CADCHF trade ideas

CAD/CHF BULLS ARE GAINING STRENGTH|LONG

CAD/CHF SIGNAL

Trade Direction: long

Entry Level: 0.586

Target Level: 0.607

Stop Loss: 0.572

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

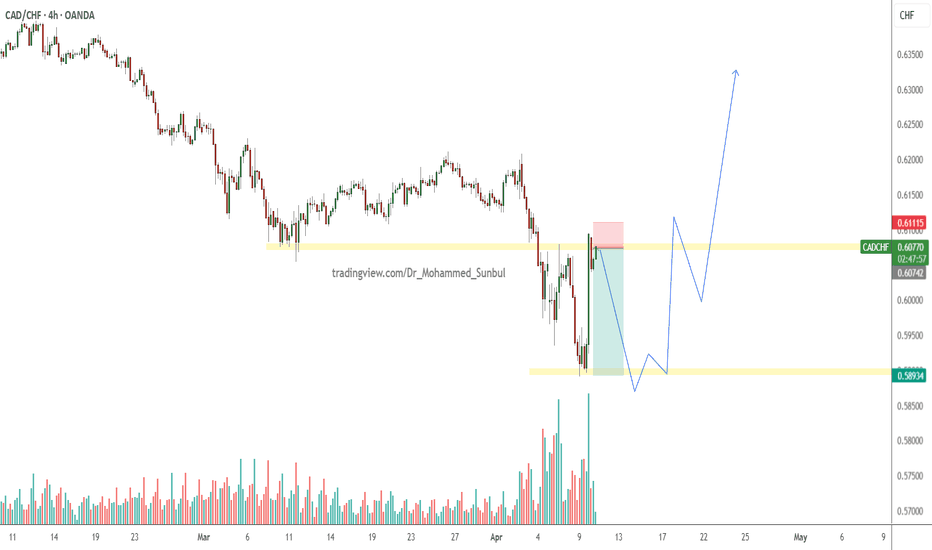

Pre-Market Analysis – CAD/CHF1️⃣ The price has broken below the previous support zone, which had held multiple times in the past. This area is now likely to act as a new resistance.

2️⃣ The bottom boundary of the descending channel has been touched, signaling a potential reaction or short-term bounce from this level.

3️⃣ It’s quite probable that the price retraces back to the midline of the channel before continuing its downward move. This would be a classic pullback within a bearish channel structure.

📉 If price fails to reclaim the broken support and reacts bearishly near the resistance-turned zone or the channel’s midline, it could provide a solid continuation setup to the downside.

CAD_CHF RISKY LONG|

✅CAD_CHF has retested a key support level of 0.5892

And as the pair is already making a bullish rebound

A move up to retest the supply level above at 0.5949 is likely

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD/CHF long term small SL This is my personal view on CAD/CHF in both the short and long term. I believe the pair presents interesting opportunities based on recent market behavior and potential fundamental shifts. Short-term movements might differ from the long-term trend, so I’m keeping both perspectives in mind when analyzing and making decisions.

cadchfThis is my personal view on CAD/CHF in both the short and long term. I believe the pair presents interesting opportunities based on recent market behavior and potential fundamental shifts. Short-term movements might differ from the long-term trend, so I’m keeping both perspectives in mind when analyzing and making decisions.

Major downside for Canada thanks to Tariffs, oil and InterestWith Tariffs on pause for 90 days EXCLUDING Canada, Mexico and China - This is going to have a major negative effect on the Canadian Dollar.

We are already seeing it come down and the news gets worse, because Tariffs are just one thing fuelling this fire. Others include:

1. Oil's Looking Weak 🛢️📉

Since Canada’s economy is tightly linked to oil exports, the recent softness in crude oil prices could drag CAD down, making CADCHF more likely to dip.

2. Swissy’s Flexing Safe Haven Muscles 💪🇨🇭

When global uncertainty rises (think geopolitical tensions or shaky equities), traders usually flock to the Swiss Franc for safety — pushing CHF higher and pressuring the pair.

3. BoC’s Dovish Leaning 📉🏦

The Bank of Canada has been hinting at potential rate cuts or at least staying cautious, while Switzerland isn’t exactly rushing to ease — that’s a recipe for CAD weakness.

4. Risk-Off Vibes Across Markets ⚠️📊

If markets stay nervous — like during global slowdown fears or recession talks — CAD typically suffers since it’s more “risk-on” while CHF benefits.

And as per above, the technicals are looking shocking too.

