JKH.NDisclaimer;

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website’s content as such. We do not recommend buying, selling, or holding any stock. Nothing on this website should

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.7 LKR

11.25 B LKR

280.77 B LKR

11.26 B

About JOHN KEELLS HOLDINGS PLC

Sector

Industry

CEO

Krishan Niraj J. Balendra

Website

Headquarters

Colombo

Founded

1979

ISIN

LK0092N00003

FIGI

BBG000FNYMJ6

John Keells Holdings Plc engages in the investment and provision of transportation, consumer foods, retail, leisure, property, and financial services. It operates through the following segments: Transportation, Consumer Foods, Retail, Leisure, Property, Financial Services, and Others. The Transportation segment provides an array of transportation related services, which comprise of a container terminal in the Port of Colombo, a marine bunkering business, domestic airline, joint venture/associations with shipping, logistics, and air transportation multinationals as well as travel and airlines services in Sri Lanka and the Maldives. The Consumer Foods segment focuses on manufacturing of a wide range of soft drinks, dairy products, ice creams and processed foods, which competes in three major categories namely beverages, frozen confectionery and convenience foods. The Retail segment focuses on modern organized retailing through a chain of supermarkets and distribution of printers, copiers, smart phones and other office automation equipment. The leisure segment comprises of five-star city hotels, a lean luxury hotel, resort hotels spread across prime tourist locations in Sri Lanka, as well as destination management business in Sri Lanka. The Property segment concentrates primarily on property development, renting of commercial office spaces and management of the Group’s real estate. The Financial Services segment engages in a broad range of financial services including insurance, commercial banking, debt trading, fund management, leasing, and stock broking. The Others segment represents companies in the plantation industry, Information technology, management and holding Company of the Group as well as several ancillary companies. The company was founded in 1979 and is headquartered in Colombo, Sri Lanka.

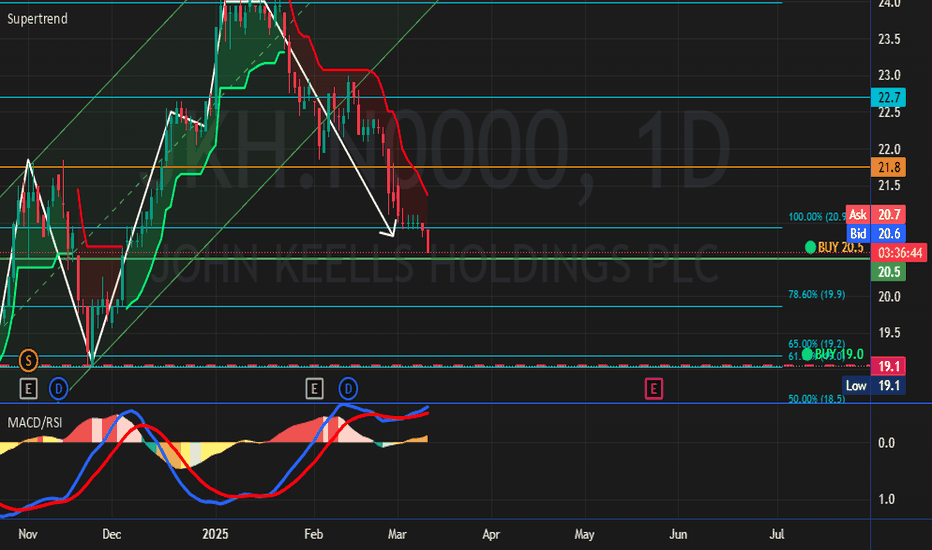

JKH.N0000 - Key fib levels in monthly chartJKH is consolidating in golden pocket now. It should close above golden pocket to keep bullish momentum.In next few months, Next support will be around 0.5 fib level and resistance will be 0.718

Disclaimer: The information and analysis provided in this publication are for educational purposes only

JOHN KEELLS HOLDINGS PLC (JKH.N0000) at Strong Support ZoneEntry Point: 132 to 136

Profit Target: 175 ( Short Term ), 215 ( Mid Term ), 400+ ( Long Term )

Stop-Loss: 127

Disclaimer: The information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell,

JKH | Horrifyingly BearishThe stock broke below the long-term support range on February 20th and subsequently retested the previous support level on Feb 24th. However, it encountered heavy resistance and continued to show a bearish trend, forming a head and shoulders pattern. If the stock fails to hold at 135 levels, it may

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Related stocks

Frequently Asked Questions

The current price of JKH.N0000 is 20.6 LKR — it has decreased by −0.48% in the past 24 hours. Watch JOHN KEELLS HOLDINGS PLC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on CSELK exchange JOHN KEELLS HOLDINGS PLC stocks are traded under the ticker JKH.N0000.

JKH.N0000 stock has fallen by −0.48% compared to the previous week, the month change is a 3.00% rise, over the last year JOHN KEELLS HOLDINGS PLC has showed a 0.71% increase.

We've gathered analysts' opinions on JOHN KEELLS HOLDINGS PLC future price: according to them, JKH.N0000 price has a max estimate of 27.50 LKR and a min estimate of 26.10 LKR. Watch JKH.N0000 chart and read a more detailed JOHN KEELLS HOLDINGS PLC stock forecast: see what analysts think of JOHN KEELLS HOLDINGS PLC and suggest that you do with its stocks.

JKH.N0000 reached its all-time high on May 21, 2013 with the price of 29.9 LKR, and its all-time low was 8.0 LKR and was reached on May 15, 2020. View more price dynamics on JKH.N0000 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

JKH.N0000 stock is 0.97% volatile and has beta coefficient of 0.87. Track JOHN KEELLS HOLDINGS PLC stock price on the chart and check out the list of the most volatile stocks — is JOHN KEELLS HOLDINGS PLC there?

Today JOHN KEELLS HOLDINGS PLC has the market capitalization of 363.00 B, it has increased by 4.52% over the last week.

Yes, you can track JOHN KEELLS HOLDINGS PLC financials in yearly and quarterly reports right on TradingView.

JOHN KEELLS HOLDINGS PLC is going to release the next earnings report on May 26, 2025. Keep track of upcoming events with our Earnings Calendar.

JKH.N0000 net income for the last quarter is 2.85 B LKR, while the quarter before that showed 1.37 B LKR of net income which accounts for 107.99% change. Track more JOHN KEELLS HOLDINGS PLC financial stats to get the full picture.

JOHN KEELLS HOLDINGS PLC dividend yield was 0.77% in 2023, and payout ratio reached 18.62%. The year before the numbers were 1.43% and 15.24% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of May 6, 2025, the company has 20.61 K employees. See our rating of the largest employees — is JOHN KEELLS HOLDINGS PLC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. JOHN KEELLS HOLDINGS PLC EBITDA is 30.95 B LKR, and current EBITDA margin is 10.87%. See more stats in JOHN KEELLS HOLDINGS PLC financial statements.

Like other stocks, JKH.N0000 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade JOHN KEELLS HOLDINGS PLC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So JOHN KEELLS HOLDINGS PLC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating JOHN KEELLS HOLDINGS PLC stock shows the buy signal. See more of JOHN KEELLS HOLDINGS PLC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.