BTC.D% my notes for short-termThe negative scenario could be that the dominance tries to create a double top or take 50% of the upper wick. If it does this, it will try quickly, in this scenario we can have a heart attack. These levels are: 61.3 - 62.7 - 63.5 and 64.5.

In the positive scenario, the dominance will rise to 61.3% at most and fall down quickly. A drop to 56% and 58% below could create nice recoveries for altcoins in the coming weeks.

In the short term, these are the possibilities I expect in the coming days/weeks and the price levels I follow.

This is not investment advice.

BTC.D trade ideas

Was 64% the top, or is there more downside coming for altcoins ?Hello Traders 🐺

In my last idea, I discussed the potential short-term pump for altcoins, which you can check out here: 👇

As you can see in the chart above, BTC.D dropped exactly as I predicted—so congratulations to all my dear followers who took advantage of it!

But what now?

Despite the recent dumps in the market, I still strongly believe that 64% was the top for BTC.D. Let me explain why:

1️⃣ The chart shows a rising wedge pattern, which is typically a bearish formation.

2️⃣ If BTC.D moves higher again, in my opinion, it could form a double top, making the chart look even more bearish!

3️⃣ Most altcoins are currently experiencing a severe decline, but in the past few days, ETH has shown slight outperformance over BTC, which is a bullish sign.

4️⃣ Always remember that technical analysis is about learning from history and acting accordingly. So far, we have never seen a bull market peak when BTC.D is at such a high level, and the Altcoin Season Index is still around 30%.

I hope you enjoyed this idea!

🐺 Stay sharp, trade smart! – KIU_COIN 🐺

BTC.D ON DAILY CHARTCRYPTOCAP:BTC.D

on daily chart the bitcoin dominance continues to put significant market pressure and still on uptrend line.

we has a very strong resistance at 62% and I don't think it's easy to overcome, maybe it's the last breath.

Lets wait and see what happen soon , but in any case, in the event of a rebound and not exceeding the resistance, we will have support at 59% and 58%, and it must be broken to see a recovery in the market .

waiting..

Reality SlapI’m here to slap those calling for alt season since 2023. Yes, you deserve a big fat slap for calling for something that hasn’t happened yet. I’m guilty of calling for alt season without seeing any signs myself. You only need one indicator to tell you that we are in alt season and that’s when BTC.D goes and closes below 150 EMA on the weekly chart. For now the dominance is far above the150 EMA and we can all bark about alt season, but it’s not going to happen until we get a close below the 150 EMA.

BTC.D has not topped out yet vol.2In case you missed december 16th post there it is

After 2 months BTC.D still in uptrend.

Previous resistance is acting like support right now.

RSI is trending higher (formed higher low) and StochRSI has strong momentum upside.

BTC.D is not Topped. It is still going higher in coming WEEKS. So we must expect for big opportunity to buy altcoins at 50-60% discount from current prices.

I believe that this incoming crash must be the last one.

Bitcoin Dominance Analysis Channel Rejection and Its Impact Bitcoin Dominance is currently trading within a well-defined downward channel, indicating a consistent decline over time. Recently, dominance attempted to break below the channel but failed, resulting in a re-entry back into the channel. This failed breakdown suggests that the bearish momentum is weakening, at least temporarily.

A declining Bitcoin dominance typically signals a potential bullish phase for altcoins, as market capital moves away from Bitcoin into alternative cryptocurrencies. However, in this scenario, the downward movement is relatively slow, confined within the channel, which explains the lack of a strong recovery in the altcoin market.

For a more significant altcoin rally, we need to see a clear breakdown of this channel, accompanied by a sharper decline in dominance. A rapid drop would likely trigger stronger buying activity in altcoins, providing better opportunities for traders.

It's crucial to monitor Bitcoin dominance closely, as its next move will provide key insights into potential market shifts. Stay alert and adjust your trading strategy accordingly.

If you find these market insights helpful and want to stay updated with more trade setups and detailed analysis and join my community,feel free to ping me.

