SUIUSDT.PS trade ideas

Lingrid | SUIUSDT trend CONTINUATION Pattern In The MARKETThe price perfectly fulfills my last idea . BINANCE:SUIUSDT market bounced off the key support level at 2.00 and then broke and closed above the triangle pattern as well as the trendline. Additionally, the market made a fake breakout of the previous month's low before heading toward the next resistance zone by making higher highs and higher lows. Recently, the market broke the downward trendline, and I believe the price may rise further if it remains above the support zone at 2.20. I expect the price to continue moving higher, as we are seeing a contraction-expansion price action pattern. My goal is resistance zone around 2.4685

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

SUI/USDT – Short Setup (45min)🟠 SUI/USDT – Short Setup (45min)

Double Top formed near $2.22–$2.25 resistance zone.

Rejection with overbought signals (93) – bearish divergence likely.

Price testing 50 EMA – break below = short confirmation.

Entry: Below $2.16

SL: Above $2.25

TPs: $2.06 / $2.00

Bearish bias unless price breaks and holds above resistance.

#SUI #Crypto #ShortSetup #TradingView

Sui: Your Altcoin ChoiceThe action is happening right above 0.786 Fib. retracement level support. Above it, the actual level wasn't hit and this is a signal of strength.

I looked at this chart when the action was happening above 0.618 and mentioned that it could drop further before the start of the next bullish wave. See what happened, as soon as the next support gets challenged, volume goes up. This is significant volume in comparison with the daily average. The highest volume since November 2024.

This volume signal can be easily translated as support found. Support found means that the down-move is no more. The down-move being over invariably leads to change. Change means the market won't be dropping no more. If it was going down, soon, SUIUSDT should start to grow. That's my conclusion based on the data coming from the chart.

Even if prices move a bit lower, the bullish bias still remains. There is an ending diagonal on the chart. This pattern tends to show up before a change of trend. The correction is over. It is only a matter of time before the next bullish wave.

Thanks a lot for your amazing and continued support. It is truly appreciated.

It is not possible to project an accurate ATH for this pair because the chart is too young. Relevant numbers for 2025 are $9.42 and $15.24.

Namaste.

#SUI: Investing in Next-Gen Smart Contract**Description**:

This trading idea highlights **SUI**, a next-generation Layer 1 blockchain designed to offer high scalability and low latency for decentralized applications. Built by Mysten Labs, **SUI** introduces an innovative architecture based on object-centric data models and parallel execution, allowing for faster and more efficient transaction processing compared to traditional blockchains. The network's support for Move-based smart contracts and developer-friendly tools make it a strong contender in the race for Web3 infrastructure dominance. With growing developer interest and a clear focus on real-world usability, **SUI** has the potential to drive significant value in the evolving DeFi and NFT landscapes.

That said, the crypto space is inherently volatile and exposed to shifting market trends, technological risks, and regulatory developments. As such, trading **SUI** or any other crypto asset should be approached with thorough research and appropriate risk management.

**Disclaimer**:

This trading idea is intended for educational purposes only and does not constitute financial advice. Trading cryptocurrencies such as **SUI** involves substantial risk and may result in the loss of your entire investment. Always conduct your own research, assess your financial position, and consult a licensed financial advisor before making any investment decisions. Past performance is not indicative of future outcomes.

SUIUSDTSUI/USD Swing Short Setup – Bearish Rejection at 800 EMA

📍 Entry Type: Swing Trade (H12 Chart)

🔻 Position: Short

🎯 Take Profit: 1.04 (Key intersection support zone)

🛑 Stop Loss: 2.45 (Above 800 EMA for structure protection)

⚖️ R:R Ratio: ~3.5:1

📈 Technical Breakdown:

Price has retraced into the 800 EMA from below, forming a clean lower high.

55 SMA is sloping downward, confirming a bearish structure and trend direction.

Bear Power (100) remains negative, signaling sustained bearish momentum.

Williams %R (50 & 100) is rejecting from overbought territory, aligning with downside pressure.

The Parabolic SAR has flipped bearish after the retracement, providing additional confirmation.

Confluence from multi-timeframe resistance and institutional EMA rejection supports the short bias.

