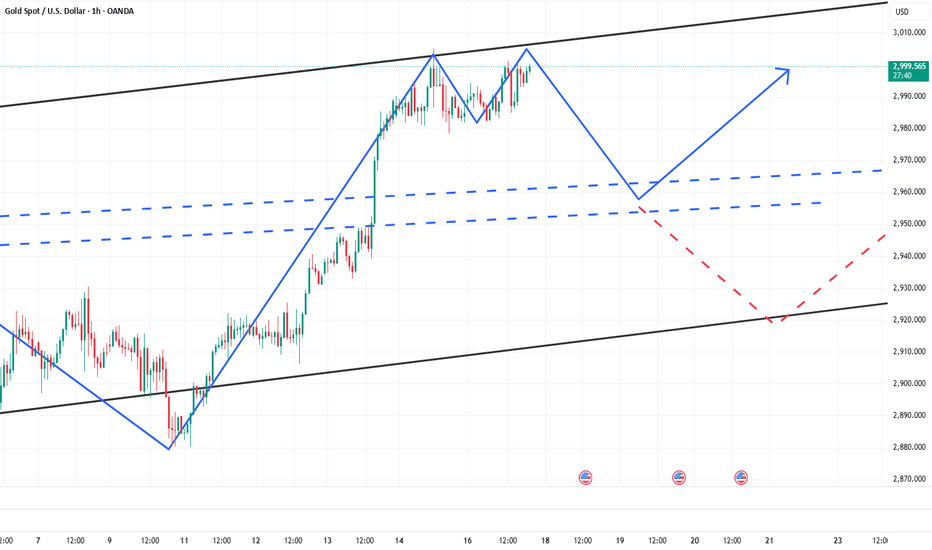

XAU/USD 18 March 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Price has printed a bullish iBOS, however, I will apply discretion and not classify as a bullish iBOS due to very insignificant pullback which would distort internal range. Therefore, I have marked the iBOS in red.

Intraday Expectation:

Await for price to indicate pullback phase initiation by printing bearish CHoCH. ChOCH positioning is denoted with a blue dotted line.

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

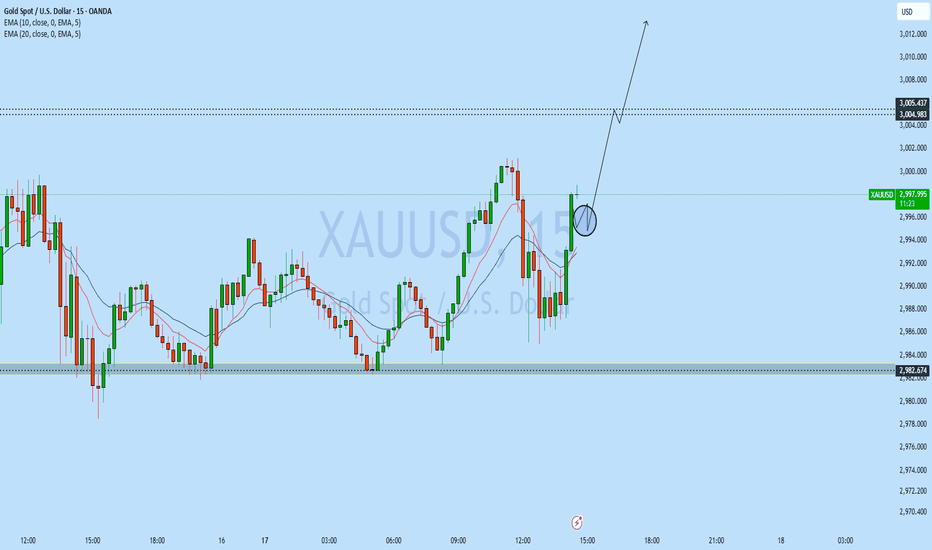

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Since yesterday's analysis, price has continued to surge to new all time highs, largely fuelled by geopolitical tensions. Gold is solidifying itself as a safe haven asset.

Whilst price has not pulled back to discount of 50% I am happy to classify as a bullish iBOS due to time spent.

Price has printed a bullish iBOS followed by a bearish CHoCH to confirm internal structure. I will however continue to monitor price.

Intraday Expectation:

Price to continue bearish to complete it's bearish pullback phase to either discount of internal 50% EQ or M15 demand zone before targeting weak internal high, priced at

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

M15 Chart:

Xauusdupdates

Gold (XAU/USD) Sell-Off Continues | Bearish Target insightGold Spot (XAU/USD) indicates a potential continuation of the current downtrend.

🔹 Sell Limit at 3082: A significant level where a sell order was placed, marking the start of the recent decline.

