Is the Metals Market Signaling a New Platinum Upswing?🏆 PLATINUM VS U.S. DOLLAR 📊 Metals Market Swing Trade Blueprint

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📈 BULLISH SWING TRADE SETUP ⚡

Asset: XPT/USD (Platinum Futures)

Timeframe: Swing Trade (4H-Daily)

Strategy: Breakout Reversal

Risk/Reward Ratio: 1:2.85 ✓

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 TRADE SETUP PARAMETERS

💰 ENTRY ZONE

Primary Level: @1,620 (Post-Resistance Breakout Confirmation)

Trigger: Clear breakout above key resistance

Strategy Note: Enter ANY price level AFTER confirmed breakout candle closes above 1,620

🛑 STOP LOSS

Hard SL: @1,530 (Risk Buffer: $90 per contract)

⚠️ CRITICAL: Place SL ONLY AFTER breakout confirmation

📌 This is YOUR risk management choice - adjust per your position sizing & strategy

🎪 TARGET LEVELS

Primary TP: @1,720 (Resistance Trap + Overbought Zone)

Profit Taking: Strong resistance cluster + momentum divergence

📌 Exit strategy is YOUR choice - capture profits when conditions align

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔗 RELATED PAIRS TO MONITOR 📊

1️⃣ GC/USD (GOLD vs USD) 🥇

Correlation: POSITIVE (0.85+) - Precious metals move together

Key Point: If gold breaks above 2,050, XPT bullish bias strengthens

Watch: USD weakness = simultaneous gold/platinum rallies

2️⃣ SI/USD (SILVER vs USD) 🔶

Correlation: POSITIVE (0.78+) - Precious metals complex

Key Point: Silver acts as leading indicator; watch for breakout first

Watch: Industrial demand driver for platinum alternatives

3️⃣ DXY (US DOLLAR INDEX) 💵

Correlation: NEGATIVE (-0.82) - Inverse relationship

Key Point: Weaker dollar = stronger commodity prices

Watch: If DXY drops below 104.50, XPT uptrend likely accelerates

4️⃣ PALLADIUM/USD (PA/USD) 🔹

Correlation: POSITIVE (0.72+) - Autocatalyst/industrial metals

Key Point: Similar industrial demand patterns

Watch: Pd strength validates industrial commodity rally

5️⃣ CRB INDEX (Commodity Index) 📉

Correlation: POSITIVE (0.68+) - Broad commodity sentiment

Key Point: General risk-on environment supports metals

Watch: If CRB breaks resistance, XPT momentum likely continues

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📋 TRADE MANAGEMENT CHECKLIST

✅ Wait for CONFIRMED breakout candle above 1,620

✅ Risk only what you can afford to lose

✅ Monitor USD weakness as bullish catalyst

✅ Watch gold (GC) for correlation confirmation

✅ Set alerts at key resistance levels

✅ Take partial profits at 1,720 resistance

✅ Trail stop after 50+ pips profit

✅ Review position during FOMC/economic data

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎓 KEY TAKEAWAYS

→ Platinum bullish bias on breakout above 1,620

→ Multiple precious metals correlations support uptrend

→ USD weakness = primary tailwind

→ Gold confirmation = higher probability setup

→ Target 1,720 resistance with proper risk management

Trade Smart. Trade Safe. Trade Responsibly. 🎯

Trade ideas

Bullish Momentum Confirmed on $XPT/USD!💎 PLATINUM vs U.S DOLLAR | Wealth Strategy Map (Swing/Day Trade) 💎

Plan:

📈 Bullish plan confirmed ✅ with pullback retest in triangular moving average + re-accumulation at neutral zone.

Entry:

💰 YOU CAN ENTER AT ANY PRICE LEVEL — Thief Layer Strategy.

Stop Loss:

⛔ This is Thief SL @1500

⚠️ Note: Dear Ladies & Gentlemen (Thief OG's), I do NOT recommend using only my SL. Your choice, your risk — make money responsibly.

Target:

🎯 @1720 → Police barricade zone: strong resistance + overbought + trap alert 🚨

💎 Preferred escape target: @1700

⚠️ Note: Dear Ladies & Gentlemen (Thief OG's), I do NOT recommend using only my TP. Your choice, your risk — take profits as you see fit.

