CADJPY trade ideas

CADJPY: Bullish Continuation & Long Signal

CADJPY

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long CADJPY

Entry - 101.91

Sl - 101.20

Tp - 103.24

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Bullish bounce?CAD/JPY is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 101.88

1st Support: 101.45

1st Resistance: 102.91

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

CADJPY still bullish expecting

OANDA:CADJPY first analysis highly accurate it's attached.

In first analysis i am share bullish view, having op we are not see some special big bullish move and based on PRICE ACTION analysis expecting here new bullish push.

SUP zone: 102.500

RES zone: 105.800, 106.400

WHY CADJPY IS BULLISH ?? DETAILED ANALYSIS CAD/JPY is currently trading around 104.200, forming a falling wedge pattern—a technical indicator often suggestive of a potential bullish reversal. Traders are closely monitoring this setup for a breakout, which could potentially propel the pair toward the target price of 107.000, indicating a prospective gain of approximately 300 pips.

Fundamentally, the Canadian dollar's performance is closely tied to global oil prices, given Canada's status as a major oil exporter. Recent stability in oil markets has provided underlying support to the loonie. Conversely, the Japanese yen, traditionally viewed as a safe-haven currency, has experienced fluctuations influenced by shifts in global risk sentiment and the Bank of Japan's monetary policy stance. The divergence in economic indicators and central bank policies between Canada and Japan may contribute to the anticipated bullish momentum in the CAD/JPY pair.

Technical analysis reinforces this outlook. The falling wedge pattern observed on the charts is characterized by converging trendlines sloping downward, indicating diminishing bearish momentum. A decisive breakout above the upper trendline of the wedge, accompanied by increased trading volume, would serve as a confirmation of the bullish reversal. Key resistance levels to monitor include 105.000 and 106.000, with a sustained move above these thresholds enhancing the likelihood of reaching the 107.000 target.

Traders should exercise prudent risk management strategies, such as setting appropriate stop-loss orders, to mitigate potential market volatility. Additionally, staying informed about upcoming economic data releases and central bank communications from both Canada and Japan will be crucial in navigating this trade effectively. By aligning technical insights with fundamental developments, traders can position themselves to capitalize on the potential bullish breakout in the CAD/JPY pair.

CADJPY → Consolidation before the news. DowntrendFX:CADJPY continues to forge a downtrend, but within the current movement a symmetrical triangle of accumulative nature is forming

The currency pair may continue its decline due to the strengthening of the Japanese Yen, while the Canadian is consolidating in a narrow range.

The situation may be accelerated by today's news, namely Trump's speech, where he may announce new tariff measures.

Technically, the price is correcting after the false break of 103.56, being below the previously broken upside support. Price is testing key resistance at 104.90, and against 0.5 Fibo is forming a false breakout. A consolidation below 104.69, a break of 104.525 could trigger further decline.

Resistance levels: 104.900, 105.36, 105.74

Support levels: 104.525, 103.56

There are important news ahead, high volatility is possible, especially at the moment of Trump's speech, which may set a medium-term tone in the market.

The currency pair is in consolidation on the background of the downtrend and the priority is to expect a continuation of the fall

Regards R. Linda!

CADJPY Wave Analysis – 7 April 2025- CADJPY reversed from strong support 101.60

- Likely to rise to resistance level 105.00

CADJPY currency pair recently reversed from the support zone surrounding the strong support 101.60 (which has been reversing the price since last August). This support zone was strengthened by the lower daily Bollinger Band.

The upward reversal from support 101.60 stopped the earlier intermediate impulse wave (5) from the end of March.

Given the strength of the support 101.60 and the bullish Canadian dollar sentiment seen today, CADJPY currency pair can be expected to rise to the next resistance level 105.00.

CADJPY Will Go Up! Long!

Please, check our technical outlook for CADJPY.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 102.695.

Considering the today's price action, probabilities will be high to see a movement to 106.707.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

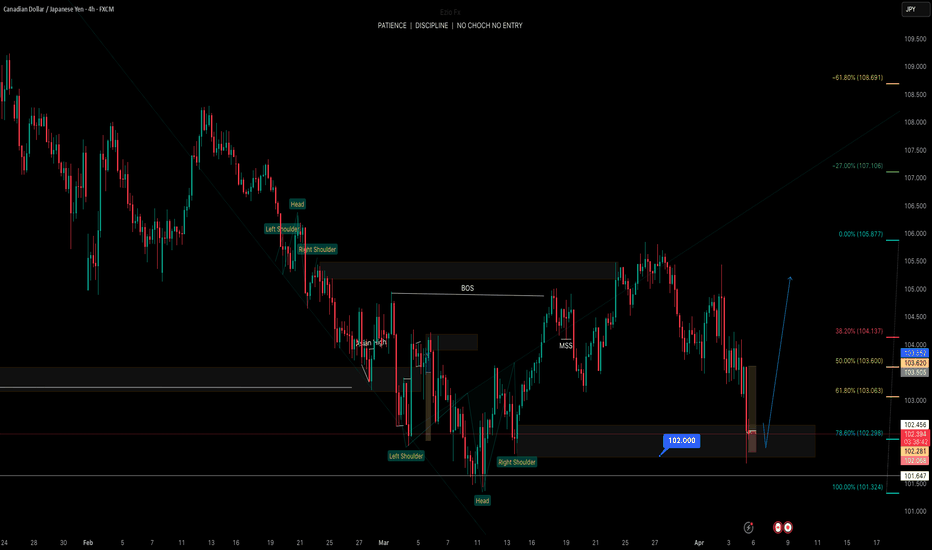

CAD/JPY breakDown trend line 1h analysis chartBased on your CAD/JPY chart analysis, here are key levels I can identify:

Entry Point:

A sell entry seems valid after a break below 104.656, confirming bearish momentum.