Altcoin Season is imminent!Hello Traders 🐺,

As you can see in the chart, I’ve included all the key information, but let me break it down for you more clearly:

1️⃣ We have never seen the RSI reach this level on the monthly BTC.D chart before! This looks extremely bearish for BTC.D and highly bullish for Altcoins!

2️⃣ As you might know, every time we see a golden cross in TOTAL2 (which represents the Altcoins’ market cap excluding BTC), it signals the beginning of Altcoin season. The exciting part? This golden cross is happening exactly when BTC.D is at its high percentage levels , making the setup even stronger!

🐺 Stay sharp, trade smart! – KIU_COIN 🐺

$BTC.D and $DXY are in diametrically opposite directionsIn this blog space we have been discussing Bitcoin Dominance ( CRYPTOCAP:BTC.D ) since Dec 2024. On 9th Feb 2025 I posted a blog where we discussed the Fib Retracement levels in CRYPTOCAP:BTC.D chart and we said that we can expect more upside and has broken past 0.618. I said it is possible that the dominance can reach the 0.786 Fib level at 66.12%.

I tried to plot the Dollar index TVC:DXY in the same weekly chart as CRYPTOCAP:BTC.D and it was quite surprising that the FIB retracement levels in CRYPTOCAP:BTC.D are the same as the top to the bottom levels in the TVC:DXY chart. We are looking at the last 5 years for our analysis.

When CRYPTOCAP:BTC.D has broken past 0.618 Fib level and trying to reach 0.786 @66.12%. But the TVC:DXY has broken below 0.786 and in the near term the TVC:DXY level can end up at 0.618 Fib levels which can take TVC:DXY to 104.

So, in the near to medium term is CRYPTOCAP:BTC.D @ 66.12% and TVC:DXY @ 104.

ETH/USDT 1H: Momentum Strong – Can Bulls Break $2,820?!"ETH/USDT 1H: Momentum Strong – Can Bulls Break $2,820?"

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Market Structure & Momentum:

Price: $2,734, showing strong momentum after breaking key resistance.

RSI at 64.50, confirming bullish momentum but not yet overbought.

Clear bullish structure, with higher lows forming.

Hidden bullish divergence confirmed on RSI, supporting continuation.

Key Levels:

Resistance: $2,780 (major supply zone).

Support: $2,680 (previous resistance turned support).

Fair Value Gap (FVG): $2,600-$2,620 range.

Trading Strategy:

Entry: Current price ($2,734) or pullback to $2,700 for better risk-reward.

Targets:

T1: $2,820 (+3.1%).

T2: $2,860 (+4.6%).

Stop Loss: Below $2,645 (-3.2%).

Risk Score:

6/10 – Momentum is strong, but price is nearing major resistance.

Smart Money Analysis:

Accumulation visible at the $2,600 zone, confirming institutional interest.

Market Makers likely targeting liquidity above $2,800.

Strong institutional buying pressure evident from the volume profile.

Recommendation:

Longs remain favorable, but watch for potential resistance at $2,780.

Keep tight stops below $2,645 in case of rejection.

Break and hold above $2,780 confirms strength for a move toward $2,860.

Confidence Level:

8/10 – Bulls in control, but price must clear $2,780 resistance for extended upside.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

BTC.D weekly chartCRYPTOCAP:BTC.D

Is the 2017 scenario repeating here? I think it is the most likely, the price reached an important resistance.

We also have a negative weekly candle at the resistance and tomorrow is the close.

So, all the data says that the takeover should fall from this area.

Let's observe and see behavior after the weekly close.

waiting .....

BTC Dominance Drops: Is the Alt Season About to Begin?Hello, Traders!

After its recent rise to 64%, BTC.D started to decline slowly and currently dropped below 61%.

In order to resume alt season, BTC.D needs to drop at least below 57% and hold below that mark for a prolonged period of time.

Ideally, it should break below 54% to make a lower low and confirm a sustained downward trend.

Historically, when BTC.D enters a clear downtrend, liquidity flows into altcoins, leading to significant rallies across the board.

I don’t think that even if the alt season really takes off, we will see BTC.D much below 48%—perhaps 45%, but not lower.

