BTC.D trade ideas

BTC Dominnace: The Real Disaster is Here!🚨 BTC Dominance: The Real Disaster is Here! 🚨

Bitcoin Dominance (BTC.D) has officially confirmed its uptrend, breaking through key resistance levels and heading toward the upper zone. The next major stop? **The black zone**—a crucial area that could dictate the fate of the market.

🔥 What This Means for Altcoins 🔥

With BTC dominance on the rise, liquidity is shifting heavily into Bitcoin. Historically, this scenario has spelled **bad news for altcoins**—any hopes for an "Altcoin Season" could be fading fast. If this move continues, many altcoins could suffer heavy losses in BTC pairs.

💡 Key Takeaways for Your Trades 💡

✅ Be cautious with new altcoin entries—risk is high.

✅ Keep an eye on **Bitcoin's price action**—a strong BTC move can further crush alts.

✅ **Risk management is key**—don’t overexpose yourself to high-risk plays.

✅ If BTC.D continues to climb, expect further dominance over altcoins in the coming weeks.

🚀 Final Thoughts 🚀

We’re at a critical moment—stay vigilant and adjust your strategy accordingly. Pay close attention to your new buy trades, as market conditions could shift rapidly.

What’s your game plan? Let’s discuss it in the group! 📢👇

Mid-February, Btc.d peaks and the altcoin rally may start.Trust fibonacci.

It is clear from Fibonacci extensions that we are close to the peaks in Bitcoin dominance.

Fibonacci circles also give us ideas of both resistances and time periods.

In my opinion, Bitcoin dominance will peak in mid-February and the altcoin bullrun may begin. Bitcoin dominance will bottom at the end of May 2026.

* What i share here is not an investment advice. Please do your own research before investing in any digital asset.

* Never take my personal opinions as investment advice, you may lose all your money.

BTC.D at a Critical Juncture – Will Altcoins Take the Spotlight?CRYPTOCAP:BTC.D

The BTC Dominance (BTC.D) chart is at a critical juncture. Here's my analysis:

1️⃣ Key Resistance Area: The dominance has approached a significant resistance trendline. This zone is crucial, as it has historically acted as a turning point.

2️⃣ Potential Pullback: In my opinion, this could be the last pullback before BTC.D resumes its downtrend. If this scenario plays out, it could signal the start of the long-awaited altseason.

3️⃣ Break Confirmation: Keep an eye on the lower support level highlighted on the chart. A clean break below this level (more secure than the previous one) would confirm bearish momentum and strengthen the case for a further decline.

4️⃣ Targets: The first target is around 50.81%, with potential for deeper declines if momentum continues.

💡 Key Takeaway: This analysis suggests that BTC dominance is showing signs of weakening. If the support breaks, altcoins could gain significant market share. Watch these levels closely and prepare for opportunities in the altcoin market.

What do you think? Do you agree with this outlook, or do you see BTC.D holding its dominance longer? Feel free to share your thoughts below!

#Crypto #BTC.D #Altseason

Bitcoin Dominance Keeps Climbing Despite Bearish Divergence📉 Bitcoin Dominance Keeps Climbing Despite Bearish Divergence

🚨 Since January 29, 2025, a massive bearish divergence on Bitcoin dominance ( CRYPTOCAP:BTC.D ) has been forming... yet it never materialized!

🔍 Even worse—this divergence keeps growing, meaning CRYPTOCAP:BTC.D is overbought but still pushing higher, defying all technical indicators.

💡 The March 19, 2025 FOMC Pump:

Bitcoin jumped +6% from GETTEX:82K to $86K 📈

Altcoins barely moved—most stayed stable or had a minor push 📉

This was not an organic move—it was institutional & political manipulation

⚠️ The Consequences:

Altcoins are getting wrecked—again 😤

When Bitcoin corrects, altcoins will crash harder 🚨

Bitcoin maximalists (Saylor, politicians, whales) are pushing Bitcoin at the expense of the entire crypto industry

🎭 Reality Check:

Bitcoin maximalists don’t care about crypto—they care about their own bags 💰. Their goal? Kill altcoins & centralize wealth in Bitcoin.

