Bank of America May Face a DowntrendBank of America has rebounded sharply in recent weeks, but some traders may expect a move to the downside.

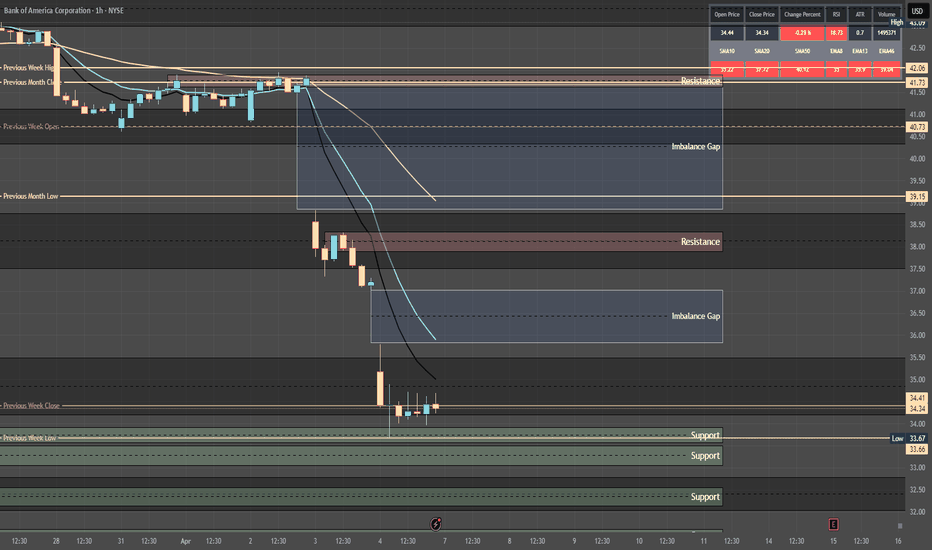

The first pattern on today’s chart is the series of lower highs since March 3. Combined with the low in early April, a falling channel may have formed.

Second is the price zone between roughl

Key facts today

On May 6, 2025, Bank of America revealed its position on Qualcomm Inc., including interests and short positions in relevant securities, as required by the Takeover Code.

On May 5, 2025, Bank of America reported a change in its holdings of Spirent Communications PLC, crossing a threshold for voting rights on May 2, 2025.

About Bank of America

Bank of America Corporation is a bank and financial holding company, which engages in the provision of banking and nonbank financial services. It operates through the following segments: Consumer Banking, Global Wealth and Investment Management, Global Banking, Global Markets, and All Other. The Consumer Banking segment offers credit, banking, and investment products and services to consumers and small businesses. The Global Wealth and Investment Management provides client experience through a network of financial advisors focused on to meet their needs through a full set of investment management, brokerage, banking, and retirement products. The Global Banking segment deals with lending-related products and services, integrated working capital management and treasury solutions to clients, and underwriting and advisory services. The Global Markets segment includes sales and trading services, as well as research, to institutional clients across fixed-income, credit, currency, commodity, and equity businesses. The All Other segment consists of asset and liability management activities, equity investments, non-core mortgage loans and servicing activities, the net impact of periodic revisions to the mortgage servicing rights (MSR) valuation model for both core and non-core MSRs, other liquidating businesses, residual expense allocations and other. The company was founded by Amadeo Peter Giannini in 1904 is headquartered in Charlotte, NC.

BAC Holding Above EMA 200 with Strong Buyer SupportBank of America (BAC) is showing resilience:

Price is above the 209-WEEK EMA, indicating a bullish trend.

Recent down candles have occurred with high volume, suggesting that buyers are absorbing selling pressure.

