XAU/USD "The Gold" Metal Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

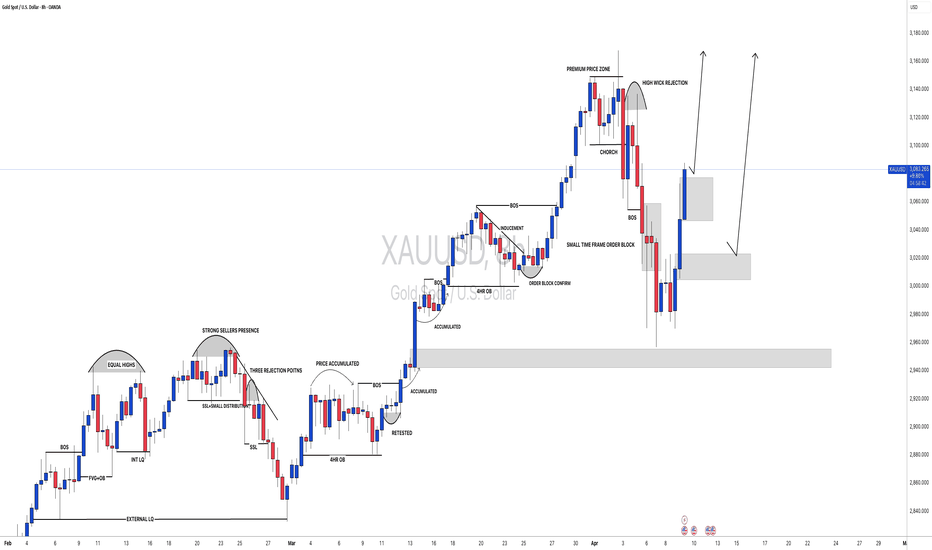

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red zone area. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (3400) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 2H timeframe (3280) Day / Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 3700 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸XAU/USD "The Gold" Metal Market Heist Plan (Swing/Day Trade) is currently experiencing a Bullish trend.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Xauusdsignals

Gold levels for long positions target ATH.GOLD (XAU/USD) – Smart Money Buying Opportunity!

Gold just tapped into a key Buying Zone after pulling back from its All-Time High (ATH).

Price is now sitting at a potential launchpad for bulls, aligning perfectly with Smart Money Concepts.

Entry Zone: 3357 – 3350

Target: 3500

SL: Below 3328

Risk-to-Reward: Ultra clean setup with 3R+ potential

Backup Plan: Extreme Buying Zone at 3244 for deeper entries

This is a textbook liquidity sweep and demand re-test, with a high chance of bullish continuation.

Patience pays. Let the market come to you and strike with precision!

Like, share, or save if you're trading Gold this week!

Gold rose 90 points and then fell back? Maybe there will be a suIt rose from the early trading, rose to the 3500 mark and was under pressure, and then returned to the 3409 line at the lowest. If it does not fluctuate by more than 100 points every day, is it not the ultimate safe-haven asset? My heart really can't stand it. Brothers who have observed carefully should have discovered that the current round of gold rise started from 2961, and rose by 500 US dollars in just 14 days. Only when today's upper lead is really closed, can we say that the bulls will cool down a little!

But this is not the first time. For example, last week's weekly line retreated, and it was directly pulled up at night. This week's opening rose by more than 100 points. The current market retreat is to go long. No matter what point you are at, as long as it is currently rising, then you can only witness one thing, that is, rising!

At present, I am not optimistic about the continued decline. The market sentiment of long positions also leaves me no choice. The current long positions have not reached the top. The best opportunity is to look at the integer support of 3400, which may give the bulls an unexpected surprise!

I am Quide. Seeing my analysis strategy, no matter the past gains and losses, I hope that you can achieve investment breakthroughs with my help and turn every tide of the gold market into our wealth wave.

GOLD trade setup looking for long.This chart is a technical analysis of the Gold Spot price (XAU/USD) on the 15-minute time frame. The analysis outlines a potential bullish trading setup, aiming for a price recovery toward the all-time high (ATH) and a final target of 3,500 USD.

Market Phase: The price has recently pulled back from a high and is currently showing signs of consolidation or minor retracement.

2. Chart Highlights:

Final Target (Take Profit):

Level: 3,500 USD

This is marked at the top of the chart and labeled as Final Target and also tagged as ATH (All-Time High).

