SPX at a Tipping Point Rising Wedge Meets 200 EMAThe SPX is currently trading within a rising wedge a bearish pattern that typically signals exhaustion of upward momentum. Price has now stalled right at the 200 EMA, a key dynamic resistance level, and today's close came just beneath it.

If this rising wedge breaks to the downside especially with a confirmed rejection from the 200 EMA we could see accelerated selling. The next key support level to watch is $5,438.43. A breakdown from here would likely test that zone quickly.

This setup follows our earlier call from March 27, where we highlighted the $4,790 area as a bottom nearly nailed to the point. From that low, SPX rallied, but now the structure is showing signs of strain.

We’re at a decision point: hold the 200 EMA and potentially break higher or confirm the wedge breakdown and begin a new leg down.

SPX500 trade ideas

Little Rest For SPXI think the SPX structure is more prone to bearishness. There is a structure that will probably move quickly in one direction. I don't think a good structure has been formed for a bottom. And the rise does not seem very strong. For this reason, I expect an increase after the first fall.

Since this situation will probably reflect on crypto, my bearish contracts are still in place. But I am thinking of buying a bullish contract until the FOMC time.

Bullish rise off pullback support?S&P500 has reacted off the support level which is a pullback support and could potentially rise from this level to our take profit.

Entry: 5,478.47

Why we like it:

There is a pullback support level.

Stop loss: 5,349.10

Why we like it:

There is a pullback support level;

Take profit: 5,776.02

Why we like it:

There is a pullback resistance level that is slightly above the 161.8% Fibonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

S&P 500 Tests Key Zone Ahead of FOMCThe S&P 500 has reached the 5,700–5,800 zone after a nearly 18% rally in just half a month. This zone could determine whether the rally marks the end of the bearish trend or if more pain lies ahead for the stock market.

The 200-day simple moving average, several previous horizontal support levels, and the most recent top all converge in this area. The upward move has been driven by correction dynamics, optimism around potential trade deals, signs of de-escalation with China, and rising expectations for Fed rate cuts in 2025.

This week, the FOMC may either temper those optimistic rate cut expectations or hint at a more dovish tone. In either case, some profit-taking may occur ahead of the meeting, and the 5,700–5,800 zone is a strong candidate for that to happen.

April 25 crypto and stock market results📈 April portfolio recap: $2,293 in profit despite market decline

Each month, I publish performance reports to stay accountable and track the real results of my trading strategies across both stock and crypto markets.

In this post, I’ll break down my April 2025 performance — where my portfolio grew, even as the broader market declined.

🏛️ Stock market results: $1,144 profit

Despite a red month for the broader market, my equity portfolio performed well:

• Monthly return: just above 1%

• S&P 500 performance: -44 basis points (−0.44%)

Outperforming the S&P 500 in a down month is never easy, but my holdings managed to stay in the green.

🪙 Crypto portfolio: $1,139 recovery

My crypto allocation also showed strength in April, largely thanks to my liquidity pool strategy, which is finally beginning to yield real results.

• Monthly crypto return: just over 6%

• By comparison, simply holding BTC would have yielded around 14%

While my strategy didn’t beat Bitcoin in raw percentage terms, it offered recovery after previous drawdowns.

📊 Portfolio Overview

• Cumulative profit: $10,000+

• Average portfolio return since inception: ~11.5%

I began investing in 2020, and have steadily built a portfolio that balances growth with risk control. My approach involves both active management (via options and selective equities) and passive yield strategies in DeFi.

🔍 What’s Next?

I’ll continue to post live trade updates, monthly recaps, and strategy breakdowns. If you’re interested in real portfolio transparency and real-time insights — follow along.

SPX is entering into a new phase of complex corrective waveThe SPX downside is likely to be over after the index was seen invalidating the wave-4 rule of the 5-wave impulse Elliott wave structure. Furthermore, theres a bear trap as price never closes below 6% from 5,120 major support and strong bullish pressure was seen thereafter, and returning back above the uptrend with strong bullish pressure was seen as a strong upside.

Stochastic Oscillator has confirmed the oversold signal.

Target is likely to see 5,792 as the next immediate target. But we do not foresee a new high yet. We think that the correction is likely to unfold in a three wave manner.

Mechanical Over Mood. AlwaysWell, this week really wanted to test both my trading discipline… and my tech patience.

My laptop decided to kick the bucket mid-session.

But honestly? Not even mad.

Because it reminded me of something traders forget too often:

Simple is better. Mechanical is best.

