CVX 11 RRR short positionReposting this since TV removed this idea earlier for containing links to my telegram group.

Trading Methodology:

1. An asymmetric bullish/bearish pennant is drawn using ascending and descending curved trend lines with a minimum of three price action touche points per line. The direction is determined by the previous trend.

2. The angle tool is applied from the earliest two trend touch points, beginning at the earliest touch point.

3. A trend-based Fibonacci retracement triangle is drawn starting from the earliest trend touch point and ending at the earliest touch point of the opposite trend line .

4. Based on the degree, of the earlier defined angle, the appropriate (and secret) levels are selected for the fibonacci retracement ; two levels for stop-loss and two levels for take-profit. The closest stop-loss level to the current price level is the top priority stop-loss. Though the secondary stop-loss level is often chosen for some markets such as FX and some equities in order to account for seldom unexpected resistance breaks. The greater target level is the top priority, and where majority of the shares are sold, though some may choose to close part of the position at the first target level or set it to be the stop-loss once price exceeds it. Entries should be laddered in around the levels closest of the yellow line.

This trading strategy can be applied to any market and time frame, and positions most often garner the greatest risk-to-reward ratio with the highest success rate. What more can you ask for? I will only be posting my unique trading strategy until EOY. I work solely with price action to identify pennants and apply unique trend-based fibonacci retracement levels for SL and TP levels. Reach out to me if you have any questions.

CVX trade ideas

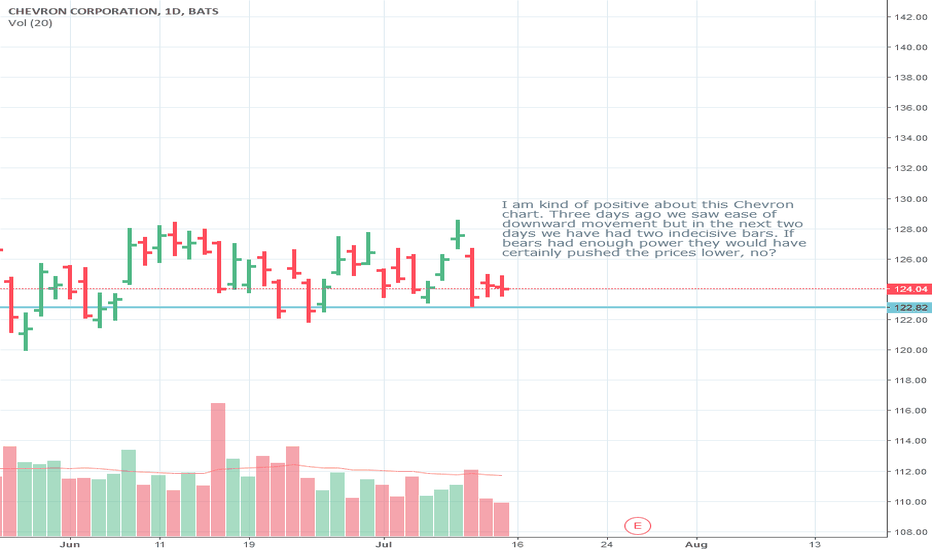

What can I Say About These ClownsCorporate Vision is Important. I can’t stress that enough. It’s also important to work on one’s flaws, to be the best one can be. I look at this Crew and I just shake my head. Some how these F’Ups manage to succeed and move forward despite themselves. I guess there is a lot to be said for being in the right place at the right time…

This is a company I know way too much about, technologically and financially. These guys invest in their business, but they are always playing catch up technologically. They have no problem putting money into their operation in order to conduct business, but their capital utilization is horrifically low. These guys will never be the innovators of their industry, but they will squeeze the last drop of value out of the technology they have.

The Elliot Wave pattern implies that after this decade, this company should do really well. The company is positioned really well to take advantage of the growth in the middle class of the Asian markets. Could be a pretty bumpy ride in the mean term.

Selling Chevron sharesAt the daily chart of CVX shares, the price has started a new downtrend, as the instrument has fixed below Alligator indicator with AO crossing below the zero line. Also, a sell signal was formed in a form of the fractal, breakdown of its level would be an optimal level to open short.

Chevron, CVX, Bull Put, Credit SpreadI am not licensed or certified by any individual or institution to give financial advice. I am not a professional Stock trader.

Chevron (CVX) gapped down today, big time; but it couldn't break the 100 Day Exponential Moving Average (EMA). If you look back to October 27, 2017 (see the purple arrow I inserted on the lower left of the chart to mark the date) Chevron did the exact same thing. It proceeded to go back up. I think it will repeat itself in the coming days. It used the 100 Day to bounce and will go back up. I typed up the strategy I used for this play and you should be able to see it on the chart. The 200 Day EMA is sitting just above $118.40ish giving this play more than $4.00 of cushion. Additionally, next week is a short trading week in the United States due to markets being closed on Monday in observation of Memorial Day. That means this Stock has four days to not go down more than four dollars, and the Credit from opening the play is kept. Yes, you could tighten the spread; but having the 200 Day EMA adds a little protection, and I'm still learning how to do Spreads. :)