Stop Loss (SL105.900):

Place SL above the recent highs, likely around 105.900 , depending on your risk tolerance.

Take Profit (TP) / Target Zones:

First Support Zone: 103.500

Second Support Zone: 102.800

Final Target: 102.000 (as indicated by the large red arrow)

Support & Resistance Zones:

Major Resistance: 104.800 - 105.000

First Support: 103.500

Second Support: 102.800

Key Demand Zone: 102.000

This setup follows a breakout-retest strategy before continuation to the downside. Let me know if you need refinements!

CADJPY Strong Bearish Move Coming On my last Idea Post i was anticipating for CADJPY to drop to the March's Monthly Low, Now that I've analyze more in depth i do believe CADJPY is gonna have a Meltdown and Price is gonna start trading between 100. and 90. Levels, The reason of this is because if we look at the CADJPY charts specifically the Monthly Timeframe chart we can see price rejected a Mayor Level ( 112.500 ) with a lot of sellers coming in after the break of the level, now with time price was hesitant to break back above 112.500 until the monthly candle closure of February, confirming a Shift in Mayor Market Structure to the Downside creating a Lower High, not only the market did a Lower High but also printed a beautiful H&S Pattern and a FIB set up and combining the H&S Pattern with the FIB most likely Price will fall to the 61 ext. ( 92.000 level ) giving us more confluences that price will have a mayor drop on the Long Term, if we factor in News and Data, its also pointing out that CAD hasn't have bullish data being released from its latest news data and now with President Trump and his Tariff Proposal/Plan i do believe it is not gonna go very well for the CAD.

CAD/JPY Bearish Setup Near Resistance – Rejection Incoming?📉 Trend Analysis:

The pair is in a downtrend, confirmed by the descending trendline.

Lower highs and lower lows indicate bearish momentum.

📌 Key Levels:

Resistance Zone (104.5 - 106.0): Marked in purple, this area has previously acted as support and is now a key resistance zone.

Support Area: Around 100.0 - 101.0, a psychological level where price may find demand.

📊 Trade Scenario:

Bearish Rejection Expected: Price is approaching the resistance zone and trendline confluence. If rejection occurs, a downward move towards 100.0 is likely.

Break Above? If price breaks above the resistance zone and trendline, bullish momentum could invalidate the bearish setup.

🔍 Conclusion:

Watching for rejection near 105.0-106.0 to confirm a short opportunity.

If rejection happens, next targets are 102.0 → 100.0.

A bullish breakout above 106.0 could shift momentum upwards.

CAD/JPY "Loonie-Yen" Forex Bank Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/JPY "Loonie-Yen" Forex Bank . Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (106.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 2H timeframe (104.500) Day / swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 108.200 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

CAD/JPY "Loonie-Yen" Forex Bank Heist Plan (Day / Swing Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CADJPY Massive Long! BUY!

My dear followers,

This is my opinion on the CADJPY next move:

The asset is approaching an important pivot point 103.33

Bias - Bullish

Safe Stop Loss - 102.73

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 104.29

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CADJPY BUY**📈 Key Long-Term Zone and Bullish Signal in Progress 🚀**

We are observing a **long-term key zone around 102**, which is acting as a **market support**. Additionally, there is a **support/resistance zone around 104**, which the pair has successfully broken and is holding above.

✅ **Downtrend TL broken**

✅ **Other technical signals aligned**

Everything suggests that the **pair is moving upwards**. A **pullback towards 103** could be an interesting area to watch.

👀 **Keep a close eye on this! Good luck, everyone!** 🚀📊

---

Still Holding Despite Trump’s Volatility Impact**

Trump’s speech caused **significant market nervousness and volatility**. Despite this, **my position on CADJPY remains open**.

➡️ **Staying alert to market reactions** and how the pair behaves in response to this uncertainty.

➡️ **My trading plan remains unchanged for now**, so I’ll keep following the setup.

💬 **How are you managing this sudden volatility?**

CHECK CADJPY ANALYSIS SIGNAL UPDATE > GO AND READ THE CAPTAINBaddy dears friends 👋🏼

CADJPY trading signals technical analysis satup👇🏼

I think now CADJPY ready for BUY trade CADJPY BUY zone

( TRADE SATUP) 👇🏼

ENTER POINT (103.100 to (102.950) 📊

First tp (103.400)📊

2nd tp (103.800)📊

Last target (104.300) 📊

stop loss (102.500)❌

Tachincal analysis satup

Fallow risk management

Inverse Head and shoulders NFP An increasing probability of stagflation risk in the US may see further narrowing of the 2-year sovereign yield premium spread between US Treasuries and JGBs.

CAD/JPY is the second worst-performing major yen crosses in the past three months.

CAD/JPY may see another round of impulsive down move sequence with the following medium-term supports coming in at 99.60 and 97.55.

CADJPY Will Move Lower! Sell!

Please, check our technical outlook for CADJPY.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 103.448.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 102.631 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Lingrid | CADJPY channel BREAKOUT. Potential Bearish MoveFX:CADJPY market recently broke and closed below the upward channel and following the channel breakout, the price has formed a range zone around 130.500. On the 1H timeframe, the market is making lower lows, while the daily timeframe shows a large engulfing candle, suggesting that the correction may be coming to an end. Given that today we have high-impact news, we can expect increased volatility in the market. I think that the price may move lower if it remains below the 104.000 resistance zone. My goal is support zone around 102.500

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