2.6% → bullish reaction likely

• Above 2.6% → bearish pressure expected

• Exactly 2.6% → could trigger a short-term bearish pullback

Key Risk Level:

A confirmed break below 22,905 would signal weakness and open the door for a correction toward 22,615.

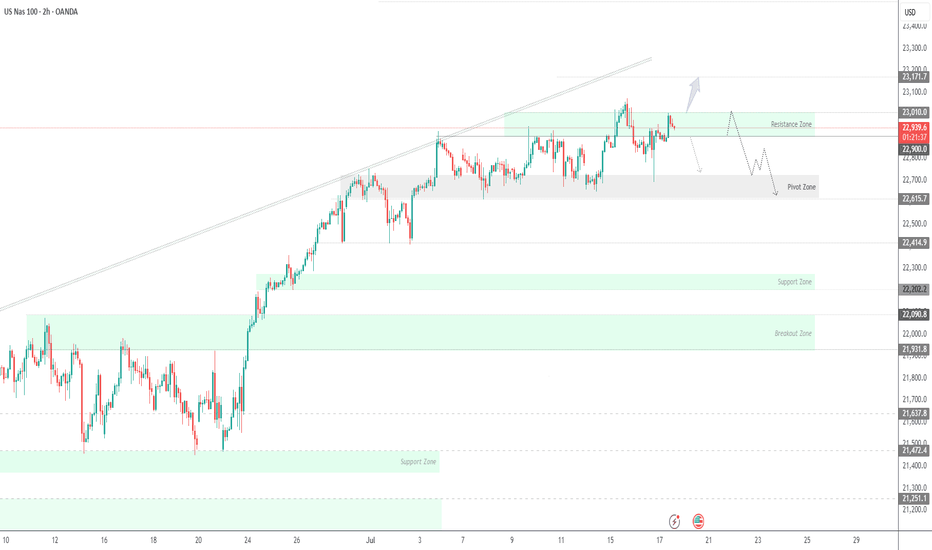

NASDAQ at Risk – Tariffs Pressure Tech IndexUSNAS100 – Market Outlook

The index is currently in a sensitive zone, heavily influenced by ongoing tariff tensions. If the current geopolitical pressure continues, it may fuel bearish momentum across the tech-heavy index.

To regain a bullish outlook, we need to see signs of negotiation or de-escalation, which could stabilize the price and lead it toward 23010 and 23170.

However, as of today, the market appears to be setting up for a correction, potentially dipping to 22815, followed by a deeper bearish move targeting 22420.

Support Levels: 22615 – 22420

Resistance Levels: 22905 – 23010

Bearish Momentum Builds Below pivot zone USNAS100 Analysis

Price has reversed from its ATH and now shows bearish momentum.

Below 22705, downside targets are 22615 and 22420.

Bullish scenario only valid if price breaks and holds above 22815.

Pivot: 22710

Support: 22615, 22420

Resistance: 22815, 22910

USNAS100 Bullish Ahead of NVIDIA Milestone – 23010 in SightUSNAS100 – Outlook

The index continues its bullish momentum, supported by strong tech performance — notably NVIDIA surpassing a $4 trillion market cap.

As long as the price holds above 22880, the trend remains bullish toward:

23010 Then extended targets near 23170

However, a 1H close below 22815 would signal weakness, potentially opening the way for a retracement toward: 22705 And 22615, especially if tariff tensions escalate.

Resistance: 23010, 23170

Support: 22815, 22705, 22615

USNAS100 Consolidates Between 22815–22705 | Breakout Will DefineUSNAS100 – Technical Outlook

The NASDAQ remains under pressure amid ongoing tariff uncertainty, with traders closely watching for any progress in negotiations or signs of escalation.

Currently, the price is consolidating between 22815 and 22705, awaiting a breakout to define the next directional move.

A 1H candle close below 22705 would confirm bearish continuation, targeting 22600, with further downside potential toward 22420.

A break above 22815 would shift momentum bullish, opening the way to 22880, followed by 23010.

Key Levels:

Support: 22600 / 22420

Resistance: 22815 / 22880 / 23010

NASDAQ Bulls Defend Pivot – Can 23,000 Break Next?USNAS100

The Nasdaq 100 is currently holding above the pivotal 22,720 level, supported by market optimism amid recent tariff-related developments from the White House.

Bullish Scenario:

Sustained price action above 22,720 keeps bullish momentum intact. A break and 1H close above 22,815 would confirm strength, opening the path toward the psychological milestone and potential all-time high at 23,000.

Bearish Breakdown:

A 1H or 4H close below 22,720 would invalidate the bullish bias and strengthen downside pressure, with initial support seen at 22,615 and deeper correction likely toward 22,420.

Key Technical Levels:

• Resistance: 22,815 · 23,000

• Support: 22,615 · 22,420

USNAS100 Key Level: 22,740 – Will the Trend Continue or Reverse?USNAS100 Update – Bullish Momentum Holds Above 22,740

USNAS100 has continued to push higher, following through as expected from yesterday’s analysis.

The index maintains bullish momentum as long as it trades above the key pivot at 22,740.

However, a 1H close below 22,730 could trigger a bearish correction toward 22,615.

A sustained break below that level may shift the trend to bearish.

Key Levels:

• Resistance: 22,870 / 23,000

• Support: 22,615 / 22,410

USNAS10 Faces Key Test at 22,615 Ahead of NFP VolatilityUSNAS100 – Key Levels Ahead of Major News

Today’s economic data releases (NFP, Unemployment Rate, etc.) are expected to drive volatility in the market. Traders should watch key levels closely.

Technical Outlook (USNAS10):

• Price is attempting to test 22,615.

• If it holds above 22,615, the bullish momentum is likely to continue.

• However, if price stabilizes below 22,615 on the 1H chart, further downside toward 22,420 is expected before a potential bullish reversal begins.

A breakout above 22,740 could trigger further upside toward 23,000

Key Levels:

• Resistance: 23,000 / 23,100

• Support: 22,420 / 22,280

USNAS100 Bullish Momentum Holds Above Key PivotUSNAS100 – Overview

The price successfully retested the 22,610 level and resumed its bullish trend, reaching 22,750 as anticipated in our previous idea.

Currently, the index needs to maintain stability above the 22,610 pivot line to sustain the upward momentum toward the next resistance at 22,790. A sustained move above this level may open the path toward 23,000.

However, a 1H candle close below 22,610 could trigger a corrective move down to 22,480. A break below this support would expose the next key level at 22,280.

Pivot: 22,610

Resistance: 22,790 – 23,000

Support: 22,480 – 22,280