Inverse Cup and Handle

Price <20 and 200

Target 0.5768

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD/CHFCAD/CHF Bullish Setup – Re-entry Opportunity 📈

Price has pulled back into a favorable zone, offering a fresh long setup on CAD/CHF.

🔁 Re-entry: 0.60144

🛑 Stop Loss: 0.59303

🎯 Take Profit: 0.62014

Watching for momentum confirmation before full commitment. Always manage your risk. 🔐

#CADCHF #Forex #TechnicalAnalysis

OPPORTUNITY FOR BUY CADCHFWe have identified the following indicators suggesting a BUY opportunity:

• Rebound from the long-term downtrend line (established in 2021)

• Low volume, indicating a potential lack of momentum to continue the current downward movement

• Retest of key support levels: Yearly low, 6-month low, 3-month low, and 1-month low

We have set three target profit levels:

TP 1 = 40 pips

TP 2 = 100 pips

TP 3 = 200 pips

SL = -200 pips

CADCHF Wave Analysis – 8 April 2025- CADCHF reversed from pivotal resistance level 0.6050

- Likely to fall to support level 0.5935

CADCHF currency pair recently reversed from the resistance zone between the pivotal resistance level 0.6050 (former monthly low from March) and the 50% Fibonacci correction of the downward impulse from the start of April.

The downward reversal from resistance level 0.6050 continues the active impulse wave iii of the intermediate impulse wave (3) from the end of November.

Given the clear daily downtrend and the strongly bullish Swiss franc sentiment seen today, CADCHF currency pair can be expected to fall to the next support level 0.5935.

CADCHF Will Explode! BUY!

My dear friends,

CADCHF looks like it will make a good move, and here are the details:

The market is trading on 0.6030 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 0.6097

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CAD/CHF🔁 CAD/CHF Re-Entry Setup 🔁

Revisiting CADCHF with a clean re-entry level on the radar:

📌 Entry: 0.60525

🛡️ SL: 0.59981

🎯 TP: 0.64599

Price action still respecting key levels — looking for follow-through with proper structure. Setup aligns with recent momentum and potential continuation on higher timeframes 📈

Sharing for journaling and learning purposes only.

Stay disciplined and manage risk! ⚖️🧠

#CADCHF #forex #tradeideas #technicalanalysis #forexjournal #priceaction #fx

CAD/CHF "Loonie-Swiss" Forex Bank Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/CHF "Loonie-Swiss" Forex Bank . Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.61950) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 2H timeframe (0.61200) Day / swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.62600 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

CAD/CHF "Loonie-Swiss" Forex Bank Heist Plan (Day / Swing Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CAD/CHF SENDS CLEAR BULLISH SIGNALS|LONG

Hello, Friends!

Previous week’s red candle means that for us the CAD/CHF pair is in the downtrend. And the current movement leg was also down but the support line will be hit soon and lower BB band proximity will signal an oversold condition so we will go for a counter-trend long trade with the target being at 0.613.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CADCHF BUY TRADE PLAN🔥 CAD/CHF TRADE PLAN 🔥

📅 Date: April 1, 2025

🔖 TRADE PLAN TYPE

✅ Main Swing Plan

📈 MARKET BIAS

Bias: Bullish Reversal (HTF Demand Zone + Liquidity Sweep)

Trade Type: Reversal

⭐ CONFIDENCE LEVEL

⭐⭐⭐⭐ (80%)

(Reason: D1 OB + LTF sweep + H4 liquidity run + H1 momentum shift + H1 MACD regular bullish divergence + CHF overbought)

📌 STATUS

Waiting for Entry

Price has not yet tapped the buy zone. No position active. Monitoring for clean confirmation.

📍 ENTRY ZONES

Primary Buy Zone: 0.6135 – 0.6145

(H4 OB + equal lows sweep + imbalance tap)

Secondary Buy Zone: 0.6115 – 0.6125

(Deeper fill below inducement + within D1 OB)

❗ STOP LOSS

🔻 0.6090

(Below both OBs + clean invalidation low)

🎯 TAKE PROFIT TARGETS

TP1: 0.6185 🥉 (reaction high – secure partials + SL to BE)

TP2: 0.6220 🥈 (H4 liquidity pool)

TP3: 0.6275 🏆 (D1 OB supply / range top)

