XAUUSD:Wait for Nonfarm Payrolls to boost upward trendOn Thursday, the price of gold plummeted by $110 initially. Subsequently, it rebounded from $3,054 to $3,135, surging by nearly $80. This was a typical market scenario of a double whammy for both bulls and bears in a washout. Whether it was those who chased long positions at high levels or those who chased short positions expecting a pullback, they all suffered losses. The level of $3,054 witnessed a perfect conversion from a top to a bottom.

Today, when it comes to the resistance levels of gold, there are two key positions to focus on. One is the morning's high point at $3,120, and the other is the high point of the pullback at $3,135. As for the support levels below, we should pay attention to $3,080 and $3,065. There will be a market movement influenced by the Nonfarm Payrolls data tonight. It is expected that before the release of the data, the price will fluctuate within a range above and below $3,100, which serves as the demarcation line. When the price surges, look for a pullback towards $3,100; when it dips, look for a rebound towards $3,100. It is recommended to mainly take long positions at low levels. Tonight, we need to pay attention to whether the Nonfarm Payrolls data will help gold prices rise again.

Here, I would like to caution all traders once again to protect their accounts. Wait until the washout of both bullish and bearish forces is over before resuming trading!

Trading Strategy:

buy@3080

TP:3110

Sell@3135

TP:3100

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

Xauusdlong

Structural analysis and operation suggestions after gold washAnalysis of gold market trend: Gold fluctuated quite a lot yesterday. It rose at the opening yesterday, rising to nearly 60 US dollars, and then fell back after being blocked at the 3167 line. However, it fell below 3100, and the lowest to the top and bottom conversion was around 3054, a drop of nearly 114 US dollars. Beyond expectations, it pulled back to 80 US dollars, and the daily line finally closed with a cross Yin line. The rapid roller coaster is too scary. The market volatility is too large, so you can only watch more and do less. If you encounter non-agricultural data, according to yesterday's trend, the market may not be so big today. After all, it has already ended yesterday. When the price fell sharply, and then there was a sharp rebound to stand firm at 3100, the market of gold yesterday was thrilling, a super roller coaster, and the difficulty of gold operation has increased a lot. However, this kind of market is rare after all. After the ups and downs of gold, it will return to normal. Although today's non-agricultural data, I personally tend to fluctuate in a large range. It is estimated that it will not break yesterday's high point or yesterday's low point. If combined with silver, gold is still oscillating and bearish. At present, it should peak in the short term, and it will choose a direction after a correction.

Gold technical analysis: Therefore, gold is not as strong as before, so it is possible for gold to rise or fall in this state. Pay attention to the previous high of 3150 on the upside, and pay attention to the gains and losses of 3055 on the downside. The 4-hour cycle has cleverly entered the oscillation range. Although the market has gone out of the big drop space, the 4-hour cycle Bollinger has not opened, and the moving average system has not diverged. The effective range for the time being is within 3085/3135. Therefore, if there is no large fluctuation on Friday, you can refer to the range of the 4-hour cycle to do high-altitude and low-multiple transactions. The 1-hour moving average of gold still shows signs of turning downward, but the rise of gold in the US market has not allowed the 1-hour moving average of gold to enter the dead cross pattern, but the gold bulls are not very strong. Of course, there is also the impact of non-agricultural data. It is expected that after the big rise and fall on Thursday, the impact of Friday's data will not be great. Before the release of non-agricultural data, we should operate in the range of 3120-3066. On the whole, the short-term operation strategy of gold today is to short on rebound and long on pullback. The short-term focus on the upper side is 3120-3125 resistance, and the short-term focus on the lower side is 3054-3066 support. Friends must keep up with the rhythm. We must control the position and stop loss, set stop loss strictly, and do not resist single operation. The specific points are mainly based on real-time intraday. Welcome to experience, exchange real-time market conditions, and follow real-time orders.

