JKH.NDisclaimer;

The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other advice, and you should not treat any of the website’s content as such. We do not recommend buying, selling, or holding any stock. Nothing on this website should be taken as an offer to buy, sell or hold a stock. Conduct your due diligence and consult your financial advisor before making investment decisions.

I do not accept any responsibility and will not be liable for the investment decisions you make based on the information provided on the website.

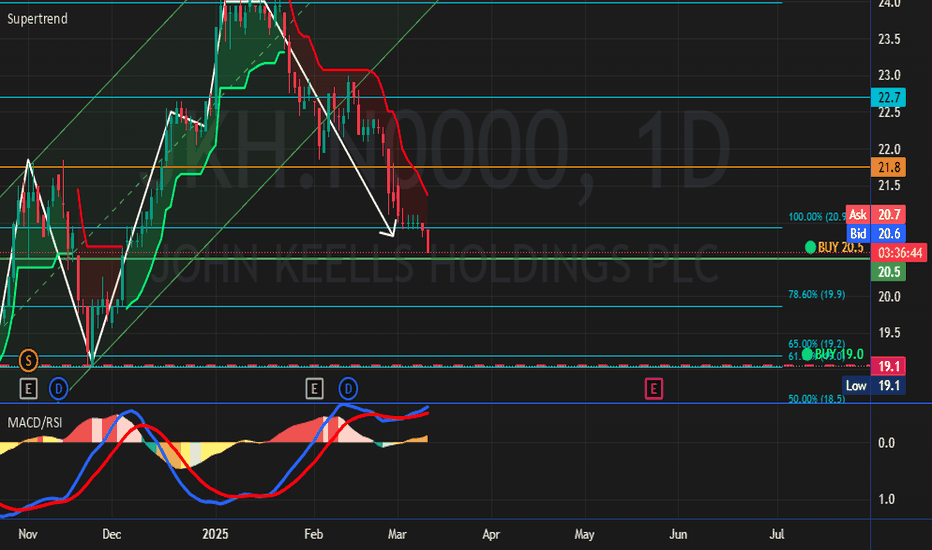

JKH.N0000 trade ideas

JKH.N0000 - Key fib levels in monthly chartJKH is consolidating in golden pocket now. It should close above golden pocket to keep bullish momentum.In next few months, Next support will be around 0.5 fib level and resistance will be 0.718

Disclaimer: The information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell, or hold any securities. The author and TradingView are not responsible for any investment decisions made based on the content presented herein. Always consult a financial professional before making any investment decisions.

JOHN KEELLS HOLDINGS PLC (JKH.N0000) at Strong Support ZoneEntry Point: 132 to 136

Profit Target: 175 ( Short Term ), 215 ( Mid Term ), 400+ ( Long Term )

Stop-Loss: 127

Disclaimer: The information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell, or hold any securities. The author and TradingView are not responsible for any investment decisions made based on the content presented herein. Always consult a financial professional before making any investment decisions.

JKH | Horrifyingly BearishThe stock broke below the long-term support range on February 20th and subsequently retested the previous support level on Feb 24th. However, it encountered heavy resistance and continued to show a bearish trend, forming a head and shoulders pattern. If the stock fails to hold at 135 levels, it may seek support at the 200-day moving average or even at the Fibonacci retracement level of 1.618 around the 128 range