🔗 Related Pairs to Watch & Key Points

$XAU/USD (Gold vs USD): Often shows strong correlation with Platinum. Watch Gold for leading/confirming bullish momentum.

$PALL/USD (Palladium vs USD): Platinum & Palladium can diverge in industrial demand cycles. Check for divergence alerts.

AMEX:USD Index (DXY): Strong USD = pressure on XPT/USD; weak USD = tailwind. Key macro driver.

Key Points:

1️⃣ Pullback retest on triangular MA shows strong buying interest.

2️⃣ Re-accumulation at neutral zone signals continuation of bullish trend.

3️⃣ Keep an eye on overbought conditions near $1720 — possible profit-taking zone.

4️⃣ Cross-asset signals (Gold/Palladium) strengthen conviction for swing/day trades.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

Disclaimer:

⚠️ This is Thief-style trading strategy just for fun. Trade responsibly and at your own risk.

#XPTUSD #Platinum #ForexTrading #SwingTrade #DayTrade #BullishSetup #TradingStrategy #ThiefStyleTrading #MetalsMarket #TradingViewIdeas

$PLATINUM (WEEKLY): WAVE 3, the MONEY WAVE, exhaustion signsMy first TVC:PLATINUM position has been triggered during the current correction in metals — I’m now LONG (x10) from $1,575, as mentioned in my previous update (quoted post).

The 3-month chart I used in that post clearly showed a money wave, and the weekly chart looks just as strong — also in what appears to be its own Wave 3.

Global supply and demand dynamics are perfectly reflected in this chart (see the attached graphic for a summary). Shortages remain a major theme.

After a huge parabolic rise this year, my take-profit targets are based on trend-based Fibonacci extensions, assuming the rally continues toward the falling wedge target at $3,402:

Fib 1.618 → $2,063

Fib 2.618 → $2,829

Fib 3.168 → $3,596

Three levels to make me happy.

Currently, I’m seeing some signs of wave exhaustion, mainly a bearish RSI divergence, so I’m preparing for a possible Wave 4 correction.

In any case, we must not close below the top of Wave 1 ($1,332) — that’s my exit level.

Potential dip-buying between $1,300 and $1,400 makes a lot of sense, as long as no weekly candle closes below $1,330.

This is my strategy — quite a big position, actually — but I’ll be willing to make it even larger if a clean, technical dip sets up.

💙👽

#platinum

Platinum: Metals Enter a Confident Correction PhaseMetals are confidently moving into a correction.

The chart looks bearish — for platinum, the downside target is around 1500, and I don't expect it to go much lower.

I believe it’s reasonable to enter at current levels.

Place the stop above today’s high.

This is not a trend reversal or a metals crash — it’s a correction within an ongoing uptrend.

The bullish structure remains intact! So trade carefully, set your stops, and capture some profits on the downside.

Platinum Swing Setup: SMA Pullback + Hull MA Breakout!🎉 Platinum Heist: XPT/USD Bullish Breakout Plan

Asset: XPT/USD (Platinum vs. U.S. Dollar)

Trade Type: Swing/Day Trade

Vibe: Thief-Style Market Raid with a Bullish Twist! 🚨

Get ready, Thief OG's! We're plotting a slick move on the Platinum market, using a layered limit order strategy to sneak into profits. Let’s break down this heist with a polished, professional, yet fun approach to maximize views and likes on TradingView! 😎

📊 The Setup: Bullish Confirmation for the Win!

Here’s the plan to pull off this Platinum Profit Pathway:

🟢 Bullish Confirmation: Price pulling back to the Simple Moving Average (SMA), setting the stage for a breakout.

🕯️ Heikin Ashi Power: A bullish Doji candle confirms the upward momentum—our signal to strike!

📈 Hull MA Breakout: Price smashes through the dynamic resistance of the Hull Moving Average (HMA), screaming bullish vibes.

⚠️ Market Mood: Overbought conditions and strong resistance lie ahead, so we’ll need to be quick to escape the police close-in (aka profit-taking zone).

The Thief Strategy: Layered Limit Order Entry

We’re not just diving in—we’re layering our entries like a master thief stacking their loot!

Entry Plan: Place multiple buy limit orders to catch the price at key levels:

🎯 $1400

🎯 $1410

🎯 $1420

Pro Tip: Feel free to add more layers based on your risk appetite—customize your heist!

