US30 trade ideas

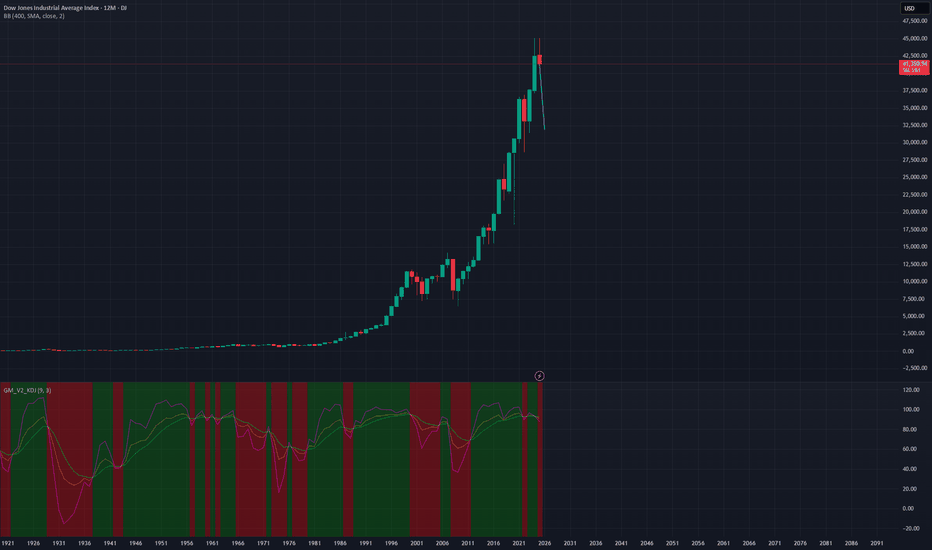

DOW JONES: Starting the final stage of 3year Bull Cycle.Dow Jones got oversold on its 1D technical outlook (RSI = 29.297, MACD = -550.130, ADX = 76.606) as it is currently testing its 1W MA50. This is a level that has been intact since November 2023 and is of high importance to the trend as it has a key cyclical attribute. The driving growth pattern of Dow since the 2009 bottom is a Channel Up and every time a Bull Cycle starts, the 1W MA50 is the first level of support, with every touch of it being the strongest buy opportunity. When the 3 year Bull Cycle is coming to an end, the 1W MA50 breaks and the index approaches the 1M MA50 during its Bear Cycle correction, which becomes the ultimate buy entry for the new long term 3 year Bull Cycle.

The current Cycle should starts getting completed technically after September 2025, so there is a high chance that the 1W MA50 holds here. The three Bull Cycles we've had so far had a fairly similar growth percentage, rising by +70.38% to +76.64%. If the +70.38% minimum range is followed on the current (4th) Bull Cycle, then we're aiming at 48,000 (TP) towards the end of the year. The 1M CCI seems to be printing the exact same build up to the Bear Cycle as in the past.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

US30 BUYOANDA:US30USD

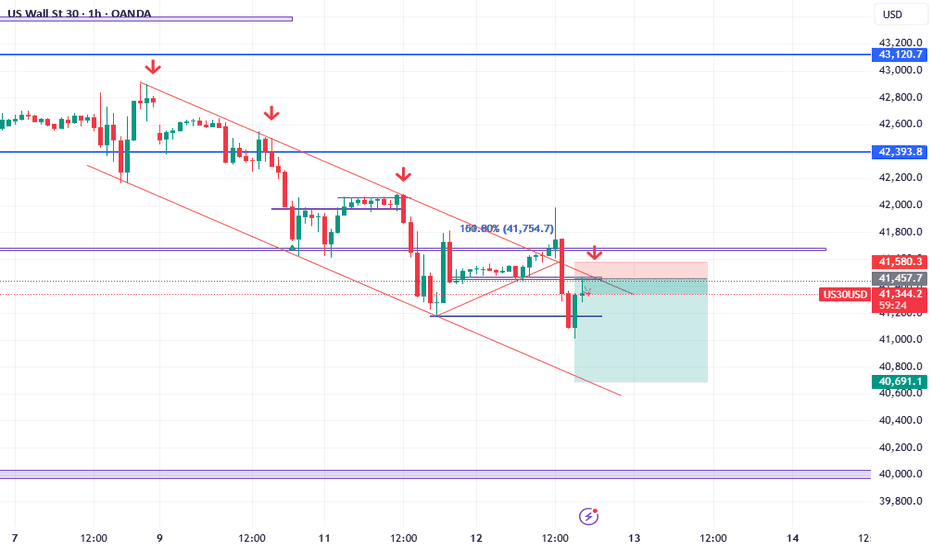

We caught a massive sell on US30. At this moment, price is retesting a Key-Level on the Daily time frame. The break beneath the 41,736.5 area seems to be a huge liquidity grab while also retesting this structural level. If price fails to break this zone, there is a big chance that we will see a retest of the highs over the month. We enter this trade at the lows, and we're already in profit. Let's see how it holds up.