No charts? No problem.

Noisy bias? Ignore it.

Just follow the system and let the setups do the work.

And right now?

The market gave us a Tag off the lower Bollinger Band…

Then a Turn with some clean bullish pulse bars…

Now we’re tagging the upper band again.

Textbook mechanical structure.

No predictions. No overlays. Just rules.

Yes, compression still lingers – the bands are squeezed tighter than my laptop battery casing.

But until something breaks out (or explodes), I’m trading it simple.

---

SPX Market View

Some days the market whispers.

Some days it screams.

And then… there are days like this – where it quietly tags, turns, and retags like a kid playing solo hide and seek.

Welcome to compression.

Welcome to Tag ‘n Turn 2: Return to the Band.

Yesterday gave us exactly what we needed:

Tag off the lower Bollinger Band

Bullish pulse bars firing in sequence

Now back to the upper BB as of this morning

It’s a full mechanical cycle playing out in slow motion.

The band width? Still squeezed.

So unless we get a confirmed breakout – no compounding, no fireworks, no fast lane.

That’s not a problem.

It’s a feature.

Why?

Because in environments like this, the strategy doesn’t just work – it filters the noise.

No guesswork. No hoping. No “is this the one?”

Just a defined setup, and a playbook that responds only when the price earns it.

I’m staying bullish as long as this range holds.

Pulse bars off the highs or lows? I’m in.

Breakout confirmed? Let’s ride it.

Dip to mid-band? Still valid.

The structure is intact.

The setup is valid.

And even if my laptop’s dying breath is a warning beep, I’ll still be trading off what matters.

Trade the system. Trust the sequence. Let the rest break down.

---

Expert Insights:

Mistake #1: Overcomplicating compressed conditions.

Compression doesn’t mean “do more” – it means “do less, better.”

Fix: Let the pulse bar do the talking. Keep your setup clean.

Mistake #2: Ignoring band re-tags as valid setups.

Returning to the upper or lower band doesn’t invalidate the prior move.

Fix: Use structure. Re-tags can still deliver if pulse bars confirm.

Mistake #3: Letting tech failures bleed into trading decisions.

Just because your screen flickers doesn’t mean your system broke.

Fix: Stay mechanical. Even from a mobile. It’s not the gear – it’s the method.

---

Rumour Has It…

Wall Street insiders are reporting that Apple’s next product will be the MacBook Trader, a laptop designed specifically to fail whenever Bollinger Bands compress.

Features include:

An auto-dimming screen whenever pulse bars form

A built-in “Hope Mode” that deletes your rulebook

And a random error that whispers “maybe just this once…”

Traders are advised to plug directly into their mechanical setups or, failing that, scribble strategies on a coffee-stained napkin like it’s 2002.

Rumour has it that a squirrel from Central Park is currently outperforming several hedge funds using nothing but broken Fibonacci tools and pure optimism.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

---

Fun Fact – Did You Know?

The term “Frankenstein” originally came from Mary Shelley’s story of a scientist trying to control something he didn’t fully understand…

Which is what most traders do with indicators.

They bolt on RSI here, MACD there, sprinkle in some Fibonacci dust, and hope it walks.

But the real monsters aren’t the tools – they’re discretionary trades pretending to be mechanical.

Moral of the story?

You don’t need a stitched-together algo monster.

You just need a clean pulse bar, a set of rules, and the ability to sit still.

S&P 500 index Wave Analysis – 29 April 2025

- S&P 500 index broke key resistance level 5500.00

- Likely to rise to resistance level 5700.00

S&P 500 index recently broke the key resistance level 5500.00 (former support from March, which also stopped A-wave of the active ABC correction B from the start of April).

The breakout of the resistance level 5500.00 coincided with the breakout of the 50% Fibonacci correction of the downward impulse from February.

S&P 500 index can be expected to rise toward the next resistance level 5700.00, target price for the completion of the active impulse wave C.