⏳ Until the crypto industry wakes up to this war between Bitcoin maximalists & the rest of the market, nothing will change.

Another altseason cancelled, another liquidity funnel into Bitcoin to protect institutional & banking interests.

Hopefully this bearish divergeance will finally plays out and we will see this very welcome altseason. Until then, altcoins are struggling.

#Bitcoin #Crypto #Altcoins #BTC #BearishDivergence #CryptoManipulation #AltseasonCancelled #BTCMaximalists #CryptoNews #Saylor #InstitutionalManipulation

Technical and Statistical Time-Series Analysis For Dominan (BTC)Bitcoin dominance is currently at 62.24%, a level it has reached during the latest bullish wave in a three-year continuous uptrend. This coincides with the formation of an all-time high in the recent fifth wave.

Current Situation Analysis:

Bitcoin Dominance Level: Bitcoin dominance indicates the percentage of control Bitcoin investors hold. When Bitcoin dominance is high (as it is here at 62%), it signifies that Bitcoin investors control the market, supporting the uptrend. 📈

Uptrend: The three-year continuous bullish wave indicates the strength of the current trend. 🚀

Fifth Wave: In Elliott wave theory, the fifth wave often represents the end of an uptrend. Therefore, the formation of an all-time high in this wave may indicate an approaching trend reversal. 📉

Predictions:

The market may target the 65.70% level before it begins to reverse. 🎯

A daily close below the 60.30% level may signal the beginning of a change in the uptrend, with an initial target at 52.5%. 📉

Notes:

Technical analysis is one tool among many used by traders and investors. 📊

Bitcoin dominance analysis is part of the market analysis tools that contribute to decoding trades. 🔍

Financial markets are volatile and cannot be predicted with absolute accuracy. ⚠️

Recommendations:

Monitor the mentioned support and resistance levels (65.80%, 60.30%, and 52.5%). 👀

Use other technical analysis tools to confirm signals. ✅

Consider other factors that may affect the market, such as economic news and political events. 📰

Always exercise caution in trading. 🚨

Bitcoin Dominance Nearing Major Resistance – Big Move Incoming!Bitcoin dominance (BTC.D) has been in a strong uptrend and is now approaching a key resistance zone between 65% - 75%. Historically, this level has acted as a major turning point, leading to significant shifts in market dynamics.

✅ BTC.D has broken above long-term trendline resistance.

✅ The 62%-65% zone is a strong supply area where dominance previously reversed.

✅ A fakeout above resistance could trigger a sharp rejection, leading to a decline in BTC dominance.

✅ The projected drop in BTC.D (expected in Q3 2025) aligns with potential altcoin strength, signaling an upcoming altseason.

🔸 BTC dominance could push toward 75% before a rejection.

🔸 This move could coincide with Bitcoin reaching $100K+ levels

🔸 If BTC.D gets rejected at resistance, a sharp drop toward 50% or lower could fuel a massive altcoin rally in Q3 2025.

🔸 This scenario aligns with past cycles, where BTC.D peaked before capital rotated into altcoins.

⚡️ BTC dominance is nearing a make-or-break level – a rejection could mark the start of altseason 2025, while a breakout could further strengthen BTC’s dominance.

💬 What do you think? Will BTC.D break higher, or is altseason around the corner? Drop your thoughts below! 👇

Cheers

GreenCrypto

Bitcoin Dominance: End Game Approaching Looking at this chart, a powerful story unfolds:

Bitcoin's dominance has been trapped in a textbook rising wedge since 2022 - a pattern that's screaming for a breakdown. After touching 62.16%, the technical structure suggests we're witnessing the final stage before a major reversal.

The Coming Collapse -

The current setup projects a dramatic fall toward 40% support by mid-2026. This isn't just a minor correction - it represents a potential 35% decline in Bitcoin's market share and signals a massive rotation into altcoins.

Key Insights -

- Rising wedge formation complete (purple zone)

- Resistance rejection at 62.16%

- Historical support at 40% (lower orange boundary)

- Breakdown target aligns with previous market cycle timing

Trading Implications -

This pattern suggests we're approaching "The Great Altcoin Awakening" - a phase where capital flows aggressively from Bitcoin into alternative cryptocurrencies.