Why Layering?: This sneaky strategy spreads your entries to reduce risk and maximize your chance of catching the move.

🛑 Stop Loss: Protect Your Loot!

Thief SL: Set at $1390 to keep the cops at bay.

Note: Dear Thief OG's, this SL is my suggestion, but it’s your heist! Adjust based on your risk tolerance—take the money and run at your own discretion.

🎯 Target: Escape with Profits!

Profit Zone: Aim for $1460, where strong resistance + overbought conditions signal a potential trap.

Escape Plan: The police (market reversal) might close in, so lock in profits quickly!

Note: Dear Thief OG's, this TP is my call, but you’re the boss of your trades. Secure your gains when you feel the heat!

🔗 Related Pairs to Watch

Keep an eye on these correlated assets to spot market clues:

OANDA:XAUUSD (Gold vs. U.S. Dollar): Gold and Platinum often move in tandem due to their precious metal status. A bullish Gold trend could support our XPT/USD heist.

OANDA:XAGUSD (Silver vs. U.S. Dollar): Silver’s volatility can signal broader metal market sentiment—watch for bullish confirmation here too.

USD Index ( TVC:DXY ): A weaker USD often boosts precious metals. If DXY weakens, it could fuel our Platinum breakout.

Key Correlation Insight: Platinum tends to follow Gold’s lead but can be more volatile due to industrial demand. Monitor XAU/USD for confirmation and DXY for USD strength/weakness.

📝 Disclaimer

This Thief-Style Trading Strategy is just for fun and educational purposes! Trading is risky, and past performance doesn’t guarantee future results. Always do your own research and manage your risk carefully. I’m not a financial advisor—just a fellow market thief sharing the plan! 😜

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#TradingView #XPTUSD #Platinum #SwingTrading #DayTrading #ThiefStrategy #BullishBreakout #TechnicalAnalysis

XPTUSD – Will Platinum Retest Its Daily Support?After a powerful rally to 1,739, Platinum (XPTUSD) is cooling off with a sharp pullback toward 1,610. This move looks more like healthy profit-taking than a reversal, and it may be setting up the next major swing opportunity. The zone to watch is 1,439.408, where price meets the ascending daily trendline — a level that has consistently acted as the base for previous rallies.

🛡️ Support Zone (if pullback occurs)

🟢 1,439.408 | ⚪️ Stop-loss: 1,395.309 (Daily Support – Great Swing Trade Setup)

🧭 Outlook

Bullish Case: A successful retest and rebound from 1,439.408 could fuel a continuation toward 1,700 and the 1,740 resistance zone.

Bearish Case: A decisive break below 1,395.309 would weaken the uptrend and open the door toward 1,300.

Bias: Bullish while above 1,439.

🌍 Fundamental Insight

Recent volatility across precious metals and a slightly softer U.S. dollar are driving short-term fluctuations in Platinum. Despite this, sentiment remains supported by industrial demand, especially from the automotive and hydrogen sectors. However, macro uncertainty and rate expectations can still trigger short-term swings before the larger trend resumes.

✅ Conclusion

This pullback could offer a high-probability swing entry near 1,439.408, where structure and trendline confluence align. Holding above that level keeps the bullish structure intact, making patience a key part of the trade plan.

💬 If you find this content useful, don’t forget to like & follow for more structure-based insights.

Bearish Key Reversal Puts Platinum Bulls on NoticePlatinum was slaughtered along with every other precious metal on Tuesday, delivering on the risk we flagged 24 hours earlier. Given the scale of the move, the question everyone is now asking is whether that was it? I don’t know personally, but the bearish key reversal candle that printed only adds to the signals from longer timeframes in recent weeks, warning of the potential for more downside to come.

Looking at the price action on the dailies, it’s notable the rout halted Tuesday at $1516—the high that was set in July. That suggests technicals still matter even if some of the selling was likely forced in nature. As such, it’s now the key level to watch when assessing directional risks.

Should $1516 give way, the 50-day moving average is the first point of interest, with $1478 and $1440 other minor levels before more substantive support is found at $1380. Should $1516 hold, $1555, $1675 and $1775 are the levels to watch.