Gold operation strategy: Short order strategy: Strategy 1: Short gold rebound near 3120-3125, stop loss 6 points, target near 3100-3085, break to see 3065 line;

Long order strategy: Strategy 2: Long gold pullback near 3070-3065, stop loss 6 points, target near 3100-3090, break to see 3110 line;

NFP - Shorting GoldThe gold market experienced huge fluctuations on Thursday, which created very good profits for us. During the entire trading process, we seized the profits of fluctuations of more than $50.

The unemployment rate and NFP data during the US trading session on Friday, as well as Powell's speech on the economic outlook, are the focus of Friday's trading.

Judging from the data released in March, the unemployment rate and NFP are more likely to be bearish for gold, so when trading data, my plan is to focus on short positions.

At present, in terms of technical form, the indicators show that the bulls have not ended. In this case, the transaction needs to pay attention to the 3123/3136 resistance. If it cannot break through, the price is expected to fall again to 3103 or even 3086.

Overall, today's trading focus is to sell at high levels.

GOLD Bullish Trend Continues After FVG Test🟢 GOLD is maintaining strong bullish momentum after successfully testing a Fair Value Gap (FVG). A Break of Structure (BOS) confirms the uptrend, with higher lows forming—a clear sign of continuation.

📊 Analysis:

✅ Bullish Trend: The price structure confirms an uptrend with higher highs and higher lows.

✅ Fake Reversal Break of Structure (BOS): A key level has been broken, signaling reversal but based on current momentum that follows it shows Buyers continued strength.

✅ FVG Test Success: Price respected the Fair Value Gap, reinforcing buying pressure.

✅ 🎯 Target: , aligning with .

✅ 📈 Momentum: Strong upward drive suggests further gains ahead.

🔮 Potential Scenario:

The price is likely to continue climbing, forming a new higher high toward the target level.

📢 Confirmation Signals to Watch:

📌 Volume: Increasing volume on bullish moves.

📌 Candlestick Patterns: Bullish signals at key support levels.

📌 Moving Averages: Price holding above critical moving averages.

📌 🚨 Disclaimer: This is not financial advice. Trade responsibly and conduct your own research.

🔗 Tags:

#GOLD #XAUUSD #Bullish #TechnicalAnalysis #TradingView #FVG #BreakOfStructure #TrendAnalysis #PriceAction #MarketAnalysis

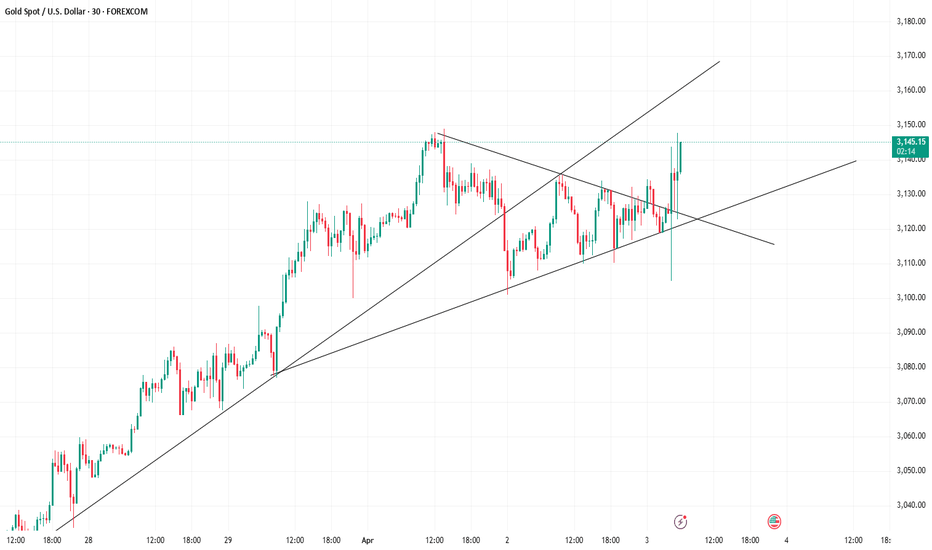

XAU/USD: 5th Wave Rally After CorrectionOn the 1-hour timeframe, XAU/USD has formed an Elliott Wave corrective structure. This is an expanded flat correction, typically seen in the 4th wave. The correction seems to have been completed at 3,054, suggesting that the 5th wave may be in progress.