US30 Trade Outlook – 12/03/2025📊 Market Structure & Key Levels

US30 is still in a downtrend, but we are seeing a bullish reaction from recent lows. Price is testing resistance around 41,718 - 41,800, a key zone for potential rejection or breakout.

🔍 Key Observations:

✅ Bearish Trend – Price remains below major EMAs, but attempting a recovery.

✅ Key Resistance – 41,800 level is a crucial decision point.

✅ Bullish Breakout? – If price holds above 41,800, we could see a push toward 42,200+.

🎯 Trade Plan:

🔹 Short if rejection at 41,800, targeting 41,628 & 41,400.

🔹 Long if clean breakout & retest above 41,800, targeting 42,200 - 42,400.

💡 Patience. Confirmation. Risk Management.🔥

DowJones INTRADAY Key Trading Levels post CPI dataThe softer-than-expected inflation data has fueled optimism among equity investors, as cooling inflation could alleviate pressure on the Federal Reserve to maintain an aggressive tightening stance. The positive market reaction suggests that participants are increasingly pricing in the possibility of a more gradual approach to interest rate adjustments.

With inflation appearing to moderate, the Federal Reserve may be more inclined to pause or slow the pace of rate hikes in the coming months. The data supports the case for a more dovish stance, as policymakers assess the effectiveness of prior rate increases and the risk of economic slowdown. Markets will continue to monitor upcoming economic releases and Federal Reserve statements to gauge the likelihood of a shift toward a less aggressive monetary policy.

Key Support and Resistance Levels

Resistance Level 1: 42256

Resistance Level 2: 42600

Resistance Level 3: 43000

Support Level 1: 41150

Support Level 2: 40576

Support Level 3: 40073

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US30 (Dow Jones) Buy Analysis: GTEUS30 has successfully pushed through an Inverse Fair Value Gap (IFVG) on the 1-hour timeframe, confirming bullish momentum. Price action suggests a continuation upward, with the next target being the top trendline around 41,950 - 42,000.

With CPI news scheduled for tomorrow morning, we can anticipate further volatility, but until then, US30 is likely to maintain its bullish structure. As long as price holds above the recent support zone around 41,500, the bias remains bullish towards the higher resistance levels.

Potential longUS30 may find bullish pressure from the 41,500, as it was a previous resistance turning into support.

As long as price action is below 41,500 - 41,000 region, the indice will likely continue it's downward trajectory.

Remaining above the 41,500 may lead to a rise aiming for the above resistance barriers.

Dow Jones Potential DownsidesHey Traders, in today's trading session we are monitoring US30 for a selling opportunity around 41900 zone, Dow Jones is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 41900 support and resistance area.

Trade safe, Joe.

Flat correction in DOW JonesA flat correction differs from a zigzag in that the sub wave sequence is 3-3-5, as shown in chart. Since the first actionary wave, wave A, lacks sufficient downward force to unfold into a full five waves as it does in a zigzag, the B wave reaction, not surprisingly, seems to inherit this lack of countertrend pressure and terminates near the start of wave A. Wave C, in turn, generally terminates just slightly beyond the end of wave A rather than significantly beyond as in zigzags.

Dow Jones: A Make-or-Break Buy Setup with Smart Money BackingDow Jones Industrial Average - Buy Setup

Technical: U.S. markets have struggled recently due to uncertainty over tariffs imposed by President Trump. While the S&P 500 and NASDAQ have broken key support levels, the Dow remains resilient, holding the critical 41,648 support. A break below would confirm a large double-top pattern, signaling a bearish outlook. This is a pivotal moment. The rebound from overnight lows is encouraging, but with the U.S. CPI release tomorrow, caution is warranted. While speculative, COT and seasonal data favour a short-term move higher.

Fundamental: The latest Commitment of Traders (COT) Report shows increasing long interest in the Dow, suggesting "smart money" accumulation.

Seasonal: Historically, from March 12 – May 2, the Dow has posted gains 84% of the time, averaging +3.68% over the past 25 years.

Setup:

Entry: 41,800 – 42,000

Stop Loss: 41,285 (below the Nov 2024 low at 41,648)

Target: 44,290

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.