SGDAUD trade ideas

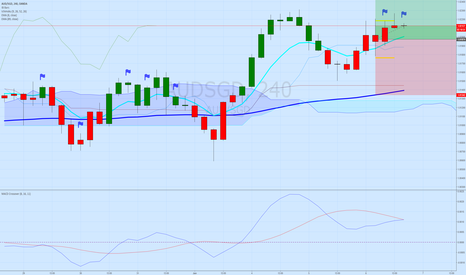

AUDSGD swing look for short continuation day traders wait n seeAnalysis for swing traders

Price action test > re-test of shadow zone confirms that it is resistance. Price action at resistance meets Bollinger Band overbought so there is confluence. Now for trigger which could look like

/\/\ in line chart

clear wash and rinse of shadow+bollinger upper band

break below shadow zone

break black dotted trend line

Analysis for day traders

Wait n see.

AUDSGD Channel Down on 1W. Short.AUDSGD is trading near a Lower High on the 1W Channel Down (RSI = 43.936, MACD = -0.009, B/BP = -0.0054). 1D remains neutral (RSI, STOCH, ADX) and bullish on Highs/Lows = 0.0017 as the price is trading above the intermediate line (blue dots). This suggests that on the long term the downside gap is sizable. Our short TP is 0.99691.

AUD/SGD 1H Chart: Ascending channel guides pairAfter testing the senior channel near 0.9970 early in May, the Aussie gained momentum against the Singapore Dollar and began moving higher in an ascending channel. This move has been gradual with the pair being located near the 1.02 mark at the time of this analysis.

It is expected that the pair continues to approach the upper boundary of the senior channel located near the 1.06 mark.

In the short term, however, the Aussie might fail to surpass the 100-day SMA at 1.0228 for a few sessions. This could allow bears to drag the rate lower during the remainder of the week. It is likely that the pair continues to respect the junior pattern and thus reaches for its lower boundary circa 1.0120. The monthly PP and the 100-period (4H) SMA are likewise located at this level.

AUDSGD long term buyIf we do reverse at this point, we are definitely going for a higher high. We do not have a divergence on the two tops. If that is the case, the drop was a correction and we are getting ready for upside. We have divergence on the two lows however the last piece is not finished yet. Get in the buy with small risk 50 pips below low

AUDSGD W1Doing this for friends, and I don't really trade this pair, at least not yet. :D

I'm looking at 0.9828 as the major support level and if you are waiting for lower rates, ie stronger SGD over AUD or weaker AUD over SGD I would pretty much wait for this level. The rate should achieve this level within this month.

Disclaimer: Information or opinions provided herein should not be used for investment advice and do not constitute an offer to sell or solicitation of an offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. When making a decision about your investments, you should seek the advice of a professional financial adviser.

All rights reserved of Forex100 Academy (Pte Ltd). No part or in whole of this report may be reproduced and disseminated without the written permission of Forex100 Academy (Pte Ltd).

AUD/SGD is landing soon.From the weekly chart on the left. AUD/SGD extends its bearish movement in the yellow highlighted area.

We found demand zone is between 0.9841 and 0.9928.

From ichimoku analysis, we found two strong support levels by chinkou span in the past. The demand zone is between 0.9877 and 0.9923.

Therefore AUD/SGD will fall one more percent.

AUD/SGD 4H Chart: Possible change in sentimentAUD/SGD continues to trade in a long-term descending channel. The pair, however, has diminished its trading range, as it failed to overcome the 1.06 mark late in January. The Aussie has been since edging lower in a junior channel and was consolidating near 1.0124 at the time of this analysis. This level is a 2017/2018 low.

The pair trading sideways for the last four days suggests that the market sentiment might change in favour of bulls soon, especially given that this area is likewise reinforced by the weekly S1 and the monthly S2.

In order to confirm this scenario, the Australian Dollar has to overcome two significant resistance levels, namely, the 55– and 100-hour SMAs and the weekly PP at 1.0250 and the 200-hour SMA at 1.03. A possible upside target is a downward-sloping trend-line circa 1.0450. The pair might even climb higher to test the upper boundary of the senior channel in the 1.07/08 territory.

Singapore Dollar Cross Correlations: The Winner is...To truly assess the impact of Chinese Growth on the region, we decided to do some analysis on the AUDSGD. The chart looks a little more interesting when you do an overlay with the EURSGD (red), GBPSGD (orange), and CHFSGD (blue). Interesting volatility and correlation between the major pairs. Trading Forex / CFDs is High Risk.