SUI Long Spot Trade Setup – Oversold Bounce PotentialSUI has dropped into a key support zone ($1.60 – $1.96) after an extended selloff. The price is showing oversold conditions, making this a potentially high-reward setup if a bounce confirms from this zone.

📌 Trade Setup:

Entry Zone: $1.60 – $1.96

Take Profit Targets:

🥇 $2.50 – $2.90

🥈 $3.25 – $3.60

Stop Loss: Just below $1.50

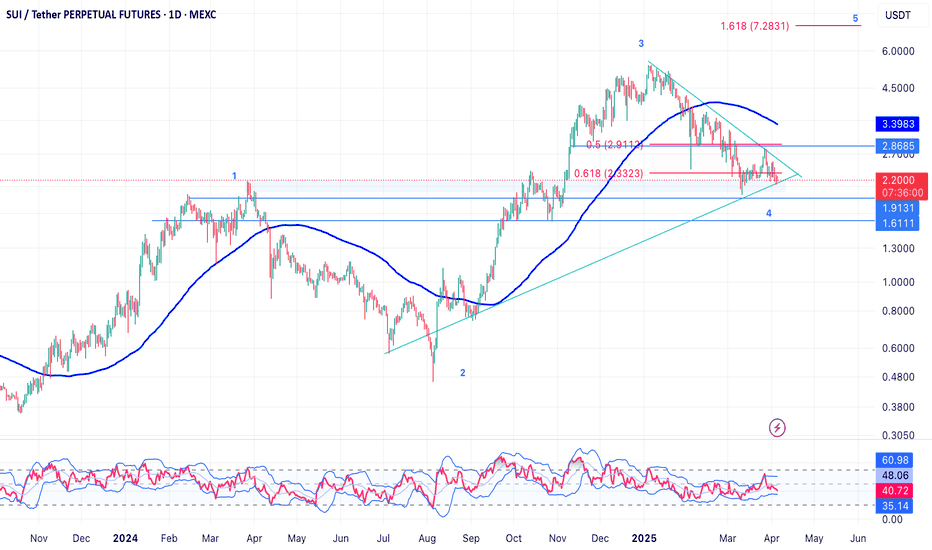

TradeCityPro | SUI: Analyzing the Shift from Hype to Stability👋 Welcome to TradeCity Pro!

In this analysis, I will review the SUI coin. This project gained significant hype in 2024 and experienced a substantial upward movement.

🔍 However, in the past few months, after reaching a price ceiling of 5.2689, it entered a corrective phase, and it can be said that its hype has completely dissipated and no longer carries much excitement.

📅 Daily Time Frame

As you can observe in the daily time frame, the price had a strong upward trend and, after breaking and pulling back to the 1.8392 area, it undertook the next upward leg up to 5.2689. During this movement, a severe divergence occurred in the RSI, which influenced the market when it was activated by breaking 50.

✔️ The upward movement accompanied by a trendline, was broken after being rejected from the 5.2689 area. The trigger for this trendline was the 4.0866 area, which was activated and confirmed the trend change after a pullback to this trigger and the break of the 3.6402 support.

🔽 Currently, after the break of 3.6402, a bearish trendline has formed, and the price has reacted to this area several times. Meanwhile, the price has also reacted to a significant support area around 1.8392. This area, actually a range between 1.6462 and 1.8392, is one of SUI's most crucial supports and could prevent further price drops.

✨ For the coin to become bullish again, the main trigger we have is breaking the bearish trendline, and I believe for buying in the spot market, the primary trigger will be breaking this trendline. There is also a significant resistance at 2.7830, which is the main trigger for breaking the trendline.

📈 If the price makes a lower high and low and breaks the support area it currently holds, the trendline trigger will shift to 2.2495, allowing us to enter earlier. A break of 50 in the RSI will also be a suitable trigger for entering a bullish momentum.

🛒 Alternatively, if you trade reactively, the price's reaction to this support area and breaking short-term resistances in lower time frames could be suitable for risky spot buying.

