PENGU Tests Key Confluence Zone, Bullish Reaction ?PENGU price action is currently trading at the Point of Control (POC), an area that aligns with both the 0.618 Fibonacci retracement and a previous daily support, forming a high-confluence region on the chart.

This zone represents a technically significant area where a potential reversal or relief

PENGU / USDT : Bullish continuation setup / Target 10-15%Pengu / USDT is showing strength to continue its bullish momentum after the recent pullback.

Price is approaching key support zones that could trigger a 10–15% short-term move if held successfully. Watch these levels closely for confirmation.

Manage risk wisely and avoid early entries.

BTC QuantSignals V3 Crypto 2025-11-09BTC QuantSignals V3 Crypto 2025-11-09

BTC Crypto Signal | 2025-11-09

• Direction: NEUTRAL | Confidence: 68%

• Timeframe: 15M

• Entry Range: $103500.00

• Target 1: $105586.35

• Stop Loss: $102800.00

• Volume vs Avg: 1.0×

• Recent Move: +1.31%

• ⚠️ MODERATE RISK WARNING: Consider reducing position siz

PENGU bear market started for it#PENGU / USDT

Price lost 6 months uptrend line which is breakdown bullish structure

As result this could be just the beginning of bearish market for it in the coming weeks

Invalidation: price will turn bullish if ONLY able to breakout and hold above red zone marked in my chart

Note : price w

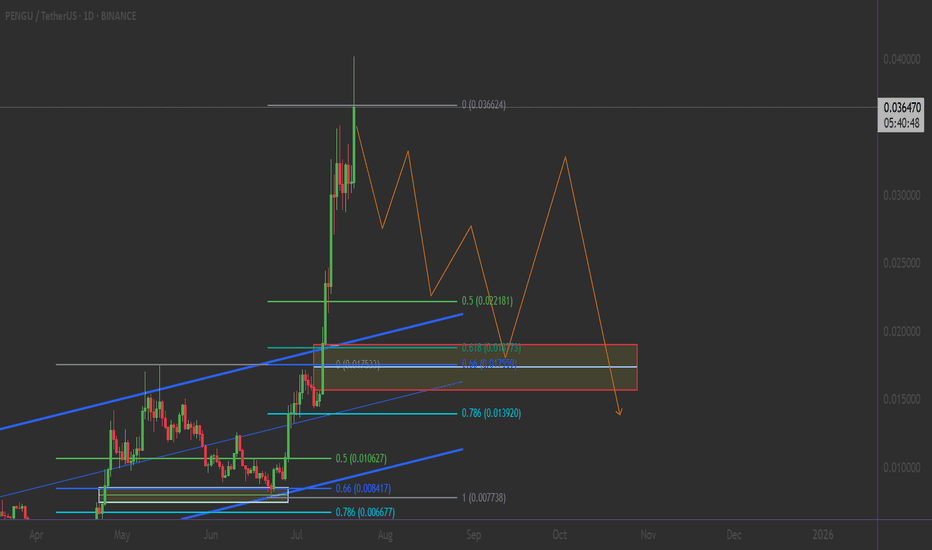

PENGU/USDT: THE ULTIMATE FIBONACCI RETRACEMENT PLAY💎 THE GOLDEN SETUP: 5-Point Technical Confluence

1️⃣ FIBONACCI MASTERCLASS IN ACTION

0.5 Fib Level: $0.021181 (HELD PERFECTLY) ✅

0.618 Golden Ratio: $0.017920 (Strong Support Zone)

0.786 Deep Retracement: $0.013920 (Ultimate Backstop)

Current Position: Trading above 0.5 Fib = BULLISH CONTROL

_____

PENGU Approaches Point of Control — Weakness PersistsPENGU price action continues to trend lower, maintaining a bearish market structure characterized by consecutive lower lows and lower highs. The market now approaches the Point of Control (POC) of its broader trading range — a key level where previous high-volume activity occurred and where short-te

PENGUUSDT.P - November 1, 2025PENGUUSDT.P is showing a series of higher lows supported by an ascending trendline, indicating sustained bullish pressure. The planned long setup targets the $0.019059 profit level, with a stop placed near $0.0177738 for clear risk management. A break above the breakeven zone would confirm bullish c

PENGUUSDT.P - October 30, 2025Bullish Bias: PENGUUSDT.P is consolidating near the $0.019 support zone, showing potential accumulation after a prolonged downtrend. A breakout above $0.0269 would confirm bullish momentum and open room toward $0.0325 as the next resistance.

Bearish Bias: Price remains in a clear downtrend with low

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.