Ethereum Bullish Breakout in Sight — Targeting 1911ETH/USD has shown a strong reversal from the 1564 support zone and is currently consolidating around the 1607 level. If the current bullish momentum holds, the next key resistance levels to watch are 1698, 1790, and ultimately 1911.

The chart indicates a potential breakout move toward 1911, provided price action sustains above the 1607 support. A successful hold here could trigger a strong upward rally through the upcoming resistance zones.

This setup suggests a bullish outlook for Ethereum in the short to mid term, as long as market conditions remain stable.

Note: This idea is for educational purposes only. Please do your own research before making any trading decisions.

ETHUSD.P trade ideas

ETH/USD Analysis - Consolidation with Potential BreakoutETH/USD is currently in a consolidation phase on the 1-hour chart, trading within a range between $1,602.5 (resistance) and $1,595 (support). The price has shown multiple tests of these levels, with recent long and short signals indicating potential breakout opportunities.

Technical Indicators:

This analysis uses the " Supertrend with EMA and RSI @tradingbauhaus " indicator:

• Supertrend: The price is oscillating around the Supertrend line (green/red), with recent signals flipping between bullish (long) and bearish (short).

• EMA (10, 50): The price is near the 50-period EMA, acting as dynamic support/resistance. A breakout above or below could confirm the next move.

• RSI (14): Not visible on the chart, but typically used in this indicator to gauge overbought/oversold conditions.

Key Levels and Signals:

• Resistance: $1,602.5 (recent high, marked with a short signal at -6).

• Support: $1,595 (recent low, marked with a long signal at +6).

• Entry (Long): A confirmed break above $1,602.5 could signal a long entry, with a recent long signal at $1,610.

• Entry (Short): A break below $1,595 could confirm a short entry, as seen with the recent short signal at $1,602.5.

• Stop Loss (SL): For longs, place below $1,595; for shorts, place above $1,602.5.

• Take Profit (TP): For longs, target $1,620; for shorts, target $1,580.

Conclusion:

ETH/USD is at a critical juncture, with the price testing a tight range. A breakout above $1,602.5 could signal bullish momentum, while a drop below $1,595 might favor bears. Watch for confirmation from the Supertrend and EMA alignment. What are your thoughts, traders?

ETHUSD: Bears Are Winning! Short!

My dear friends,

Today we will analyse ETHUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.582.3 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 1.551.4..Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

Ethereum (ETH/USD) Technical Analysis – Daily Chart (D1)

Method: Smart Money Concepts (SMC)

Date: April 13, 2025

🔍 Market Structure Overview

Current trend: Bearish

The chart clearly shows a sequence of Breaks of Structure (BOS) to the downside, indicating strong bearish pressure.

The latest Change of Character (CHoCH) occurred in early February 2025, marking a shift from accumulation/distribution into a downward phase.

🧠 Smart Money Concepts Highlights

Break of Structure (BOS)

Multiple BOS levels broken to the downside, confirming institutional selling activity.

The most recent BOS around $1,700 now acts as a key resistance zone.

Change of Character (CHoCH)

A confirmed CHoCH to the downside reflects a structural shift in favor of sellers.

Equal Highs (EQH) & Weak Low

The EQH has already been taken, indicating liquidity sweep above prior highs.

The Weak Low near $1,360 now becomes a likely downside target for smart money.

🧱 Key Supply & Demand Zones

Supply Zones (Resistance):

$1,950 – $2,300

$2,650 – $2,850

$3,100 – $3,500 (major EQH + distribution zone)

Demand Zone:

$1,360 – $1,300 (Weak Low and liquidity pool)

📉 Swing Trading Plan (Bearish Bias)

🔻 Potential Short Setup

Entry Area (Sell on Rally):

Price retracing into the $1,720 – $1,800 area (minor supply zone + previous BOS level)

Entry Confirmation:

Look for signs of bearish intent on the H4 timeframe:

Swing Failure Pattern (SFP)

Minor BOS

Bearish engulfing

Take Profit Targets:

TP1: $1,360

TP2: $1,280

Stop Loss (SL):

Above $1,850 (invalidates the bearish structure)

🔄 Alternative Bullish Scenario

A clean breakout and hold above $1,850 could indicate a CHoCH to the upside, potentially signaling a medium-term bullish reversal. However, the current structure remains bearish until proven otherwise.