🔹 Strong Downtrend: After rejecting the 3082 level, gold has been making lower highs and lower lows, confirming bearish momentum.

🔹 Support & Target Zone: Price is approaching a key support area near 2880-2900, which aligns with the marked target level.

📉 Bearish Outlook:

If the price breaks below the current support, further downside is expected.

A potential bounce could occur at the target zone before a trend reversal.

💡 Key Levels to Watch:

Resistance: 3082

Support/Target: 2880-2900

Traders should monitor price action at support to determine if further downside is likely or if buyers step in for a potential reversal.

What’s your outlook on gold? Will the bearish trend continue? 📉💰

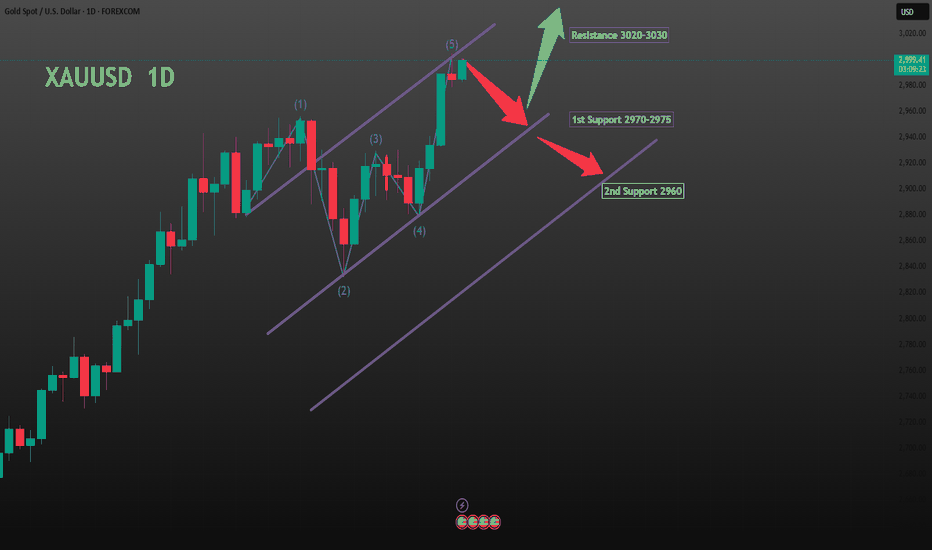

XAUUSD Continue to Long or Start to Short?Gold witnessed a substantial upward surge today, showing no chance of a pullback. When the market becomes overly fervent, caution is necessary as gold may stage its final speculative spree.

Gold trading strategy:

sell @:3030-3034

buy @:3000-3005,2983-2987

My current gold trading strategies and signals have been consistently accurate. If you also want free, precise signals, you can visit my profile to access them.

The secret behind gold's crazy riseGold surged as soon as it was stimulated by the news, but it is expected that this momentum will not last long. Instead, it is a good opportunity to short at high levels. From a macroeconomic perspective, the current global inflation expectations and monetary policy trends have a profound impact on gold demand. In terms of technical indicators, MACD shows that although bullish energy is being released, KDJ has entered the overbought area. It is expected that after gold hits the resistance range of 3025-3035 in the short term, continue to increase short positions and increase the number of transactions, with the target of 3010-3000, accurately grasp the band opportunities, and use the possible correction market to achieve profit goals.

You can read bottom signals, interpret daily market trends, share real-time strategies, and no longer blindly follow the trend.

Historic Milestone for Gold: My Outlook and Key Support LevelsLast Friday, for the first time in history, Gold printed a "3" handle, and since the beginning of the year, it has already climbed an impressive 4,000 pips.

However, what matters most now is what Gold will do next.

As we can see on the chart, after reaching a new all-time high (ATH) at 3005, Gold has started to pull back slightly and has recently formed a support level around 2980.

As I also mentioned in my Friday analysis, although I expect a correction, I don’t see Gold dropping all the way back to test the previous ATH zone at 2950 , which should now act as a strong support. Instead, even if Gold breaks below the newly formed 2980 support, I will be watching for reversal signs between 2965 and 2970, and from there, I expect a new bullish wave and a fresh all-time high.

In conclusion, my strategy remains unchanged: buy the dips.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

XAUUSD Today's strategyYesterday, the price of gold fluctuated within our marked range, so in the short term, both bulls and bears are feasible. However, you must be careful to set the SL level and not take excessive risks.

Today's xauusd trading strategy

buy@2985-2990

SL:2980

tp:3000-3010

sell@3010-3000

SL:3015

tp:2990-2985

If you don't know how to do it, you can refer to my transaction.