The momentum picture has unsurprisingly shifted quickly as a result of the pullback, with RSI (14) now trending lower beneath 50, indicating increasing downside pressure. MACD has yet to turn outright negative, but it has already crossed the signal line and is accelerating downwards. At the very least, it provides a warning for bulls looking to immediately buy the dip.

Good luck!

DS

The Rally in Metals Is Not Over YetI believe the rally in metals is not over.The upward move could resume from current levels. While we have seen a slight pullback, the metals are holding up strongly. The stop-loss level would be quite wide, but I believe the chances of a continuation significantly outweigh the risks, making it a calculated risk worth taking. The chart shows a continuing uptrend. Metals are set to heat up the market, and at the moment, I like platinum the most.

📝Trading Plan

🟢Entry: current level -1630

🔴Stop: 1565

🎯Target: 1720 / 1925 / 2100 / 2200 / 2300 and beyond

Bearish Candles Flash Warning: Platinum’s Rally May Be OverPlatinum’s breakneck rally since June looks at risk of reversing, with the last two weekly candles delivering notable topping patterns. A shooting star from above $1,700 was followed by an enormous bearish pin, doubling down on the message. With momentum indicators like RSI (14) and MACD rolling over but still in overbought territory, selling into rallies is preferred near term, especially if we see another push above $1,650 where bears were active in each of the past three weeks.

Downside targets for shorts include the July high of $1,516, with the February 2021 swing high of $1,350 and $1,300 as other options after that. Risk management is extremely important for anyone looking to act on the bearish price signals given how far the price has run over recent months, so make sure stop placements above entry are aligned with your desired risk-reward ratio from the trade.

Good luck!

DS

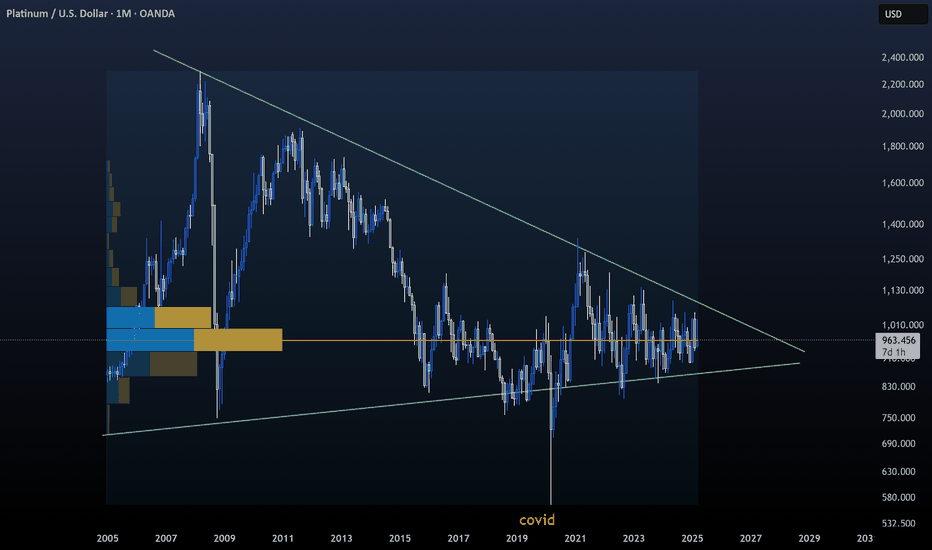

$PLATINUM (3-MONTH): WAVE 3, the MONEY WAVE is onCAPITALCOM:PLATINUM , the 3-MONTHLY chart showing all the price action in the XXI century, in case anyone still has any doubts re where precious metals are going next.

One dominant chart pattern, a 12-year-old FALLING WEDGE, text-book breakout during COVID (surpluses of production), retested, a few years of accumulation done (constant shortages since 2022, more demand than supply by roughly 1 Moz a year, on average), and finally a big BREAKOUT above the GOLDEN POCKET ($1063 - $1123) in Q1 to start 2025.

So, a clear WAVE 3, a.k.a the MONEY WAVE. Briefly hit $1737 and now we have got a 7% correction.

I have been in the market for a position in #platinum after missing out on this year's run solely due to engaging my free capital in other metals.

So, two potential long entries:

1) $1575, a 2% pullback from here, fib 0.382 retest and continuation upwards on that money wave.