S&P500: Buying accelerating as the bottom is confirmed.S&P500 is neutral on its 1D technical outlook (RSI = 52.628, MACD = -41.490, ADX = 32.588) as it has been volatile during the day but on the long-term, it has resumed the bullish trend, making a strong recovery last week. The bottom is now confirmed (above the 1W MA200) and as the oversold 1W RSI was bought, the index eyes a +28.50% rise on the medium term, same as in early 2024. This falls practically on the previous ATH level (TP = 6,150).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

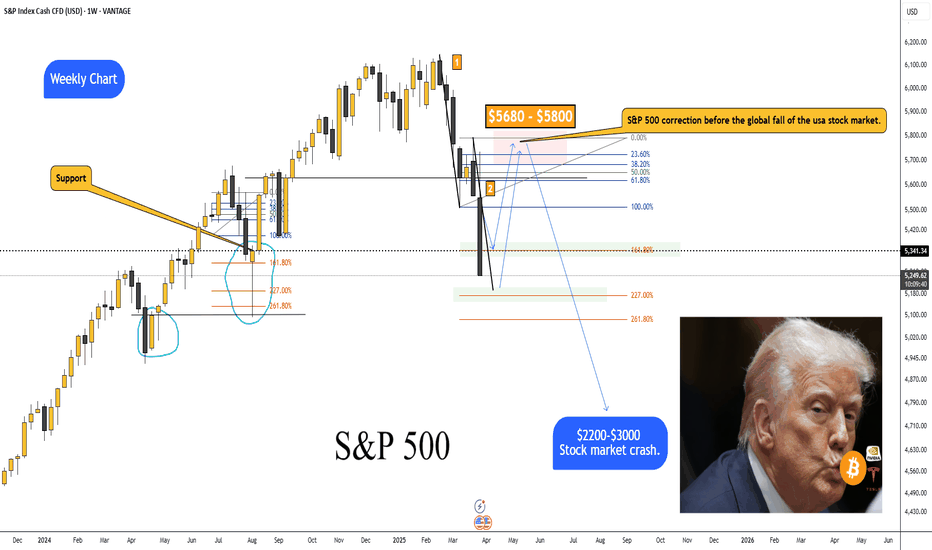

S&P 500 correction before the global fall.S&P 500 correction before the global fall of the usa stock market.

Hey traders! I’m sure many of you have noticed that after the introduction of retaliatory tariffs, the markets started getting pretty choppy.

The S&P 500 took a serious dive.

• On the weekly chart, I’ve marked a support level + the 161.8% Fibonacci level, where we might see a bounce back to the $5680–$5800 range.

• But from there, I think we could see the start of a major crash—both in equities and crypto—that could last 1–2 years.

• Based on my estimates, the S&P 500 could drop back to 2020–2021 levels, a wide range of 2200–3000.

• For Bitcoin, we’re talking around $5000; for Ethereum, $100–$300; and for Solana, $2–$12.

3D Chart:

3W Chart:

Real-world events that could tank the stock market this hard:

Global Recession: If major economies (US, China, EU) slide into a recession at the same time—think trade wars, rampant inflation, or a debt crisis—investors will dump risky assets like hot potatoes.

Trade War Escalation: Harsher tariffs between the US and China/EU could wreck supply chains, crush corporate earnings, and spark a full-on market panic.

Geopolitical Conflict: A big blow-up—like a full-scale war or crisis (say, Taiwan or the Middle East)—could send capital fleeing to safe havens (gold, bonds), while stocks and crypto get slaughtered.

Collapse of a Major Financial Player: If a big bank or hedge fund goes bust (Lehman Brothers 2.0-style) due to an overheated market or bad debt, it could trigger a domino effect.

Energy Crisis: A spike in oil/gas prices (from sanctions or conflicts, for example) could kneecap the economy and drag risk assets down with it.

Market Bubble Burst: If the current rally turns out to be a massive bubble (and plenty of folks think it is), its pop could pull indexes down all on its own.

Looming Wars: A potential Russia-Europe war starting as early as 2025, or an Iran-Israel conflict that drags in multiple nations, could destabilize global markets, spike energy prices, and send investors running for the exits.

US 500 Index – How Far Can the Recovery Extend?The upside recovery in the US 500 index continued last week, adding nearly 5% to close at 5523 on Friday, a 1 month high, as weak short positions continued to be squeezed out by a combination of factors, including signs that US/China trade relations may be starting to thaw out, President Trump pulling back on his initial commentary challenging Federal Reserve independence and more positive Alphabet earnings.

Now, looking forward to the week ahead, traders trying to work out where the index may move next face a number of scheduled economic data updates to digest and then react to, which will provide a health check on the US economy and labour market, while also showing the impact of President Trump's tariffs on US inflation.

