Is it finally time for a rally?Looking at NVIDIA (NVDA) on the weekly chart over the past two years, a significant gap up becomes apparent around April, which persisted for much of the year. Considering the recent news and the stock's pullbacks lately, this may be the moment for NVDA to resume its upward grind. The coming weeks will reveal its direction.

Additionally, it's worth noting the formation of a massive bull pennant on the weekly chart. If history repeats itself and this pattern holds, the next 2 to 6 weeks could prove to be a thrilling period for NVDA.

NVDA trade ideas

NVDA 2025 Descending Channel- My TakeNVDA has been staying in this descending for the past 3-months or so and without fail has been unable to breakout like it is trapped in a cell. For the near future and especially with the ping-pong trade and international policy approach by the administration I would take puts for 3+ weeks out on any rally. fade any rally. Building in the US is a nightmare for NVIDIA's profit margins as workers in china are simply more skillful and the country is much more adept at production and exports than we are. Huge gap to bridge.. and until we do I will be respecting the trend.

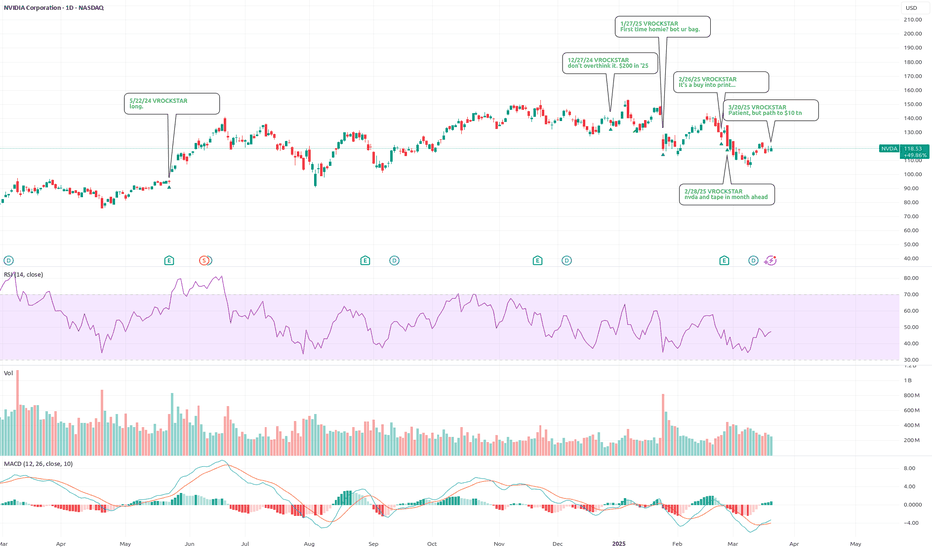

3/20/25 - $nvda - Patient, but path to $10 tn (LONGER READ sry!)3/20/25 :: VROCKSTAR :: NASDAQ:NVDA

Patient, but path to $10 tn

- as we reflect on this crack tape, i'd like to share a few thoughts here, hopefully keeping it a bit punchy and we can duke it out/ debate in the comments.

- objectively, the level of HPC/ AI compute is accelerating up the S curve.

- nvidia's customers are the most price inelastic buyers you could want in a recession. microsoft. tesla. amazon. nation states *cough*. these aren't BNPL customers ordering burritos and a side of GPU chips thru doordash.

- NVIDIA's platform won. such that they don't screw the pooch and their 35k engineers all focused on a singular issue don't decide to go solve some unrelated market (/sarc bc we know Jensen's style), effectively there's no "rebuilding" NVIDIA. ASICs will eventually come, but they won't dominate. In the chip business, there's a reason each vertical tends toward 70... 80... 90% market share players.

- the real issue here, when i run the math (and i've built out my own model tn to wrap my head around this all), is really *where* we are on this S-curve. the mkt is concerned about a few things, and actually, the macro/ risk assets and long-duration i.e. discount rate seem to be more important than fundamentals. that's a good thing, BUT, in the short-term it can really dislocate price. and price tells a story. and that story can distract. it can avert your attention. it can make you nervous (on the converse, fomo). so it's good to have a clear idea of what's going on here, which is why i underwent this exercise.

- all-else equal, as beats, communication and sector dominance remain (and they don't need to be massive beats, just not misses that portend lower growth in the terminal), my estimates put NVDA's mkt cap close to 10 tn.

