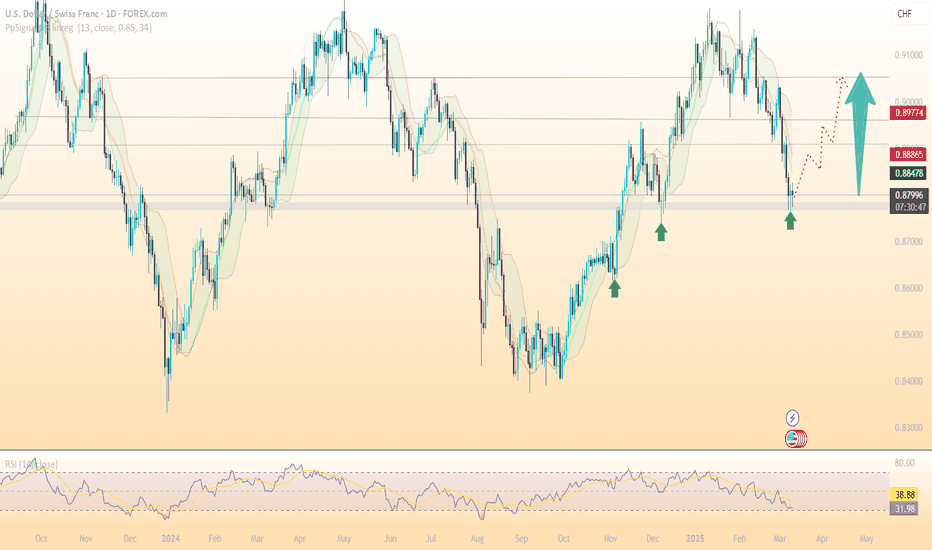

Bullish idea USD 25% increase tariff I am bullish on USD for the week.. the pink box above is the daily ifvg which is the overall target ( magnet) but not to be so greedy i have a short term target and as the day go by i will look to scale in my position. Tradingview wont let me go below 15min but if u scale down will find an Ob on the 5min + the bullish data on the news release supports my bias and buying view on USD

CHFUSD trade ideas

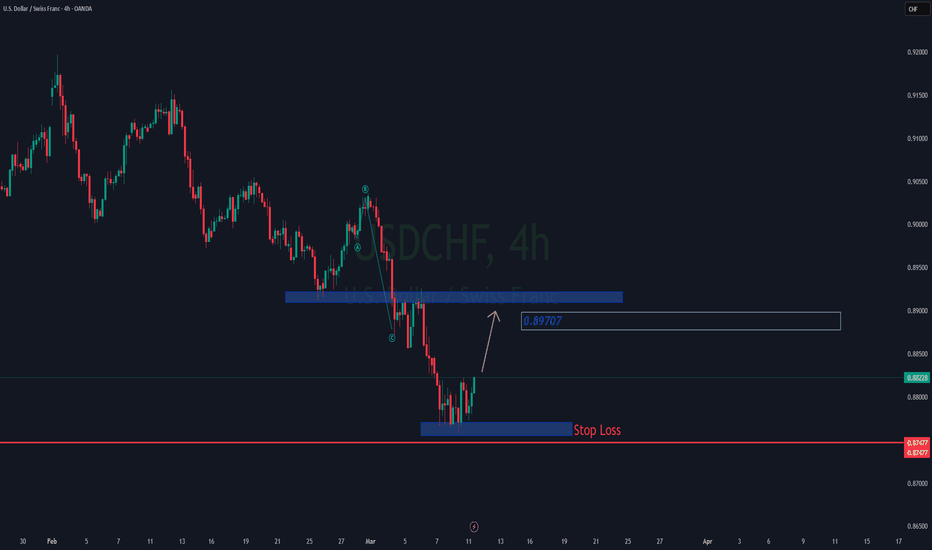

USDCHF.. MINE TARGET BUY>>The proposed USDCHF trade idea presents a logical technical setup, but several factors should be considered before confirmation:

### *Technical Rationale*

1. *Bollinger Bands*: The bounce from the lower band suggests potential oversold conditions, but confirmation above 0.8820 (likely a key resistance-turned-support) is critical to validate bullish momentum.

2. *Stochastic Oscillator*: Exiting oversold signals weakening downward momentum, though this alone isn’t sufficient—watch for a bullish crossover (e.g., %K > %D).

3. *Support Level*: The "critical support" likely aligns with recent swing lows or a psychological level. A strong bounce here adds credibility.