These include,

* Tuesday 1500 BST US Consumer Confidence

* Wednesday 1330 BST US Preliminary Q1 GDP,

* Wednesday 1500 BST US PCE Index (Fed's preferred inflation gauge)

* Thursday 1500 BST ISM Manufacturing PMI Survey

* Friday 1330 BST US Non-farm Payrolls

Not only that, 4 of the Magnificent Seven companies also report earnings, with Microsoft and Meta results due after the close on Wednesday and Amazon and Apple due after the close on Thursday.

The outcome of all these events, plus trade war/tariff updates may well determine if the rally has already run its course, or has further to go.

Technical Update: Is the Break of Mid-Point (50%) Fibonacci Resistance Important?

Last week was a positive one for the US 500 index, as an 8.5% rally developed from Monday’s session low at 5095 into Friday’s high at 5530. This of course comes after what was an aggressive liquidation of assets into the April lows at 4799 (April 7th), and some may now be asking if this could be a sign of further attempts at price strength.

Much will of course depend on future market sentiment and price trends, but last week’s strength did see a closing break above the 5474 level, which is equal to the 50% Fibonacci retracement of the February to April 2025 price weakness.

This upside move may leave traders looking at the possibilities of further attempts at price strength this week and wondering where the next resistance levels may now stand.

Potential Resistance Levels:

A closing break of a 50% retracement while not a guarantee of further price strength, can suggest risks to higher levels and 5635, which is the higher 62% Fibonacci retracement could be the next resistance level to monitor.

If a further phase of price strength is to materialise, traders might now focus on closing defense of this 5635 resistance, with breaks higher possibly opening up potential tests of 5788, which marks the March 25th session high.

Potential Support Levels:

Of course, as we have said, the latest breaks of the 50% retracement resistance are not a sure sign of continued price strength. So, with that in mind, lets look at possible support levels that if broken, might point to the potential of downside pressure.

The 38.2% Fibonacci retracement of last weeks rally stands at 5364, so even if the new week starts with a price setback, this level may need to be broken on a closing basis to suggest risks of further price declines.

Such breaks lower could then point to a deeper decline and retracement towards 5313, the 50% level, even 5262, which is equal to the 62% retracement.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

S&P 500: What’s Happening?S&P 500 Market Update

Recent changes to tariffs have made investors feel more confident, and because of that, the S&P 500 has broken out of a downward trend it had been stuck in. This breakout suggests prices could continue rising for now.

However, technical analysis shows that many investors might still be cautious. A lot of them may plan to sell if the market climbs back near $5,650 (faded yellow rectangle box on chart), trying to limit losses compared to when prices dropped to around $4,800 a few weeks ago.

If the market struggles to get past $5,650 (faded yellow rectangle box on chart), we could see prices fall again, possibly down to around $5,300, before the market settles for a bit and decides on its next big move.

• Blue line: shows the path I expect the market to take based on investor behavior and technical patterns.

• White line: shows the general trend where buyers typically step in. If the price falls through this line, it could signal more downside ahead.

What the S&P did and what to look forward to this coming week. A walkthrough different levels on the S&P for the short term (1-2 weeks).

The S&P broke above a key weekly downtrend line this past week, shifting the structure slightly more bullish in the short term. We’re now testing an important resistance zone with multiple possible scenarios ahead.

Scenarios for the Week Ahead:

Bullish:

If the S&P holds above the breakout zone (5484) and continues climbing, we could see a move toward 5,650 (near the declining 50SMA). Some minor pauses or consolidations could occur at moving averages, but overall momentum would remain constructive if buyers stay active.

Bearish:

If the S&P fails to hold above 5,484 and breaks back below the uptrend line, we could see a pullback toward (in this order) 10 and 20 EMAs, recent uptrend line, or at most the key level around 5,264. A deeper breakdown seems less likely unless broader selling pressure returns.

Neutral: Think this would be a chop between where it is at now and 5650.

Another move down for SPX500USD?Hi traders,

SPX500USD made a bigger orange X-wave last week into the Daily FVG.

So next week we could see the start of the last impulse wave down to finish the bigger (red) WXY correction. But it first has to close below the Daily FVG.

Let's see what the market does and react.

Trade idea: Wait for a change in orderflow to bearish, a small impulse wave down and a small correction up on a lower timeframe to trade shorts.

If you want to learn more about trading FVG's & liquidity sweeps with Wave analysis, then please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

Spy putsHello friends.

We just bought some 5/16 $550 SPY puts. It's looking like the low for this crash is not anywhere near being in. Retail is still in a buying frenzy because they expect that this will be another V shaped recovery like we're used to. Meanwhile the smart money is selling everything they have and expecting more blood. The fed hasn't come in to save this market, and they aren't going to be able to. Their hands will be tied by artifical inflation caused by tariffs and there won't be an intervention until it's already too late.