2) between fib 0.5 ($1350) and a potential WAVE 4 first target ($1385). In case the WAVE 3 is finished, then dip-buying would make sense.

LONG (x10) LIMIT order set at $1575 for now.

The mentioned FALLING WEDGE has got a target at $2.4k. Very doable, it will take some time, but it will HIT👽💙

Platinum- While everyone is chasing Gold’s rally, I’ve got my eyes on Platinum.

- That doesn’t mean Gold is a bad investment, it just means it’s already had its moment.

- Platinum feels “delayed,” but its time is coming.

- Observe closely, this simple graph reveals a tightening triangle.

Remember my first rule: Buy the blood, not the moon.

Stay sharp. Diversify. Never go all in.

Happy Tr4Ding

Platinum 10 years accumulation 2 000 USD Overview of Catalysts

Here’s a detailed look at the top 10 key catalysts influencing platinum prices—and how they stack up on a 0–10 impact scale 🎯.

1. Supply Deficits (Mining Shortfalls) ⛏️

Trend: Persistent structural deficits—the largest since 2013—with a projected deficit of \~598 koz in 2024.

Drivers: Declining output in South Africa and Russia, underinvestment, and aging mines.

Impact Score: 10/10 – Direct upward pressure on price.

2. Industrial Demand & Green-Energy Growth 🏭

Trend: Industrial consumption is booming, with strong growth in sectors like wind turbines, glass, and electronics.

Support: This broad demand fuels a large part of the supply deficit, and goes well beyond automotive use.

Impact Score: 9/10 – Strong structural support.

3. Auto Catalyst Substitution (Pd → Pt) 🔄

Trend: Cost-effective substitution as platinum approaches price parity with palladium; significant volume was substituted in 2023, with more projected for 2024.

Significance: Boosts automotive demand in an area previously dominated by palladium.

Impact Score: 8/10.

4. Electric Vehicle Adoption (EVs) ⚡

Trend: EVs don’t use platinum in catalytic converters, which is a structural hit to demand as EV growth continues.

Significance: Long-term downside pressure.

Impact Score: 7/10.

5. Hydrogen Fuel Cell Demand 💧

Trend: Hydrogen vehicles use platinum, with projected demand growth toward 2030.

Limitations: Growth remains slower than battery EVs.

Impact Score: 6/10.

6. Recycling Constraints 🔄

Trend: Recycling, which provides about a quarter of supply, is falling due to fewer end-of-life vehicles and glass, reducing the supply buffer.

Market Effect: This amplifies supply tightness.

Impact Score: 6/10.

7. Chinese Emission Policies 🏭

Trend: China’s tightening emissions regulations are supporting demand, with end uses well protected against a slowdown.

Importance: China is the largest platinum user; policy gives stability.

Impact Score: 7/10.

8. Jewellery & Investment Trends 💍

Trend: Jewellery demand remains steady, and investment demand is rising.

Note: This is a smaller demand segment, but it is supportive.

Impact Score: 5/10.

9. Macroeconomic & Auto Production Outlook 📉

Trend: Weak global auto production is lowering platinum use, but recovery in auto could lift demand.

Aftermath: Economic rebound could support prices.

Impact Score:** 5/10.

10. Speculative Sentiment & Positioning 📈

Trend: Inventories are depleted; investors are waiting for a breakout.

Tipping Point: A price surge could spark momentum-driven demand.

Impact Score:** 4/10.

| Rank | Catalyst | Score (/10) |

| ---- | ---------------------------------- | ----------- |

| 1 | Supply Deficit | 10 |

| 2 | Industrial / Green-Energy Demand | 9 |

| 3 | Auto Catalyst Pd → Pt Substitution | 8 |

| 4 | EV Adoption (Negative Impact) | 7 |

| 5 | Chinese Emission Policies | 7 |

| 6 | Hydrogen Fuel Cell Growth | 6 |

| 7 | Recycling Constraints | 6 |

| 8 | Jewellery & Investment Demand | 5 |

| 9 | Macro Slowdowns / Auto Production | 5 |

| 10 | Speculative Positioning | 4 |

📌 Key Insights & Outlook

* Tight supply and diversified demand—especially from green energy and industrial sectors—are the strongest bullish forces for platinum.

* Auto-driven substitution offers further upside, while EV growth and recycling limitations act as constraints.

