Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5.60 EUR

859.64 M EUR

11.07 B EUR

119.99 M

About Booz Allen Hamilton Holding Corporation

Sector

CEO

Horacio D. Rozanski

Website

Headquarters

McLean

Founded

1914

ISIN

US0995021062

FIGI

BBG00194K569

Booz Allen Hamilton Holding Corp. engages in the provision of management and technology consulting services. It offers analytics, digital solutions, engineering, and cyber expertise. The company was founded by Edwin Booz in 1914 and is headquartered in McLean, VA.

Related stocks

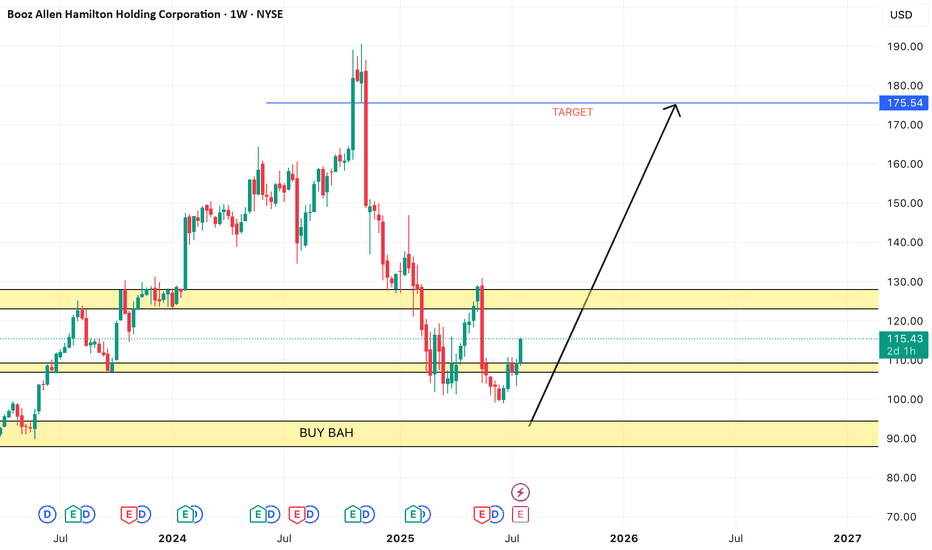

BAH Gaining Momentum With New DOD ContractsBAH recently fell after missing earning expectations, though the results were quite decent. It is currently sitting at 57% of 52 Weeks high. Seems oversold. Its AI products are going to contribute significantly to future revenues. Recently on June 16th, it won a DoD contract worth $96.07 million. Pl

BAH hitting bouncing off long-term support levelNYSE:BAH has been in a steep downtrend since the election. Finally hit a long-term support level ~$107 last week and bounced nicely. BAH has gained ~7% since hitting that level in the face of broadly negative market sentiment and declines in the major indexes. Starting long position in the $110-$11

Booz Allen Hamilton Announces Q4 and Fiscal Year 2024 ResultsBooz Allen Hamilton ( NYSE:BAH ) delivered strong fiscal fourth-quarter results for 2024, with earnings per share (EPS) growing by 32% to $1.33 and revenue increasing by 14% to $2.77 billion. The company also raised its outlook for fiscal 2025, forecasting adjusted EPS of $5.80 to $6.05 and revenue

Booz Allen Hamilton Surges 13% After Impressive Earnings Beat

Booz Allen Hamilton (NYSE: NYSE:BAH ), the renowned Defense IT company and a key player in the realm of government technology services, is making headlines after delivering quarterly earnings that far exceeded expectations. The company's robust performance has not only propelled its stock up by an

BAH: Reasons to Invest Medium-TermFundamentals:

Increasing earnings and growing sales on a q/q bases.

Return on equity is about 58%. So, for each $1 of shareholders' equity it has, the company made $0.58 in profit.