- but at shy of $3 tn today, that 3x LIKELY will take 2-3 years to play out and will largely be driven by the short term climb of the S-curve, and more immediately driven by, again, terminal rates.

- fair value today ex-beats but with lower terminal rates likely takes the stock toward $5 tn (and i'd expect this to be a reasonably year-end target) or a stock of $200. let's call that move 2/3 "macro" and 1/3 "fundamental"

- and the remainder of the move toward doubling likely happens over the following 2 years because more data will need to be collected by the market to assess this dominance, cash generation etc. etc.

- okay this isn't a punchy write up... at this pt. excuse me!

- so what's the downside? again, there's a lot we can and should duke out in comments to shorten the conclusion here, but i'd suggest something closer to $2 tn for a variety of reasons. that's nearly 30% downside or a stock in the $80s. do we get there? no clue. but in this environment, we've seen how deepseek headlines, blackwell overheating rumors (which btw remain), asic announcements, chinese "competition" etc. etc. all affect the bid. and i'd suggest that a 30% downside for a potential 70% upside into year-end remains a great risk-reward here at $120 today.

- my guess would be that long-term buyers accumulate at these levels and we probably get taken closer to the $130s... even $140s before this becomes more of a complicated equation.

- that being said, it's a clear buy, IMO, at this price, in a YE context and especially in a multi-year context given downside to upside potential and the work i've put in here. truly a one-of-a-kind asset that has actually held it's own against BTC in the last 10 years (THE ONLY of any real market cap)

TL;DR

- still a great buy at $120

- downside below $100 and it's obvious. buying that fear, possibly on leverage in the $80s.

- not using leverage ST in this environment

- YE target of $200

- unfortunately more of a macro punching bag ST but fundamentals remain the meat of the 2-3 year move and so far, don't see any flaws.

lmk what u think.

V

US President Says All Necessary Permits Will Be Given to NVDAIn shocking turn of events today, US President Donald Trump said "All necessary permits will be expedited delivered to Nvidia."

The asset however, fail to play according to the rhythm of the fundamental, up by 1.51% as of the time of writing with the RSI at 56.27. Nvidia has also been plaque by Trump's tariff rate increment that saw the shares lose about 29% in market value for the past 3 weeks.

For Nvidia Shares ( NASDAQ:NVDA ), a break above the $150 resistant could pave way for a bullish course. Similarly, failure to break pass the resistant point could resort to a bearish reversal bringing it back to the support point.

Analyst Forecast

According to 43 analysts, the average rating for NVDA stock is "Strong Buy." The 12-month stock price forecast is $172.76, which is an increase of 53.68% from the latest price.

Nvidia next predictionForecast (Based on Chart Drawing & Price Structure):

Late 2025:

Expected Price Range: $140–$160

Reasoning:

The projected path on the chart shows a short-term dip followed by a strong bullish recovery.

RSI rebounding from oversold may confirm strength returning.

Likely to test the $152.76 resistance level.

Late 2026:

Expected Price Range: $180–$200+

Reasoning:

If bullish momentum continues and no macroeconomic crises occur, NVDA could break past previous highs.

Strong fundamentals in AI, data centers, and GPU tech could fuel growth.

Late 2027:

Expected Price Range: $220–$260+

Reasoning:

Assuming continuation of tech sector growth and Nvidia’s dominance, price could move into new ATH (All-Time High) territory.

Institutional buying could increase around $200 levels if technical and fundamental conditions align.

NVDA Stock – Bullish Outlook Based on Technical & FundamentalI'm bullish on Nvidia (NVDA) and currently see a strong opportunity to enter the stock at $114.32, targeting a take profit at $137.22, with a conservative stop loss set at $105.00.

Technical Analysis

At present, NVDA is trading within a consolidation range between $75.61 and $152.78. Historically, this zone has shown consistent buying pressure on dips, while selling pressure has remained weak, indicating that bulls are firmly in control during this accumulation phase.

Most notably, the last weekly candle closed with a strong bullish signal, reinforcing our confidence in a potential breakout or upward continuation within the current range. With buyers showing dominance in this zone and no significant bearish momentum on the horizon, the technical setup supports a favorable risk-to-reward long trade.