For bullish traders, a potential long position can be considered around the 0.236 retracement level as a pullback entry point.

The 5th wave has the potential to reach the following upside targets: 3,110, 3,145, 3,165

However, this bullish outlook remains valid only if the low of Wave IV holds. A breakdown below this level would invalidate the bullish scenario.

Is gold going to be eclipsed?

-------------------------

Timeframe: 240 Min

-------------------------

The price action suggests a completed impulse structure originating from the 2833 low, with gold now trading at an all-time high. Based on cluster zones and Fibonacci extensions, wave (5) still has the potential to extend toward the 3150-3200 range. This zone represents a key resistance level where buying momentum may slow down, signaling an impending shift in market dynamics.

Once wave (5) completes, it will mark the end of wave ((3)) of a higher degree, setting the stage for a corrective move. A retracement toward the previous wave (4) level is expected as wave ((4)) develops, aligning with historical corrective behavior after extended rallies. This phase will provide crucial insights into the market’s next major move. Stay tuned for further updates.

Is the golden large-scale "roller coaster" near miss?Gold took a large "V"-shaped reversal pattern on Thursday, with the highest hitting 3167 in the Asian session, and continued to fluctuate and fall in the European session. It successfully fell to the lowest 3054 before the US session and then rebounded. As of now, gold has deeply bottomed out and rebounded to 3135. It has now started the oscillation mode. Gold continues to fluctuate in the range of 3100-3135, waiting for the release of the initial jobless claims data in the US session. The data is bearish, and the shorts broke through the 3080 line. After all, the technical adjustment is almost done, and everyone can find opportunities to go long. Later, gold hit the 3054 line and rebounded quickly, and the long orders also recovered the losses. This process is full of thrills and excitement. After all, such a large bottoming rebound is relatively rare. If your current gold operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate with us!

From the 4-hour analysis, pay attention to the short-term suppression of 3130-35 on the upper side, and pay attention to the short-term support around 3100-3106 on the lower side. Pay attention to the support of 3083-3087. After stabilizing above this position, continue to follow the low-long rhythm, and stick to the idea of going long after stepping back. I will remind you of the specific operation strategy during the trading session, so pay attention to it in time.

Gold operation strategy: Go long at 3105-3095

The golden large-scale "roller coaster" has near misses and no dFrom the 4-hour analysis, pay attention to the short-term suppression at the 3130-35 line on the top, and the short-term support at the bottom is around 3100-3106, with a focus on the support at 3083-3087. Continue to maintain the rhythm of low-long positions above this position, and stick to the idea of buying more on pullbacks. Go long with the trend to hold the long space, and try not to go against the trend.

Gold operation strategy:

Gold retreats to the 3100-3106 line for more, and retreats to the 3083-3087 line to cover more positions, stop loss 3077, target the 3130-3135 line, and continue to hold if the position is broken;

Gold has been moving big recently, don’t hold it blindly!What is coming has come, more than 100 US dollars a day, the decline is always faster than the rise, and more fierce, after breaking the 3100 watershed, it accelerated downward, the current minimum is 3054, the key position below is 3000/3040, pay attention to the plunge and the card position can also participate in the long, but must be patient to wait for the position.

After the big drop, the stage high point appears, and the follow-up is that both long and short can participate. The first plunge only establishes the high point position, and it is not so fast to turn short. It will fluctuate for a period of time. Generally, major news is an opportunity. The evening news detonates the market, and the main force often uses the news to pull up shipments. If the rebound touches 3110-3120, short it.

