FAS trade ideas

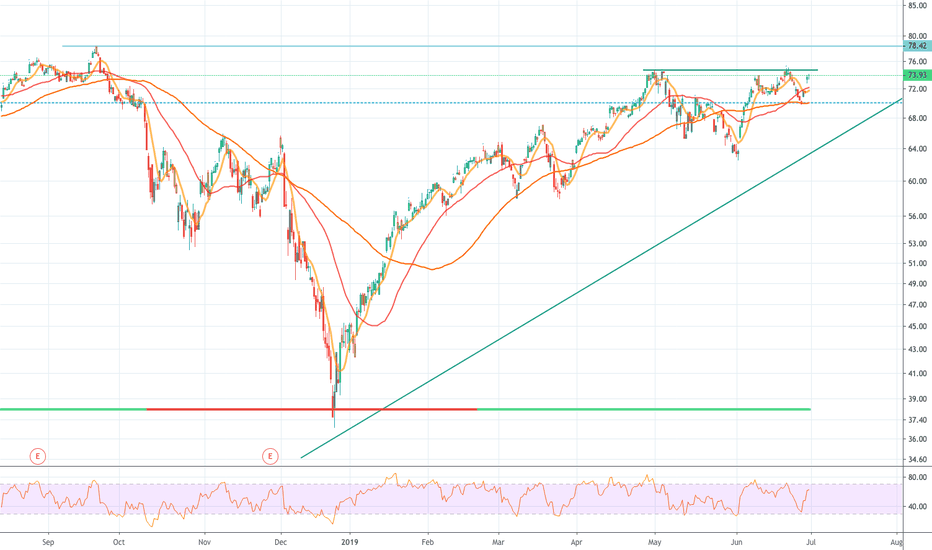

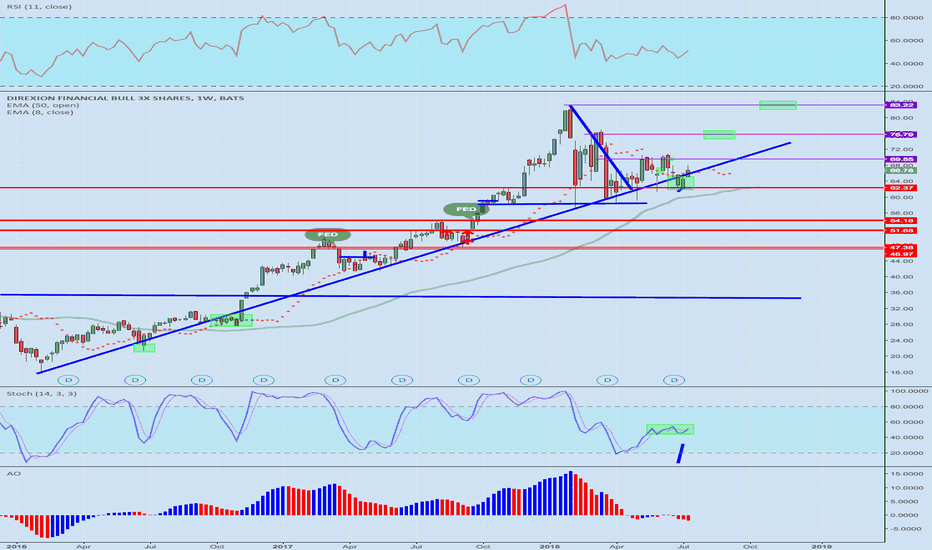

FAS - Swing Trade Short term CallsThis is for our aggressive portfolio. Watch how FAS fights to stay within its pattern. If FAS turns higher it is time to buy CALLS. 2 or 3 day hold MAX. If we break the channel to the downside, keep an eye out for PUTS. As I am writing this now the S&P Futures are lower. Wait and See. Be SMART AMEX:FAS