Trade Setup

Entry: $114.32

Stop Loss: $105.00

Take Profit: $137.22

This setup offers a clear structure for both risk management and profit-taking as we anticipate further upside momentum.

Fundamental Analysis

Nvidia continues to be the undisputed leader in the AI revolution. As the maker of the world’s highest-performance GPUs, NVDA is powering cutting-edge technologies from AI to gaming, data centers, and autonomous driving. Its recently launched Blackwell architecture already generated $11 billion in its first quarter — demand is so intense that customers are willing to wait for access.

What sets Nvidia apart is its aggressive innovation cycle. The company has committed to annual GPU updates and maintains a clear roadmap through the next two years. This rapid pace ensures it stays ahead of competitors and keeps customer interest high.

Beyond GPUs, Nvidia offers a complete suite of AI products and services, positioning itself as a holistic AI ecosystem provider. Even more exciting is its entry into quantum computing, with a research center under construction in Boston — a long-term bet that could pay off massively in the next tech era.

While short-term tariff-related volatility could cause minor pullbacks, Nvidia’s fundamentals remain incredibly strong. Trading at just 23x forward earnings, this stock still looks like a bargain considering its future growth potential.

FREE Day Trade Setup 15April: $NVDA🚨 FREE Day Trade Setup: NASDAQ:NVDA 🚨

🚀 Bullish Scenario:

Entry: Break above $111.88 (S/R Area)

🎯 Targets: 10% / $112.70, $114.05, PDH

📈 Instruments:

Options: April 18th $112 Calls

🚪 Exit: Close below H5 on chosen timeframe (2m / 5m / 15m)

📉 Bearish Scenario:

Entry: Break below PDL at $109.07

🎯 Targets: 10% / $108.01, $106.92, $105.77

📉 Instruments:

Options: April 18th $109 Puts

🚪 Exit: Close below H5 on chosen timeframe (2m / 5m / 15m)

Not Financial Advice

NVIDIA (NVDA) | Long Bias | Key Supply Zone| (April 2025)NVIDIA (NVDA) | Long Bias | Watching Key Supply Zone + Overvaluation Risk | (April 2025)

1️⃣ Quick Insight:

NVIDIA has been in a strong uptrend since November 2024, but price is now approaching a critical zone around $120–122. We’ve seen a key liquidity grab around the August highs, and the price has been pushing upward since. However, there are signs of possible correction ahead.

2️⃣ Trade Parameters:

Bias: Long (with caution at resistance)

Entry: Already in from $94 zone (liquidity area)

Stop Loss: Below $94 (liquidity base)

TP1: $120 – Watch this for potential rejection

TP2: $143 – If breakout happens

Final Target: $153 – Previous high area

Correction Watch: Potential ABC correction back to $106 or even retesting $94 before continuation

3️⃣ Key Notes:

We're currently in a parallel channel, and NVDA continues to move higher. However, valuation risk is real. Based on fundamentals, NVDA appears overvalued — with a price-to-sales ratio near 20 and book value suggesting a much lower fair value. Earnings have been decent, but cash flow and valuation metrics don’t support this kind of rally sustainably.

A rejection from $120 could lead to a short-term correction. This move could be deeper if macro risks arise — such as tariff threats or negative headlines from political events (e.g., Trump-related trade policies). Always monitor broader tech sentiment (QQQ, NDX) when analyzing NVDA.

4️⃣ Follow-up:

I'll continue watching price action near $120 and update the idea if structure changes significantly.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not a financial advise. Always conduct your own research. This content may include enhancements made using AI.

Will NVDA Breaks 115 and Trigger the Next Leg?Technical Analysis (1H Chart)

NVDA is riding a strong intraday uptrend within a clean ascending channel. Price is now sitting just under the key resistance zone around 115, which aligns with a prior high and the top of the current structure. This level also matches the upper boundary of the rising channel, making it a high-confluence breakout point.

* Support zones: $103.07 (prior breakdown area), followed by $92.53 (major swing low).

* Resistance: $115.05 — a critical decision zone.

* Volume: Increasing on bullish candles, suggesting buyer interest.

* RSI: Sitting just below overbought, indicating room for a breakout continuation before exhaustion.

* Outlook: Holding above the mid-channel trendline signals strength. A push and close above 115 could unlock a rapid move toward 120–125.

GEX Options Insight

The options market is showing strong bullish positioning:

* Highest positive NETGEX / Call Wall at 115 – this level acts as a magnet and resistance.