📏 RISK-REWARD

Minimum R:R = 1:3.2

⚠️ CONFIRMATION CRITERIA

✅ H1 bullish engulfing or SFP wick

✅ Volume spike at OB

✅ Optional: M30 hidden bullish divergence

✅ Prefer NY session or London Close reaction

⏳ TRADE VALIDITY

🕒 Valid for: 1–3 days

❌ Invalidate if: H4 CHoCH to downside OR daily close below 0.6100

🌐 FUNDAMENTAL SNAPSHOT

✅ CHF overbought (risk unwind reversal)

✅ CAD stable (no major news drivers)

✅ Sentiment bias = Risk-On → supports bullish continuation

📋 FINAL TRADE SUMMARY

CAD/CHF shows high-probability reversal potential after clean sweep of HTF lows and LTF re-accumulation. Entry zone aligns with OB + liquidity + divergence. No early entries — confirmation inside the zone is mandatory. Plan is swing-based and fully risk-managed.

CAD/CHF - Trade SetupHi all

This is a simple A+ trade setup that I have been looking at. All aligning with higher TF we have already pushed away from the OTE zone and this is a simple retracement.

In smaller timeframes we can notice a large buy side volume gap that give me confluence buyers are in control but also showing me price need to fill fair value before looking to buy from that same area.

Please follow for me details on this trade setup

Cheers!

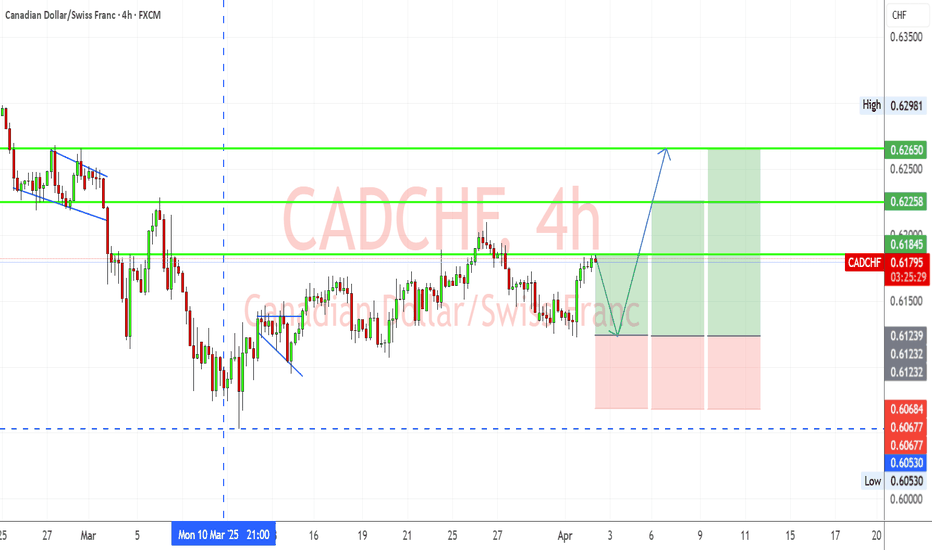

CADCHF Bullish Breakout: Key Levels to WatchThe market has been in an uptrend, forming higher highs and higher lows after a previous strong downtrend.

Currently, CADCHF is testing a key resistance level (0.6185 - 0.6190), with signs of consolidation.

A slight retracement is expected before a potential breakout to the upside.

Key Levels:

Resistance Levels:

0.6225 – First target after breakout.

0.6265 – Major resistance zone and final target.

Support Levels:

0.6130 - 0.6140 – Potential retest zone before further upside.

0.6050 – Strong demand zone (invalidates bullish bias if broken).

Trade Plan:

📉 Pullback Entry: Waiting for a small retracement to the 0.6140 zone before entering long.

📈 Bullish Breakout Confirmation: A break and close above 0.6190 could confirm further upside towards 0.6225 - 0.6265.

Final Outlook:

Bias: Bullish above 0.6140, bearish below.

Risk Management: Stop loss below 0.6130.

Potential Reward: A successful breakout can provide +80 pips upside.

CADCHF Bullish Outlook In DevelopmentCADCHF Bullish Outlook In Development

CAD/CHF recently completed a bullish harmonic pattern near 0.6055, and the initial price reaction has been promising so far.

From the our previous analysis we can see that CADCHF already reached the first target.

SNB rate cut certainly created a less favorable outlook for the Swiss Franc.

Given the ongoing volatility from Trum's tariffs, it’s prudent to adopt a conservative approach, however the price is well positioned to continur rising more as shown on the chart even if it moves down before the news today.

Key resistance areas: 0.6225 and 0.6265

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.