📌 Conclusion

Bias: Bearish while price remains below $1,800

Strategy: Sell on retracement into premium zone

Confirmation: Look for SFP, BOS, or bearish PA on H4

Target Levels: $1,360 – $1,280

For full breakdown and SMC swing strategies, search: KepoinTrading on Google

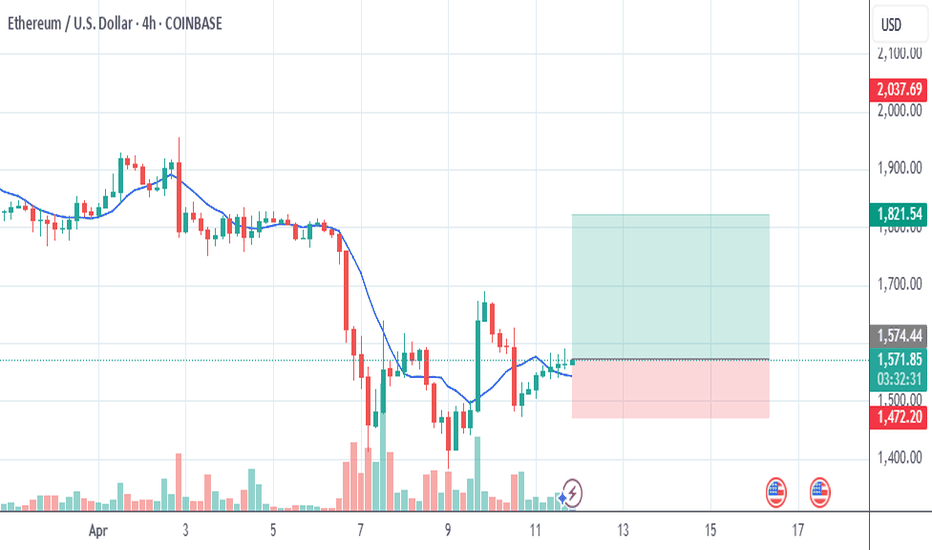

ETH/USD Bearish Reversal Setup – Targeting $1,470 After ResistanPair: Ethereum / U.S. Dollar (ETH/USD)

Exchange: Coinbase

Timeframe: 15 minutes

Indicators:

EMA 30 (red line): ~1635.82

EMA 200 (blue line): ~1585.79

🟣 Key Levels & Zones

Resistance Zone (Purple Rectangle Top): Around $1,647 – previously tested and rejected.

Support Zone (Purple Rectangle Bottom): Around $1,470 – marked as the "EATARGET POINT".

Current Price: ~$1,645

📉 Bearish Breakdown Setup

Chart Pattern: There’s a potential double top or distribution zone forming near the resistance.

Projection: The price is expected to break below the smaller support zone and drop to the target zone around $1,470.67, representing an 11.13% drop.

Measured Move Tool: Indicates a bearish price target if the price breaks down from the current consolidation.

✅ Confluence

Price is currently hovering under resistance.

EMAs show short-term bullish momentum but could flatten if breakdown confirms.

Support near $1,635 is being tested – a break below could trigger the expected drop.

⚠️ Trading Implications

Short Setup: A trader might look to enter short around $1,647 if breakdown confirmation occurs.

Stop Loss: Just above the resistance zone (~$1,650+).

Take Profit: Near $1,470 zone.

$ETH update, are we at the bottom?We’re getting close.

If you’re still holding AMEX:ETH , you might just need a bit more patience — in a month, we could be heading back up.

Let’s break down the chart, because this is a fascinating setup:

1️⃣ Two similar patterns with three tops and three MACD resets.

2️⃣ AMEX:ETH is in a consolidation zone between $1950 and $1075, right where past rallies have started.

3️⃣ MACD on the weekly is near reset — a bullish reversal could kick in within 2 weeks and last 6+ months.

4️⃣ RSI is at the bottom, aligning perfectly with the MACD: this often signals a bounce.

📉 Yes, one last dip is possible — maybe $1150–$1250 — but I personally think AMEX:ETH will bounce above the previous low.

🚫 Don’t sell the bottom. Capitulating now could mean missing out on the reversal.

📅 Timeline? January was the time to exit. If you’re still in, just hold tight — things might look very different by May and beyond.

⚠️ Disclaimer: This is a chart-based analysis. Macro factors (👋 tariffs!) can shift everything, so stay alert and manage risk.

ETH) to U.S. Dollar (USD) A potential bullish reversal is indicaETH/USD (Ethereum vs. US Dollar)

4-hour chart, meaning each candle represents 4 hours of trading activity.

2. Key Chart Features

Support and Resistance Zones:

Resistance: A rectangular box near the $2,600 to $2,800 price zone. This area previously acted as a ceiling where price was rejected.

Support: A box near the $1,700–$1,750 region. Price has bounced off this area, suggesting a strong demand zone.