* Chinese regulations add resilience; hydrogen offers potential if growth accelerates.

* Jewellery and investment flows remain minor but supportive.

* Much depends on auto sector recovery and investor psychology—momentum effects could amplify gains if technical levels break.

🔮 Final Take

Platinum remains positioned for medium-term strength, thanks to severe supply tightness and robust non-auto demand drivers. For investors, key areas to watch are further deficits, industrial trends, and catalytic substitution. Be mindful of potential headwinds from EV adoption and macroeconomic softness, but the structural case remains compelling.

XPT/USD: Re-Accumulation or Just Another Trap?🏴☠️ PLATINUM HEIST: The Metal Market Profit Playbook | XPT/USD Swing/Day Trade Setup

📊 Asset Overview

XPT/USD - Platinum vs. U.S. Dollar

Market: Precious Metals

Trading Style: Swing/Day Trade

Strategy: Thief's Layered Entry Method 🎯

🎭 The Setup: Re-Accumulation Zone Confirmed

Bias: BULLISH 🐂

Platinum is currently consolidating in what appears to be a re-accumulation zone – the perfect opportunity for strategic entries before the next potential leg up. The "Thief Strategy" uses multiple limit orders (layering) to build a position across key price levels, minimizing risk while maximizing opportunity.

🎯 Entry Strategy: The Layered Approach

Entry Method: Multi-Layer Limit Orders (Thief's Ladder Style)

Instead of going all-in at one price, we're spreading entries across multiple levels:

Layer 1: $1,600.00

Layer 2: $1,620.00

Layer 3: $1,640.00

You can add more layers based on your capital and risk appetite. This approach averages your entry and reduces timing risk.

Alternative: Market entry at current levels is acceptable if you prefer immediate exposure.

🛑 Risk Management: The Exit Door

Stop Loss: $1,560.00

⚠️ Important Note: Dear Ladies & Gentlemen (Thief OGs), this is MY stop loss level based on my analysis and risk tolerance. You should determine your own based on your account size and risk management rules. Trade at your own risk and always protect your capital first!

💰 Target: The Police Barricade Zone

Take Profit Target: $1,760.00

This level represents a confluence of:

Strong resistance (the "police barricade" 🚨)

Potential overbought conditions

Historical reversal zone (the trap)

Profit Potential: ~$160 per ounce from mid-entry point (~10% move)

⚠️ Important Note: Dear Ladies & Gentlemen (Thief OGs), this is MY take profit target. You're free to scale out earlier, trail stops, or extend targets based on your trading plan. Secure profits when YOU feel comfortable – it's your hard-earned money!

🔗 Related Markets to Watch (Correlation Play)

Keep an eye on these correlated assets:

GC/USD (Gold) - Platinum typically follows gold trends due to precious metals correlation

DXY (U.S. Dollar Index) - Inverse correlation; weak dollar = stronger platinum

SI/USD (Silver) - Often moves in tandem with platinum in industrial demand cycles

CL/USD (Crude Oil) - Industrial demand correlation (platinum used in catalytic converters)

PA/USD (Palladium) - Sister metal with automotive industry demand overlap

Key Point: A weakening dollar combined with rising gold prices typically supports platinum rallies. Watch the DXY for confirmation of dollar weakness.

📈 Technical Key Points

✅ Re-accumulation phase confirmed

✅ Layered entry reduces timing risk

✅ Risk-reward ratio favorable (~4:1)

✅ Clear invalidation level ($1,560)

✅ Strong resistance identified ($1,760)

⚡ Quick Action Plan

Set your layered limit orders OR enter at market

Place stop loss according to YOUR risk tolerance

Monitor correlated markets (especially DXY and Gold)

Scale out profits as price approaches target

Move stop to breakeven once position is profitable

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

⚠️ Disclaimer

This analysis represents the "Thief Style" trading strategy and is for educational and entertainment purposes only. This is NOT financial advice. Trading precious metals and forex carries substantial risk of loss. Always conduct your own research, use proper risk management, and never risk more than you can afford to lose. Past performance does not guarantee future results.