This behavior often precedes upward movements, as strong hands accumulate shares dur

Good times are brewing for the central banks

Bank of America (BAC) | 4D Chart 📈

After a hard dip into $33.07, BAC is finding its legs — now reclaiming the 0.382 Fib level (38.78) and pushing toward the 0.5 zone at $40.54. A full retrace into the 0.618 (42.30) and possibly the 0.786 (44.81) would not be far-fetched if this bullish pressure co

BAC – Building the Base for a Breakout?Bank of America (BAC) has been consolidating quietly, attracting attention as it sits near a key mid-range level. With a 52-week low of $33.06 and a 52-week high of $48.08, the stock currently trades around $36.92 – roughly 11% above its low and 23% below its high.

This setup could be the calm befo

BAC on the UPTRENDBAC has completed the correction. Now running on the Uptrend.

On chart frame WEEK, the price was crossed MA200 then back up.

On chart frame Day, the volume so high and RSI look good.

It's mean, the Uptrend started from 04.09.25.

In the short term, the price still has to come back to fill at least

4/14/25 - $bac - not a short but prefer jpm/gs4/14/25 :: VROCKSTAR :: NYSE:BAC

not a short but prefer jpm/gs

- defn more of a focus for me on financials this year, which have some distinct advantages to other industry, in many ways you can think of them as the "picks and shovels" of the MAGA agenda. they r nearest to money printer. the stock

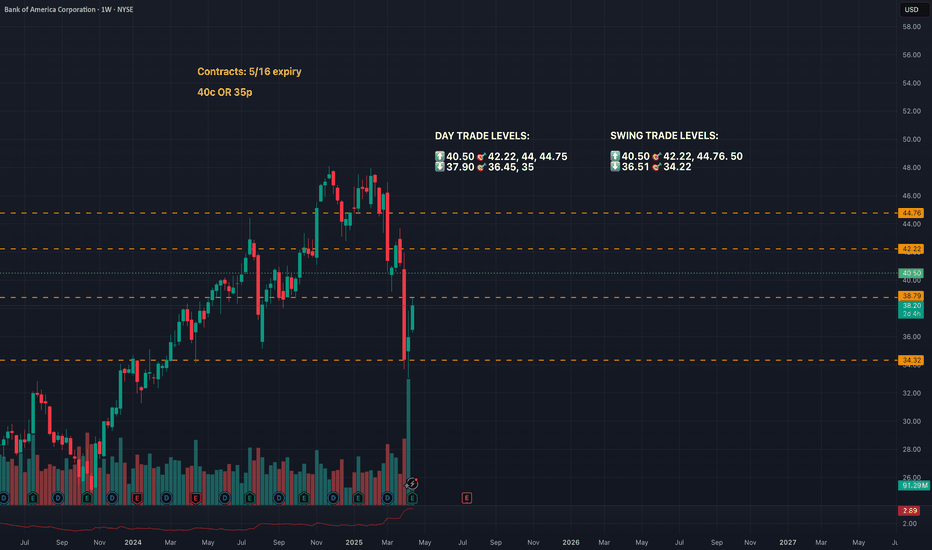

Quantum's BAC Trading Guide 4/8/25BAC (Bank of America Corporation) - Sector: Financials (Banking)

Sentiment:

--Neutral (slight bullish tilt). Pre-market options lean call-heavy, RSI likely ~48 (up from ~45 with +1.8% from $35.58 to $36.23), X posts overnight mixed—rate fears vs. recovery hopes—suggesting a bounce from $34.19 (Apr

Quantum's BAC Ultimate Weekly OutlookBAC (Bank of America Corporation) - Sector: Financials (Banking)

Sentiment: Bearish. Put volume rises, RSI 45 weakens, X posts note banking fears from tariffs/economic uncertainty.

Tariff Impact: Moderate. Tariffs may slow growth, impacting loans, but domestic focus softens the blow. Sentiment dri

BAC in Monthly chart Hello

This idea is quite imaginary but possible. The problem for this LD pattern is that Leading Diagonals do not usually happen in monthly timeframe but I give you all I think and you can sort them.

The reason for this page is to provide an interactive atmosphere for those who want to share their i

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where BAC is featured.