### *Key Considerations*

- *Trend Context*:

- If USDCHF is in a broader downtrend (e.g., driven by CHF strength or USD weakness), this bounce may be a short-lived retracement.

- A break above 0.8820 could signal a near-term reversal, especially if paired with rising volume and bullish candlestick patterns (e.g., engulfing bars).

- *Confluence*:

- Look for alignment with RSI (>50), MACD histogram turning positive, or momentum divergences.

- Monitor risk sentiment—CHF often strengthens during market turmoil, which could cap gains.

### *Risk Management*

- *Entry/Stop*:

- A conservative stop loss (e.g., below 0.8880) limits risk to ~300 pips.

- Ensure a risk-reward ratio ≥ 1:2 (targets at 800/1300 pips).

- *Confirmation*:

- Wait for a close above 0.8820 with strong bullish follow-through to avoid false breaks.

### *Conclusion*

The setup is plausible *if*:

- Price consolidates above 0.8820 with bullish confirmation signals.

- The broader market context (e.g., USD momentum, risk sentiment) supports upside.

*Verdict*: Cautiously agree, but traders should wait for clear confirmation and manage risk tightly. 👍 with disciplined execution.

USDCHF to find sellers at market price?USDCHF - 24h expiry

There is no clear indication that the downward move is coming to an end.

20 4hour EMA is at 0.8816.

Bespoke resistance is located at 0.8800.

Our outlook is bearish.

The weaker US dollar has boosted performance.

We look to Sell at 0.8803 (stop at 0.8843)

Our profit targets will be 0.8703 and 0.8683

Resistance: 0.8811 / 0.8830 / 0.8845

Support: 0.8765 / 0.8740 / 0.8720

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

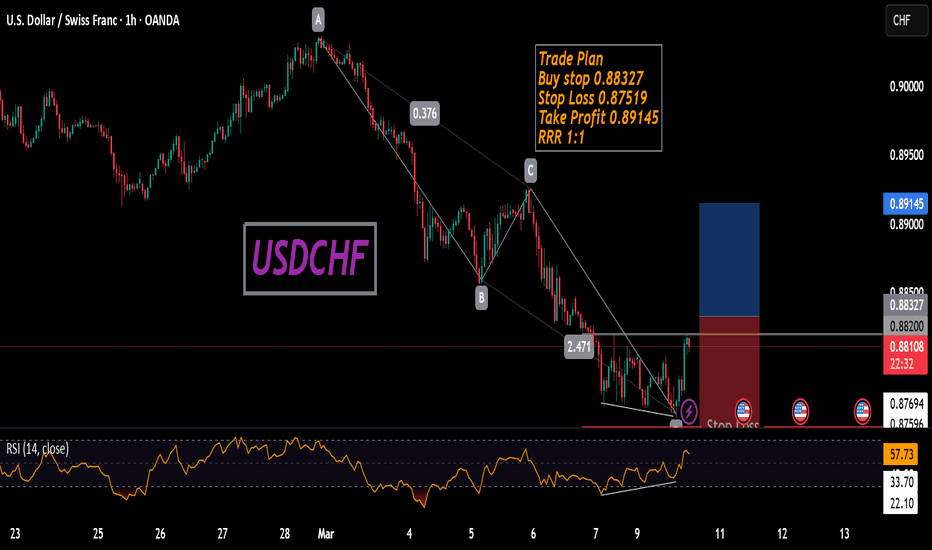

USD/CHF BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

We are going long on the USD/CHF with the target of 0.895 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

UPDATE ON USD/CHF TRADEUSD/CHF 15M - As you can see price is playing out well up to now, we are seeing that price is respecting these areas of Demand and price is trading higher from them.

As we are respecting these areas and new highs are being created it further backs our analysis and running trade to take this market long. This trade was placed based on a BOS to the upside and price respecting these areas.

This trade is running + 35 pips. (+ 2%) 2RR

It is important that you are all managing your trades correctly and you are taking partials throughout your position. You could also look to apply further safety measures.

A big well done to anyone who got involved in this position, if you have any questions with regards to the analysis or the trade itself then drop me a message or comment below!

USD/CHF Short Trade Setup📉 Bearish Outlook on USD/CHF – Here's Why I'm Going Short! 📉

🔎 Fundamental Analysis:

Swiss Franc's Safe-Haven Appeal:

Despite recent rate cuts by the Swiss National Bank (SNB), the Swiss franc continues to attract investors seeking stability amid global uncertainties. SNB Chairman Martin Schlegel emphasized that the franc is likely to remain a safe-haven currency.

marketwatch.com

Reuters

SNB's Monetary Policy:

The SNB's recent 50 basis point rate cut to 0.5% was a proactive measure to address low inflation and prevent excessive franc appreciation. This move indicates the SNB's commitment to maintaining economic stability.