4/3 Gold Trading StrategiesTariff concerns and inflation have once again triggered significant volatility in gold. After yesterday’s price surge following news announcements, today’s market opened with continued bullish momentum, reaching around 3170.

For traders who managed to keep up with the market rhythm, this was a golden opportunity—but for those caught on the wrong side, it was a disaster. The persistent price rally has put short sellers under significant pressure. While I hope most of you are in long positions, I also understand that’s not always the case. For those stuck in short trades, the key now is to minimize losses or even turn the situation into a profit.

Based on the current price structure, I expect a high-level pullback. If your short position isn't causing serious damage to your account, holding on could be a viable strategy.

The expected trading range includes a high point at 3166-3178 and a low point at 3138-3123. Additionally, several key technical levels need to be monitored for potential reversals.

Trading Recommendations:

📌 Main Trades:

Sell in the 3166-3182 range

Buy in the 3136-3121 range

📌 Short-Term Scalping:

Be flexible in the 3147-3158 range

Manage your risk carefully and adjust your trades based on market movements! 🚀

Data will be Bearish for GOLDAffected by tariffs and inflation news, gold fluctuated sharply before the market closed. The market was in a situation of double kills for both long and short positions, and the sentiment was still fermenting. At present, the bulls also took this opportunity to successfully break through the resistance, and the price returned to above 3140 again. From the perspective of the pattern, there is still room for growth in the short term.

Before the US market, you can look for trading opportunities in the 3158-3123 range. The unemployment benefit data will be released during the US market, and the data is expected to be bearish for gold. Therefore, within 30 minutes before the data is released, if you hold a long order, please be cautious. At that time, I will also send you the latest trading plan based on the market situation.

If you are currently in trouble and need help, you can leave me a message.

The battle for the 3200 mark is imminentThe United States has officially launched a tax increase policy on major global trading partners. The wide range of goods involved and the high tax increase are rare in history. The essence of the tax increase is to require countries to have the same tax rate on US goods as the US export tax rate to them. For example, if Indian motorcycles face a 2.4% tax in the United States, and American motorcycles are taxed 100% in India, the United States will reversely tax Indian motorcycles at 100%. This "tit-for-tat" mechanism directly leads to a surge in the price of imported goods, and companies are forced to restructure their supply chains. Next, once the Federal Reserve starts to cut interest rates, gold is bound to reach a new level. Cutting interest rates is the general trend. When the economy is down, only by cutting interest rates can economic development be stimulated, and raising interest rates will only push the economy to the brink of collapse. The US economy is already in collapse, not on the edge!

After the tariff news, gold quickly retreated to 3105 and then soared, reaching a high of 3168. Gold, hold the position of 3100 US dollars, which is the key to determine the long and short positions. The rising market is not about staring at the high point speculation, but the gains and losses of the key support area. As long as the key support is not broken, the rising trend will not see the top.

Gold operation suggestion: long around 3120-3110

Gold bullish trend remains unchangedThe current bullish structure of gold has not changed. The key support below is still the 3100 line. The strong bullish thinking remains unchanged above 3100. Short-term operations rely on 3100 for defense, and gradually move up near 3116. Focus on the strength of the European session. If the European session rebounds but does not break the high, then short the US session at highs. Pay attention to the resistance of 3140-45 above.

Gold: Soaring on Tariffs, Testing Technical WatersIn the early trading session of the Asian market on Thursday (April 3rd), spot gold continued its upward trend and once reached a new all - time high of $3,167 per ounce. This was because US President Donald Trump said on Wednesday that he would impose a benchmark tariff of 10% on all goods imported into the United States and impose higher tariffs on some of America's largest trading partners. This move will lead to an intensification of the trade war that he initiated after returning to the White House, causing the market's risk - aversion sentiment to soar sharply.

However, given the rapid increase in the gold price, one should not blindly chase after buying more gold. On the one hand, the rapid rise in the gold price has accumulated a certain amount of pressure for a correction, and there is a high probability that a pullback and subsequent recovery rally will occur. On the other hand, the highly anticipated Nonfarm Payrolls data will be released tomorrow. On the eve of its announcement, the market will not quickly break out of a well - defined trading range and price level.