Smart money positions before the masses. The chart is telling us exactly where we are in the cycle.

The question isn't if this breakdown happens, but when - and which projects capture the redirected capital flow.

FOLLOW ME FOR MORE IDEAS :)

BTC.DSame players, same game. Third time I get to see them do this.

Crypto has been tamed since ~2018. This move is to tame the bigger markets.

All longs on /BTC pairs must die before that alt season everyone's been calling for.

We've been hanging out in euphoria and optimism for some time.

This should be a quick reset to pessimism.

Remember... "Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria."

Rising Wedge Bear Trap !?Hello Traders 🐺

I was really hoping I wouldn’t have to say this or publish this idea… but this might be one of those unseen facts that makes us a bit uncomfortable. Still, I have to be realistic with you—and that’s exactly what separates a pro trader from a nobie! 💡

As you might know, there’s a bearish expectation when it comes to the rising wedge pattern. By nature, it tends to break downward. We often see volume decreasing inside the pattern, along with bearish divergence on RSI.

So far, so good—this is what most of us expect and want to see. But...

there’s one scenario many traders don’t even consider! Let me show you:

Usually, we expect a bearish breakout from the rising wedge, which could lead to an Altcoin Season.

But—there’s a chance the price pumps even higher than the previous high to grab liquidity from the top. Then we may witness another sharp crash, especially in ETH and other Altcoins.

And just when every bear thinks we’re going down further…

Boom—things change. The bear trap inside the rising wedge plays out perfectly, and the market starts pumping again. 🧠⚠️

I really hope you don’t panic sell during that moment—because with almost 100% certainty, it’s gonna turn into a huge regret later in your trading journey.

And as always, remember:

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺

BTC.D and altcoin season analysis and prediction 2025 #BTC #BTC #BitcoinDominance #AltcoinSeason #Crypto2025 #Cryptocurrency #CryptoMarket #BitcoinAnalysis #Altcoins #Ethereum #CryptoBullRun #BTCPricePrediction #CryptoInvesting #Blockchain #CryptoTrends

Bitcoin Dominance (BTC.D):

BTC.D measures Bitcoin's market capitalization relative to the total cryptocurrency market. A high BTC.D indicates Bitcoin's market share is substantial compared to altcoins, while a declining BTC.D suggests altcoins are gaining traction.

Recent analyses indicate that BTC.D is approaching a resistance level around 62%-63%. A breakout toward 70% could delay the altcoin season, whereas a decline below 58% may signal its onset.

Market Dynamics: Analysts predict that an altcoin season has started and will continue throughout the first quarter of 2025.

CCN.COM

Historical Patterns: Historically, altcoins tend to outperform Bitcoin in the third year of a bull market, which could make 2025 the year of altcoins.

BUSINESSINSIDER.COM

Regulatory Environment: The election of Donald Trump and several crypto-friendly lawmakers has contributed to Bitcoin crossing the $100,000 mark for the first time. Analysts predict Bitcoin prices could reach between $180,000 and $200,000 by the end of 2025. Despite a potential cyclical correction, the involvement of institutional investors may dampen downturns. The Federal Reserve's interest rate policies could also impact Bitcoin prices. There is uncertainty whether altcoins will follow Bitcoin's rally, although financial institutions are preparing for broader crypto ETF approvals.

INVESTOPEDIA.COM

Predictions for 2025:

Steno Research forecasts that 2025 will be an exceptional year for both Bitcoin and Ethereum, with Bitcoin potentially reaching $150,000 and Ethereum around $8,000. This optimistic outlook is supported by a favorable regulatory environment, decreasing interest rates, improved liquidity, and expanding institutional adoption.

Bitcoin Dominance (BTC.D):#BTC #BitcoinDominance #AltcoinSeason #Crypto2025 #Cryptocurrency #CryptoMarket #BitcoinAnalysis #Altcoins #Ethereum #CryptoBullRun #BTCPricePrediction #CryptoInvesting #Blockchain #CryptoTrends

Bitcoin Dominance (BTC.D):

BTC.D measures Bitcoin's market capitalization relative to the total cryptocurrency market. A high BTC.D indicates Bitcoin's market share is substantial compared to altcoins, while a declining BTC.D suggests altcoins are gaining traction.