* 80.79% Call Wall at 130, with stacked gamma walls at 120 and 125.

* PUT Support sits at 100, reinforced by -51.01% and -29.42% put walls.

Options Sentiment:

* IVR: 61.2 — moderately elevated.

* IVx Avg: 81 — above average.

* Put Flow: 3.6% only — heavy CALL interest.

* GEX Flow: 🔵🟢🟢 — indicating net bullish pressure.

🧠 Trade Setups

For Stock Traders:

* Breakout Entry: If NVDA breaks and holds above 115, target the next gamma wall at 120–125.

* Support Bounce: Buy near 103 if it pulls back and confirms support.

* Stop-loss: Below $100.

For Options Traders:

* Call Spread: Buy 115C / Sell 125C for 4/26 or 5/3 expiry. Defined risk, targeting gamma extension.

* Put Credit Spread: Sell 100P / Buy 95P if expecting continued support at $100.

* Avoid shorting calls — heavy bullish GEX tilt suggests further upside pressure.

🔍 Final Thoughts

NVDA is one of the cleanest large-cap setups right now. Both the chart structure and GEX sentiment align for potential continuation trades to the upside, especially on a confirmed 115 breakout. While broad markets remain shaky, NVDA is flashing clear relative strength, backed by options flow and technical positioning.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

NVIDIA ---> The jorney TO ---> 90s and 80s (UPDATED) PART 2Okay guys. Here is my UPDATED idea (just dont know how to insert an updated chart in the previous exsiting idea).

I think it could be usful, CAUSE many guys burning for bullish.

I was straight bearish in the first part of idea, but here is some corrections cause of Trump canceled the additonal tarrifs for import from China, for critical technologies such as semiconductors, chips, smartphones and laptops.

So I assume the price can go first up to 113 and go down or even touch 117 and then the "Journey" at least to 90s and even 80s. As we see the lines of resistance in that areas on the chart.

The dead line for the price reversal is Tuesday, April 15

(in my opinion).

My technical analysis telling me this.

Let's watch what will happen.

NVIDIA ---> The jorney TO ---> 90s and 80s According to my technical analysis + Political causes of US trade policies and tarrifs uncertanties, which brought to losing in trust of partners and invesors to the current US administration, due to Trump's market manipulations.

My thoughts: it is should happen within next 1-3 days.

Buckle up! :)

Quantum's NVDA Trading Guide 4/13/25Sentiment: Neutral. AI chip dominance drives optimism, but tariff risks and valuation concerns temper enthusiasm. Chatter posts split—bulls see growth, bears eye correction.

Outlook: Neutral, slightly bearish. Options pin $110, with $105 puts active. ICT/SMT eyes $108-$110 buys to $115 if $108 holds. Bearish below $108 risks $105.

Influential News:

Federal Reserve: Two 2025 cuts support growth stocks, positive for $NVDA.

Earnings: Q1 due May; no update today.

Chatter: Debates AI growth vs. tariff/supply chain risks.

Mergers and Acquisitions (M&A): No confirmed NASDAQ:NVDA M&A; AI chip partnerships rumored.

Other: Tariff volatility hit NASDAQ:NVDA ; stock swung (April 3-9).

Indicators:

Weekly:

RSI: ~50 (neutral).

Stochastic: ~45 (neutral).

MFI: ~40 (neutral).

SMAs: 10-day ~$112 (below, bearish), 20-day ~$115 (below, bearish).

Interpretation: Neutral, bearish SMAs signal weakness.

Daily:

RSI: ~48 (neutral).

Stochastic: ~50 (neutral).

MFI: ~45 (neutral).

SMAs: 10-day ~$112 (below, bearish), 20-day ~$115 (below, bearish).

Interpretation: Neutral, bearish SMAs suggest pullback.

Hourly:

RSI: ~45 (neutral).

Stochastic: ~55 (neutral).

MFI: ~50 (neutral).

SMAs: 10-day ~$112 (below, bearish), 20-day ~$115 (below, bearish).

Interpretation: Neutral, stabilizing.

Price Context: $110.93 (April 11), 1M: -9%, 1Y: +28%. Range $105-$120, testing $110 support.

Options Positioning (May 2025):

Volume:

Calls: $115 (12,000, 60% ask), $120 (10,000, 55% ask). Mild bullish bets.