On the daily chart level, gold entered a downward adjustment mode on Tuesday, breaking the previous consecutive upward trend with positive candles. However, the current moving - average system still maintains a pattern of diverging upwards. Today, the key focus is on whether the downward movement of the market is sustainable. Firstly, we need to pay attention to the support effectiveness of the short - term moving average MA5. Currently, this moving average is roughly located around 3098, which is extremely close to yesterday's low of 3100 when the price dropped. If this support level can hold, then in the short term, gold can still be regarded as being in a strong pattern.

XAUUSD

buy@3105-3115

tp:3140-3160

The tariff hammer helps bulls rise stronglyTechnical analysis of gold: Affected by fundamentals, gold rose sharply again. The daily line finally closed in the positive zone and maintained a strong high at the opening. Pay attention to the upper and lower support of 3148 during the day. If it holds, it will have the momentum to continue to rise. The 4H cycle will strongly break through the upper Bollinger Band. , moving higher around the moving average support, there is no doubt that it is strongly bullish. At the same time, the middle rail has recovered, and the middle rail is still a key watershed. The lower support is around 3148 and 3138. We will go long according to the strength of the decline during the day, and then gradually look at 3170 and 3200!

Operation suggestion: Gold is long near 3138-40, stop loss at 3130, and look at 3150 and 3170!

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions. Operate according to your own operation plan. Market information is complicated and blindly following the trend is easy to fall into the dilemma of chasing ups and downs.

2. The market is changing rapidly. There is no general who always wins in this market. Therefore, it is important for us to make corresponding adjustments according to market changes. We must do a good job of protection. There will always be some ups and downs in the market, but there will be a rainbow after the rain. We must not forget our original intention and forge ahead.

The long-short sweep may still explodeThe tariffs were also successfully implemented. In response, the market bulls and bears also responded strongly. After all, the 3105-3142 area rose and fell in seconds, which was a terrifying market. Of course, to be honest, this wave of turbulence was mostly caused by institutions. After all, the market smashing was also extremely strong. However, I don’t agree with the impact of the tariffs implemented last night. First of all, looking back at the market situation, Trump said that tariffs would be imposed on many countries, which actually meant a 20% retaliatory tariff on the European Union. As for some other countries, only a 10% general levy was implemented, which relatively resulted in an unequal tariff situation. Of course, Trump also reiterated that Canada and Mexico still have tariff exemptions in a limited range of goods. So what impact will this situation have on the bulls and bears of gold? To be honest, personally, I have undoubtedly overestimated the announcement of this tariff. In other words, the implementation of this tariff is a bit insufficient in my eyes. After all, I expected that Trump would make major changes in his previous speech. As a result, it is a significant reduction compared to his previous years in office. This has also limited the outbreak of risk aversion. Of course, trade risks definitely exist, but through the matter of adding Mexico, this is completely negotiable. For this tariff event, I don’t think there is a big risk stimulus. Of course, the key is to see whether the market buys it. If the market thinks it will stimulate long-term risk aversion, then it will inevitably be pushed up by buying. However, the intensity of yesterday’s tariffs was not strong in my opinion. This may also limit the outbreak of longs to a certain extent. After all, the market’s expectations for it were too strong in the early stage, which also led to the early rise of longs, which also included the digestion of news. For this, you still need to be cautious.

