Aud/Usd Long Term SellAud is weak. So has also Usd been this week. But, what I'm looking for here is long term picture. Institutions are shorting Aud and buying Usd. This we can see looking at COT reports and priceaction.

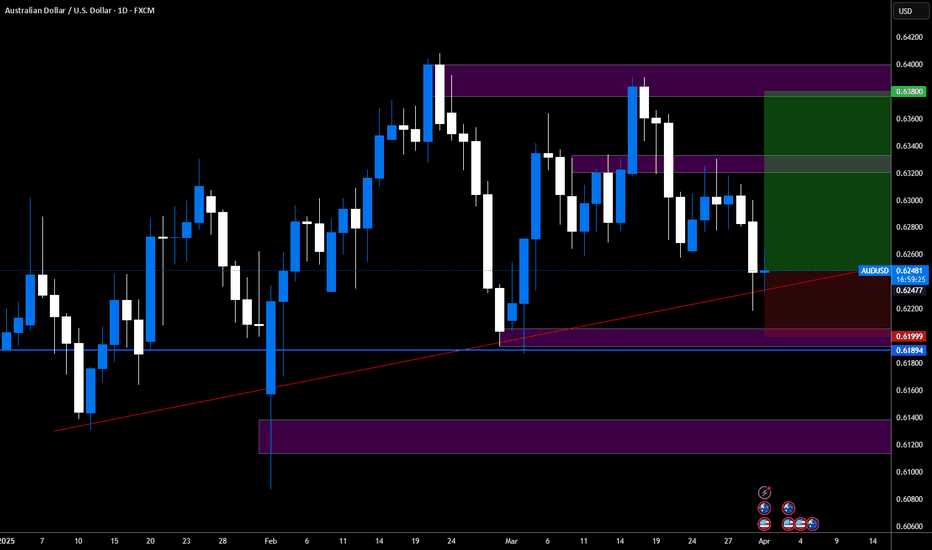

Looking at monthly and weekly charts bulls have difficulties to move price higher. Simply put, sellers are holding their resistance at 0.6400 level and price is ranging in side movement. Also, Aud had a strong push up from 0.6240 level after US put tarrifs on foreign countries on April 2nd. Despite this price was pushed down again on April 4th.

Entry: 0.62400

SL: 0.65000

TP: 0.5800

For best performance: trade in small size and scale into trade. This gives you opportunity to DCA with small size while keeping risk down.

AUDUSD.1.MINI trade ideas

#AUDUSD: Three Swing Target Accumulating Total of 1400+ Pips! Analysing the AUDUSD currency pair on a broader timeframe of three days reveals a bearish trend. This suggests a potential final decline in prices before a significant bullish surge in the market.

Two golden lines are drawn around the entry area, indicating potential entry points at the first, second, or intersection of these lines. Alternatively, the first and second lines can serve as entry and stop loss points, tailored to your trading strategy.

Additionally, important economic indicators are set to impact the market. For instance, the Non-Farm Payrolls (NFP) report scheduled for this coming Friday will significantly influence the direction of the DXY monthly price.

If you find our analysis valuable, please consider liking and commenting on our ideas. Your feedback will be instrumental in our efforts to provide more detailed and insightful analysis.

Much Love and Gratitude for your support in advance, happy to help.❤️🚀

Team Setupsfx_

AUDUSD - Lets Continue The Bear TrendThe aussie has been bearish so far this year, and rightly so! We must consider that whilst the US Reserve Bank has talked about cutting rates they have just had a Jobless Claims print lower than the last few decades, signaling that the US economy is going well.

In addition, we must consider tensions in Red Sea and the middle east are disrupting trade, and when there are tensions the world looks to USD.

Technically, price has been in a bear market this year, and has just bounced out of the first fibonacci resistance. It is also hovering below the 200 hour moving average, which has been trading down this year.

AUDUSD Analysis: Bullish Momentum Ahead?Based on the EASY Trading AI strategy, I'm positioning for a potential bullish movement on AUDUSD. The signal clearly indicates a Buy entry at 0.59776 with profit expectations aiming towards 0.60924333. A precise Stop Loss is set at 0.58973333.Why bullish? The EASY Trading AI algorithm evaluates market momentum, volatility, and trend consistency. Right now, the currency pair signals strengthening positive sentiment alongside technical rebounds from key support areas, suggesting upward price pressure.Follow strict risk management and watch closely – volatility remains significant, and tight guidelines are essential.

audusd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUD/USDAUD/USD Trade Recap + Opportunity

Earlier AUD/USD positions closed partially with a trailing stop. Some trades are still active. Price has now retraced back to our original entry around 0.59908, offering a potential re-entry setup.

Trade Setup:

Entry: 0.59908

Stop Loss: Original setup

Take Profit: Original target

Trailing Stop: 33 pips

Watching for reaction during the upcoming Asian session. Manage your risk accordingly.

AUDUSD bullish continuation still to expect

FX:AUDUSD we are have break of CHANNEL, break of long trend line, price is make revers, now its on strong sup zone and from here new bullish push expecting.

USD showing self weak still, continuation expecting, +we are not see some special moves here.

SUP zone: 0.62500

RES zone: 0.64400, 0.64900, 0.65400

AUDUSD INTRADAY loss of support at 0.5680AUD/USD maintains a bearish outlook, reinforced by the prevailing downtrend and a confirmed break below the previous consolidation zone.

Key Resistance Level: 0.6140 – previous support turned resistance

Downside Targets:

0.5930 – initial support

0.5890 and 0.5740 – longer-term bearish targets

An oversold bounce may retest 0.6140, but unless the pair breaks above this level, a bearish rejection could reinforce downside continuation toward the key support zones.

A daily close above 0.6140, however, would invalidate the bearish scenario, potentially shifting momentum toward 0.6240, with further gains to 0.6300.

Conclusion

AUD/USD is bearish below 0.6140. Watch for rejection at that level to confirm further downside potential. A break and daily close above 0.6140 would shift the outlook to bullish, opening the path toward 0.240 and beyond.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Confirmation to buy to a Daily supply Like the previous week price was on a weekly demand.

Today buyers are trying to maintain their position.

On the 4hr there was a rejection candle showing that buyers still have interest in pushing price higher.

Will the daily supply? 🤔

Does buyers have the will power to beat sellers.

The week shall tell.

Pipful week.

GBPUSD, EURUSD and AUDUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

AUD/USD AUD/USD – New Long Position After Liquidity Sweep Post-NFP

After the trailing stop on our last AUD/USD long was hit during the NFP-induced liquidity sweep, we've re-entered the pair on signs of bullish continuation.

🔹 Entry: 0.59907

🔹 Stop Loss: 0.59229

🔹 Target: 0.61900

Price swept key liquidity levels and reclaimed structure with strong momentum, indicating a potential shift back toward bullish territory. Watching closely for follow-through above .6050 for added confirmation.

Trade safe and keep your risk tight.

#AUDUSD #forex #priceaction #liquiditysweep #technicalanalysis #nfp