XAUUSD BUY it 3000....Resistance Rejection:

The price is nearing a strong resistance zone (~$3,004). If it fails to break through and forms a bearish pattern (e.g., triple top, bearish engulfing), a downward move could occur.

2. False Breakout:

The chart suggests an expected breakout above resistance, but a fake breakout (bull trap) could lead to a sudden reversal, trapping long positions

3. Double Top Confirmation:

A double top pattern is forming. If the price fails to maintain higher highs, this could confirm the pattern and trigger a bearish move.

4. Break of Trendline Support:

A critical trendline support is marked. If this level breaks, buyers may lose control, leading to increased selling pressure.

5. Market Sentiment & News Events:

Any major economic news (interest rate decisions, inflation data) could disrupt the technical setup, causing unexpected volatility.

Bearish Scenario If Disrupted:

If price fails at resistance and breaks below $2,996, we could see a sharp decline towards $2,988 or lower

Last chance to short gold💡Today, gold hit a low of around 2980 during its decline. Obviously, gold's decline has not reached its peak! There is still demand for gold to continue to retreat.

💡At present, gold has rebounded to above 2998 again, but gold has not broken through the 3005-3010 zone during multiple rebound tests. The upper space has been compressed smaller and smaller, and the bullish momentum has been largely consumed. Gold is expected to seek a breakthrough downward;

💡In the process of multiple rebounds, the momentum of the rebound has gradually weakened, the bull market confidence above 3000 is not strong, the confidence of bulls is not firm, and after the profit realization and selling psychology gradually gain the upper hand, gold is likely to have a flash crash!

📉So we can short gold in the 3000-3010 zone! The first target: 2985-2975, followed by 2965-2955

📞Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Excellent window for gold-------News---

The U.S. inflation data for February was released, and the data showed that the U.S. inflation in February fell across the board, exceeding expectations. The decline in inflation also gave the Federal Reserve more room and possibility for interest rate cuts, and also slightly reduced the concerns originally caused by tariffs. However, with the full implementation of tariffs on Europe, retaliation from Europe also followed, and concerns about the global economic downturn also intensified. The U.S. dollar index rebounded slightly and then fell again.

Gold hourly line pattern chart;

Spot gold; Previously, the gold market continued its strong upward trend, and the bulls performed extremely well. On Wednesday, gold successfully broke through the key resistance level of 2930, breaking the previous confinement and opening the upward channel. On Thursday, the rally not only continued, but also entered a large-volume stage, directly breaking through the previous high of 2956, and without any stop, the highest impact reached 2990. The daily line closed with a long positive line, showing a strong pattern of three consecutive positive attacks. On Friday night, it even reached above 3000. You can short sell near 3000 above, and continue to hold the short positions at the previously arranged points. Reduce positions at the target area of 2970, and exit all positions when it reaches 2950.

You can read bottom signals, interpret daily market trends, share real-time strategies, and no longer blindly follow the trend.

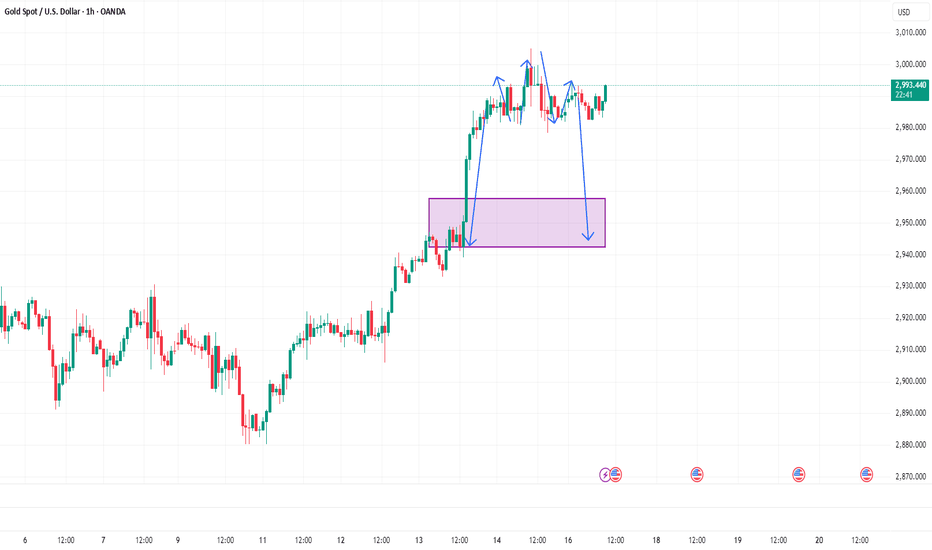

Gold's strong sideways correction continues to be bullishThe 1-hour moving average of gold crosses upwards and the support of the 1-hour moving average of gold has now moved up to around 2985. Gold fell back to the support near 2985 in the US market and continued to buy on dips. The gold bull market has not ended yet. Gold continues to try to break through the new high resistance above. As long as there is no sharp correction, there is a high probability that gold will continue to break through the new high after accumulating momentum.