Then looking back at the current market, the tariffs have been implemented, and in a blink of an eye, we will also welcome the announcement of non-agricultural data. As far as the current market is concerned, the various US economic data have also improved relatively. After all, the substantial growth of ADP has undoubtedly dispelled the rumors of economic downturn. After all, the warming of the labor market undoubtedly reflects the warming of the US economy. Under the influence of tariffs, it has indeed boosted the US economy. Of course, the impact of the data is not just that. The current remarks about the slowdown in inflation are self-defeating. Due to the implementation of tariffs, inflation is likely to rise further. This directly hits the Fed's expectations of a rate cut, and the warming of the labor market has further limited the possibility of the Fed implementing a rate cut. In this regard, no matter what the final result of the market outlook is, based on the current situation, I personally think that it is really difficult for the Fed to implement a rate cut this year, which has also led to a reduction in the momentum of gold bulls. Moreover, if this situation continues, the Fed does not rule out the possibility of being forced to implement a rate hike. Although Trump is also calling on the Fed to cut interest rates, the fact is that it cannot be implemented at present, unless the US talks with other countries again during this period to discuss a reduction, as it did with Canada and Mexico. Otherwise, as time goes by, as the tariff issue intensifies, inflation will be restricted, thus affecting the implementation of the Fed's policy. At this time, you can pay more attention to the market dynamics.

So for today, although gold is currently stimulated to rise, I don't quite agree with the emergence of new highs for gold bulls. To put it bluntly, for now, even if a new high appears, gold breaks through 3160, which is more of a possibility of inducing more. I am not saying that I am blindly bearish, but you have actually seen that gold is blocked at a high level, and the momentum of falling back is also extremely strong, especially gold started three consecutive positives last Friday, and as of Tuesday this week, it stopped falling near the highest point of 3149. The bull outbreak is already facing exhaustion. Even if the bulls rise again today, where can they rise, to 3200? Then what? You should know that it is cold at the top. Unless there is absolute bullish momentum to support gold to continue to rise, there will be a peak at any time. The short space is still large, just waiting for an opportunity. In particular, the sharp increase in ADP has led to the market betting on the negative non-agricultural data. Once gold is blocked from rising, it will inevitably collapse in an instant. Especially when this kind of news stimulates gold to rise, retail investors in the market will not consider its fundamentals. They will only think that interest rate cuts are absolutely good for bulls and the implementation of tariffs is absolutely good for bulls, which will lead to buying. This is also a chance for institutions to snipe bulls. For this, for today and tomorrow, even if gold breaks a new high, you should not blindly follow the trend. Remember to guard against the possibility of a resurgence of shorts. In this regard, I personally prefer the possibility of shorts looking back at the possibility of breaking 3100 and falling to 3080-3050. You can be cautious about this.

As for today's opening, gold opened high at 3141, and encountered a flash crash at 3128 at the opening, and then rebounded to 3139 and then flash crashed to 3123. This performance can be said to be extremely strong. In this case, I certainly cannot notify the operation. After all, the fluctuation is too fast. With a quote every second, even if you give an order, you may not be able to enter the market in time. For this, you still need to wait for the market to calm down. As for today's market, the fluctuation may be relatively strong. You can wait and see and be cautious. As for the specific operation details, I will give them in real time. Remember to strictly follow my requirements to control the position and stop loss.

Gold Market and the Impact of Trump’s Tariff PolicyGold prices hit a new all-time high as investors seek safe haven assets amid growing uncertainty in the global economy. After several rounds of market turmoil, investors have recovered somewhat in Asian markets this week. In the coming week, the focus will be on the reciprocal tariff plan that Trump will announce on April 2. If Trump decides to take tough measures and implement high tariffs across the board, it may have a big impact on the market. However, if there is some relaxation of tariff policies, such as tax exemptions for specific countries, then the market may have a chance to rebound.

Trump was proud of Wall Street's record highs during his first term, but now seems to be less concerned about the stock market and more focused on the adjustment of overall economic policies. I think this may be the time to make structural changes to the US economy, although these adjustments may bring challenges in the short term, but the hope is that the economy will recover before the mid-term elections next year.

In addition, Asian stock markets have also been affected by volatility, especially the automotive industries in Japan and South Korea are under pressure. The automotive manufacturing industries in these countries face the challenge of change due to the upcoming 25% tariffs. Investors are full of doubts about Trump's tariff policy, and market sentiment is cautious, and all parties are waiting for the policy announcement on April 2.