Puts: $105 (8,000, 70% bid), $108 (6,000, 65% bid). Put selling supports $108.

Open Interest:

Calls: $115 (35,000, +6,000), $120 (25,000, +5,000). Bullish interest.

Puts: $105 (20,000, flat), $108 (22,000, +3,000). Hedging. Put-call ~1.0.

IV Skew:

Calls: $115 (40%), $120 (42%, up 3%). $120 IV rise shows upside hope.

Puts: $105 (35%, down 2%), $108 (36%). Falling $105 IV supports floor.

Probability: 60% $105-$120, 20% <$105.

Karsan’s Interpretation:

Vanna: Neutral (~300k shares/1% IV). IV drop could pressure $110.

Charm: Neutral (~150k shares/day). Pins $110.

GEX: +60,000. Stabilizes range.

DEX: +8M shares, neutral.

Karsan view: GEX holds $105-$120; tariff news key.

ICT/SMT Analysis:

Weekly: Neutral, $105 support, $120 resistance. No $NVDA/ NASDAQ:AMD divergence.

Daily: Bullish at $110 FVG, targets $115. Bearish < $108.

1-Hour: Bullish >$110, $115 target. MSS at $108.

10-Minute: OTE ($109-$111, $110) for buys, NY AM.

Trade Idea:

Bullish: 50%. ICT/SMT buys $108-$110 to $115. Options show $115 calls. Fed cuts aid.

Neutral: 35%. RSI (~50), SMAs (bearish), $105-$120 range.

Bearish: 15%. Below $105 possible with tariffs. $105 put volume grows

Nvidia (NASDAQ: $NVDA) Advances AI Strategy Amid Tariff PauseNvidia (NASDAQ: NASDAQ:NVDA ) is quickly strengthening its positions in artificial intelligence and data center technologies. This comes as the U.S. government temporarily halts new export restrictions, offering relief to the semiconductor sector.

Nvidia will continue selling its H20 AI chips to China following a decision not to enforce new trade limits. This followed a key meeting between CEO Jensen Huang and former President Donald Trump. The announcement eased concerns over losing access to a major international market. Nvidia recently introduced its latest innovation, the Blackwell Ultra AI chips, at the GPU Technology Conference. These chips target the rising demand for high-performance computing used in AI systems. The move could boost Nvidia’s market lead as competition grows.

Market volatility followed the government’s tariff update. Nvidia stock surged nearly 19% after the 90-day tariff pause announcement, excluding China-specific measures. The next day, the stock dropped 5.8% to close at $107.74.

Technical Analysis

Nvidia's price bounced sharply from the $92 support zone. This area has attracted strong buying activity. The RSI is currently at 44, showing neutral market momentum. The key resistance level to watch is $153.13. If the price breaks this level, it could rise toward a new all-time high. Failure to do so may lead to a pullback toward $92.

Watch the $153 level closely for confirmation of trend direction. Nvidia's recent price movement leaves room for both uptrend continuation and short-term correction depending on upcoming market signals.

NVIDIA Possible play's for next week So major stocks are finally coming down to levels where we could see several bounce back up & the market to rip to the upside. we need some more confirmation but as of right now, this is showing a bullish momentum. let's see if it can show a hold starting next week.

NVDA Drops to $100: Volatility Squeeze Signals More DownsideNVDA Daily Chart Analysis

Price Action: NVDA saw a strong uptrend from late 2023, peaking at $150 in mid-2024. It has since pulled back sharply to $100.33 as of May 2025, showing bearish momentum.

Indicator: The Smart-Trend Indicator flagged multiple buy (blue X) and sell (red X) signals. The latest sell signal near $150 preceded the current drop, with sentiment marked as "Bullish" but showing a "Volatility Squeeze."

Key Levels:

Support: $90 (next major level).

Resistance: $111.05 (recent high).

Outlook: Bearish in the short term after the breakdown. A drop below $100 could target $90. A reclaim of $111.05 might signal a trend reversal.

Trade Idea: Short on a bounce to $111 with a stop above $115, targeting $90. Alternatively, wait for $90 support confirmation for a long entry.