The analyst anticipates that after a short-term retracement, the price will rise again and potentially reach this level.

Support Zone (Buy Area):

approximately between $3,443.840 and $3,442.

This is considered a demand zone or support level where buying interest might emerge.

The analyst expects the price to drop into this area and then reverse upward.

Entry Strategy:

The chart suggests waiting for the price to touch the support zone (blue area), and once signs of bullish reversal appear, enter a buy position.

Stop Loss (SL):

Clearly marked just below the support zone at $3,427.438.

Placing the SL here minimizes loss in case the market breaks the support and continues downward.

A minor drop into the support area.

A reversal and bullish continuation.

Targeting the all-time high near $3,500.

5. Risk-Reward Setup:

This trade appears to be structured with a favorable risk-to-reward ratio, aiming for a high return (from around $3,443 to $3,500) compared to the risk (down to $3,427).

XAUUSD It's most important week in 5 years.Gold (XAUUSD) hit last week the multi-year Higher Highs trend-line that has been in effect since the July 04 2016 High. Last time it had a rejection on it was on August 03 2020 when the market started the last 2-year Bear Cycle.

The current 1W candle has opened above this Higher Highs trend-line, so the week is of utmost importance as a closing below it maintains the pattern and the bearish Cycle Top bias, while above it jeopardizes invalidating it.

If as a result, the market closes the week below it and remains within the Fibonacci Channel Up, we may indeed be on Leg (4) peak and our Target will be near the 0.382 horizontal Fibonacci level at 2700 towards the end of the year. If not, we will see what new pattern is created and adapt accordingly (updates will follow).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XAUUSD Gold Is Surging: Technical / Macro Analysis & Trade IdeaHey traders! Let’s break down the current price action on Gold (XAUUSD) using both Wyckoff and ICT concepts, and tie it all together with the latest macroeconomic context. 🚀✨

Wyckoff Methodology:

Looking at the 4H chart, we see a classic accumulation phase that transitioned into a strong markup. The recent price action shows a clear spring (liquidity sweep) below previous lows, followed by a sharp bullish move—this is textbook Wyckoff manipulation, where smart money grabs liquidity before driving price higher. The current rally suggests we’re in the markup phase, with demand overwhelming supply.

ICT Concepts:

Liquidity Zones: The chart shows a sweep of liquidity below the recent consolidation, trapping late sellers before a powerful bullish displacement. This is a classic ICT move—liquidity engineered and then swept.

Displacement: The large bullish candle breaking above the previous range signals a market structure shift (MSS) to the upside. This is a strong sign of bullish intent.

Fair Value Gaps (FVG): The impulsive move up has likely left a fair value gap (imbalance) between 3335 and 3385.50. Price may retrace to fill this gap before continuing higher.

Market Structure: The break above the previous swing high confirms a bullish market structure. As long as price holds above the 3335-3340 zone (50% retracement), the bullish bias remains intact.

Technical Trade Setups:

Bullish Scenario: Look for a retracement into the 50-61.8% Fibonacci zone (3335-3323) for potential long entries. If price forms a bullish rejection or bullish engulfing pattern here, it could be a high-probability setup targeting the recent high (3385.50) and the next extension at 3436.

Bearish Scenario: If price fails to hold above 3335 and closes below 3320, we could see a deeper retracement toward 3284 (100% retracement) or even lower, but this is less likely given the current momentum.

Market Sentiment:

Bullish 🟢 – The strong displacement, liquidity sweep, and market structure shift all point to bullish sentiment. Buyers are in control, and any pullbacks into the FVG or key fib levels are likely to be bought up.

Macroeconomic & Fundamental Drivers:

Gold’s rally is being fueled by several key factors:

CPI & Inflation: Recent CPI data shows persistent inflation, increasing demand for gold as an inflation hedge.

Interest Rate Expectations: The market is pricing in potential rate cuts by the Fed later this year, weakening the USD and supporting gold.

Geopolitical Tensions: Ongoing global tensions (e.g., Middle East, Ukraine) are driving safe-haven flows into gold.

USD Strength: Any signs of USD weakness further boost gold’s appeal.

