EURAUD – Bullish BAT Harmonic PatternURAUD – Bullish BAT Harmonic Pattern Formed 🟢🦇

✅ Pattern Overview:

Pattern Type: Bullish BAT Harmonic

Status: Completed or nearing completion at PRZ (Potential Reversal Zone)

Timeframe: Typically visible on 1H / 4H / Daily

Bias: Bullish Reversal Expected from PRZ

🧩 Harmonic Breakdown:

XA: Strong bullish leg

AB: Retraces 38.2–50% of XA

BC: Retraces 38.2–88.6% of AB

CD: Extends to 88.6% of XA

→ Pattern completes at D, where buyers are expected to step in

📍 Key Bullish Zone: Around D-leg @ 0.886 retracement of XA

📈 Often aligns with demand zone or structural support

📈 Trade Plan – LONG Setup

Entry:

Buy near PRZ (D-point) — ideally with confirmation candle or bullish divergence

Look for RSI bullish divergence, pin bar, engulfing, or trendline break

Stop Loss:

Just below the X-point or the low of the PRZ

Take Profit Targets:

TP1: 38.2% of AD

TP2: 61.8% of AD

TP3 (Optional): Full retrace toward point B

Risk-to-Reward Ratio: At least 1:2 recommended

⚠️ Things to Watch:

Confirmation is key — wait for signs of reversal (momentum indicators, volume, price action)

Fundamentals like EUR or AUD news/events could cause volatility

Use structure confluence for extra confidence

EURAUD trade ideas

Bearish drop off pullback resistance?EUR/AUD is rising towards the pivot and could reverse to the 1st support which has been identified as a pullback support.

Pivot: 1.79554

1st Support: 1.74201

1st Resistance: 1.83703

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

#EURAUD: Daily Timeframe Suggest Major Price Correction! EURAUD is currently implementing a significant correction, which could potentially be advantageous for swing traders like ourselves. This correction presents an opportunity to execute swing trades.

There are two potential entry points for swing trades: a risky trade and a safer trade option.

Best of luck and trade safely!

Warm regards ❤️

Team Setupsfx_

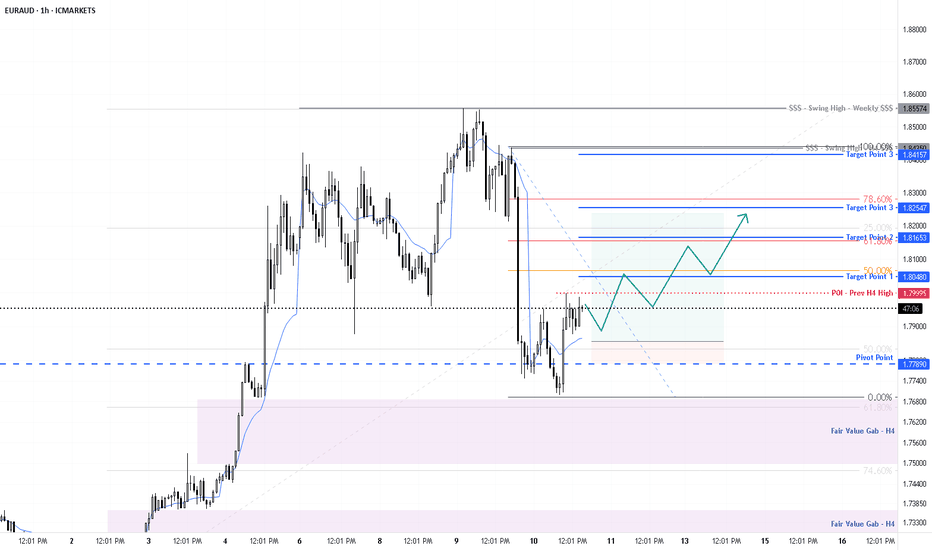

EURAUD INTRADAY support zone retest?EURAUD maintains a bullish bias, supported by the prevailing upward trend. Recent intraday movement indicates a corrective pullback toward a key consolidation zone, offering a potential setup for trend continuation.