At that level, the market typically starts rotating back into BTC, capping further dominance declines.

However, if BTC stagnates while liquidity continues flowing into alts, a deeper drop isn’t entirely out of the question.

One of the potential catalysts for a BTC.D decline and the start of the alt season is Ethereum’s upcoming Pectra upgrade.

Historically, ETH has shown strong performance ahead of major network upgrades, often doubling in price in anticipation.

If history repeats itself, we could see increased demand for ETH, driving capital into the broader altcoin market.

The Pectra upgrade is scheduled for April 8, meaning we might see altcoins gaining momentum in the next couple of weeks.

If BTC remains stable and ETH starts outpacing it, this could create the perfect conditions for the much-anticipated alt season.

Keep an eye on ETH/BTC as well—it could serve as an early indicator of the shift. 🚀

Please don’t forget to boost this idea and leave your comments below.

Bitcoin Dominance (BTC.D) – Current Market OverviewRecent Trend:

Bitcoin Dominance (BTC.D) has been in a steady uptrend for the past two years, reflecting Bitcoin’s outperformance relative to altcoins. The rise in BTC.D indicates that Bitcoin has been capturing a larger share of the overall cryptocurrency market compared to altcoins.

Bearish Divergence:

The weekly chart now shows a bearish divergence, as the Relative Strength Index (RSI) has failed to confirm the recent upside move. This signals that the buying momentum behind BTC.D is weakening, even though the price has been pushing higher. A divergence of this nature can often suggest a reversal or slowdown in the current trend.

Resistance Levels:

There is significant overhead resistance between the 66% and 73% levels, which were last tested during the 2021 bull run. During that time, BTC.D faced rejection in this range, leading to a shift of capital into altcoins.

A rejection at this resistance could lead to a shift in market dynamics, with altcoins seeing increased demand and potentially entering a rally.

Potential Catalysts for an Altcoin Rally:

If BTC.D faces rejection at these key resistance levels, it could signal the start of an altcoin rally, as market capital may flow out of Bitcoin and into altcoins. Traders will closely monitor this resistance zone as a potential catalyst for a shift in market sentiment.

Outlook:

The bearish divergence on the RSI and the presence of strong resistance between 66% and 73% suggests that Bitcoin dominance might be at a turning point. A rejection in this zone would open up the possibility for altcoins to outperform Bitcoin in the near term.

Conclusion:

Bitcoin dominance remains in an uptrend, but the bearish divergence and resistance between 66% and 73% on the BTC.D chart suggest that altcoins could gain momentum if BTC.D faces rejection at this level. Traders should closely monitor this zone, as a reversal in Bitcoin’s dominance could signal the start of a broader altcoin market rally.

BITCOON DOMINANCE at a decision point (12H)Bitcoin dominance has reached a key resistance level at the top and is currently in a critical zone. If it gets rejected from the red box, we could see a green market this month.

Let's see what happens!