#XPTUSD #Platinum #PreciousMetals #ForexTrading #SwingTrading #DayTrading #TradingStrategy #MetalsTrading #TechnicalAnalysis #ThiefStrategy #LayeredEntry #RiskManagement #TradingView #ForexSignals #PlatinumTrading #MetalMarkets

🏴☠️ Trade smart, trade safe, and may the profits be ever in your favor!

Platinum chartPlatinum is commencing wave E on the monthly chart. The E wave could unfold as a Triangle or Diametric — opening the door for a massive rally. Targets: $5K+ 🚀

The upcoming wave E could evolve as a Triangle or Diametric pattern, potentially fueling a powerful bullish rally.

This suggests the current consolidation is not the end — but the setup for the next explosive leg upward.

BULLISH ANALYSIS OF XPTUSD ( PLATINUM SPOT VS US DOLLAR)As of October 3, 2025, the XPT/USD stands at approximately $1,571 per troy ounce, reflecting a robust year-to-date (YTD) gain of over 58% from early 2025 levels around $992. This surge has propelled platinum out of a decade long consolidation, marking it as one of the top-performing precious metals in 2025. The World Platinum Investment Council (WPIC) projects an average annual deficit of 620,000–727,000 ounces (koz) from 2025 through 2029, equivalent to 8–9% of average demand. XPT/USD has broken out of a decade-long trading range ($800–$1,100), signaling the start of a new uptrend. While short-term volatility remains a risk, the structural case for platinum's rise is compelling, with forecasts pointing to sustained deficits and prices potentially exceeding $1,700–$2,000 by year-end or into 2026. A buying opportunity presents on the recent bullish breakout on the weekly Timeframe, which was confirmed by above average volume.

PLAT/GOLD ratio: why my stockpick number 4 will start to fly !!Platinum is usually 1 to 2 times more expensiv than Gold historically (between 1.17 and 2.37 times from 1998 until 2008).

After the Great Financial Crisis things went out of wack ! The ratio fell inside a bullish descending wedge until it touched its low point around 0.39 !

At the peak of the Corona Crisis you could buy 2.5 ounces of Platinum with 1 ounce of Gold !

This undervaluation is of factor 3 compared with its average.

This means Platinum could very well outperform Gold by 3 times in the future.

Intresting is that price formed a double bottom with its recent March low and that a bullish divergeance formed between the March 2020 and March 2024 low.

Whereas the March 2020 low was a FALSE breakout of the wedge. The March 2024 is a REAL backtest of the apex of the bullish wedge.

The future price movement of the ratio, and especially the price movement of the PLG (Platinum Group Metals - stock pick number 4/10) should be dramatic !!

Precious Metals: Bullish Momentum IntactThe picture remains unchanged — trading should be done only from the long side.

The trend is still strongly bullish, with all major metals showing solid growth.

The greatest upside potential remains in silver, platinum, and palladium.

The market environment continues to favor buyers, so it makes sense to hold existing long positions or add to longs on pullbacks.

Platinum Breakout Pending! Layered Entry + Macro Edge Inside🔒💎 XPT/USD (Platinum vs. U.S. Dollar) — Swing/Scalping Thief Plan

📌 Trade Plan (Bullish Setup)

Asset: XPT/USD (Platinum vs. U.S. Dollar)

Bias: Bullish (Pending Order Plan)

Breakout Entry: Watching $1400.00 ⚡ (Resistance Breakout)

Layered Buy Entries (Thief Strategy):

$1380 (Layer 1)

$1390 (Layer 2)

$1400 (Layer 3 / Breakout Confirm)

(You can increase/adjust layering based on your own risk strategy — set alerts on TradingView for breakout confirmation 📲)

Stop Loss (Thief SL): $1360.00 (after breakout confirmation).

Note: Adjust SL based on your own risk management — not a fixed recommendation.

Target (Escape Point): $1460.00 🎯

Resistance + Overbought + Trap Zone → exit with stolen money before the vault closes!

💡 Why This Thief Plan?

Combines Thief Layer Strategy (multiple buy limits around breakout) with macro, fundamental, and sentiment drivers.

Breakout level @ $1400 is technically + psychologically key.

Layering ensures better risk-adjusted entry & scaling opportunities.

Target chosen at resistance/overbought zone — escape before trap triggers.