Fibonacci Circles:

These concentric circles are used to project potential support/resistance levels and timing based on Fibonacci ratios.

The price seems to be reacting near some of these circle lines, which are drawn from a major swing high to swing low.

Price Action:

There was a strong downward movement (highlighted in blue) followed by a consolidation.

A potential bullish reversal is indicated on the right, with a possible breakout to the upside shown by the green arrow and price projection box.

Risk/Reward Setup:

A long trade setup is illustrated:

Entry around $1,800

Stop loss near $1,417.5

Target around $2,100 or higher

This reflects a bullish outlook with an upward price trajectory.

3. Indicators and Tools Used

Fibonacci Retracement and Fibonacci Circles

Price Action Zones (Support/Resistance)

Projection arrows and rectangular zone for trade visualization

3k before august, is it real?Looking at history, ETH corrections of 65–75% have often been followed by sharp rallies. I believe we’re in a similar situation right now. With the upcoming Pectra upgrade on the horizon, there’s a strong chance we could see this pattern repeat.

At the same time, ETH is currently undervalued — not just against BTC, but also compared to many altcoins.

In my opinion, ETH is the most undervalued asset in the market right now.

Nice squeeze ETHWe're still in a negative trend from December, but as you can see the situation is becoming a squeeze, what happens often after this is, if the green indicator breaks this line, there is a good chance that the next consolidation will be around 2000

Normally when that happens, people react and buy because they think its going to continue, and this brings more liquidity to the market

its is what is called FOMO - fear of losing out, and it can affect the actual trajectory big time

causing it to continue its climb until no one has any more funds to put in

but looking at the previous years of Eth and whats been happening this year, its the lowest eth has been in three years at this time of year

its an indicator too that anyone who is actually interested in eth will get on board, because of these trend signs.

So what ever your ideas or choices, know that Eth has a very strong buying price point right now. It can't really get much better.

Bullish break or bearish breakTo me its bullish and quite tike the bears trying to find the way to reject it. If still in a buy becareful; be sure buy it at the right time..

So look if it breaks above 1,800 then it can go up to 2000 but it keeps the momentum to go higher then 3200 and lastly 4000. Baby steps; but if the rejects hits time after time and after time then possible will drop to 1250 or a little lower.

Lets see what happens

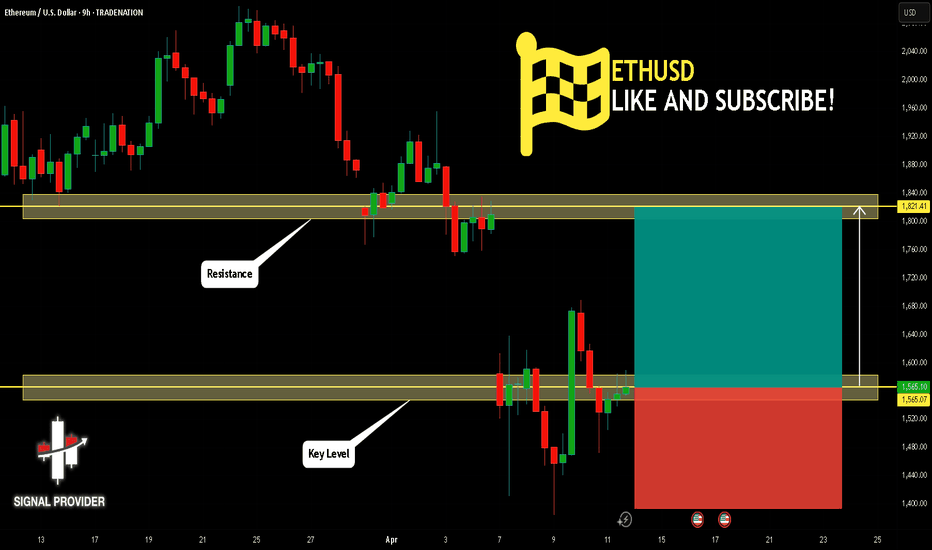

ETHUSD Will Go Higher! Buy!

Please, check our technical outlook for ETHUSD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 1,565.07.

Considering the today's price action, probabilities will be high to see a movement to 1,821.41.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Ethereum - The Perfect Crypto Trade!Ethereum ( CRYPTO:ETHUSD ) is retesting massive support:

Click chart above to see the detailed analysis👆🏻

For the past four years, Ethereum has overall been trading sideways with significant swings towards the upside and downside. As we are speaking, Ethereum is retesting a significant confluence of support and if the bullrun actually continues, Ethereum will rally parabolically.

Levels to watch: $2.000, $4.000

Keep your long term vision,

Philip (BasicTrading)