On October 4, 2023, the company received a contract from US Space Force to support systems engineering and integration

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

BAH6026921

Booz Allen Hamilton, Inc. 5.95% 15-APR-2035Yield to maturity

5.54%

Maturity date

Apr 15, 2035

BAH5627181

Booz Allen Hamilton, Inc. 5.95% 04-AUG-2033Yield to maturity

5.24%

Maturity date

Aug 4, 2033

BAH5198769

Booz Allen Hamilton, Inc. 4.0% 01-JUL-2029Yield to maturity

4.87%

Maturity date

Jul 1, 2029

BAH5029955

Booz Allen Hamilton, Inc. 3.875% 01-SEP-2028Yield to maturity

4.68%

Maturity date

Sep 1, 2028

See all BZ9 bonds

Frequently Asked Questions

The current price of BZ9 is 73.16 EUR — it has increased by 0.72% in the past 24 hours. Watch Booz Allen Hamilton Holding Corporation Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange Booz Allen Hamilton Holding Corporation Class A stocks are traded under the ticker BZ9.

BZ9 stock has risen by 2.68% compared to the previous week, the month change is a −10.08% fall, over the last year Booz Allen Hamilton Holding Corporation Class A has showed a −56.99% decrease.

We've gathered analysts' opinions on Booz Allen Hamilton Holding Corporation Class A future price: according to them, BZ9 price has a max estimate of 137.40 EUR and a min estimate of 68.70 EUR. Watch BZ9 chart and read a more detailed Booz Allen Hamilton Holding Corporation Class A stock forecast: see what analysts think of Booz Allen Hamilton Holding Corporation Class A and suggest that you do with its stocks.

BZ9 stock is 3.66% volatile and has beta coefficient of 0.42. Track Booz Allen Hamilton Holding Corporation Class A stock price on the chart and check out the list of the most volatile stocks — is Booz Allen Hamilton Holding Corporation Class A there?

Today Booz Allen Hamilton Holding Corporation Class A has the market capitalization of 8.88 B, it has decreased by −0.25% over the last week.

Yes, you can track Booz Allen Hamilton Holding Corporation Class A financials in yearly and quarterly reports right on TradingView.

Booz Allen Hamilton Holding Corporation Class A is going to release the next earnings report on Jan 23, 2026. Keep track of upcoming events with our Earnings Calendar.

BZ9 earnings for the last quarter are 1.27 EUR per share, whereas the estimation was 1.29 EUR resulting in a −1.45% surprise. The estimated earnings for the next quarter are 1.12 EUR per share. See more details about Booz Allen Hamilton Holding Corporation Class A earnings.

Booz Allen Hamilton Holding Corporation Class A revenue for the last quarter amounts to 2.46 B EUR, despite the estimated figure of 2.53 B EUR. In the next quarter, revenue is expected to reach 2.38 B EUR.

BZ9 net income for the last quarter is 148.28 M EUR, while the quarter before that showed 228.36 M EUR of net income which accounts for −35.07% change. Track more Booz Allen Hamilton Holding Corporation Class A financial stats to get the full picture.

Yes, BZ9 dividends are paid quarterly. The last dividend per share was 0.47 EUR. As of today, Dividend Yield (TTM)% is 2.55%. Tracking Booz Allen Hamilton Holding Corporation Class A dividends might help you take more informed decisions.

Booz Allen Hamilton Holding Corporation Class A dividend yield was 1.99% in 2024, and payout ratio reached 28.69%. The year before the numbers were 1.29% and 41.79% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Nov 14, 2025, the company has 35.8 K employees. See our rating of the largest employees — is Booz Allen Hamilton Holding Corporation Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Booz Allen Hamilton Holding Corporation Class A EBITDA is 1.11 B EUR, and current EBITDA margin is 11.92%. See more stats in Booz Allen Hamilton Holding Corporation Class A financial statements.

Like other stocks, BZ9 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Booz Allen Hamilton Holding Corporation Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Booz Allen Hamilton Holding Corporation Class A technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Booz Allen Hamilton Holding Corporation Class A stock shows the sell signal. See more of Booz Allen Hamilton Holding Corporation Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.