Key Support Level: 1.7645 – previous consolidation range and pivotal support

Upside Targets:

1.8100 – initial resistance

1.8265 and 1.8500 – extended bullish targets on higher timeframes

A bullish reversal from 1.7645 would suggest continuation of the uptrend, confirming buying momentum.

However, a decisive break and daily close below 1.7645 would invalidate the bullish structure, opening the door for further retracement toward 1.7420, with additional support at 1.7240 and 1.7000.

Conclusion

EURAUD remains bullish above 1.7645. A bounce from this level supports further gains. Traders should watch for confirmation signals before positioning for the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Short-term sell setups on the retraceUpside potential remains toward 1.87487, but we’re seeing early signs of exhaustion.

🎯 We’re eyeing short-term sell setups on the retrace, and looking to re-enter long from key demand once price confirms support 1.73242 zone

Stay sharp — both sides of the move could offer clean opportunities this week.

Price Stalls Near Resistance, Pullback for Bullish ContinuatiomPrice has extended into a major weekly resistance zone after a strong impulsive move. With momentum slowing, we anticipate a corrective pullback toward the 1.73400–1.75000 zone. We'll be looking to take advantage of this move, as it could present both short-term sell opportunities and a clean re-entry point for the overall bullish trend continuation.

EUR/AUD 4H Trade Setup: Demand Zone Bounce to 1.87500🔵 Key Zones and Levels

🟦 Demand Zone: Strong support area where price has bounced multiple times.

✅ Confluence with the trendline gives extra strength.

🎯 Entry Point: 1.78990

Perfect spot for a potential buy setup.

🛑 Stop Loss: 1.76962

Below the demand zone to protect against false breakouts.

🚀 Target Point: 1.87500

Profit goal with an impressive +4.85% potential (867.4 pips)!

📊 Price Action

📍Current price: 1.80528 (hovering near EMA and close to entry)

🔁 Price has tested the support zone several times — showing signs of accumulation.

⬆️ Potential bullish breakout from this zone.

🔍 Indicators & Patterns

📏 EMA (7): Price is near it, waiting for a clear move above for momentum.

📈 Trendline: Holding well as dynamic support.

🔶 Channel pattern: Higher highs and higher lows indicate uptrend structure.

📌 Summary

🟢 Buy Setup:

🛒 Entry: 1.78990

🛑 Stop Loss: 1.76962

🎯 Target: 1.87500

⚖️ Risk-Reward: Great R:R setup with strong technical backing!

Mon 14th Apr 2025 EUR/AUD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a EUR/AUD Sell. Enjoy the day all. Cheers. Jim

EurAud sell insight Price rejects an old weekly level 1.84352 clearing the previous week's high 1.82907 hence closing bearish.

Now I'm anticipating the previous week's low to be cleared so I'm bearish for the week 1.71115 (previous week low) as my draw of Liquidity 🧲

1.81291 and 1.84782 are my point of interest to short after getting confirmation

Kindly boost of you find this insightful 🫴

EURAUD Will Go Down! Sell!

Here is our detailed technical review for EURAUD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 1.804.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 1.720 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Bullish bounce off pullback support?EUR/AUD has bounced off the pivot and could rise to the pullback resistance.

Pivot: 1.79142

1st Support: 1.76955

1st Resistance: 1.82291

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURAUD – Correction May Be Complete, Bearish Scenario in PlayI’m currently interpreting the recent price action on EURAUD as a classic five-wave decline, followed by a three-wave corrective structure, likely in the form of a Zigzag. Notably, this correction ended around the 50% Fibonacci retracement level, which adds credibility to the bearish setup.

Trading plan:

Short positions may be considered after a confirmed breakout below wave B at 1.78730, which would indicate the resumption of the downtrend.

However, if price continues to rise and breaks through 1.85568, this scenario becomes invalid, and bearish setups should be abandoned.

Always let the market confirm your bias.