Gold strategy: It is recommended to buy at 2995, stop loss at 2985, and target at 30010-3020;

XAUUSD Analysis of TodayToday, the price of gold has been fluctuating between the support and resistance levels I analyzed.

Therefore, in the short term, both long and short positions are viable. However, you must pay attention to setting the SL level and must not take excessive risks.

XAUUSD

🎁 Buy@2983 - 2985

🎁 SL 2980

🎁 TP 2993 - 2995

🎁 Sell@3000 - 2997

🎁 SL 3002

🎁 TP 2988 - 2985

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

If you also aspire to achieve financial freedom,Follow the link below to get my daily strategy updates

Gold is testing the barrier again! About to plungeGold hit a new record high again on Friday, reaching 3005 at one point, and also perfectly reaching 3000 points. Obviously, the bulls' goal has been basically achieved. The current K-line must fall back. Moreover, Trump imposed sanctions on the Middle East at the weekend, but the gold price did not rise. Obviously, the bulls are also weak.

From the perspective of gold trend, the situation between Russia and Ukraine has become confusing again under the background of the originally expected clear situation, so the risk aversion sentiment has heated up again. In addition, the global trade concerns caused by Trump's tariff policy have led to the intensification of the risk of global economic recession. The uncertainty of the market has also increased again. At this time, gold has become the most sought-after product in the market. From a technical point of view, gold has repeatedly rushed to the 3000 mark last week. On Friday, it pulled out a Yin cross star at a historical high. There is a need for adjustment in the short term. Don't watch it blindly for the time being.

There is an obvious bearish engulfing at the top of the gold four-hour line, that is, the big Yin line entity directly covers the Yang line entity, forming a top signal. At the same time, the K-line is also seriously deviated from the moving average. It is an abnormal trend again. The decline is inevitable, and returning to the moving average is also a certain short selling.

You can read bottom signals, interpret daily market trends, share real-time strategies, and no longer blindly follow the trend.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

The 3000 mark falls back, continue short-term operationsAfter gold tested the 3000 mark again, it fell back and is currently hovering around 2990. It failed to test 3000 again in the short term. This position is obviously suppressed in the short term. The second upward test quickly fell back. The gold price may fall further. The idea is to follow the trend and short-sell. Pay attention to the short position near 2990, and the target area is 2980-2970. If it falls below 2980, you can directly look at the position of 2955-2940.

You can read bottom signals, interpret daily market trends, share real-time strategies, and no longer blindly follow the trend.

XAUUSD Today's Strategy AnalysisLast Friday, after consolidating around the 2980 level, bullish momentum finally broke higher, driving prices to accelerate during European trading hours. Gold pierced the psychological 3000 resistance level but was rejected and pulled back into a choppy consolidation phase. The session closed near 2985 with a doji candlestick, maintaining the strong bullish trend with unidirectional momentum.

From a 4-hour technical perspective, today's downside support levels are focused on the vicinity of 2975-80. Particular attention should be paid to the critical bull-bear dividing line support at 2960-2963. Intraday pullbacks should maintain a bullish bias initially while holding above the 2975-80 support zone. Upside targets remain focused on breaking above recent highs.

Gold trading strategy:

sell @:3000-3005

buy @:2975-2980 , 2960-2963

If you are currently not satisfied with your gold trading performance, and if you also need to obtain accurate trading signals every day, you can check the information in my profile. I hope it can be of some help to you.

XAUUSD Start to Short?The gold price briefly pierced the $3,000 per ounce threshold again today.

From a 4-hour technical perspective, today's downside support levels remain focused on the vicinity of 2975-2980.

The current day's orders are already in profit.

Gold trading strategy:

sell @:3000-3005

buy @:2975-2980 , 2960-2963

If you are currently not satisfied with your gold trading performance and need daily accurate trading signals, you can visit my profile for free strategy updates every day.

gold on bearish#XAUUSD price have reached back 3000 which is making multiple corrections there.

Now we await for any possible breakout above 3010 for bearish retracment. Sell limit 3010, take profit 2930, Stop loss 3025.

Below 2993 on H1 closure price holds strong bearish there also, or double breakout to occur.