US Dollar Dynamics:

The US dollar has been under pressure due to shifting Federal Reserve policies and economic data suggesting a potential slowdown. This environment may lead to further USD depreciation against the CHF.

📊 Technical Analysis:

Downtrend Confirmation:

USD/CHF has been on a consistent downtrend, breaking below key support levels.

actionforex.com

Bearish Trendline:

A prominent bearish trend line is forming with resistance at 0.8825 on the 4-hour chart, indicating sustained selling pressure.

actionforex.com

Moving Averages:

The pair is trading below its 50-day and 200-day moving averages, reinforcing the bearish momentum.

Decision timeUSDCHF Multi-Timeframe Analysis

Daily Chart Observations:

✅ Trend Still Bearish – No significant shift in structure.

✅ Price Holding Below Rejection Zone – No break above yet.

✅ MACD Still Bearish – No sign of reversal on the daily yet.

4H Chart Observations:

✅ Short-Term Push Up – Price attempting to re-enter downtrend channel.

⚠️ Will It Break or Reject? – Price at critical decision point.

⚠️ MACD Starting to Flatten – Upside momentum slowing down.

1H Chart Observations:

⚠️ Losing Momentum at Resistance – Struggling to push higher.

✅ Potential Rejection Area – Confluence with trendline & moving averages.

⚠️ MACD Histogram Shrinking – Weakening bullish pressure.

⸻

Key Trading Decision: Break or Rejection?

Scenario 1: Price Breaks Above Downtrend Channel → Look for Buys

• If 1H closes above trendline with strong volume, the move up may continue.

• Target 0.88500 - 0.89000 for a short-term retracement.

Scenario 2: Price Rejects and Bounces Down → Look for Sells

• If 1H closes with strong rejection wicks, this confirms a fake-out.

• Look for M5 or M15 bearish confirmation to enter short.

• Target a move back toward 0.87700 - 0.87500 zone.

USD/CHF Short Setup – Institutional Flow & Liquidity TargetsUSD/CHF is setting up for a bearish move, with confluence from technical structure, order flow, and fundamental events. Here’s a complete breakdown of the setup, execution plan, and institutional positioning.

📊 Trade Execution & Technical Breakdown

🔹 Entry Zone: Price rejected from the 0.8786 - 0.8794 supply zone, aligning with 0.62 - 0.79 Fibonacci retracement levels.

🔹 Confluences:

✅ Bearish trend continuation – Lower highs forming.

✅ Liquidity grab above minor resistance, suggesting smart money distribution.

✅ Break & retest structure confirms potential downside.

🔹 Target Zones:

📉 First target: 0.8767 (previous low & liquidity area).

📉 Final target: 0.8750 (-0.62 Fibonacci extension).

📌 Market Structure:

Higher timeframe bearish bias remains intact.

Supertrend (4H) signals continued downside.

EMA alignment (1D) confirms selling pressure.

🏦 Institutional Positioning & Market Sentiment

📌 Commitment of Traders (COT) Report Insights:

📈 USD: Institutional long positions declining, indicating potential USD weakness.

📉 CHF: Increased net short positioning, suggesting institutional flow favoring CHF strength.

📌 Liquidity & Order Flow Data:

Market depth shows heavy short positioning near resistance.

Volume profile indicates a lack of demand above 0.8780, confirming weak bullish momentum.

⚡ Fundamental Drivers – Key News Events

📊 Macroeconomic Data Impacting USD/CHF:

📌 Employment Trends Index (108.35) – USD strength limited.

📌 T-Bill Auction & Treasury Buyback – Potential liquidity shifts affecting risk sentiment.

📌 Fed’s Beige Book & Policy Outlook – Key for USD direction.

🛑 Impact on Trade:

✔️ USD uncertainty fuels risk-off flows into CHF.

✔️ Short-term retracement provides an ideal short entry before further downside.

📈 Volatility & Liquidity Insights

📌 Prime Market Terminal Data:

ATR shows increased volatility, supporting large price swings.

Institutional short positioning rising, indicating strong bearish control.

DMX data suggests liquidity buildup below 0.8760.

🔥 Conclusion – High-Probability Short Setup

✅ Bearish trend structure aligns with institutional positioning.