#NVDA #Bearish #SmartTrend

Nvidia (NASDAQ: $NVDA) Shares Rally Amid AI Sector OptimismShares of Nvidia Corporation (NASDAQ: NASDAQ:NVDA ) have gained over 3% on Friday 11th April. The positive results come after U.S. markets rallied on tariff news. President Trump announced a 90-day pause on new tariffs. Reciprocal tariffs for most countries dropped to 10%, sparking investor optimism.

Major U.S. indices rose sharply following the announcement after being under pressure from rising trade tensions. The pause was seen as a welcome shift toward calmer negotiations.

However, Trump excluded China from this relief. Instead, he stated that tariffs on Chinese goods would increase to 125%. This came after China announced new retaliatory tariffs on U.S. imports. The tough stance toward China contrasted with the softened approach to other countries.

Despite the relief, market uncertainty remains. Investors are unsure whether the rally will last. Ongoing trade disputes, especially with China, could disrupt momentum.

Nvidia's price rose to $110.78, gaining $14.99 on Friday's session. The stock reached an intraday high of $111.53 and a low of $107.48. The current resistance sits at $153.13 high.

Technical Analysis

Nvidia bounced sharply off the $92 support zone, highlighted by strong buying pressure. The RSI sits at 49, indicating neutral momentum. A clear resistance lies near $153.13 high. If Nvidia breaks this level, a move toward $180 is likely. If it fails, price may revisit the $92 zone. Two scenarios are possible. The stock could either continue upward to $180 or face rejection and fall back. Watch the $153 level closely for confirmation.

What Technical and Fundamental Analysis Says about NvidiaNvidia NASDAQ:NVDA soared nearly 20% Wednesday before pulling back some later in the week, leaving the stock down roughly 25% over the past six months. Where does technical and fundamental analysis say the chip giant’s stock could go from here?

Let’s take a look:

Nvidia’s Fundamental Analysis

Nvidia got a huge boost Wednesday from the Trump administration's decision to pause the tariffs it planned to impose on most nations’ U.S.-bound exports.

Instead, the White House decided to delay most tariffs on countries other than China for the next 90 days while it conducts trade negotiations with some 70 nations.

As an added benefit for Nvidia, the president's team separately paused an expected export ban that would have prohibited Nvidia from shipping its high-end H20 GPUs to China.

Now, I don't know how many of these chips Nvidia would really sell to Beijing, as both nations recently placed almost prohibitive tariffs on each other's exports.

But the market had probably already largely priced in the H20 export ban, which is now not moving ahead. The sale of these chips to Chinese customers in all likelihood remains legal.

Nvidia's publicly known Chinese customers for those chips include such well-known names as Alibaba NYSE:BABA , Tencent OTC:TCEHY and privately held ByteDance. All of those three have placed large H20 orders this year.

As for earnings, Nvidia won’t report fiscal Q1 results until probably May’s last week.

However, the firm posted fiscal Q4 numbers in February that showed 82% year-over-year earnings growth on 72% y/y revenue gains.

While those are big percentage increases, they nonetheless marked a deceleration from prior quarters’ y/y gains.

Similarly, management’s latest forward sales guidance remains strong, but also reflects a continuance of this year-over-year percentage deceleration.

The company’s midpoint projection calls for $43 billion in fiscal Q1 revenue, which would amount to about a 65% year-on-year revenue gain.

NVDA also guided fiscal Q1 GAAP gross margin to 70.6% and adjusted gross margin at 71%, plus or minus 50 basis points. That was just a touch below analysts’ consensus view at the time.

All in, the Street is looking for Nvidia to report $0.88 in GAAP earnings per share for its current quarter, as well as $0.93 in adjusted EPS and $43.3 billion in revenues.

That would represent an 52.5% gain from the year-ago quarter’s $0.61 in adjusted EPS, while also reflecting 64% in year-over-year sales growth.

This would beat of the firm's own guidance, as 25 of the 32 sell-side analysts that I can find that cover Nvidia have increased their estimates for the quarter since it began. (Seven have cut their forecasts.)

Technically Speaking

Now let’s check out NVDA’s chart going back to last September and running through midday on Thursday (April 10):

Readers will see that NVDA recently came out of a so-called “double top” pattern of bearish reversal that spanned from last October into early January, as marked with the “Top 1” and “Top 2” red boxes above.

However, the stock trended lower from that point on, as I capture above within the confines of an Andrews' Pitchfork model.