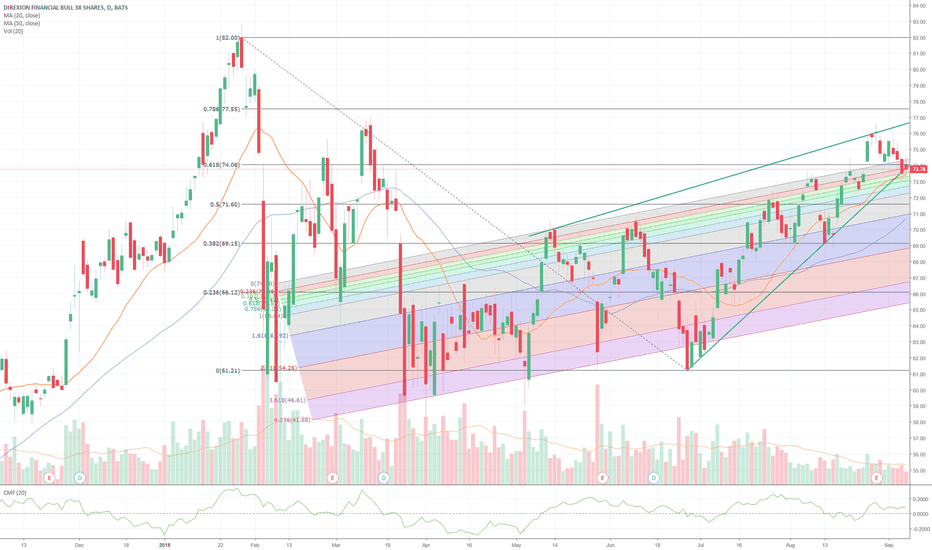

Financials Passing Overhead Resistance in Pre-marketA very bullish sign for the Financial sector when FAS passed the double top overhead resistance at around $74.93 in premarker trading. New resistance is at $78.42 which is good for a further 3.5%. Given the events of Saturday I expect this to continue marching forward.

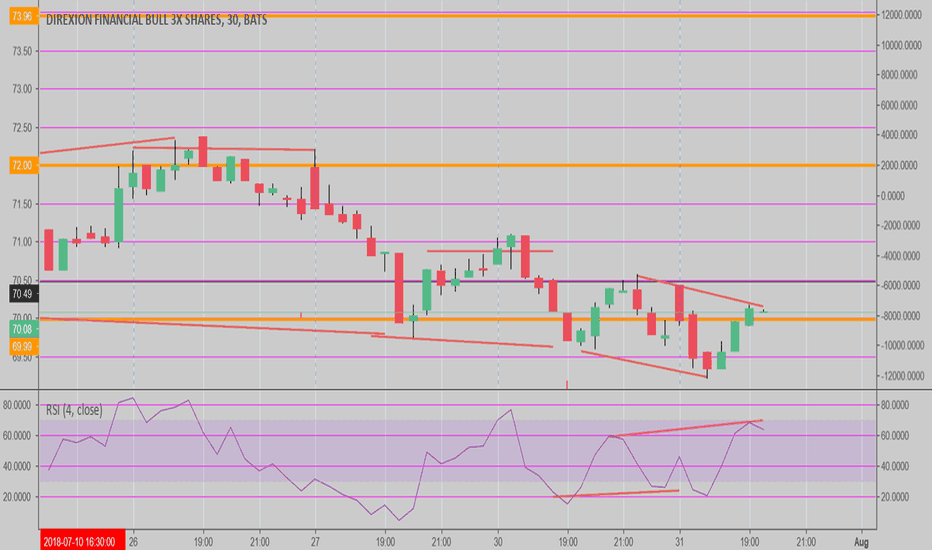

FAS Buy 70.85 stp, TP 72.10, SL 69.74Hidden divergence on three time periods.

Price unchanged, but RSI divergence down in an up trend and just coming off support -> buy signal.

TP 72.10, but could go higher

RR = 1.25

Shorter TP, could have entered Friday about 90 minutes before close, with better RR.

Back testing shows RR 1.25 to 2.0 with entries 3-4X/week.

Only check chart 3 times a day with this method.