Summary & Trade Plan:

Gold is in a strong bullish phase after a classic liquidity sweep and market structure shift. Watch for retracements into the 3335-3320 zone for potential long setups, with targets at 3385 and 3436. Stay alert for any macro news that could impact sentiment, but for now, the bulls are in control! 🏆📈

Disclaimer:

This is not financial advice. Always do your own research before trading.

GOLD (XAUUSD): Classic Trend-Following Pattern

Gold closed on Thursday, forming a bullish flag pattern

on an hourly time frame.

The flag reflects a correction that the market started after a completion

of a strong bullish wave.

A breakout of its resistance line and a candle close above will signify

a highly probable resumption of the trend.

With a high probability, the price will move up at least to a current ATH.

(Remember that the price may respect a trend line one or several times more

and a correction can be more extended, that is why we rely on a breakout of a reliable trigger).

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

#XAUUSD:Time to Sell Gold ? Gold experienced a record high after touching $3358, but it subsequently declined. We anticipate further price drops until it reaches $3250, representing a 1000 pips move. We expect the price to remain bearish until it reaches a specific level. We appreciate your continued support.

Wishing you a joyous Easter.

Much Love ❤️

Team Setupsfx_

Gold hits new heights again, price correction may occurThe current consolidation fluctuations are completely in line with my previous predictions.

The market has hit new all-time highs again and there is a possibility of moving towards higher levels. The price has now hit the resistance area around 3320, which may mean the possibility of a correction in this area, creating long opportunities. The price has formed a sideways trend around 3220 points, which may be looking for a buy trade signal. In addition to these, there is an ascending trend line below the range, which previously served as both support and resistance. In view of the interest rate cut information released by the European Central Bank today, Quaid expects market volatility to increase. The expected target is the resistance area around 3390 points.

The market may continue to rise. On the chart, the price formed a strong positive line, which indicates the continuation of the upward trend. Currently, its price is retracing after hitting a new high. Some consolidation areas can be seen now, which play a supporting role in the bullish market. In addition, there is an ascending trend line, which has been broken many times before. I think that the retracement area of the previous volatility range may be a benign area to expect the continuation of the rise.

Quaid recommended:

Aggressive trades can be made by going long in the current consolidation area.

Smooth trading allows for part-time observation.

I hope this analysis can help you.

I am Quiad. Seeing my analysis strategy, no matter the past gains and losses, I hope you can achieve investment breakthroughs with my help and turn every tide of the gold market into our wealth wave.

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout then make your move at (3185) - Bearish profits await!"

however I advise to Place sell stop orders below the Breakout level (or) after the breakout of Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 30min timeframe (3240) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 3130

💰💵💴💸XAU/USD "The Gold" Metal Market Heist Plan (Day / Scalping Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness).., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

2 hours ago

#XAUUSD: Possible Easy 600+ Pips Buying OpportunityFollowing a substantial decline in gold prices, which dropped more than 1000 pips, there is a possibility that the price may experience a minor correction before resuming its downward trajectory. It is imperative to acknowledge that trading gold in the current market conditions carries significant risks, and there is a substantial likelihood of incurring substantial losses.

Good luck and trade safe!

Gold Consolidates Below Key Resistance — Awaiting Breakout from Gold has entered a phase of subdued volatility, currently trading around $3,221/oz. This stands in sharp contrast to the previous week’s triple-digit swings, with recent intraday ranges tightening to under $20 — a sign of market indecision and volatility compression.

From a technical perspective:

$3,245/oz remains a critical resistance level, representing the recent swing high.

Support levels are observed at $3,200, with $3,190 acting as the key bull/bear pivot zone.

🎯 Trading Strategy:

Watch for rejection near $3,245 to consider tactical short positions.

If price retraces and holds above $3,190, look for long opportunities on rebound setups.

In the current range-bound environment, traders are advised to stay patient, avoid overtrading, and wait for a decisive breakout to establish conviction positions.

XAU/USD "The Gold" Metals Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (3260) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (3150) Swing/Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 3470 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸XAU/USD "The Gold" Metals Market Heist Plan (Day / Swing Trade) is currently experiencing a Neutral trend (there is a chance to move bullishness).., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Risks gradually accumulate, and short gold in batchesAt present, the highest price of gold has reached around 3244, but it soon fell back to below 3240; and the PPI data is obviously bullish for gold, but gold has not shown a significant upward fluctuation, indicating that as gold rises sharply, market sentiment tends to be more cautious, so that liquidity is insufficient. So from this point of view, gold still has a need for a correction!