Though the chipmaker’s stock has at times pierced both the pitchfork’s upper and lower trendlines, it hasn’t broken out in either direction so far.

Even after NVDA’s 18.7% one-day rally on Wednesday, the stock immediately gave back its 21-day Exponential Moving Average (or “EMA,” marked with a green line above) on the very next day.

The stock also remains well below both its 50-day Simple Moving Average (or “SMA,” denoted by a blue line) and its 200-day SMA (marked with a red line).

This means that in all likelihood, Nvidia might very well remain an instrument of short-term trading rather than long-term investing. After all, portfolio managers generally don’t like to carry a lot of exposure below those two moving averages.

As for Nvidia’s other technical indicators, the stock’s Relative Strength Index (or “RSI,” marked with a gray line at the chart’s top) remains unimpressive.

Similarly, the company’s daily Moving Average Convergence Divergence indicator (or “MACD,” marked with the black and gold lines and blue bars at the chart’s bottom) looks bearish.

All of its three components -- the histogram of the 9-day EMA (the blue bars), the 12-day EMA (the black line) and the 26-day EMA (the gold line) -- are below zero. That’s usually a bearish technical indicator.

From where I stand, Nvidia’s upside pivot is the stock’s 50-day Simple Moving Average (or “SMA,” marked with a blue line and currently at around $119.30 vs. NVDA’s $107.57 close Thursday).

Meanwhile, if the stock can hold its 21-day EMA (the green line above, currently at about $109.90) that could get the swing-trading crowd on board.

However, a failure to hold there would likely make the odds of attracting capital flows from portfolio managers pretty weak.

(Moomoo Technologies Inc. Markets Commentator Stephen “Sarge” Guilfoyle had no position in NVDA at the time of writing this column.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

Support Zone: 106.19

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(NVDA Chart)

The HA-Low indicator on the 1D chart was formed at 106.19.

Therefore, the key is whether it can receive support and rise near 106.19.

-

(30m chart)

If it falls below 106.19,

1st: M-Signal indicator on 1M chart

2nd: HA-Low indicator on 30m chart

You need to check if it is supported near the 1st and 2nd above.

In order to continue the uptrend, the price must be maintained above the M-Signal indicator on the 1M chart.

-

(1D chart)

Since the HA-Low indicator on the 1D chart has been newly created, the key is whether it can be supported near this area and rise above the M-Signal indicator on the 1D chart.

If so, it is expected to turn into a short-term uptrend.

If not, there is a possibility of a stepwise downtrend, so the current position is an important section.

-

Thank you for reading to the end.

I hope your transaction will be successful.

--------------------------------------------------

NVIDIA Corporation Will Start Growing (Recover) —New ATH In 2025I gave you the bad news but only because the market peaked and turned bearish. When the chart is bearish, I call it bearish. In reverse, when the chart turns bullish, I will share with you exactly what the share says.

All possible scenarios?

No! I will tell you the future before it happens...

Put your seatbelt on.

Join the ride.

Let's trade!

The markets today are not the same as they were 100 years ago. Today, bear markets are short, bull-markets are long.

Money is easily accessible now.

Companies that are in trouble do not have to go bankrupt. The system has many tools to protect the market and its participants. The business world and finance, continues to improve, advance and evolve. With time, bear markets will continue to become shorter while bull markets will continue to expand.

Prosperity and stability will be the norm.

Humanity is in an ascending trend. We are going up, worldwide, civilization wise...

The correction you saw between early January and today was the end. Three months going down and a total drop of 43% (-43%). That's it, NVDA is going up next.

NVDA produced a peak in June 2024. There was a correction and support was found at 91 in August. After some sideways, distribution, the drop was resumed and the same level activated again. NVDA bottomed yesterday at 92 and today it hit 86 but just to recover right away.

The recovery is really strong and also a positive signal. This recovery is happening on a Monday and is producing high volume. This is a long-term support level and it holds.

Minimum, we get a bounce now and prices move up because of this support. Once support is tested, the action moves back to resistance. By the time our previous resistance level is hit the market will be bullish and strong; interest rates will be lowered and in May we will have Mars (astrology) with a stabilized orbit, the action planet, which means that we will moving ahead with full force.

These signals combined are telling us that the down period is no more.

This is a friendly reminder: NVDA is going up.

I love you.

Thanks a lot for your continued support.

Namaste.