In short, although the market has rebounded in the short term, future trends still need to focus on Trump’s tariff decisions and their potential impact on the global economy.

Gold fluctuates sideways at a high level and seesaws!The 1-hour moving average of gold has gradually begun to show signs of turning around. The 1-hour moving average of gold is also a head and shoulders top pattern. Even if it pulls back and forth again, gold will continue to fluctuate in a large range. There will be more data in the second half of this week, and there will also be important event news. Therefore, gold still needs to wait for news or data to let gold go out in a new round of direction. Gold did not break through the intraday high, so our US market will continue to be high and empty.

Today's gold short-term operation ideas suggest that rebounding is the main focus, and callbacks are supplemented by longs. The upper short-term focus is on the first-line resistance of 3138-3140, and the lower short-term focus is on the 3100-3110 first-line support.

Short position strategy:

Strategy 1: Short 20% of the position in batches when gold rebounds to around 3138-3140, stop loss 6 points, target around 3120-3110, break to see 3100 line;

Long position strategy:

Strategy 2: Long 20% of the position in batches when gold pulls back to around 3100-3103, stop loss 6 points, target around 3110-3120, break to see 3130 line;

Gold suppresses the fall and shorts make big profitsYesterday, gold fell under pressure at 3150 and then tested the 3100 mark again in the evening, breaking the previous trend line that had been rising for several days. The market gradually slowed down from strong bullish trend, and the daily line turned negative.

Don’t expect the market to turn to bearish and fall sharply at this point. The long-short conversion needs time to brew, and now it is still a bullish trend, so the probability of forming a volatile trend here is relatively high, with a range of 3138-3100. Only when it breaks below 3100 can we see the market turning to bearish.

If the daily line is just a single negative correction, it will not change the overall upward trend. It depends on whether it can continue to close negative today.

If the European session suppresses the decline and weakens, then the third test of 3100 may break.

If the European session continues to strengthen and break through 3138, it will also hit the high point of 3148-3149

What impact will the implementation of gold tariffs have?As expected, gold fell below yesterday's low of 3124 support and came all the way to 3100. I have been emphasizing that gold will have a large retracement, but the current decline is far from enough and gold will continue to decline. The 1-hour moving average of gold has begun to turn downward, and gold may open up room for decline. The 1-hour gold moving average has now formed a head and shoulders top structure. The rebound will continue to be short. The market has weakened. Gold has tested the 3100 mark for the first time and has not yet broken it, but the direction of the market has turned short. If it does not break the first time, I believe there will be a second test in the future. Then the bearish situation has been finalized, and long positions have to be put aside for now, because it is a bearish market now. Gold can continue to be short after the rebound. Pay attention to the upper pressure level of 3128, and you can go short directly after it rebounds!

Today's short-term operation strategy for gold is to short on rebounds and long on pullbacks. The short-term focus on the upper side is the 3138-3130 line of resistance, and the short-term focus on the lower side is the 3100-3083 line of support.

Short position strategy:

Strategy 1: Short 20% of the gold position in batches when it rebounds to around 3128-3130, stop loss 6 points, target around 3110-3100, break to see 3085 line;

Long position strategy:

Strategy 2: Long 20% of the gold position in batches when it pulls back to around 3083-3085, stop loss 6 points, target around 3100-3110, break to see 3120 line;

Trade Idea: XAUUSD (Gold 15m Chart)Trade Idea: XAUUSD (Gold 15m Chart)

Price is holding above the short-term FVG and showing bullish intent after reacting from a higher timeframe zone. A continuation move is likely if this zone holds, targeting the next premium zone above.

Bias: Bullish

Context: Market structure is bullish; price is building a base for a potential expansion toward the upper inefficiency. A clean liquidity run is expected toward the premium zone.

Wait for confirmation before entry. Trade with proper risk management.