📊 Currently, the market volume has been more favorable to sellers, with volume increasing during price drops and decreasing during corrections, indicating the strength of the bearish trend. However, after the price reached the support area and reacted to it, we've seen two strong bullish candles with significant volume, which could be the first signs of a trend change.

📉 For the price to turn bearish and start the next bearish leg, as mentioned, breaking the support area and the 1.6462 trigger would be suitable, and in this case, the price could start the next bearish leg.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

SUI Rebuy Setup (12H)After forming a 3D pattern at the top, wave E of a higher-degree pattern has completed.

A new leg has formed from the point marked by the red arrow on the chart.

It seems that wave E will end in the green zone, followed by a strong upward reversal.

Truthfully, there are other support levels above our marked zone, but we have identified the most important one. If the price reaches this level, we can take a safe buy on SUI.

This project is one of the strongest in crypto, but we always manage risk.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 1.86.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 1.90

First target: 1.99

Second target: 2.10

Third target: 2.19

SUI is expected to have a 50% pump ahead (1D)SUI, after completing the 3D pattern at its price peak, has entered a corrective phase.

It is now approaching a high-potential zone, which is the origin of a strong move with significant buy orders. We are looking for buy/long positions in the demand zone.

The target could be the supply zone.

A daily candle closing below the invalidation level will invalidate our bullish outlook.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

Will SUI break $2 support and drop 20% to $1.80?Hello and greetings to all the crypto enthusiasts, ✌

let’s dive into a full analysis of the upcoming price potential for SUI 🔍📈.

SUI is currently trading within a downward channel, signaling a potential continuation of its bearish trend. A decline of at least 20% appears likely, with the primary target set at $1.80, provided that the critical psychological support at $2 is decisively broken. If this key level fails to hold, increased selling pressure could drive the price lower, reinforcing the downtrend.📚🙌

🧨 Our team's main opinion is: 🧨

SUI is stuck in a downtrend, and if it breaks below the key $2 support, we could see at least a 20% drop, with $1.80 as the main target.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

SUI-USDT Analysis: Watching Key Support at $1.75Hello Traders,

The price of SUI-USDT has been locked in a consistent downtrend, marked by a series of lower highs and lower lows. However, the asset is now testing a critical support level that could determine whether we see a relief bounce or a continuation of the decline.

Key Highlights:

• Price is approaching $1.75, a major support zone with confluence from the Value Area Low (VAL), HTF support, and a possible Swing Failure Pattern (SFP).

• If this level holds, there’s potential for a relief rally up to $2.78 over the coming days.

• A break below $1.75 opens the door to a deeper pullback toward $0.57, the next significant support.

SUI is currently sitting at support, and while it’s possible to see short-term candle closes above this region, confirmation is still needed before any strong bullish bias can be adopted. This is a level where patience and discipline will pay off — entering prematurely could result in getting trapped in a deeper leg down.

Overall, the market structure remains bearish. Unless the pattern of lower highs and lower lows is broken, momentum will continue to favor the downside. Holding $1.75 is crucial for any chance at a rotation higher.

SUI is approaching a key support zone...

The price has already dropped by -74% from the top — and if it reaches the $1.00–$1.40 area, it could be a potential entry signal, just like it was before after a ~70% correction.

🔁 History doesn’t repeat, but it often rhymes.

An interesting level to watch — no need to rush, just be ready.

⚠️ Risk management is everything.

SUI/USDT Is a Trend Reversal on the Horizon?1D CHART of SUI on USDT market pair. indicates a potential trend reversal following a prolonged downtrend within a descending parallel channel. The price has consistently formed lower highs and lower lows, indicating strong bearish momentum. However, a recent breakout from the channel suggests a possible shift towards bullish price action.

A critical support zone around $2.00 has shown significance, as buyers have stepped in to defend this level, preventing further declines.

This breakout signals a potential trend change, with the price now targeting key resistance levels at $2.9357, $3.5131, and $4.2060. In an extended bullish scenario, the price could reach as high as $4.7538.

#SUI/USDT#SUI

The price is moving in a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a breakout.

We have a support area at the lower boundary of the channel at 2.17.

Entry price: 2.24

First target: 2.27

Second target: 2.32

Third target: 2.38