$SPX Urgent! My <3 & My Soul: Slow Bleed Crash to 3k by Q4 26' Do be warned. Very important post here. I put my heart and soul into this. I made a video earlier and then it got deleted by accident, so I made a less happy one right after. I've got news for all the bulls and investors out there that feel they will be able to continue buying every single dip out there. Get ready for the dip that keeps dipping. Big names already cracking heavy. NASDAQ:META NASDAQ:TSLA NASDAQ:AMD NASDAQ:NVDA to name a few. Big tech is getting cleaned out and layoffs are on the rise. Tariffs create huge amounts of uncertainty. I don't feel like this is rocket science. Buffet is all cash. 89% of Hedge Fund managers believe the US market is the most expensive its ever been and Tutes have been selling at the highest rate ever before. I think it's time the US finally gets a shake down. Bullish conditioning has been running rampant, and I've seen Social Media Accounts discourage charting and only paying attention to price action? Price action involves the entire collective, not just one Timeframe. Anyways, here's an overlay from 01' ... the only one I could find that matches. Says short 560 around May 7th and then take profits around 500 again. Let's make this a nice one. Calls till 560 into May then flip to Puts into June. From then short 530 every time you can. $450 is My first target after we break previous lows. I will update as we go. Have a good one yall.

Built Up Swing Short Bet Over the Last Day.Got another good chunk of the rally taking our net SPX long earnings to over 20% for the year on low risk (For context, our max DD is about 1/4 of what SPX is down this year).

I still would prefer to see 5800 for me to take a real big swing at the short (because I know at 5800 even if I am wrong I'll generally get some reaction to size down a bit in risk) but we may undershoot that.

I've build up my position around the 5400 sort of area. Small tolerance for stop zones. If I am wrong, I think 5800 would hit really quickly.

Update to below idea.

Bull in a China Shop. The S&P 500 Index After 100 Days of TrumpPresident Donald Trump's first 100 days in office were the worst for the stock market in any postwar four-year U.S. presidential cycle since the 1970s.

The S&P 500's 7.9% drop from Trump's inauguration on Jan. 20 to the close on April 25 is the second-worst first 100 days since President Richard Nixon's second term.

Nixon, after taking office as President of the United States (for the second time) on January 20, 1973, witnessed the S&P 500 index fall by 9.9% in his first 100 days in office, due to the unsuccessful economic measures he took to combat inflation, which led to the recession of 1973-1975 when the S&P 500 index losses of nearly to 50 percent.

It all started in January 1973 in the best soap opera traditions of Wall Street, at the historical peaks of the S&P 500 index..

..But less than two years later it quickly grew into a Western with a good dose of Horror, because the scenario of a 2-fold reduction of the S&P 500 index was unheard those times for financial tycoons and ordinary onlookers on the street, since the Great Depression of the 1930s, that is, for the entire post-war time span since World War II ended, or almost for forty years.

Nixon later resigned in 1974 amid the Watergate scandal.

On average, the S&P 500 rises 2.1% in the first 100 days of any president's term, according to CFRA, based on data from election years 1944 through 2020.

The severity of the stock market slide early in Trump's presidency stands in stark contrast to the initial "The Future is Bright as Never" euphoria following his election victory in November, when the S&P 500 jumped to all-time highs on the belief that Mr. Trump would shake off the clouds, end the war in Ukraine overnight, and deliver long-awaited tax cuts and deregulation.

Growth slowed and then, alas, plummeted as Trump used his first days in office to push other campaign promises that investors took less seriously, notably an aggressive approach to trade that many fear will fuel inflation and push the U.S. into recession.

The S&P 500 fell sharply in April, losing 10% in just two days and briefly entering a bear market after Trump announced “reciprocal” tariffs, amid a national emergency that gave him free rein to push through tariffs without congressional oversight.

Then Trump began yanking the tariff switch back and forth, reversing part of that tariff decision and giving countries a 90-day window to renegotiate, calming some investor fears.

Many fear more downside is ahead.

Everyone is looking for a bottom. But it could just be a bear market rally, a short-term bounce of sorts.

And it's not certain that we're out of the woods yet, given the lack of clarity and ongoing uncertainty in Washington.

Time will tell only...

--

Best 'China shop' wishes,

@PandorraResearch Team