Recent analyses indicate that BTC.D is approaching a resistance level around 62%-63%. A breakout toward 70% could delay the altcoin season, whereas a decline below 58% may signal its onset.

Market Dynamics: Analysts predict that an altcoin season has started and will continue throughout the first quarter of 2025.

CCN.COM

Historical Patterns: Historically, altcoins tend to outperform Bitcoin in the third year of a bull market, which could make 2025 the year of altcoins.

BUSINESSINSIDER.COM

Regulatory Environment: The election of Donald Trump and several crypto-friendly lawmakers has contributed to Bitcoin crossing the $100,000 mark for the first time. Analysts predict Bitcoin prices could reach between $180,000 and $200,000 by the end of 2025. Despite a potential cyclical correction, the involvement of institutional investors may dampen downturns. The Federal Reserve's interest rate policies could also impact Bitcoin prices. There is uncertainty whether altcoins will follow Bitcoin's rally, although financial institutions are preparing for broader crypto ETF approvals.

INVESTOPEDIA.COM

Predictions for 2025:

Steno Research forecasts that 2025 will be an exceptional year for both Bitcoin and Ethereum, with Bitcoin potentially reaching $150,000 and Ethereum around $8,000. This optimistic outlook is supported by a favorable regulatory environment, decreasing interest rates, improved liquidity, and expanding institutional adoption.

Bitcoin Dominance Update

Dominance flip to bullish since 11AM in this morning panda fam ! 🚀🩸

— ( QUICK TIP ) Pag nag pump si Bitcoin Dominance 📈 then Alts will bleed or drop. 📉

As of now majority of altcoins panda fam is bleeding and it means not safe to place some longs right now since bitcoin dominance still approaching to our Resistance Keylevel at 62.33%

When Safe to long on alts ?

— If bitcoin Dominance form a possible bearish structure that time we will spot a possible bullish bias on altcoins. 💡

WARNING! Sell Your Altcoins, They Will Go To Zero!Hello, Skyrexians!

We had some doubts in this scenario, but now price action clarified it. CRYPTOCAP:BTC.D has finally decided to pump in the wave 5 and this wave can be even extended. Altcoins Will lose 70% of their value and never pump after that to cover your losses.

Let's take a look at the daily chart. We have already shown you this Elliott waves picture. Earlier we mentioned that may be wave 5 was shortened, but not, it has finally decided to reach new highs at 66% at least, in case of normal wave 5, but just imagine if it will reach 70%, the extended target. Your portfolio will be -70% from the current price. We need to be honest with you, altseason never comes and we have to forget about it.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

explained regarding Bitcoin's dominanceAs I previously explained regarding Bitcoin's dominance, the trendline was broken on March 24th 📉, indicating a bearish signal on the daily timeframe. However, today it has rebounded and re-entered the line, signaling a bullish trend 📈. If it breaks through the 62.23% level, even with a wick, it would be a strong indicator of continued upward momentum 🚀, potentially delaying the altcoin season by a month or more ⏳.

The second scenario is that it tests this area and bounces back down, which would be very favorable for the altcoin season and the bull run 🐂. Therefore, I urge everyone to watch closely 👀 and avoid making hasty decisions 🙅♂️. We want to prevent any failed trades due to impulsive actions 💥.

I'd also love to hear your thoughts, my friends! Please share your opinions in the comments below 🗣️. We need to discuss various ideas 💡 together.

BTC dominance: verge of breakdown!!Join our community and start your crypto journey today for:

In-depth market analysis

Accurate trade setups

Early access to trending altcoins

Life-changing profit potential

Let's analyze BTC dominance:

After months of climbing, BTC.D is repeatedly rejected at 62.5% resistance, suggesting a potential shift. Alts, which suffered from prolonged low liquidity, are showing signs of recovery. Immediate support for BTC.D is 61.12%; a break here could trigger further decline. If BTC.D falls below 61.12%, watch 59.37%. A breakdown at these levels could significantly favor altcoin recovery, marking a turning point in market dynamics.