In the past three trading days, the increase in gold has reached $270. So even if gold remains strong at present, we should not blindly chase more gold. On the contrary, we can still gradually establish short positions in batches. As long as we strictly control the number of transactions in the transaction, we don’t have to worry too much about the transaction risk!

Let us wait patiently for the market to gradually accumulate risk sentiment. Once it accumulates to the critical point, it only takes one opportunity for gold to collapse soon.

XAUUSD Reversal imminent. Potential short-term top reached.Gold (XAUUSD) hit the 1-month Higher Highs trend-line and has started to form a short-term Top. The last two short-term High sequences peaked on the 2nd High and pulled-back to at least the 4H MA50 (blue trend-line).

The peak formation on the 4H RSI of those two sequences was demonstrated with Lower Highs. Similarly the most optimal short-term buy was when the 4H RSI got oversold below 30.00. At the same time, the price hit the 4H MA200 (orange trend-line).

But for now, the best action is to sell and take profit when the price makes contact with the 4H MA50.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XAUUSD Daily Analysis📈 XAUUSD Daily Analysis – 12/04/2025

🔥 Strong bullish move after a clear Market Structure Shift (MSS) and liquidity grab below the Previous Daily Low.

📉 A significant Fair Value Gap (FVG) remains between 3,100,000 and 3,175,000 – a potential pullback zone.

📍 Price could revisit this FVG before continuing the bullish momentum towards 3,300,000+.

🔹 PDL = Previous Daily Low

🔴 BAG = Breakaway Gap

🧠 Patience is key – wait for price reaction in the zone of interest.

📌 For educational purposes only – not financial advice.

💬 Drop your thoughts in the comments ⬇️

🔁 Like if you found this helpful!

GOLD (XAUUSD): The Next Important Resistance Levels

Gold updated the All-Time High yesterday and trades

in the no-man's land again.

Here are the next potentially significant resistances

based on psychological levels.

Resistance 1: 3247 - 3252 area

Resistance 2: 3397 - 3302 area

Important historic supports:

Support 1: 3128 - 3167 area

Support 2: 2953 - 2982 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD: Investors are more interested in Gold than ever! Gold reversed successfully after touching our entry point, moving to over 1400 pips. We previously advised closing the idea, but now we see a strong bullish market likely to create another record high. The ongoing tariff war between China and the US will likely create more fear in the global market.

Like, comment, and support us.

Team Setupsfx_

It is hard not to make a profit by trading CPI like thisI have to say that gold is indeed in a bullish pattern at present. After all, gold did not even fall below 3110 during the correction process. However, the current fluctuations are relatively cautious, and we are waiting for the guidance of CPI data, which may exacerbate short-term fluctuations!

To be honest, although gold is in a bullish pattern, the resistance above cannot be ignored, especially the 3150-3155 area and the previous high of 3167. It is not ruled out that gold will form a secondary high during the rise and form a double-top structure with the previous high of 3167, so I will not be a radical in the short term and set the target at 3200.

In addition, during the CPI data period, it is not ruled out that gold will rise and then fall back, so I do not advocate blindly chasing gold. On the contrary, I will definitely try to short gold in the 3050-3060 area. However, the market's long sentiment is high, and it is not advisable to have too high expectations for the magnitude of the correction in short-term trading. The first retracement target area is: 3105-3095, followed by 3080!

4/9 Gold Trading Strategies

Gold opened with a mild bullish tone yesterday but faced resistance near 3018 , pulling back briefly before attempting a second push toward 3023 . However, the rally failed to sustain, and price returned near the opening level. Compared to recent sessions, yesterday marked a clear contraction in volatility, suggesting either a bottoming formation or a setup for a directional breakout.

From both candlestick structure and indicator alignment, the market appears primed for a potential bullish push today. If momentum builds as expected, a test of the 3037–3043 resistance zone is highly probable.

On the downside, 2976 remains the key initial support , followed by 2952 , which was the previous local low.

On the fundamental side, no major data releases are scheduled today. However, updates related to tariff policies will likely be the main market driver, and could trigger intraday volatility.

🎯 【Trade Setup for Today】

🔻Sell Zone: 3047–3066

🔺Buy Zone: 2968–2942

🔄Flexible/Scalping Zone: 2978–3023