✅ Liquidity grab above resistance confirms distribution phase.

✅ Confluence of technicals, fundamentals, and order flow supports downside movement.

📌 Short Bias: Targeting 0.8767 → 0.8750.

📌 Key Invalidations: A break above 0.8800 could shift sentiment.

💬 What’s your take on USD/CHF? Let me know in the comments! 🚀📉

USDCHF Key Trading Level to watch at 0.8865The USD/CHF currency pair is currently exhibiting a bearish sentiment, as evidenced by the loss of the longer-term prevailing uptrend. The key trading level to watch is 0.8865, which represents the current intraday swing low and the falling resistance trendline level.

Bearish Scenario:

If the price fails to break above the 0.8865 level and faces a bearish rejection, it could trigger a downside move targeting the support levels at:

0.8735 - Initial downside support

0.8700 - Secondary support level

0.8600 - Longer-term support

Bullish Scenario:

Alternatively, a confirmed breakout above the 0.8865 resistance level, followed by a daily close above that point, would negate the bearish outlook. This scenario could open the path for further rallies, targeting:

0.8918 - Immediate resistance level

0.8965 - Next potential resistance level

Conclusion:

Traders should closely monitor the 0.8865 level for directional clues. A rejection from this level would favor short positions targeting lower support zones, while a breakout and daily close above would support long positions aiming for higher resistance levels. Proper risk management and trend confirmation are crucial for successful trading in this volatile environment.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

super R:R Bullish Thesis for USD/CHFSNB reduced its policy rate by 50 BIPS

As US introduced new tariffs on multiple countries

BOA adviced US CORPs to increase their Hedges

which all Translates to a Bullish outlook for USDCHF.

simple ADR calculations for the last 5 yrs deduces to the TP i marked.

if you read down this far ,

i am trying to make a signal service

please let me know if i should elaborate like a blog story or keep the analysis short and straight to the point like this.

feel free to reach out.

USDCHF SHORTMarket structure Bearish on HTFs DH

Entry at both Daily And Weekly AOi

Weekly rejection at AOi

Weekly EMA retest

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 0.89000

H4 Candlestick rejection

Rejection from Previous structure

Levels 5.16

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

UPDATE ON USD/CHFUSD/CHF 1H - Since our Sunday Sessions video, price seems to be playing out well. As you can see price looks to be accumulating, giving us the suggestion that its preparing to reverse.

We want to see the last protected high break to give us full confluence that enough Demand has been introduced into this market to flip the S&D balance, I have gone ahead and marked it out for you all.

Once we see price break that high its then a case of waiting for price to pullback trading down and into a fractal area of Demand, this will be where we will look to enter from.

We will find this area of Demand by looking at the impulsive wave that breaks the structure to the upside, typically we see an area of interest display itself, giving us retail traders and area to enter from.

USD/CHF "The Swissy" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ˗ˏˋ ★ ˎˊ˗USD/CHF "The Swissy" ˗ˏˋ ★ ˎˊ˗ Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on! profits await!" however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or swing low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (0.90700) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.88500 & 0.88000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook:

USD/CHF "The Swissy" Forex Market is currently experiencing a Bearish trend in short term,{{{(>HIGH CHANCE FOR BULLISHNESS IN FUTURE<)}}} driven by several key factors.

⭐1. Fundamental Analysis

Fundamental analysis evaluates the economic indicators driving the USD/CHF pair:

US Economic Indicators:

GDP Growth: 2.3% – Indicates robust economic expansion.

Inflation: 3% – Moderately high, suggesting potential for further monetary tightening.

Interest Rates: 4.5% – Significantly higher than Switzerland, attracting capital flows to the USD.

Trade Balance: Deficit of -98.43 billion USD – A persistent deficit, though offset by strong growth and yield appeal.

Switzerland Economic Indicators:

GDP Growth: 0.2% – Slow growth, reflecting a weaker economic performance.

Inflation: 0.4% – Very low, indicating stable but minimal price pressures.

Interest Rates: 0.5% – Low rates, reducing attractiveness for CHF-denominated assets.

Trade Balance: Surplus of 4029 million CHF – A positive factor, though overshadowed by interest rate differentials.

Key Insight: The significant interest rate differential (4.5% vs. 0.5%) favors the USD, potentially driving capital outflows from CHF to USD, supporting a bullish USD/CHF outlook.

⭐2. Macroeconomic Factors

Macroeconomic conditions provide context for currency movements:

Global GDP Growth: Projected at 3.3% for 2025, with mixed regional performances.