📊 Real-Time Market Data (Sept 8, 2025)

Current Change: +5.39 (+0.39%)

Previous Close: $1,376.35

Day’s Range: $1,369.14 – $1,407.52

52-Week Range: $887.50 – $1,486.23

😰 Fear & Greed Sentiment

Index: 53 → Neutral 😊

Market is balanced, showing cautious optimism with no extreme fear/greed.

🧑🤝🧑 Sentiment Breakdown

Retail Traders: 55% Long 🐂 | 45% Short 🐻

Institutions: 60% Long 🐂 | 40% Short 🐻

Institutions lean bullish, supported by macroeconomic shifts & rate-cut optimism.

🌍 Fundamental & Macro Drivers

Fed Rate Cuts Expected → Weak labor data fuels precious metal demand.

Global Equity Breadth → Broadening bull market supports commodities.

China Deflation Battle → Bond yields ~1.8% → key for platinum demand.

Weak U.S. Labor Market → Only 22K jobs added in Aug → rate cut hopes rise.

Oil Price Decline → Brent at $65.50 → signals demand concerns, indirectly hitting industrial metals.

🐂📉 Market Outlook

Bullish Score: 65% ✅

Bearish Score: 35% ❌

Summary: Platinum supported by rate cut expectations, weak labor data, and institutional flows. Risks remain due to oil price volatility & broader economic uncertainty.

🔍 Related Pairs to Watch

OANDA:XAUUSD (Gold)

OANDA:XAGUSD (Silver)

$PALLUSD (Palladium)

TVC:DXY (U.S. Dollar Index)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Platinum #XPTUSD #Metals #SwingTrade #Scalping #LayerStrategy #Breakout #ThiefTrader #Commodities #TradingPlan #TechnicalAnalysis #MacroAnalysis

XPT/USD BULL HEIST ALERT! Breakout & Layering Strategy!🌟 XPT/USD "THE PLATINUM HEIST" - BULL MARKET SWING PLAN 🌟

Greetings, Fellow Thieves & Market Robbers! 🤑💎✂️

The vault on XPT/USD (Platinum) is primed for a major bull heist. Our intel suggests a massive breakout is imminent. This is not a drill! Time to execute the plan and fill our bags with shiny loot. 🚨💣🚔

🏦 THE MASTER HEIST PLAN (BULLISH SWING) 🏦

📍 ENTRY PROTOCOL: THE BREAKOUT TRIGGER ⚡

The main vault door is at 1380.00. We do not enter until this level is CONFIRMED BROKEN. 🚨 SET YOUR TRADINGVIEW ALARMS! 🚨 Do not miss the signal! This is crucial!

🤵♂️ THE "LAYERING" STRATEGY: (Thief's Signature Move)

Once the breakout is confirmed, we deploy multiple limit orders to maximize our haul. The classic thief method:

LAYER 1 BUY LIMIT: 1370.00

LAYER 2 BUY LIMIT: 1360.00

LAYER 3 BUY LIMIT: 1350.00

LAYER 4 BUY LIMIT: 1340.00

(Add more layers based on your own risk appetite, you cunning criminals!)

🛑 STOP LOSS: THIEF'S ESCAPE ROUTE

This is a HEIST, not a holiday. Our emergency exit is far below at 12400.0 to avoid any market whipsaw traps.

⚠️ Dear Ladies & Gentleman (Thief OG's), adjust your SL based on your own strategy & risk tolerance! Protect your capital!⚠️

🎯 TARGET: CASH OUT & VANISH!

The police have set a barricade at 25500.0. Our mission is to escape with the stolen money BEFORE we get there! Take your profits at 25400.0 and disappear into the night! 🚓💨💰

⚠️ HEIST SAFETY BRIEFING ⚠️

NEWS CANCEL HEISTS: Economic data can cause chaos. Avoid opening new positions during high-impact news events. 🗞️🔍

MANAGE YOUR LOOT: This is a SWING/DAY plan. Size your positions wisely. Greedy thieves get caught! 🚓👮♂️

THE MARKET IS A TRAP: Stay vigilant. Price can fake out at any moment. Trust the plan, not your emotions.

💖 SUPPORT THE CREW!

Smash that 👍 LIKE button and 🔔 FOLLOW to boost the signal! Your support funds our next market robbery and keeps the heist plans coming! Let's get this platinum! 🏆💎🚀

I'll see you on the next job. Stay sharp, thieves! 🤑🐱👤