Key Levels:

Support: 61.12%

Resistance: 62.50%

If you find this analysis helpful, please hit the like button to support my content! Share your thoughts in the comments, and feel free to request any specific chart analysis you’d like to see.

ALTSEASON 2025Dear investors and traders, members of the Horban Brothers community!

Today I come to you not with a warning of an impending crisis, but with the certainty that we are on the threshold of significant changes. The cryptocurrency market, which has been wavering in uncertainty for a long time, is finally entering a phase of active growth. Yes, you heard me right - from this moment, from today, we see all the signs that cryptocurrency is ready to take off.

All the data points to this: institutional investment in cryptocurrency is up 400% year-on-year, regulation is becoming clearer, leading to increased confidence among the big players, and most importantly, technological innovation in blockchain continues to convince even the most skeptical.

Make no mistake, the volatility of the cryptocurrency market will not go away, but those who are willing to accept these risks can expect rewards that are rarely seen in traditional markets. I'm not suggesting you rush out to buy everything, but carefully analyze those assets that show fundamental strength and technological resilience.

Now is not the time to be passive. Check your portfolios, reassess your strategies. If you're still standing on the sidelines of cryptocurrencies, now is the time to get in on the action. But remember, this is not for the faint of heart - this is a game for those who are willing to study, analyze and act.

This market, like any other, requires discipline and knowledge. Don't get caught up in emotions, don't fall for the hype, evaluate each project critically. But if you see that the project has potential, do not be afraid to invest.

Remember that cryptocurrencies are not just tokens; they are the foundation of the future financial world. And that world is already beginning to take shape.

Regards CFO Horban Brothers,

Alex Kostenich

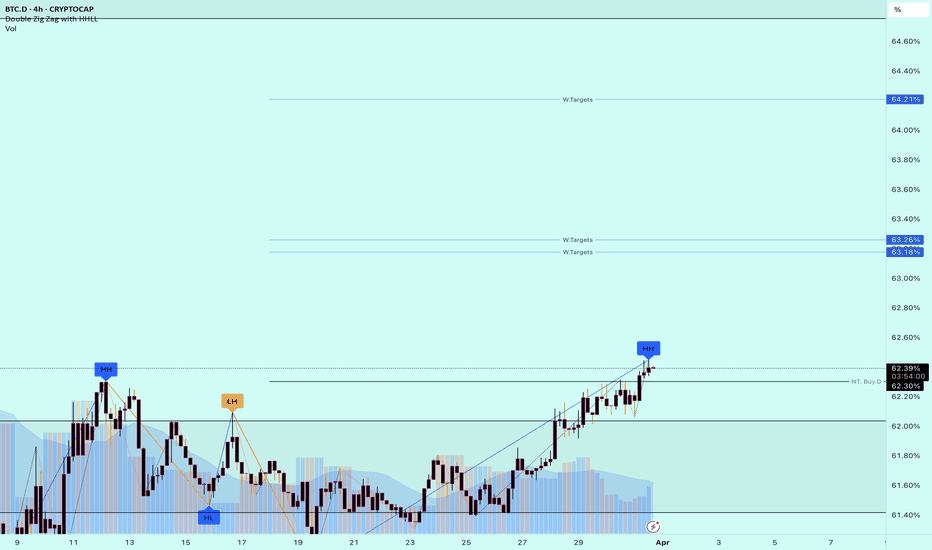

BTC Dominance (BTC.D) Update🚀 BTC Dominance (BTC.D) Update

📊 4H Timeframe:

✅ Breakout from **Descending Trendline** – Possible shift in market dynamics.

🔍 Key Observations:

🔹 **Downtrend Resistance Broken** – Signals potential bullish continuation.

🔹 **Confirmation Needed** – A successful retest and hold above the trendline strengthens the breakout.

🔹 **Impact on Alts** – Rising BTC.D could apply selling pressure on altcoins.

👀 Watch for confirmation to assess trend strength!