US Economy: Strong growth (2.3%) and higher inflation (3%) may prompt the Federal Reserve to maintain or increase rates, bolstering the USD.

Swiss Economy: Low growth (0.2%) and inflation (0.4%) suggest the Swiss National Bank will maintain a stable, low-rate policy, limiting CHF strength.

Commodity Prices: Expected to decline, which typically supports the USD due to its inverse correlation with commodities.

Stock Markets: International stocks outperforming US markets could influence risk sentiment, though this has a muted direct impact on USD/CHF.

Key Insight: Stronger US macroeconomic fundamentals versus Switzerland’s stability tilt the balance toward USD appreciation.

⭐3. Global Market Analysis

Global factors influencing the USD/CHF pair:

Geopolitical Events: Potential tensions could boost CHF as a safe-haven currency, though no specific events are currently noted.

Central Bank Policies:

Federal Reserve: Possible further rate hikes if US data remains strong, supporting USD.

Swiss National Bank: Likely to maintain low rates, limiting CHF upside.

Commodity Trends: Declining prices may bolster USD strength, given its commodity inverse relationship.

Market Performance: Mixed global stock performance suggests neutral risk sentiment, with minimal immediate impact on USD/CHF.

Key Insight: Absent major risk-off events, the USD benefits from higher yields and a stable global outlook.

⭐4. COT Data (Commitment of Traders)

COT data reflects trader positioning:

Non-Commercial Traders: Likely net long USD against CHF, driven by the interest rate differential and stronger US economic outlook.

Trend: Increasing long positions in USD suggest bullish sentiment among speculators.

Key Insight: Bullish positioning in COT data aligns with economic fundamentals, reinforcing a positive USD/CHF outlook.

⭐5. Intermarket Analysis

Correlations with other asset classes:

USD and Commodities: Typically inversely correlated; declining commodity prices could strengthen the USD.

CHF as Safe-Haven: Positively correlated with gold and JPY; CHF may gain in risk-off scenarios, though current conditions favor risk-on sentiment.

Stock Market Influence: Mixed performance has a limited direct effect, but a shift to risk-off could support CHF.

Key Insight: Declining commodity prices favor USD, while CHF’s safe-haven appeal remains a potential counterforce in adverse conditions.

⭐6. Quantitative Analysis

Technical indicators based on the current price of 0.89700:

Moving Averages: Assuming the price is above key moving averages (e.g., 50-day or 200-day), this suggests an uptrend.

Relative Strength Index (RSI): If not in overbought territory (e.g., below 70), there’s room for further gains.

Support/Resistance Levels:

Support: 0.8900 – A potential downside target if the trend reverses.

Resistance: 0.9009 and 0.9026 – Upside targets if bullish momentum continues.

Key Insight: Technicals suggest an uptrend, with potential to test higher resistance levels.

⭐7. Market Sentiment Analysis

Sentiment gauged from trader behavior:

Current Sentiment: Likely moderately bullish on USD/CHF, reflecting economic and technical factors.

Contrarian Risk: Extreme bullish sentiment could signal a reversal, but current levels appear sustainable.

Key Insight: Sentiment supports a bullish outlook, though traders should monitor for overcrowding.

⭐8. Positioning

Trader positioning insights:

Speculative Positions: Increased long positions in USD, as per COT data assumptions, indicate confidence in further gains.

Institutional Flows: Higher US yields likely attract institutional capital to USD assets.

Key Insight: Positioning reinforces the bullish case for USD/CHF.

⭐9. Next Trend Move

Direction: Likely upward, driven by interest rate differentials, technical momentum, and economic strength.

Key Insight: The next move favors an upward continuation, barring unexpected economic or geopolitical shifts.

Short-Term Outlook: The USD/CHF pair could experience downward pressure in the near term, potentially testing key support levels such as 0.8900. If this level is breached, the pair might decline further toward 0.8850 or lower.

⭐10. Overall Summary Outlook

Summary: The USD/CHF pair, at 0.89700 on March 4, 2025, exhibits a bullish outlook. Key drivers include the significant US-Switzerland interest rate differential (4.5% vs. 0.5%), stronger US GDP growth (2.3% vs. 0.2%), and higher inflation (3% vs. 0.4%). Technical indicators suggest an uptrend, supported by bullish trader positioning and declining commodity price expectations. Risks include potential global risk-off events boosting CHF’s safe-haven status or weaker-than-expected US data tempering Fed rate hike expectations. However, the prevailing trend points to further USD appreciation.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