Gold’s Big Moment: $3,000 in Play – Can Bulls Hold It?Gold has finally reached the psychological $3,000 level, triggering the first round of sell-offs as traders take profit. The question now is whether this move can sustain itself or if we are set for a deeper pullback. Given the rapid move up, I remain cautious, ready to cut the trade quickly if I see signs of weakness in the continuation.

Fundamentals:

• Market Sentiment: Bullish drivers remain strong as gold benefits from rising inflation expectations and the Fed’s rate pause, which has fueled demand for safe-haven assets.

• Geopolitical & Economic Factors:

• President Trump’s aggressive tariff agenda is fanning concerns about global trade, increasing risk aversion and driving flows into bullion-backed assets.

• Chinese jewelry stocks are soaring, signaling growing demand for gold in the region.

• The CME FedWatch Tool indicates a 97% probability that the Fed will hold rates steady at its next meeting, reinforcing gold’s appeal.

• Technical Considerations:

• Gold hit a fresh all-time high of $2,993, putting the psychological $3,000 mark in focus.

• Above $3,000, there is little historical price action to guide resistance levels, making price discovery uncertain.

• On the downside, $2,970 acts as a key pivot, with $2,951 and $2,914 serving as strong support zones if a deeper retracement occurs.

Risk Management:

• The first sell-off at $3,000 indicates short-term profit-taking.

• I am monitoring price action closely and will exit quickly if the move proves unsustainable.

Let’s see if gold can hold above $3,000 or if we are in for a correction!

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

The gold high top signal appears, deep correction!It can be found that 3004 is just the top position of the 4-hour chart. After failing to break through the range last Friday, a retracement signal has also appeared. The current lower range support of the 4-hour chart is 2955-50. And 2955-50 happens to be the previous high point. Therefore, this position may be the dividing point between long and short positions of gold this week.

Secondly, from the hourly chart:

It can be seen that the current hourly chart of gold shows signs of a head and shoulders top. Once gold falls below 2980 today, it is very likely to develop towards the lower 2955-2940. 2955-50 happens to be the 618 position of this trend. The lower 50% is around 2940, which may also be the extreme retracement position of gold. Therefore, I do not recommend that you continue to chase more, but consider entering the market to short near 2990. If it falls below 2980, you can directly look at the position of 2955-2940.

You can read bottom signals, interpret daily market trends, share real-time strategies, and no longer blindly follow the trend.

GOLD IN CONSOLIDATION – IS A MAJOR BREAKOUT IMMINENT?📌 Market Overview

Gold starts the week with limited momentum following last week’s sharp drop from its highs. Investors remain cautious, waiting for stronger signals before committing to a clear direction.

This week, the FOMC meeting will be the key event, as the Federal Reserve is expected to provide crucial updates on monetary policy based on last week’s inflation data.

At the same time, geopolitical tensions are rising after Trump's airstrikes on Iran-backed Houthi forces. However, gold has yet to respond significantly to these developments, suggesting that traders are looking for more confirmation before the next big move.

📊 Key Technical Levels

🔹 Support Levels: 2982 - 2976 - 2966 - 2948

🔹 Resistance Levels: 2994 - 3004 - 3015 - 3034

🎯 Today's Trade Setups

🟢 BUY ZONE: 2975 - 2973

📍 SL: 2970

🎯 TP: 2980 - 2984 - 2988 - 2992 - 2998

🔴 SELL ZONE: 3033 - 3035

📍 SL: 3038

🎯 TP: 3030 - 3025 - 3020 - 3016 - 3010

⚠ High Volatility Expected – Prepare for a Breakout!

Gold has been trading within a tight range since last week, and a breakout is likely during the late Asian or early European session. Traders should anticipate increased volatility and ensure strict risk management. Stick to your TP/SL strategy to safeguard capital.

📢 What’s your outlook for gold this week? Will it break higher, or is another correction coming? Share your thoughts below! 🚀🔥

Gold Eyes $3,000 Breakout: Buy the Dip Strategy Remains in PlayYesterday, as expected, Gold reached a new all-time high, coming very close to the key $3,000 psychological level.

Currently, the price is undergoing a minor correction, consolidating the strong gains from yesterday — which may present traders with a fresh opportunity to join the prevailing bullish trend.

The $2,955 level, representing the previous ATH, now acts as a key support. However, in my view, Gold is unlikely to revisit this level, as it would be too obvious and heavily watched by the market. Instead, I expect a shallow pullback followed by a new impulsive leg higher, likely pushing the price above the $3,000 mark.

Conclusion:

The strategy remains unchanged — buy dips in anticipation of a breakout to new all-time highs beyond $3,000.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.