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

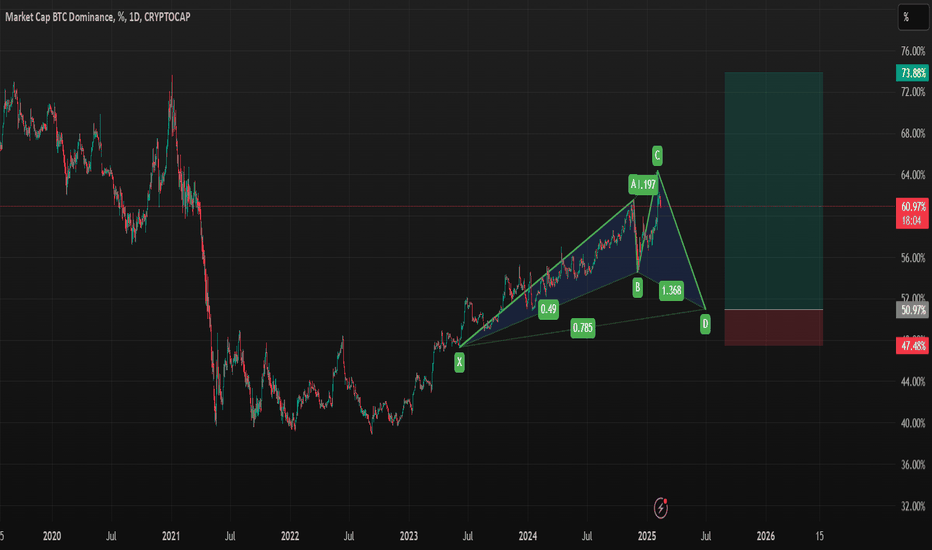

Bullish Scenario for BTC.DOMBTC.DOM might be playing out a bullish cypher pattern. Retracement of BTC.DOM is needed to in order to rotate the money flow to the alts with good utility. Market markers will buy BTC and Alts (with good utility in the long run) at discount. This might be the final shake out before the massive move to the upside.

BTC DOMINANCE:- Alts are nearly set to rally! 🚀 Alts are almost ready for a rally! 🚀

We’re approaching the resistance zone on the BTC dominance chart, which has historically led to strong rejections and market-wide rallies since May 2017. The index has already reached a 64.34% high. We could see another push to this level, potentially forming a double top on the lower timeframes, followed by a slight correction in altcoins. During this phase, many alts will likely form double or triple bottoms.

Despite the low volume in the market, on-chain analysis shows accumulation in altcoins like FET and TAO.

Be prepared for what's coming next!

Drop your thoughts in the comments, and don’t forget to hit that like button for support!

Thank you

#PEACE

When Alt-Season? Here's the Key FactorAlt-Season = BTC.D going down, but liquidity is king.

Right now, I don’t believe we’ll see a true alt-season until the Fed starts QE.

At the last FOMC meeting, Powell confirmed that QT will continue, meaning there is no reason to expect QE soon.

For QE to return, something needs to break—whether in the stock market or the broader economy.

Right now:

- Stock indices are at all-time highs

- The economy remains resilient

But cracks could form later this year

Possible triggers for QE:

- A stock market correction

- A credit event (bank failures, debt crisis)

- A sudden economic downturn

Why QE Matters for Crypto

- QE (Quantitative Easing) = Fed buys assets → Lowers interest rates → Pumps risk assets.

- QT (Quantitative Tightening) = Fed sells assets → Raises interest rates → Drains liquidity.

Crypto thrives in QE environments—that’s why we had the last alt-season in 2021, during extreme money printing.

In the chart, BTC.D is overlaid with Total Fed Assets.

- When the Fed’s balance sheet expands (QE) → BTC.D drops → Alts pump.

- When the Fed’s balance sheet contracts (QT) → BTC.D rises → BTC dominance increases.

Bottom Line:

For altcoins to outperform, we likely need another QE cycle. Without it, liquidity remains tight, and BTC.D stays high.

What’s your take? Will QE return in 2024, or will the Fed hold the line?

Is Altcoin Season STILL About to Begin in 2025?Looking at CRYPTOCAP:BTC.D , before the 2021 altseason kicked off, there were 3 key stages:

▍Stage 1: A steep rounded top formed.

▍Stage 2: Along the neckline of the rounded top, a rounded bottom developed.

▍Stage 3: BTC.D dropped sharply, triggering a crazy altseason.

For 2025, it seems we're about to enter Stage 3:

▍Stage 1: Again, a steep rounded top formed.

▍Stage 2: Just like before, a rounded bottom appeared along the neckline.

What’s different this time?

BTC.D just retested the neckline resistance zone for the second time yesterday.

After touching it, BTC.D formed a long lower wick, signaling strong rejection.

Now, it's all about watching the next moves.

If BTC.D mirrors Stage 3 from the last cycle, we could see a sharp drop soon.

And if that happens, the crazy altseason might start before anyone is ready.

🔴 for more future script "guesses" like this!

🔥 I've dropped another 2 analyses for the 2025 altseason on the right hand side if you're using computer, and scroll down a bit to see the link if you're using mobile.